AMCON Distributing Company (“AMCON” or “Company”) (NYSE

American: DIT), an Omaha, Nebraska based consumer products company,

is pleased to announce fully diluted earnings per share of $4.46 on

net income available to common shareholders of $2.6 million for its

first fiscal quarter ended December 31, 2022.

“AMCON has a strategic focus on Customer Service and this

long-held approach enables our leadership in the Convenience

Distribution industry,” said Christopher H. Atayan, AMCON’s

Chairman and Chief Executive Officer. Mr. Atayan further noted,

“AMCON continues to seek out acquisition opportunities for

convenience and foodservice distributors who want to align with the

Company’s growing platform and customer centric management

philosophy.”

The wholesale distribution segment reported revenues of $555.7

million and operating income of $8.2 million for the first quarter

of fiscal 2023. The retail health food segment reported revenues of

$10.3 million and an operating loss of $0.3 million for the first

quarter of fiscal 2023.

“We are proud of the extra efforts our team made to ensure

timely delivery to our customers during the severe weather we

encountered during the quarter,” said Andrew C. Plummer, AMCON’s

President and Chief Operating Officer. Mr. Plummer further noted,

“We are investing heavily in our foodservice and technology

platforms and associated staffing for these strategic focus areas.

Our customer base is growing, and we continue to search for

facilities in, and adjacent to, the geographic markets we

serve.”

“We are actively managing our working capital position to take

advantage of strategic opportunities in the marketplace,” said

Charles J. Schmaderer, AMCON’s Chief Financial Officer. Mr.

Schmaderer further noted, “As a core operating principle, we

maintain high levels of liquidity and ended the quarter with $94.7

million of consolidated shareholders’ equity.”

AMCON is a leading convenience distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and refrigerated foods, automotive supplies and health and beauty

care products servicing approximately 5,400 retail stores through

distribution centers in Illinois, Missouri, Nebraska, North Dakota,

South Dakota, Tennessee and West Virginia. AMCON, through its

Healthy Edge Retail Group, also operates nineteen (19) health and

natural product retail stores in the Midwest and Florida.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Balance

Sheets

December 31, 2022 and

September 30, 2022

December

September

2022

2022

(Unaudited)

ASSETS

Current assets:

Cash

$

452,142

$

431,576

Accounts receivable, less allowance for

doubtful accounts of $2.0 million at December 2022 and $2.5 million

September 2022

54,482,938

62,367,888

Inventories, net

185,213,063

134,654,637

Income taxes receivable

660,617

819,595

Prepaid expenses and other current

assets

12,656,974

12,702,084

Total current assets

253,465,734

210,975,780

Property and equipment, net

48,449,099

48,085,520

Operating lease right-of-use assets,

net

19,078,842

19,941,009

Goodwill

5,277,950

5,277,950

Other intangible assets, net

2,050,580

2,093,113

Other assets

2,551,744

2,751,155

Total assets

$

330,873,949

$

289,124,527

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

33,296,105

$

39,962,363

Accrued expenses

14,658,185

14,446,210

Accrued wages, salaries and bonuses

3,794,970

7,811,207

Current operating lease liabilities

6,426,103

6,454,473

Current maturities of long-term debt

1,554,653

1,595,309

Current mandatorily redeemable

non-controlling interest

1,755,611

1,712,095

Total current liabilities

61,485,627

71,981,657

Credit facilities

141,488,518

91,262,438

Deferred income tax liability, net

3,474,410

2,328,588

Long-term operating lease liabilities

12,989,955

13,787,721

Long-term debt, less current

maturities

7,222,520

7,384,260

Mandatorily redeemable non-controlling

interest, less current portion

9,348,028

9,446,460

Other long-term liabilities

152,889

103,968

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 611,052 shares outstanding at December 2022 and

584,789 shares outstanding at September 2022

9,431

9,168

Additional paid-in capital

29,357,154

26,903,201

Retained earnings

96,212,704

96,784,353

Treasury stock at cost

(30,867,287

)

(30,867,287

)

Total shareholders’ equity

94,712,002

92,829,435

Total liabilities and shareholders’

equity

$

330,873,949

$

289,124,527

AMCON Distributing Company and Subsidiaries

Condensed Consolidated

Unaudited Statements of Operations

for the three months ended

December 31, 2022 and 2021

For the three months ended

December

2022

2021

Sales (including excise taxes of $130.3

million and $97.1 million, respectively)

$

565,989,507

$

422,571,278

Cost of sales

531,019,924

395,638,615

Gross profit

34,969,583

26,932,663

Selling, general and administrative

expenses

28,379,186

22,390,740

Depreciation and amortization

1,070,886

784,245

29,450,072

23,174,985

Operating income

5,519,511

3,757,678

Other expense (income):

Interest expense

1,694,158

322,097

Change in fair value of mandatorily

redeemable non-controlling interest

(54,916

)

—

Other (income), net

(53,532

)

(40,109

)

