Prospectus

Supplement

(to

Prospectus dated February 4, 2022) |

9,306,072

Shares of Common Stock |

Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-283269

|

AIM

ImmunoTech Inc.

9,306,072

Shares

Common

Stock

This

prospectus relates to the resale from time to time of up to 9,306,072 shares of common stock, par value $0.001 per share (the “Common

Stock”), of AIM ImmunoTech Inc. issuable upon exercise of Class C common warrants to purchase an aggregate of up to 4,653,036 shares

of our Common Stock (the “C Warrants”) and Class D common warrants to purchase an aggregate of up to 4,653,036 shares of

our Common Stock (the “D Warrants”, and along with the C Warrants, the “Common Warrants”) purchased by the selling

stockholder identified in this prospectus (the “Selling Stockholder”), including its pledgees, assignees, donees, transferees

or their respective successors-in-interest in a private placement transaction that closed on October 1, 2024 (the “Private Placement”).

The shares of Common Stock issuable upon exercise of the Common Warrants are sometimes referred to as the “Common Warrant Shares.”

We

are filing the registration statement on Form S-1, of which this prospectus forms a part, to fulfill our contractual obligations with

the Selling Stockholder to provide for the resale by the Selling Stockholder of the shares of Common Stock offered hereby. See “Selling

Stockholder” beginning on page 6 of this prospectus for more information about the Selling Stockholder. The registration of the

shares of Common Stock to which this prospectus relates does not require the Selling Stockholder to sell any of its shares of our Common

Stock.

We

are not offering any shares of Common Stock under this prospectus and will not receive any proceeds from the sale or other disposition

of the shares of our Common Stock covered hereby. See “Use of Proceeds” beginning on page 3 of this prospectus.

The

Selling Stockholder identified in this prospectus, or its pledgees, assignees, donees, transferees or their respective successors-in-interest,

from time to time may offer and sell through public or private transactions at prevailing market prices, at prices related to prevailing

market prices or at privately negotiated prices the shares held by them directly or through underwriters, agents or broker-dealers on

terms to be determined at the time of sale, as described in more detail in this prospectus. See “Plan of Distribution” beginning

on page 7 of this prospectus for more information about how the Selling Stockholder may sell its shares of Common Stock. The Selling

Stockholder may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended

(the “Securities Act”).

In

connection with the Private Placement, we have agreed, pursuant to a securities purchase agreement dated September 30, 2024 (the “Purchase

Agreement”) that we have entered into with the Selling Stockholder, to bear all of the expenses in connection with the registration

of the Common Warrant Shares pursuant to this prospectus. The Selling Stockholder will pay or assume all commissions, discounts, fees

of underwriters, agents, selling brokers or dealer managers and similar expenses, if any, attributable to its sales of the shares of

Common Stock.

Our

Common Stock is listed on the NYSE American under the symbol “AIM.” On December 3, 2024, the closing price of our Common

Stock on the NYSE American was $0.2061 per share.

Investing

in our Common Stock involves risks. You should review carefully the risks and uncertainties described under the heading “Risk

Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference

into this prospectus, as described beginning on page 3 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. The securities are not being

offered in any jurisdiction where the offer is not permitted.

The

date of this prospectus is December 4, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information we have provided or incorporated by reference into this prospectus and any related free writing prospectus.

We have not authorized anyone to provide you with information different from that contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You

must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the shares of Common Stock

offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information

in this prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of

delivery of this prospectus or any sale of a security.

This

prospectus and the documents incorporated by reference into this prospectus include statistical and other industry and market data that

we obtained from industry publications and research, surveys and studies conducted by AIM, by third parties, or by third parties in collaboration

with AIM. Industry publications and research, surveys and studies generally indicate that their information has been obtained from sources

believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained

from these industry publications and research, surveys and studies are reliable. We are ultimately responsible for all disclosure included

in this prospectus.

The

Selling Stockholder is offering the shares of Common Stock only in jurisdictions where such issuances are permitted. The distribution

of this prospectus and the issuance of the shares of Common Stock in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to,

the issuance of the shares and the distribution of this prospectus outside the United States. This prospectus does not constitute, and

may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the shares of Common Stock offered by this

prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”),

under which the Selling Stockholder may offer from time-to-time securities described herein in one or more offerings. If required, each

time the Selling Stockholder offers shares, we will provide you with, in addition to this prospectus, a prospectus supplement that will

contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided

to you that may contain material information relating to that offering. We may also use a prospectus supplement and any related free

writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated

by reference. This prospectus, together with any related free writing prospectuses and the documents incorporated by reference into this

prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus

supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or

superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus supplement before

buying any of the securities offered.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the sections entitled

“Where You Can Find More Information” and “Incorporation of Certain Information By Reference.”

