|

As filed with the Securities and Exchange Commission on April 26, 2023

|

| |

|

Registration No. 333-271142

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10/A

(Amendment No. 2)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TASEKO MINES LIMITED

(Exact name of the Registrant as specified in its charter)

British Columbia

(Province or other jurisdiction of incorporation or organization)

| 1040 |

Not Applicable |

| (Primary Standard Industrial |

(I.R.S. Employer |

| Classification Code Number) |

Identification Number) |

12th Floor, 1040 West Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

778-373-4533

(Address and telephone number of Registrants' principal executive offices)

Florence Copper LLC

1575 West Hunt Highway

Florence, Arizona

United States 85132

(520) 374-3984

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

|

Bryce Hamming, Chief Financial Officer

Taseko Mines Limited

12th Floor, 1040 West Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

|

Michael H. Taylor

McMillan LLP

1500 - 1055 West Georgia Street

Vancouver, British Columbia

Canada V6E 4N7

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after this Registration Statement becomes effective.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

A. ☐ upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

B. ☒ at some future date (check appropriate box below)

1. ☐ pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

2. ☐ pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

3. ☒ pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

4. ☐ after the filing of the next amendment to this Form (if preliminary material is being filed).

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☒

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registration statement shall become effective as provided in Rule 467 under the U.S. Securities Act of 1933, or on such date as the Commission, acting pursuant to Section 8(a) of the U.S. Securities Act of 1933, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

This short form prospectus is a base shelf prospectus. This short form base shelf prospectus has been filed under legislation in all the provinces and territories of Canada that permit certain information about these securities to be determined after the short form base shelf prospectus has become final and that permit the omission of that information from this prospectus. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such delivery requirements is available or has been obtained.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this prospectus from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from Taseko Mines Limited, 12th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1 (Telephone 778-373-4533) (Attn: the Corporate Secretary), and are also available electronically at www.sedar.com.

SHORT FORM BASE SHELF PROSPECTUS

US$600,000,000

Common Shares

Warrants

Subscription Receipts

Debt Securities

Units

This short form base shelf prospectus (the "Prospectus") relates to the offering for sale of common shares (the "Common Shares"), warrants (the "Warrants"), subscription receipts (the "Subscription Receipts"), debt securities (the "Debt Securities"), or any combination of such securities (the "Units") (all of the foregoing, collectively, the "Securities") by Taseko Mines Limited (the "Company" or "Taseko") from time to time, during the 25-month period that the Prospectus, including any amendments hereto, remains effective, in one or more series or issuances, with a total offering price of the Securities in the aggregate, of up to US$600,000,000. The Securities may be offered in amounts at prices to be determined based on market conditions at the time of the sale and set forth in an accompanying prospectus supplement (a "Prospectus Supplement"). In addition, Securities may be offered and issued in consideration for the acquisition of other businesses, assets or securities by the Company or a subsidiary of the Company. The consideration for any such acquisition may consist of any of the Securities separately, a combination of Securities or any combination of, among other things, Securities, cash and assumption of liabilities.

The Company’s outstanding Common Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) under the trading symbol “TKO”, on the NYSE American (the “NYSE American”) under the trading symbol “TGB”, and on the London Stock Exchange (the “LSE”) under the trading symbol “TKO”. The closing price of the Company’s Common Shares on the TSX, NYSE American, and the LSE on April 24, 2023, being the trading session on the last trading day before the date of the Prospectus, was $2.31 per Common Share, US$1.69 per Common Share and GB£1.33 per Common Share, respectively.

This offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada (the "MJDS"), to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and may not be comparable to financial statements of United States companies. Our financial statements are subject to audit in accordance with the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB") and our auditor is subject to both Canadian auditor independence standards and the auditor independence standards of the PCAOB and the United States Securities and Exchange Commission ("SEC").

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of British Columbia, Canada, that the majority of its officers and directors are residents of Canada, that all of the experts named in the registration statement are not residents of the United States, and that a substantial portion of the assets of the Company and said persons are located outside the United States.

Investing in Securities of the Company involves a high degree of risk. You should carefully review the risks outlined in this Prospectus (together with any Prospectus Supplement) and in the documents incorporated by reference in this Prospectus and any Prospectus Supplement and consider such risks in connection with an investment in such Securities. See "RISK FACTORS".