1,585,710

281,988

Income from operations before income

taxes

3,933,801

3,475,690

Income tax expense

1,304,800

1,245,000

Equity method investment earnings, net of

tax

—

770,365

Net income available to common

shareholders

$

2,629,001

$

3,001,055

Basic earnings per share available to

common shareholders

$

4.52

$

5.33

Diluted earnings per share available to

common shareholders

$

4.46

$

5.18

Basic weighted average shares

outstanding

581,612

563,546

Diluted weighted average shares

outstanding

589,881

578,964

Dividends paid per common share

$

0.18

$

5.18

AMCON Distributing Company and Subsidiaries

Condensed Consolidated

Unaudited Statements of Shareholders’ Equity

for the three months ended

December 31, 2022 and 2021

Additional

Common Stock

Treasury Stock

Paid-in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

THREE MONTHS ENDED DECEMBER

2021

Balance, October 1, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,918,781

$

83,552,298

$

77,612,626

Dividends on common stock, $5.18 per

share

—

—

—

—

—

(3,114,775

)

(3,114,775

)

Compensation expense and settlement of

equity-based awards

31,420

314

—

—

2,080,954

—

2,081,268

Net income available to common

shareholders

—

—

—

—

—

3,001,055

3,001,055

Balance, December 31, 2021

915,009

$

9,148

(332,220

)

$

(30,867,287

)

$

26,999,735

$

83,438,578

$

79,580,174

THREE MONTHS ENDED DECEMBER

2022

Balance, October 1, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,903,201

$

96,784,353

$

92,829,435

Dividends on common stock, $5.18 per

share

—

—

—

—

—

(3,200,650

)

(3,200,650

)

Compensation expense and settlement of

equity-based awards

26,263

263

—

—

2,453,953

—

2,454,216

Net income available to common

shareholders

—

—

—

—

—

2,629,001

2,629,001

Balance, December 31, 2022

943,272

$

9,431

(332,220

)

$

(30,867,287

)

$

29,357,154

$

96,212,704

$

94,712,002

AMCON Distributing Company and Subsidiaries

Condensed Consolidated

Unaudited Statements of Cash Flows

for the three months ended

December 31, 2022 and 2021

December

December

2022

2021

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income available to common

shareholders

$

2,629,001

$

3,001,055

Adjustments to reconcile net income

available to common shareholders to net cash flows from (used in)

operating activities:

Depreciation

1,028,353

784,245

Amortization

42,533

—

Equity method investment earnings, net of

tax

—

(770,365

)

(Gain) loss on sales of property and

equipment

(36,000

)

(31,000

)

Equity-based compensation

390,570

710,056

Deferred income taxes

1,145,822

1,173,648

Provision for losses on doubtful

accounts

(496,332

)

(102,000

)

Inventory allowance

141,087

99,304

Change in fair value of mandatorily

redeemable non-controlling interest

(54,916

)

—

Changes in assets and liabilities:

Accounts receivable

8,381,282

5,084,916

Inventories

(50,699,513

)

(2,629,537

)

Prepaid and other current assets

45,110

(6,573

)

Other assets

199,411

22,184

Accounts payable

(6,602,785

)

(5,750,609

)

Accrued expenses and accrued wages,

salaries and bonuses

(4,794,015

)

(1,519,848

)

Other long-term liabilities

48,921

(743,776

)

Income taxes payable and receivable

158,978

71,352

Net cash flows from (used in) operating

activities

(48,472,493

)

(606,948

)

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(1,455,405

)

(333,084

)

Proceeds from sales of property and

equipment

36,000

31,000

Principal payment received on note

receivable

—

175,000

Net cash flows from (used in) investing

activities

(1,419,405

)

(127,084

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facilities

639,488,133

439,039,482

Repayments under revolving credit

facilities

(589,262,053

)

(434,242,609

)

Principal payments on long-term debt

(202,396

)

(138,284

)

Dividends on common stock

(111,220

)

(3,114,775

)

Settlement and withholdings of

equity-based awards

—

(488,412

)

Net cash flows from (used in) financing

activities

49,912,464

1,055,402

Net change in cash

20,566

321,370

Cash, beginning of period

431,576

519,591

Cash, end of period

$

452,142

$

840,961

Supplemental disclosure of cash flow

information:

Cash paid during the period for

interest

$

1,458,843

$

333,941

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

28,183

$

16,591

Dividends declared, not paid

3,089,430

—

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

2,044,805

2,280,783

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230118005580/en/

For Further Information Contact: Christopher H. Atayan AMCON

Distributing Company Ph 402-331-3727

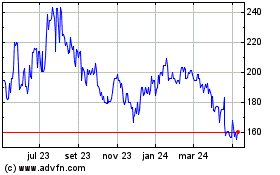

AMCON Distributing (AMEX:DIT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

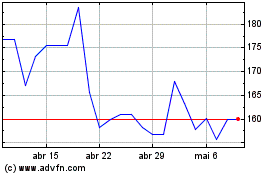

AMCON Distributing (AMEX:DIT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025