This

prospectus provides you with a general description of the shares of Common Stock the Selling Stockholder may offer. To the extent that

any statement made in an accompanying prospectus supplement is inconsistent with statements made in this prospectus, the statements made

in this prospectus will be deemed modified or superseded by those made in the accompanying prospectus supplement. You should read both

this prospectus and any accompanying prospectus supplement together with the additional information described under the section “Where

You Can Find More Information” included elsewhere in this prospectus.

Neither

we nor the Selling Stockholder has authorized anyone to provide you with information different from that contained in this prospectus,

any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. Neither we nor the Selling

Stockholder takes any responsibility for, or provides any assurance as to the reliability of, any information other than the information

in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. This prospectus

and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the securities described in this prospectus or any accompanying prospectus supplement or an offer to sell or the solicitation of

an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information

appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free-writing prospectus

is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed

materially since those dates.

Except

as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “AIM,” “the Company,”

“we,” “us,” “our” and similar references refer to AIM ImmunoTech Inc., an entity incorporated under

the laws of the State of Delaware.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes “forward-looking statements”, as such term is used within the meaning of the Private Securities Litigation

Reform Act of 1995. These “forward-looking statements” are not based on historical fact and involve assessments of certain

risks, developments, and uncertainties in our business looking to the future. Such forward-looking statements can be identified by the

use of terminology such as “may”, “will”, “should”, “expect”, “anticipate”,

“estimate”, “intend”, “continue”, or “believe”, or the negatives or other variations

of these terms or comparable terminology. Forward- looking statements may include projections, forecasts, or estimates of future performance

and developments. Forward-looking statements contained in this prospectus are based upon assumptions and assessments that we believe

to be reasonable as of the date of this prospectus. Whether those assumptions and assessments will be realized will be determined by

future factors, developments, and events, which are difficult to predict and may be beyond our control. Actual results, factors, developments,

and events may differ materially from those we assumed and assessed. Risks, uncertainties, contingencies, and developments, including

those identified in the “Risk Factors” section of this prospectus and in our most recent Annual Report on Form 10-K, subsequent

Quarterly Reports on Form 10-Q and other filings we make with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference herein, could cause our future operating

results to differ materially from those set forth in any forward-looking statement. There can be no assurance that any such forward-looking

statement, projection, forecast or estimate contained can be realized or that actual returns, results, or business prospects will not

differ materially from those set forth in any forward-looking statement. Given these uncertainties, readers are cautioned not to place

undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the

results of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments.

PROSPECTUS

SUMMARY

This

summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that

you should consider before deciding to invest in our securities. Before you decide to invest in our securities, you should read this

entire prospectus carefully, any related free writing prospectus that we have authorized for use in connection with the offering and

the documents incorporated by reference herein, including the information included under the heading titled “Risk Factors.”

Unless otherwise noted, all share and per share information relating to our Common Stock in this prospectus has been adjusted to reflect

the one-for-12 reverse stock split of our issued and outstanding shares of Common Stock effected on August 26, 2016 and the one-for-44

reverse stock split effected on June 10, 2019.

Our

Company

AIM

ImmunoTech Inc. and its subsidiaries are an immuno-pharma company headquartered in Ocala, Florida, and focused on the research and development

of therapeutics to treat multiple types of cancers, viral diseases and immune-deficiency disorders. We have established a strong foundation

of laboratory, pre-clinical and clinical data with respect to the development of nucleic acids and natural interferon to enhance the

natural antiviral defense system of the human body, and to aid the development of therapeutic products for the treatment of certain cancers

and chronic diseases.

Our

flagship products are Ampligen (rintatolimod) and Alferon N Injection (Interferon alfa). Ampligen is a double-stranded RNA (“dsRNA”)

molecule being developed for globally important cancers, viral diseases and disorders of the immune system. Ampligen has not been approved

by the Food and Drug Administration (the “FDA”) or marketed in the United States, but is approved for commercial sale in

the Argentine Republic for the treatment of severe Chronic Fatigue Syndrome (“CFS”).