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Prospective investors should read the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering of Securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC") NOR HAS THE SEC PASSED UPON THE ACCURACY OR THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The specific terms of the Securities with respect to a particular offering will be set out in one or more Prospectus Supplements and may include, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the offering price and any other specific terms; (ii) in the case of Warrants, the number of Warrants offered, the offering price, the designation, number and terms of the Common Shares issuable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price, dates and periods of exercise, the currency in which the Warrants are issued and any other specific terms; (iii) in the case of Subscription Receipts, the number of Subscription Receipts offered, the offering price, the procedures for the exchange of the Subscription Receipts for Common Shares or Warrants, as the case may be, and any other specific terms; (iv) in the case of Debt Securities, the specific designation, aggregate principal amount, the currency or the currency unit for which the Debt Securities may be purchased, the maturity, interest provisions, authorized denominations, offering price, covenants, events of default, any terms for redemption, any exchange or conversion terms, whether the debt is senior, senior subordinated or subordinated, whether the debt is secured or unsecured and any other terms specific to the Debt Securities being offered; and (v) in the case of Units, the designation, number and terms of the Common Shares, Warrants, Subscription Receipts or Debt Securities comprising the Units. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the Prospectus Supplement describing the Securities.

ii

In addition, the Debt Securities that may be offered may be guaranteed by certain direct and indirect subsidiaries of Taseko with respect to the payment of the principal, premium, if any, and interest on the Debt Securities. The Company expects that any guarantee provided in respect of senior Debt Securities would constitute a senior and unsecured obligation of the applicable guarantor. For a more detailed description of the Debt Securities that may be offered, see "Description of Securities - Debt Securities - Guarantees", below.

All information permitted under applicable securities legislation to be omitted from the Prospectus will be contained in one or more Prospectus Supplement(s) that will be delivered to purchasers together with the Prospectus. Each Prospectus Supplement will be incorporated by reference into the Prospectus for the purposes of applicable securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains. Investors should read the Prospectus and any applicable Prospectus Supplement carefully before investing in the Company's Securities.

This Prospectus constitutes a public offering of the Securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell the Securities in such jurisdictions. We may offer and sell Securities to, or through, underwriters or dealers, directly to one or more other purchasers, or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A Prospectus Supplement relating to each issue of Securities will set forth the names of any underwriters, dealers or agents involved in the offering and sale of the Securities and will set forth the terms of the offering of the Securities, the initial issue price (in the event that the offering is a fixed price distribution), the method of distribution of the Securities, including, to the extent applicable, the proceeds to us and any fees, discounts, concessions or other compensation payable to the underwriters, dealers or agents, and any other material terms of the plan of distribution. If offered on a varying price basis, the Securities may be offered at market prices prevailing at the time of sale, at prices determined by reference to such prevailing market prices, with or without discounts, or at negotiated prices, which prices may vary as between purchasers and during the period of distribution of the Securities. In connection with any offering of the Securities, other than an "at-the-market distribution", unless otherwise specified in a Prospectus Supplement, the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a higher level than that which might exist in the open market. Such transaction, if commenced, may be interrupted or discontinued at any time. See "Plan of Distribution".

We may effect sales of the Common Shares from time to time in one or more transactions at non-fixed prices pursuant to transactions that are deemed to be "at-the-market distributions" as defined in National Instrument 44-102 - Shelf Distributions, including sales made directly on the TSX or NYSE American or other existing trading markets for the Common Shares, and as set forth in a Prospectus Supplement for such purpose. No underwriter or dealer involved in an "at-the-market distribution" under this Prospectus, no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or dealer will over-allot securities in connection with such distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Common Shares. See "Plan of Distribution".

No underwriter has been involved in the preparation of the Prospectus or performed any review of the contents of the Prospectus.

Peter Mitchell and Rita Maguire, directors of the Company, reside outside of Canada. Peter Mitchell and Rita Maguire have each appointed McMillan LLP, located at Suite 1500 – 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7, as their agent for service of process in British Columbia. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any such person, even though they have appointed an agent for service of process.

iii

Unless otherwise disclosed in any applicable Prospectus Supplement, the Debt Securities, the Warrants, the Subscription Receipts and the Units will not be listed on any securities exchange. Unless the Securities are disclosed to be listed, there will be no market through which these Securities may be sold and purchasers may not be able to resell these Securities purchased under this Prospectus. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities, and the extent of issuer regulation.

You should rely only on the information contained in or incorporated by reference into this Prospectus and in any applicable Prospectus Supplement. The Company has not authorized anyone to provide you with different information. The Company is not making any offer of these Securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this Prospectus and any Prospectus Supplement is accurate as of any date other than the date on the front of those documents or that any information contained in any document incorporated by reference is accurate as of any date other than the date of that document.

Unless the context otherwise requires, references in this Prospectus and any Prospectus Supplement to “we”, “our”, “us”, “Taseko” or the “Company” refer to Taseko Mines Limited and each of its subsidiaries.