We

are currently proceeding primarily in four areas:

| ● |

Conducting

clinical trials to evaluate the efficacy and safety of Ampligen for the treatment of pancreatic cancer. |

| ● |

Evaluating

Ampligen across multiple cancers as a potential therapy that modifies the tumor microenvironment with the goal of increasing anti-tumor

responses to checkpoint inhibitors. |

| ● |

Exploring

Ampligen’s antiviral activities and potential use as a prophylactic or treatment for existing viruses, new viruses and mutated

viruses thereof. |

| ● |

Evaluating

Ampligen as a treatment for myalgic encephalomyelitis/chronic fatigue syndrome (“ME/CFS”) and fatigue and/or the Post-COVID

condition of fatigue. |

We

are prioritizing activities in an order related to the stage of development, with those clinical activities such as pancreatic cancer,

ME/CFS and Post-COVID conditions having priority over antiviral experimentation. We intend that priority clinical work be conducted in

trials authorized by the FDA or European Medicines Agency (“EMA”), which trials support a potential future new drug application

(“NDA”). However, our antiviral experimentation is designed to accumulate additional preliminary data supporting their hypothesis

that Ampligen is a powerful, broad-spectrum prophylaxis and early-onset therapeutic that may confer enhanced immunity and cross-protection.

Accordingly, we will conduct antiviral programs in those venues most readily available and able to generate valid proof-of-concept data,

including foreign venues.

Corporate

Information

Our

primary executive offices are located at 2117 SW Highway 484, Ocala FL 34473 and our telephone number is (352) 448-7797. Additional information

can be found on our website, https://aimimmuno.com and in our periodic and current reports filed with the SEC. Copies of our current

and periodic reports filed with the SEC are available to the public on a website maintained by the SEC at www.sec.gov and on our website.

The information contained on, or that can be accessed through, our website is not part of this prospectus and should not be considered

as part of this prospectus or in deciding whether to purchase our securities. No portion of our website is incorporated by reference

into this prospectus.

Smaller

Reporting Company

We

are currently a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a

majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $250 million

or annual revenues of less than $100 million during the most recently completed fiscal year. As a result of being considered a “smaller

reporting company,” we will be entitled to certain exemptions regarding the disclosure that we are required to provide in our SEC

filings. Specifically, “smaller reporting companies” are able to provide simplified executive compensation disclosures in

their filings; are exempt from the provisions of Section 404(b) of Sarbanes-Oxley requiring that independent registered public accounting

firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased

disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial

statements in annual reports. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company”

may make it harder for investors to analyze our results of operations and financial prospects.

THE

OFFERING

Shares

of Common Stock offered by

the

Selling Stockholder |

|

9,306,072

shares of our Common Stock issuable upon the exercise of Common Warrants. |

| |

|

|

Common

Stock to be outstanding

after

this offering |

|

73,085,397

shares of Common Stock, assuming the exercise of all of the Common Warrants. |

| |

|

|

Registration

of the Common

Warrant

Shares |

|

Pursuant

to the terms of the Purchase Agreement, we agreed to file the registration statement, of which this prospectus forms a part, with

respect to the registration of the resale of the Common Warrant Shares as soon as practicable (and in any event within 45 calendar

days of the date of the Purchase Agreement), and to use commercially reasonable efforts to cause such registration statement to become

effective within 181 days following October 1, 2024, the closing date of the sale of the Common Warrants, and to keep such registration

statement effective at all times until no Purchaser owns any Common Warrants or Common Warrant Shares issuable upon exercise thereof. |

| |

|

|

| Use

of Proceeds |

|

The

Selling Stockholder will receive all of the proceeds of the sale of shares of Common Stock offered from time to time pursuant to

this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of Common Stock that may be sold from time

to time pursuant to this prospectus; however, we will receive proceeds from any cash exercise of the Common Warrants. See “Use

of Proceeds.” We intend to use the proceeds from any cash exercise of the Common Warrants for general corporate purposes, including

using funds for working capital. |

| |

|

|

| Plan

of Distribution |

|

The

Selling Stockholder named in this prospectus, or its pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest,

may offer or sell the shares of Common Stock offered hereby from time to time through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Stockholder may also

resell the shares of Common Stock to or through underwriters, broker-dealers or agents, who may receive compensation in the form

of discounts, concessions or commissions. |

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” beginning on page 3 of this prospectus and in the documents incorporated by reference in this prospectus

and the other information included in this prospectus for a discussion of factors you should carefully consider before investing

in our securities. |

| |

|

|

| NYSE

American trading symbol |

|

Our

Common Stock is listed on the NYSE American under the symbol “AIM.” |

The

number of shares of our Common Stock that will be outstanding immediately after this offering as shown above is based on 63,779,325

shares outstanding as of December 2, 2024 and excludes (vested and unvested):

| |

● |

118,500

shares of our Common Stock issuable upon exercise of outstanding options granted under our 2009 equity incentive plans at a weighted

average exercise price of $18.57 per share; and 2,814,142 shares of our Common Stock issuable upon exercise of outstanding options

granted under our 2018 equity incentive plans at a weighted average exercise price of $1.54 per share; |

| |

● |

1,474,482

shares of our Common Stock available for issuance or future grant pursuant to our equity incentive plan; |

| |

● |

11,281,916

shares of our Common Stock issuable upon exercise of outstanding warrants issued to the Selling Stockholder in a prior offering at

a weighted average exercise price of $0.363 per share; and |

| |

● |

360,000

shares of our Common Stock issuable upon exercise of outstanding options granted to Azenova. |

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this

prospectus and in the documents we incorporate by reference into this prospectus before you decide to purchase our shares of Common Stock.

In particular, you should carefully consider and evaluate the risks and uncertainties described under the heading “Risk Factors”

in our most recent Annual Report on Form 10-K, as updated by annual, quarterly and other reports and documents that we file with the

SEC and incorporate by reference into this prospectus, or any prospectus, which risks could materially and adversely affect our business,

results of operations and financial condition, which in turn could materially and adversely affect the value of the shares of our Common

Stock offered by this prospectus. Our business, financial condition, results of operations and prospects could be materially and adversely

affected by these risks. As a result, you could lose all or part of your investment.

USE

OF PROCEEDS

The

Selling Stockholder will receive all of the proceeds of the sale of shares of Common Stock offered from time to time pursuant to this

prospectus. Accordingly, we will not receive any proceeds from the sale of shares of Common Stock that may be sold from time to time

pursuant to this prospectus; however, we will receive proceeds from any cash exercise of the Common Warrants. If all of the Common Warrants

are exercised for cash, we will receive approximately $2,605,700 in gross proceeds. We intend to use the proceeds from any cash exercise

of the Common Warrants for general corporate purposes, including using funds for working capital.

We

will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of the Common Warrant Shares registered

hereby, which may be resold by the Selling Stockholder pursuant to this prospectus. Other than registration expenses, such as SEC fees

and legal and accounting expenses, which we will bear, the Selling Stockholder will bear any underwriting discounts, commissions, placement

agent fees or other similar expenses payable with respect to sales of the Common Warrant Shares.

DIVIDEND

POLICY

We

have not declared or paid dividends to holders of our Common Stock since inception and do not plan to pay cash dividends in the foreseeable

future to such Common Stockholders. We currently intend to retain earnings, if any, to finance our growth.

DETERMINATION

OF THE OFFERING PRICE

The

prices at which the shares of our Common Stock covered by this prospectus may actually be sold by the Selling Stockholder will be determined

by the prevailing public market price for shares of our Common Stock or by negotiations between the Selling Stockholder and the buyer

or buyers of our Common Stock in private transactions or as otherwise described in the section of this prospectus entitled “Plan

of Distribution.”

DESCRIPTION

OF CAPITAL STOCK

The

following summary description sets forth some of the general terms and provisions of our capital stock. Because this is a summary description,

it does not contain all of the information that may be important to you. For a more detailed description of our capital stock, you should

refer to the applicable provisions of the General Corporation Law of the State of Delaware (the “DGCL”) and our Amended and

Restated Certificate of Incorporation, as amended (the “Charter”), and our Restated and Amended Bylaws (“Bylaws”).

Copies of our Charter and Bylaws are included as exhibits to the registration statement of which this prospectus forms a part.

Capital

Stock

We

have authorized 350,000,000 shares of Common Stock, $0.001 par value per share, and 5,000,000 shares of preferred stock, $0.01 par value.

As of December 2, 2024, there were 63,779,325 shares of Common Stock issued and outstanding, no shares of Series A Junior

Participating preferred stock issued or outstanding, no shares of Series B preferred stock issued or outstanding, and 118,500 shares

of our Common Stock issuable upon exercise of outstanding options granted under our 2009 equity incentive plans at a weighted average

exercise price of $18.57 per share, 2,814,142 shares of our Common Stock issuable upon exercise of outstanding options granted under

our 2018 equity incentive plans at a weighted average exercise price of $1.54 per share, 11,281,916 shares of our Common Stock issuable

upon exercise of outstanding warrants issued to the Selling Stockholder in a prior offering at a weighted average exercise price of $0.363

per share, 360,000 shares of our Common Stock issuable upon exercise of outstanding options granted to Azenova. The authorized and unissued

shares of Common Stock and the authorized and undesignated shares of preferred stock are available for issuance without further action

by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may

be listed. Unless approval of our stockholders is so required, our board of directors does not intend to seek stockholder approval for

the issuance and sale of our Common Stock or preferred stock.

Common

Stock

Holders

of our Common Stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and have no cumulative

voting rights. Holders of our Common Stock are entitled to receive ratably dividends as may be declared by our board of directors out

of funds legally available for that purpose, subject to any preferential dividend or other rights of any then outstanding preferred stock.