The head office of the Company is located at 12th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1. The registered office of the Company is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7.

iv

TABLE OF CONTENTS

v

DOCUMENTS INCORPORATED BY REFERENCE

We incorporate by reference into this Prospectus documents that we have filed with securities commissions or similar authorities in Canada, which have also been filed with, or furnished to, the SEC. You may obtain copies of the documents incorporated herein by reference without charge from Taseko Mines Limited, 12th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1 (Telephone 778-373-4533) Attn: the Corporate Secretary. These documents are also available electronically from the website of Canadian Securities Administrators at www.sedar.com ("SEDAR") and from the EDGAR filing website of the United States Securities Exchange Commission at www.sec.gov ("EDGAR"). The Company's filings through SEDAR and EDGAR are not incorporated by reference in the Prospectus except as specifically set out herein.

The following documents filed with the securities regulatory authorities in the jurisdictions in Canada in which the Company is a reporting issuer are specifically incorporated by reference into and, except where herein otherwise provided, form an integral part of, this Prospectus:

-

our annual information form for the year ended December 31, 2022, dated as at March 31, 2023 and filed on March 31, 2023 (the "2022 AIF");

-

our audited consolidated financial statements for the years ended December 31, 2022 and 2021 together with the report of the independent auditor thereon, filed February 23, 2023;

-

our management's discussion and analysis for the year ended December 31, 2022, filed February 23, 2023 (the "2022 Annual MD&A");

-

our management information circular dated April 28, 2022 distributed in connection with the annual meeting of shareholders held on June 9, 2022; and

-

our material change report dated March 3, 2023 disclosing our agreement with Sojitz Corporation for the purchase of a 50% interest in Cariboo Copper Corporation.

In addition, we also incorporate by reference into this Prospectus any document of the types referred to in the preceding paragraph including all annual information forms, all information circulars, all annual and interim financial statements and management's discussion and analysis relating thereto, all material change reports (excluding confidential material change reports, if any), all business acquisition reports, all updated earnings coverage ratio information or of any other type) or of any other type required to be incorporated by reference into a short form prospectus pursuant to National Instrument 44- 101 - Short Form Prospectus Distributions that are filed by us with a securities commission or similar authority in Canada after the date of this Prospectus and prior to the termination of the offering under any Prospectus Supplement. As discussed below, this Prospectus may expressly update or revise any document incorporated by reference and such document should be deemed so amended or updated hereby.

Furthermore, the Company may determine to incorporate into any Prospectus Supplement to this Prospectus, including any Prospectus Supplement that it files in respect of an "at-the-market" offering, any news release that the Company disseminates in respect of previously undisclosed information that, in the Company's determination, constitutes a "material fact" (as such term is defined under applicable Canadian securities laws). In this event, the Company will identify such news release as a "designated news release" for the purposes of the Prospectus in writing on the face page of the version of such news release that the Company files on SEDAR (any such news release, a "Designated News Release"), and any such Designated News Release shall be deemed to be incorporated by reference into the Prospectus Supplement for the offering in respect to which the Prospectus Supplement relates. These documents will be available through the internet on SEDAR.

To the extent that any document or information incorporated by reference into the Prospectus is included in any report on Form 6-K, Form 40-F, or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC after the date of the Prospectus, such document or information shall be deemed to be incorporated by reference as an exhibit to the registration statement of which the Prospectus forms a part. In addition, we may incorporate by reference into the Prospectus, or the registration statement of which it forms a part, other information from documents that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), if and to the extent expressly provided therein.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded to the extent that a statement contained herein, in any Prospectus Supplement or in any other subsequently filed document that is also incorporated or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement will not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of the Prospectus.

Upon a new annual information form and related annual financial statements being filed by us with, and where required, accepted by, the applicable securities regulatory authority during the currency of this Prospectus, the previous annual information form, the previous annual financial statements and all interim financial statements, material change reports and information circulars and all Prospectus Supplements filed prior to the commencement of our financial year in which a new annual information form is filed shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Securities hereunder. Upon condensed consolidated interim financial statements and the accompanying management's discussion and analysis of financial condition and results of operations being filed by us with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus is effective, all condensed consolidated interim financial statements and the accompanying management's discussion and analysis of financial condition and results of operations filed prior to such new condensed consolidated interim financial statements and management's discussion and analysis of financial condition and results of operations shall be deemed to no longer be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus. In addition, upon a new management information circular for an annual meeting of shareholders being filed by us with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus is effective, the previous management information circular filed in respect of the prior annual meeting of shareholders shall no longer be deemed to be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

All information permitted under applicable securities legislation to be omitted from the Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with the Prospectus, except in cases where an exemption from such delivery requirements is available or has been obtained. A Prospectus Supplement containing the specific terms of an offering of Securities will be delivered to purchasers of such Securities together with this Prospectus and will be deemed to be incorporated by reference into this Prospectus as of the date of such Prospectus Supplement, but only for the purposes of the offering of Securities covered by that Prospectus Supplement. Investors should read the Prospectus and any applicable Prospectus Supplement carefully before investing in the Company's Securities.