We have never paid cash dividends on our Common Stock and do not anticipate paying any cash dividends in the foreseeable future but intend

to retain our capital resources for reinvestment in our business. Any future disposition of dividends will be at the discretion of our

board of directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements,

and other factors.

Holders

of our Common Stock do not have preemptive or conversion rights or other subscription rights. Upon liquidation, dissolution or winding-up,

holders of our Common Stock are entitled to share in all assets remaining after payment of all liabilities and the liquidation preferences

of any of our outstanding shares of preferred stock. The rights, preferences and privileges of holders of Common Stock are subject to

and may be adversely affected by the rights of the holders of shares of any series of our preferred stock that is currently outstanding

or that we may designate and issue in the future.

Except

as otherwise provided by law, our Charter and Bylaws, each as amended, in all matters other than the election of directors, the affirmative

vote of a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on

the subject matter shall be the act of the stockholders. In addition, except as otherwise provided by law, our Charter or our Bylaws,

directors are elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled

to vote on the election of directors.

Preferred

Stock

Holders

of our Series A Junior Participating preferred stock, if and when issued, will have the right to purchase from us shares of Common Stock

or Common Stock equivalents pursuant to the terms of the Third Amended and Restated Rights Agreement dated May 12, 2023.

Pursuant

to a February 2019 registration statement relating to a rights offering we distributed to our holders of Common Stock and to holders

of certain options and redeemable warrants as of February 14, 2019, at no charge, one non-transferable subscription right for each share

of Common Stock held or deemed held on the record date. Each right entitled the holder to purchase one unit, at a subscription price

of $1,000 per unit, consisting of one share of B Preferred and 114 warrants with an assumed exercise price of $8.80. The redeemable warrants

were exercisable for five years after the date of issuance. As of December 3, 2024, there were no warrants and no Series B Preferred

warrants outstanding related to the rights offering.

Transfer

Agent and Registrar

The

Transfer Agent and Registrar for our Common Stock is Equiniti Trust Company.

Anti-Takeover

Effects of Provisions of Delaware Law, Our Charter, Our Bylaws and Our Stockholders’ Rights Plan

Delaware

Anti-Takeover Law

Section

203 of the Delaware General Corporation

We

are subject to Section 203 of the DGCL, which prohibits a Delaware corporation from engaging in any business combination with any interested

stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

| |

● |

before

such date, our board of directors of the corporation approved either the business combination or the transaction that resulted in

the stockholder becoming an interested stockholder; |

| |

|

|

| |

● |

upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned

at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining

the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by

persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to

determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

|

|

| |

● |

on

or after such date, the business combination is approved by our board of directors and authorized at an annual or special meeting

of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that

is not owned by the interested stockholder. |

In

general, Section 203 defines business combination to include the following:

| |

● |

any

merger or consolidation involving the corporation and the interested stockholder; |

| |

● |

any

sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| |

● |

subject

to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation

to the interested stockholder; |

| |

● |

any

transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series

of the corporation beneficially owned by the interested stockholder; or |

| |

● |

the

receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or

through the corporation. |

In

general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates

and associates, beneficially owns, or within three years before the time of determination of interested stockholder status did own, 15%

or more of the outstanding voting stock of the corporation. Prior to entry into the Purchase Agreement our board of directors approved

the issuance of Securities to the Selling Stockholder under the Purchase Agreement and related documents for purposes of Section 203.

Charter

and Bylaws

Our

Charter and/or Bylaws provide that:

| |

● |

our

Bylaws may be amended or repealed by our board of directors or our stockholders; |

| |

● |

our

board of directors will be authorized to issue, without stockholder approval, preferred stock, the rights of which will be determined

at the discretion of our board of directors and that, if issued, could operate as a “poison pill” to dilute the stock

ownership of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve; |

| |

● |

our

stockholders do not have cumulative voting rights, and therefore our stockholders holding a majority of the shares of Common Stock

outstanding will be able to elect all of our directors; and |

| |

● |

our

stockholders must comply with advance notice provisions to bring business before or nominate directors for election at a stockholder

meeting. |

Stockholder

Rights Plan

On

November 19, 2002, our board of directors declared a dividend distribution of one Right for each outstanding share of Common Stock to

stockholders of record at the close of business on November 29, 2002 pursuant to our rights agreement (as subsequently amended and restated,

the “Rights Agreement”) between us and our Rights Agent. Each Right entitles the registered holder of one share of our Common

Stock to purchase from the Company a unit consisting of one one-hundredth of a share (a “Unit”) of Series A Junior Participating

Preferred Stock, par value $0.01 per share at a Purchase Price of $4.00 per Unit, subject to adjustment. All terms not specifically defined

herein have the definition set forth in the Rights Agreement. The description and terms of the Rights are set forth in the Rights Agreement.

Prior to entry into the Purchase Agreement, our board of directors exempted the Selling Stockholder and its Affiliates and Associates

from becoming Acquiring Persons under the rights plan created under the Rights Agreement by virtue of receiving Securities under the

Purchase Agreement and related documents or under any other agreement between the Company and the Selling Stockholder.

The

current Amended and Restated Rights Agreement is included as an exhibit to the Company’s Quarterly Report on Form 10-Q for the

period ended March 31, 2023 (File No. 001-27072) filed with the SEC on May, 15, 2023. Such Plan and the Rights are described In Part

II, ITEM 5: Other Information in the foregoing Report on Form 10-Q. All of the foregoing are incorporated by reference herein.

Potential

Effects of Authorized but Unissued Stock

We

have shares of Common Stock and preferred stock available for future issuance without stockholder approval. We may utilize these additional

shares for a variety of corporate purposes, including future public offerings to raise additional capital, to facilitate corporate acquisitions

or payment as a dividend on the capital stock.

The

existence of unissued and unreserved Common Stock and preferred stock may enable our board of directors to issue shares to persons friendly

to current management or to issue preferred stock with terms that could render more difficult or discourage a third-party attempt to

obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby protecting the continuity of our management.

In addition, our board of directors has the discretion to determine designations, rights, preferences, privileges and restrictions, including

voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences of each series of preferred stock,

all to the fullest extent permissible under the DGCL and subject to any limitations set forth in our Certificate of Incorporation. The

purpose of authorizing our board of directors to issue preferred stock and to determine the rights and preferences applicable to such

preferred stock is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while

providing desirable flexibility in connection with possible financings, acquisitions and other corporate purposes, could have the effect

of making it more difficult for a third-party to acquire, or could discourage a third-party from acquiring, a majority of our outstanding

voting stock.

DESCRIPTION

OF THE PRIVATE PLACEMENT

On

September 30, 2024, we entered into a Purchase Agreement with the Selling Stockholder as Purchaser, pursuant to which we issued to the

Selling Stockholder, (i) in a registered direct offering, 4,653,036 shares of our Common Stock (“Shares”) and (ii) in the

concurrent Private Placement, we issued the Common Warrants to purchase an aggregate of up to 9,306,072 Common Warrant Shares, each with

an exercise price of $0.28. Such registered direct offering and concurrent Private Placement are referred to herein as the “Transactions.”

The purchase price for Shares in the registered direct offering was $0.27 per Share.

We

received aggregate gross proceeds from the Transactions of approximately $1.26 million, before deducting fees to the Placement Agent

and other estimated offering expenses payable by us. The Shares were offered by us pursuant to a shelf registration statement on Form

S-3 (File No. 333-262280), which was declared effective on February 4, 2022. The Common Warrants and the Common Warrant Shares issued

in the Private Placement were not registered under the Securities Act. Rather the Common Warrants and the Common Warrant Shares were

issued pursuant to the exemption from registration provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

The C Warrants and D Warrants are not exercisable until December 3, 2024, and will expire, respectively, 24 months and five years and

six months after that date.

Exercise

Limitation. Selling Stockholder will not have the right to exercise any portion of the Common Warrants if it (together with its affiliates)

would beneficially own in excess of 4.99% of the number of shares of our Common Stock outstanding immediately after giving effect to

the exercise, as such percentage ownership is determined in accordance with the terms of such warrants. However, any holder may increase

or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Exercise

Price Adjustment. The exercise price of the Common Warrants is subject to appropriate adjustment in the event of certain stock dividends

and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock.

Exchange

Listing. There is no established trading market for Common Warrants and we do not expect a market to develop. In addition, we do

not intend to apply for the listing of the Common Warrants on any national securities exchange or other trading market.

Fundamental

Transactions. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may

exercise every right and power that we may exercise and will assume all of our obligations under the Common Warrants with the same effect

as if such successor entity had been named in the warrant itself. If holders of our Common Stock are given a choice as to the securities,

cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration

it receives upon any exercise of the Common Warrants following such fundamental transaction. In addition, the successor entity, at the

request of warrant holders, will be obligated to purchase any unexercised portion of the Common Warrants in accordance with the terms

of such warrants. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Common Warrants have the

right to require us or a successor entity to redeem the common warrants for cash in the amount of the Black Scholes Value (as defined

in each warrant) of the unexercised portion of the common warrants concurrently with or within 30 days following the consummation of

a fundamental transaction.

Rights

as a Stockholder. Except as otherwise provided in the Common Warrants or by virtue of such Warrant holder’s ownership of shares

of our Common Stock, the holder of a Common Warrants will not have the rights or privileges of a holder of our Common Stock, including

any voting rights, until the holder exercises such warrant.