Any template version of any "marketing materials" (as such term is defined in NI 44-101) filed after the date of a Prospectus Supplement and before the termination of the distribution of the Securities offered pursuant to such Prospectus Supplement (together with this Prospectus) is deemed to be incorporated by reference in such Prospectus Supplement.

FORWARD LOOKING STATEMENTS

The Prospectus, including the documents incorporated by reference, contain forward-looking statements and forward-looking information (collectively referred to as "forward-looking statements") which may not be based on historical fact, including without limitation statements regarding our expectations in respect of future financial position, business strategy, future production, reserve potential, exploration drilling, exploitation activities, events or developments that we expect to take place in the future, projected costs and plans and objectives. Often, but not always, forward-looking statements can be identified by the use of the words "believes", "may", "plan", "will", "estimate", "scheduled", "continue", "anticipates", "intends", "expects", and similar expressions.

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and known or unknown risks and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

• uncertainties about the future market price of copper and the other metals that we produce or may seek to produce;

• changes in general economic conditions, the financial markets, inflation and interest rates and in the demand and market price for our input costs, such as diesel fuel, reagents, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar and Canadian dollar, and the continued availability of capital and financing;

• the impact of rising interest rates by central banks on our current and future borrowing costs, including the impact that inflation could have on the estimated costs related to the construction of the Company's Florence Copper project (the "Florence Copper Project" or "Florence Copper");

• uncertainties resulting from the war in Ukraine, and the accompanying international response including economic sanctions levied against Russia and other countries, which has disrupted the global economy, created increased volatility in commodity markets (including oil and gas prices), and disrupted international trade and financial markets, all of which have an ongoing and uncertain effect on global economics, supply chains, availability of materials and equipment and execution timelines for project development;

• uncertainties about the continuing impact of the novel coronavirus ("COVID-19") and the response of local, provincial, state, federal and international governments to the ongoing threat of COVID-19, on our operations (including our suppliers, customers, supply chains, employees and contractors) and economic conditions generally including stimulation measures implemented, rising inflation levels and in particular with respect to the demand for copper and other metals we produce;

• inherent risks associated with mining operations, including our current mining operations at Gibraltar, and their potential impact on our ability to achieve our production estimates;

• uncertainties as to our ability to control our operating costs, including inflationary cost pressures at Gibraltar without impacting our planned copper production;

• the risk of inadequate insurance or inability to obtain insurance to cover material mining or operational risks;

• uncertainties related to the feasibility study for the Florence Copper Project and our other development projects which provide estimates of future production, expected or anticipated capital and operating costs, expenditures and economic returns from these mining projects;

• uncertainties related to the accuracy of our estimates of Mineral Reserves (as defined below), Mineral Resources (as defined below), production rates and timing of production, future production and future cash and total costs of production and milling;

• the risk that grades and recoveries at Gibraltar may not remain consistent with our mineral reserve expectations and current mine plans;

• the risk that we may not be able to expand or replace reserves as our existing mineral reserves are mined;

• the availability of, and uncertainties relating to the development of, additional financing necessary for the advancement of our development projects, including with respect to our ability to obtain any remaining construction financing potentially needed to move forward with commercial operations at Florence Copper;

• our ability to comply with the extensive governmental regulation to which our business is subject;

• uncertainties related to our ability to obtain necessary title, licenses and permits for our development projects and project delays due to third party opposition, particularly in respect to Florence Copper that requires one key regulatory permit from the U.S. Environmental Protection Agency ("EPA") in order to advance to a construction decision and commercial operations;

• uncertainties related to the Florence Copper Project execution plan, including inflation risk and the potential impact of supply chain disruptions on our construction schedule, which could impact the transition into construction operations after the final permit is received from the EPA;

• uncertainties relating to the satisfaction of the conditions for the advance of the US$50 million deposit under our copper stream agreement with Mitsui for the construction of the Florence Copper commercial facility and our US$25 million equipment commitment from Bank of America;

• uncertainties relating to our ability to secure premium pricing for copper produced at the Florence Copper facility based on its low-carbon characteristics;

• the risk that until construction of the commercial facility at Florence Copper is complete and ramped up, there could be increases in actual costs incurred that will negatively impact our estimates for current projected economics for commercial operations at Florence Copper;

• uncertainties related to First Nations claims and consultation issues;

• our reliance on rail transportation and port terminals for shipping our copper concentrate production from Gibraltar;

• uncertainties related to unexpected judicial or regulatory proceedings;

• changes in, and the effects of, the laws, regulations and government policies affecting our exploration and development activities and mining operations and mine closure and bonding requirements;

• our current dependence solely on our 87.5% interest in Gibraltar (as defined below) for revenues and operating cashflows;

• our ability to collect payments from customers, extend existing concentrate off-take agreements or enter into new agreements;

• environmental issues and liabilities associated with mining including processing and stock piling ore;

• labour strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labour in markets in which we operate our mine, industrial accidents, equipment failure, weather related breakdowns or other events or occurrences, including third party interference that interrupt the production of minerals in our mine;

• environmental hazards and risks associated with climate change, including the potential for damage to infrastructure and stoppages of operations due to forest fires, flooding, extreme cold, drought, or other natural events in the vicinity of our operations;

• litigation risks and the inherent uncertainty of litigation, including litigation to which Florence Copper could be subject to;

• our actual costs of reclamation and mine closure may exceed our current estimates of these liabilities;

• our ability to meet the financial reclamation security requirements for the Gibraltar mine, Florence Copper and other development projects;

• the capital intensive nature of our business both to sustain current mining operations and to develop any new projects, including Florence Copper;

• our reliance upon key management and operating personnel;

• the competitive environment in which we operate;

• the effects of forward selling instruments to protect against fluctuations in copper prices, foreign exchange, interest rates or input costs such as diesel fuel; and

• the risk of changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates; and Management Discussion and Analysis ("MD&A"), quarterly reports and material change reports filed with and furnished to securities regulators, and those risks which are discussed in the 2022 AIF under the heading "Risk Factors".

Such information is included, among other places, in this Prospectus under the headings "The Company" and "Use of Proceeds", in our 2022 AIF under the headings "Taseko's Business" and "Risk Factors" and in our 2022 Annual MD&A, each of which documents are incorporated by reference into this Prospectus.

Should one or more of these risks and uncertainties materialize, or should underlying factors or assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Material factors or assumptions involved in developing forward-looking statements include, without limitation, that:

• the price of copper and other metals will not decline significantly or for a protracted period of time;

• our mining operations will not experience any significant production disruptions that would materially affect our production forecasts or our revenues;

• our estimates regarding future capital and operating costs, including factoring in potential inflation impacts, at Gibraltar will be accurate;

• grades and recoveries at Gibraltar remain consistent with our mineral reserve expectations and current mine plans;

• the results from our operations of the Production Test Facility ("PTF") and updated technical report at Florence Copper will continue to support that commercial operations at Florence Copper are technically and economically feasible;

• we will be able to obtain any remaining construction financing necessary for us to advance Florence Copper to a positive construction decision and eventual commercial production;

• we will be able to obtain the required permits necessary for us to proceed with construction and commercial operations at Florence;

• we will be able to satisfy the conditions for the advance of the US$50 million deposit under our copper stream agreement with Mitsui for the construction of the Florence Copper facility;

• potential supply chain disruptions and associated logistical challenges will not significantly impact our planned capital projects, including our expected development of Florence;

• potential future litigation regarding Florence Copper will not materially impede or delay our ability to proceed with construction and commercial operations at Florence;

• there are no changes to any existing agreements or relationships with affected First Nations groups which would materially and adversely impact our operations;

• there are no adverse regulatory changes affecting any of our operations;

• exchange rates, inflationary pressure on prices of key consumables, costs of power, labour, material costs, supplies and services, and other cost assumptions at our projects are not significantly higher than prices assumed in planning;

• our mineral reserve and resource estimates and the assumptions on which they are based, are accurate;

• our estimates of reclamation liabilities, mine closure costs and bonding needs are accurate; and

• we will continue to generate positive cash flows from Gibraltar and be able to secure additional funding necessary for the development and continued advancement of Gibraltar and our development projects, including Florence Copper.

These factors should be considered carefully and readers are cautioned not to place undue reliance on the forward-looking statements. Readers are cautioned that the foregoing list of risk factors is not exhaustive and it is recommended that prospective investors carefully read the more complete discussion of risks and uncertainties facing the Company included in the Prospectus. See "Risk Factors" in the 2022 AIF for a more detailed discussion of these risks.

Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on the information available to us on the date such statements were made, no assurances can be given as to future results, approvals or achievements. The forward-looking statements contained in this Prospectus and the documents incorporated by reference herein are expressly qualified by this cautionary statement. We disclaim any duty to update any of the forward-looking statements after the date of the Prospectus to conform such statements to actual results or to changes in our expectations except as otherwise required by applicable law.