Resale/Registration

Rights. Pursuant to the Purchase Agreement and the Common Warrants, we have filed this Registration Statement. We are using commercially

reasonable efforts to cause the Registration Statement to become effective within 181 days following October 1, 2024 and to keep it effective

at all times until no Purchaser owns any Warrants or Warrant Shares issuable upon exercise thereof.

Maxim

Group LLC acted as the Placement Agent on a “reasonable best efforts” basis, in connection with the Transactions pursuant

to the Placement Agency Agreement by and between us and the Placement Agent. Pursuant to the Placement Agency Agreement, the Placement

Agent was paid a cash fee of 8% of the aggregate gross proceeds paid to us for the securities sold in the Transactions and reimbursement.

In addition, we have reimbursed the Placement Agent $65,000 for certain offering-related expenses.

SELLING

STOCKHOLDER

The

shares of our Common Stock being offered by the Selling Stockholder are those issuable to the Selling Stockholder upon exercise of the

Common Warrants. For additional information regarding the issuances of the Common Warrants and the Common Warrant Shares, see “Description

of the Private Placement” elsewhere in this prospectus. We are registering these shares of our Common Stock in order to permit

the Selling Stockholder to offer them for resale from time to time. Except for the ownership of shares of our Common Stock and the Common

Warrants purchased in the prior transaction and the Transactions, the Selling Stockholder has not had any material relationship with

us within the past three years.

The

following table sets forth certain information with respect to the Selling Stockholder, including (i) the number of shares of our Common

Stock beneficially owned by the Selling Stockholder, including and securities exercisable for shares of our Common Stock, prior to this

offering without regard to any beneficial ownership limitations contained in the Common Warrants (as specified below), (ii) the number

of shares of our Common Stock being offered by the Selling Stockholder pursuant to this prospectus and (iii) the Selling Stockholder’s

beneficial ownership after completion of this offering assuming the sale of all of the shares of our Common Stock covered by this prospectus

and the shares issuable upon exercise of the warrants issued in the prior offering to Armistice. The registration of the shares of our

Common Stock issuable to the Selling Stockholder upon the exercise of the Common Warrants does not necessarily mean that the Selling

Stockholder will sell all or any of such shares, but the number of shares and percentages set forth in the final two columns below assume

that all shares of our Common Stock being offered by the Selling Stockholder are sold.

The

table is based on information supplied to us by the Selling Stockholder, with beneficial ownership and percentage ownership determined

in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to shares of stock. This

information does not necessarily indicate beneficial ownership for any other purpose. In computing the number of shares beneficially

owned by the Selling Stockholder and the percentage ownership of the Selling Stockholder, shares of our Common Stock subject to the Common

Warrants held by the Selling Stockholder that are exercisable within 60 days after October 1, 2024, are deemed outstanding. The percentage

of beneficial ownership after this offering is based on 63,779,325 shares of our Common Stock outstanding on December 2,

2024.

This

prospectus covers the resale of 9,306,072 shares of our Common Stock that may be sold or otherwise disposed of by the Selling Stockholder.

Such shares of our Common Stock are issuable to the Selling Stockholder upon the exercise of the Common Warrants. The C Warrants and

D Warrants are not exercisable until April 1, 2025, and will expire, respectively, on April 1, 2027 and April 1, 2030. The Common Warrants

have an exercise price of $0.28 per share. See “Description of the Private Placement” above for a more complete description

of the Common Warrants. Under the terms of the Common Warrants, the Selling Stockholder may not exercise the Common Warrants to the extent

such exercise would cause such Selling Stockholder, together with its affiliates and attribution parties, to beneficially own a number

of shares of Common Stock that would exceed 4.99%, as applicable, of our then outstanding Common Stock following such exercise, excluding

for purposes of such determination shares of Common Stock issuable upon exercise of such Common Warrants that have not been exercised.

The number of shares in the second and fourth columns do not reflect this limitation. The Selling Stockholder may sell all, some or none

of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder | |

Number of Shares

of Common Stock

Beneficially

Owned Prior to

Offering(1) | | |

Maximum

Number of Shares

of Common Stock

offered for Resale in this

Offering | | |

Number of Shares

of Common Stock

Beneficially

Owned After

Offering | | |

Percentage

of Shares

Beneficially

Owned after

Offering(1) | |

| Armistice Capital, LLC(1)(2) | |

| 20,587,988 | | |

| 9,306,072 | | |

| 0 | | |

| 0 | % |

| (1) |

Consists

of (i) 9,306,072 Common Warrant Shares issuable upon the exercise of the Common Warrants and (ii) 11,281,916 shares issuable upon