GLOSSARY OF CERTAIN TECHNICAL TERMS

As a Canadian issuer, we are required to comply with reporting standards in Canada that require that we make disclosure regarding our mineral properties, including any estimates of mineral reserves and resources, in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this Prospectus have been prepared in accordance with NI 43-101.

This Prospectus uses the certain technical terms presented below as they are defined in accordance with the CIM Definition Standards on Mineral Resources and Reserves (the "CIM Standards") adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Council"). Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this Prospectus have been prepared in accordance with the CIM Standards, as required by NI 43-101. The following definitions are reproduced from the latest version of the CIM Standards, which were adopted by the CIM Council on May 10, 2014:

| feasibility study |

A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. |

| indicated mineral resource |

That part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve. |

| inferred mineral resource |

That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. |

| measured mineral resource |

That part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve. |

| mineral reserve |

The economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study. |

| mineral resource |

A concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| modifying factors |

Considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

| NI 43-101 |

Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators. |

| pre-feasibility study |

A comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. A pre-feasibility is at a lower confidence level than a feasibility study. |

| probable mineral reserve |

The economically mineable part of an Indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. |

| proven mineral reserve |

The economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. |

In addition, we use the following defined terms in this Prospectus:

| BCBCA |

Business Corporations Act (British Columbia). |

| Exchange Act |

The United States Securities Exchange Act of 1934, as amended. |

| SEC |

The United States Securities and Exchange Commission. |

| U.S. Securities Act |

The United States Securities Act of 1933, as amended. |

CAUTIONARY NOTES TO UNITED STATES INVESTORS CONCERNING

CANADIAN MINERAL PROPERTY DISCLOSURE STANDARDS

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this Prospectus Supplement in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States.

The Company is subject to the reporting requirements of the applicable Canadian securities laws, and as a result reports the mineral reserves and mineral resources of the projects it has an interest in according to Canadian standards. Technical disclosure regarding our properties included herein and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws.

Unless otherwise indicated, all mineral reserve and mineral resource estimates included in this prospectus and the documents incorporated by reference herein have been prepared in accordance with NI 43-101 and the CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements (the "SEC Modernization Rules") for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"). The SEC Modernization Rules replaced the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multijurisdictional disclosure system, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101 and the CIM Standards.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Standards that are required under NI 43-101. While the SEC now recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the "inferred mineral resources" exist. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

NOTE TO UNITED STATES READERS REGARDING DIFFERENCES BETWEEN UNITED STATES AND CANADIAN FINANCIAL REPORTING PRACTICES

We prepare our financial statements in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board (the "IASB"), which differs from U.S. generally accepted accounting principles ("U.S. GAAP"). Accordingly, our financial statements incorporated by reference in the Prospectus, and in the documents incorporated by reference in this Prospectus, may not be comparable to financial statements of United States companies prepared in accordance with U.S. GAAP.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this Prospectus and any Prospectus Supplement are references to Canadian dollars. References to "$" or "C$" are to Canadian dollars and references to "U.S. dollars" or "US$" are to United States dollars.

Except as otherwise noted in our 2022 AIF and the Company's financial statements and related management's discussion and analysis of financial condition and results of operations of the Company that are incorporated by reference into this Prospectus, the financial information contained in such documents is expressed in Canadian dollars.

The high, low, average and closing indicative rates for the United States dollar in terms of Canadian dollars for each of the financial periods of the Company ended December 31, 2022, December 31, 2021 and December 31, 2020, as quoted by the Bank of Canada, were as follows:

| |

Year ended December 31, 2022 |

|

Year ended December 31, 2021 |

|

Year ended December 31, 2020 |

| |

| (in Canadian Dollars) |

| |

|

|

|

|

|

| High |

1.3856 |

|

1.2942 |

|

1.4496 |

| |

|

|

|

|

|

| Low |

1.2451 |

|

1.2040 |

|

1.2718 |

| |

|

|

|

|

|

| Average |

1.3013 |

|

1.2535 |

|

1.3415 |

| |

|

|

|

|

|

| Closing |

1.3544 |

|

1.2678 |

|

1.2732 |

On April 24, 2023 the exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was US$1.00 = $1.3542.

ADDITIONAL INFORMATION

We have filed with the SEC a registration statement on Form F-10 under the U.S. Securities Act relating to the offering of the Securities. The Prospectus, which constitutes a part of the registration statement, does not contain all of the information contained in the registration statement, certain items of which are contained in the exhibits to the registration statement as permitted by the rules and regulations of the SEC. Statements included or incorporated by reference in the Prospectus about the contents of any contract, agreement or other documents referred to are not necessarily complete, and in each instance, you should refer to the exhibits for a more complete description of the matter involved. Each such statement is qualified in its entirety by such reference.

We are subject to the informational reporting requirements of the Exchange Act as the Common Shares are registered under Section 12(b) of the Exchange Act. Accordingly, we are required to publicly file reports and other information with the SEC. Under the MJDS, the Company is permitted to prepare such reports and other information in accordance with Canadian disclosure requirements, which are different from United States disclosure requirements.

As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements in connection with meetings of its shareholders. In addition, the officers, directors and principal shareholders of the Company are exempt from the reporting and short-swing profit recovery rules contained in Section 16 of the Exchange Act.

We file annual reports on Form 40-F with the SEC under the MJDS, which annual reports include:

-

the annual information form;

-

management's annual discussion and analysis of financial condition and results of operations;

-

consolidated audited financial statements, which are prepared in accordance with IFRS, as issued by the IASB; and

-

other information specified by the Form 40-F.

As a foreign private issuer, we are required to furnish the following types of information to the SEC under cover of Form 6-K:

-

material information that the Company otherwise makes publicly available in reports that the Company files with securities regulatory authorities in Canada;

-

material information that the Company files with, and which is made public by, the TSX and the NYSE American; and

-

material information that the Company distributes to its shareholders in Canada.

Investors may read and copy, for a fee, any document that the Company has filed with or furnished to the SEC at the SEC's public reference room in Washington, D.C. at 100 F Street, N.E., Washington, D.C. 20549. Investors should call the SEC at 1-800-SEC-0330 or access its website at www.sec.gov for further information about the public reference room. Investors may read and download the documents the Company has filed with the SEC's Electronic Data Gathering and Retrieval system ("EDGAR") at www.sec.gov. Investors may read and download any public document that the Company has filed with the securities commissions or similar regulatory authorities in Canada at www.sedar.com.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the registration statement of which this Prospectus forms a part:

(i) the documents set out under the heading "Documents Incorporate by Reference";

(ii) the consents of the Company's auditor, legal counsel and technical report authors;

(iii) the powers of attorney from the directors and certain officers of the Company; and

(iv) the form of Indenture.

A copy of the form of any warrant indenture, subscription receipt agreement or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective amendment or by incorporation by reference to documents filed or furnished with or furnished to the SEC under the U.S. Exchange Act.

THE COMPANY

Taseko is a copper-focused mining company that seeks to create long-term shareholder value by acquiring, developing, and operating large tonnage mineral deposits in North America which are capable of supporting a mine for decades. The Company’s principal operating asset is the 87.5% owned Gibraltar Mine, which is located in central British Columbia and is one of the largest copper mines in North America. Taseko also owns Florence Copper, which is projected to be a low-cost copper producer, expected to manufacture high quality copper cathode in the United States, with potential to secure premium pricing based on its low-carbon characteristics. Taseko also owns the Yellowhead copper, New Prosperity gold-copper, and Aley niobium projects.

The Company was incorporated on April 15, 1966 under the laws of the Province of British Columbia and is governed by the BCBCA. Our registered office is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, V6E 4N7, and our operational head office is located at 12th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1. We operate our business through our subsidiaries, as described in our 2022 AIF.

Gibraltar

Our principal operating asset is our 87.5% interest in the Gibraltar Mine in British Columbia, Canada. Gibraltar is the second largest open pit copper mine in Canada, having produced 97 million pounds of copper and 1.1 million pounds of molybdenum (on a 100% basis) in 2022. Gibraltar has an expected mine life of at least 22 years based on Proven and Probable Sulphide Mineral Reserves of 676 million tons at a grade of 0.25% copper as of December 31, 2022.

Between 2006 and 2013, the Company expanded and modernized the Gibraltar Mine ore concentrator, added a second ore concentrator, increased the mining fleet and made other production improvements at the mine. Following this period of mine expansion and capital expenditure, Gibraltar has achieved a stable level of operations and the Company’s focus is on further improvements to operating practices to reduce unit costs and increase production. The Company increased its effective ownership stake in Gibraltar from 75% to 87.5% in 2023.

Florence Copper

Taseko is proceeding with the development of Florence Copper in Arizona. Once completed and in operation, Florence Copper is projected to be a low-cost producer of low carbon copper in the United States.

The development of Florence Copper is occurring in two phases. For the first phase, Florence Copper completed construction of a PTF in 2018 with PTF wellfield operations commencing in the fourth quarter of 2018. Operation of the PTF wellfield performed to its design and the small- scale SX/EW plant produced 1.1 million pounds of copper cathode before the leaching test phase was completed in June 2020. The PTF operation is now finishing its final rinsing process which is expected to be completed later this year. The second phase of Florence Copper will be the construction and operation of the commercial in-situ copper recovery facility.