the exercise of the common stock warrants issued in the prior offering to Armistice. All of the foregoing warrants are subject to

a beneficial ownership limitation of 4.99% of the number of shares of our Common Stock outstanding, which in each case restricts

the Selling Stockholder from exercising that portion of the warrants that would result in the Selling Stockholder and its affiliates

owning, after exercise, a number of shares of Common Stock in excess of the beneficial ownership limitation. The number of shares

set forth in the above table does not reflect the application of this limitation. |

| |

|

| (2) |

The

securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager

of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership

limitation of 4.99%, which such limitation restricts the Selling Stockholder from exercising that portion of the warrants that would

result in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the

beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue,

7th Floor, New York, NY 10022. |

PLAN

OF DISTRIBUTION

The

Selling Stockholder of the securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on the NYSE American or any other stock exchange, market or trading facility on which the securities

are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholder may use any one or more

of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholder to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholder may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify

the Selling Stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholder

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect

or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar

effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state

securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholder will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common

Stock by the Selling Stockholder or any other person. We will make copies of this prospectus available to the Selling Stockholder and

have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

Silverman,

Shin & Schneider PLLC, New York, New York will pass upon the validity of the shares of our Common Stock being registered by the registration

statement of which this prospectus is a part.

EXPERTS

The

consolidated financial statements of AIM ImmunoTech, Inc. (the Company) as of December 31, 2023 and 2022 and for each of the two years

in the period ended December 31, 2023 incorporated by reference in this prospectus and in the registration statement have been so incorporated

in reliance upon the report of BDO USA, P.C., an independent registered public accounting firm, given on the authority of said firm as

experts in auditing and accounting.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to incorporate by reference into this prospectus the information contained in other documents we file with the SEC, which

means that we can disclose important information to you by referring you to those documents. Any statement contained in any document

incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded, for purposes

of this prospectus, to the extent that a statement contained in or omitted from this prospectus, or in any other subsequently filed document

that also is or is deemed to be incorporated by reference in this prospectus, modifies or supersedes such statement. Any such statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate

by reference the documents listed below which have been filed by us and any future filings we make with the SEC under Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed

on such form that are related to such items unless such Form 8-K expressly provides to the contrary) subsequent to the date of this prospectus

and before the termination or completion of the offering of the securities covered by this prospectus. We incorporate by reference into

this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have

filed with the SEC (Commission File No. 001-27072):

| |

1. |

Our

Annual Report on Form 10-K for the year ended December 31, 2023; |

| |

2. |

Our

Quarterly Reports on Form 10-Q, for the fiscal quarters ended March 31, 2024, June 30, 2024 and September 30, 2024; |

| |

3. |

Our

Current Reports on Form 8-K, as filed with the SEC on January 10, 2024, January 10, 2024, January 25, 2024, February 9, 2024, .February 20, 2024, June 3, 2024, July 15, 2024, August 1, 2024, September 12, 2024, October 1, 2024 and November 27,2024. |

| |

4. |

Our

Definitive Proxy Statement on Schedule 14A filed with the SEC on November 4, 2024, and all Definitive Additional Materials filed

then and thereafter; and |

| |

5. |

The

description of the capital stock contained in our Registration Statement on Form S-1 (No. 333-280761) filed July 11, 2024 as updated

together with any subsequent amendment or report filed with the SEC for the purpose of updating this description. |

Any

statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed

document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You

may request, orally or in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such

exhibits are specifically incorporate by reference), by contacting AIM ImmunoTech Inc. at 2117 SW Highway 484, Ocala FL 34473, Attention:

Investor Relations, telephone No. (352) 448-7797. You may also access these documents on our website at https://aimimmuno.com/.

Information on our website, any subsection, page, or other subdivision of our website, or any website linked to by content on the website,

is not part of this prospectus and you should not rely on that information unless that information is also in this prospectus or incorporated

by reference in this prospectus.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and in accordance therewith file reports, proxy statements and other

information with the SEC. Our filings are available to the public over the Internet at the SEC’s website at www.sec.gov,

as well as at our website at https://aimimmuno.com/. Information on our website, any subsection, page, or other subdivision

of our website, or any website linked to by content on the website, is not part of this prospectus and you should not rely on that information

unless that information is also in this prospectus or incorporated by reference in this prospectus.

9,306,072

Shares of Common Stock

AIM

ImmunoTech Inc.

PROSPECTUS

December

4, 2024

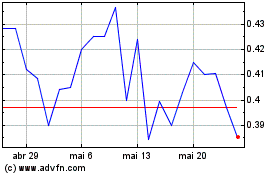

AIM ImmunoTech (AMEX:AIM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

AIM ImmunoTech (AMEX:AIM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025