In December 2020, the Company received the Aquifer Protection Permit from the Arizona Department of Environmental Quality. The Company is awaiting the issuance of the commercial Underground Injection Control (“UIC”) permit from the EPA, which is the final permitting step required prior to construction commencing on the commercial production facility. The EPA is currently addressing comments that were received during the public comment period held in the fall of 2022. Public comments submitted to the EPA have demonstrated strong support for the Florence Copper project among local residents, business organizations, community leaders and state-wide organizations.

Detailed engineering and design for the commercial production facility is substantially completed and procurement activities are well advanced. The Company has purchased the major long-lead processing equipment associated with the SX/EW plant and the equipment has now been delivered to the Florence site.

The Company’s latest technical report on Florence published on March 30, 2023 estimates remaining capital costs for the commercial facility of US$232 million. At a copper price of US$3.75 per pound, Florence Copper is expected to generate an after-tax internal rate of return of 47%, an after-tax net present value of US$930 million at an 8% discount rate, and an after-tax payback period of 2.6 years.

In December 2022, the Company signed agreements with Mitsui & Co. (U.S.A.) Inc. (“Mitsui”) to form a strategic partnership to develop Florence Copper. Mitsui has committed to an initial investment of US$50 million which is conditional on receipt of the final UIC permit, with proceeds to be used for construction of the commercial production facility. The initial investment will be in the form of a copper stream agreement on 2.67% of the copper produced at Florence Copper. In addition, Mitsui has the option to invest an additional US$50 million (for a total investment of US$100 million) for a 10% equity interest in Florence Copper, which is exercisable by Mitsui within a three-year period following completion of construction of the commercial production facility. As part of the arrangement, Taseko and Mitsui have entered into an offtake contract for 81% of the copper cathode produced at Florence Copper during the initial years of production. Refer to the 2022 AIF for additional details regarding the Mitsui copper stream arrangement.

In January 2023, the Company received an underwritten commitment for US$25 million from Banc of America Leasing and Capital, LLC. Proceeds from this financing will be available to fund costs associated with the SX/EW plant for the Florence Copper commercial production facility. Financing is subject to execution of definitive documentation, customary closing conditions, and receipt of the UIC permit.

Other Development Projects

We have a diverse pipeline of wholly-owned development projects at various stages of technical and economic feasibility studies, including the Yellowhead copper project, the Aley niobium project, and the New Prosperity gold and copper project.

Business Strategy

Our strategy has been to grow the Company by acquiring and developing a pipeline of complementary projects focused on copper in stable mining jurisdictions. We continue to believe this will generate long-term returns for shareholders. All of our producing and development projects are located in British Columbia and Arizona. Our project focus is currently on the development of Florence Copper.

USE OF PROCEEDS

Unless otherwise specified in a Prospectus Supplement, the net proceeds from the sale of the Securities will be used for general corporate purposes, including funding working capital, potential future acquisitions, debt repayments and capital expenditures. Each Prospectus Supplement will contain specific information concerning the use of proceeds from that sale of Securities.

All expenses relating to an offering of Securities and any compensation paid to underwriters, dealers or agents, as the case may be, will be paid out of our general funds, unless otherwise stated in the applicable Prospectus Supplement.

EARNINGS COVERAGE RATIO

Earnings coverage ratios will be provided as required in the applicable Prospectus Supplement(s) with respect to the issuance of Debt Securities pursuant to this Prospectus.

CONSOLIDATED CAPITALIZATION

There have been no material changes in our share and debt capital, on a consolidated basis, since December 31, 2022, being the date of the Company's most recently filed consolidated financial statements incorporated by reference in this Prospectus other the grants of stock options, performance share units ("PSUs") and deferred share units ("DSUs"), and issuances of additional common shares upon the exercise of outstanding stock options and the settlement of PSUs, as described further below under "Prior Sales".

PRIOR SALES

The following table sets out details of all Common Shares issued by the Company during the 12 months prior to the date of this Prospectus.

Date

Common Shares |

Price per

Security/Exercise Price

per Common Share |

|

Number of Common

Shares |

| |

|

|

|

| April 2022(1) |

$1.07 |

|

39,000 |

| |

|

|

|

| May 2022(1) |

$0.46 |

|

50,000 |

| |

|

|

|

| October 2022(1) |

$0.74 |

|

25,000 |

| |

|

|

|

| November 2022(1) |

$1.12 |

|

73,000 |

| |

|

|

|

| December 2022(1) |

$1.58 |

|

18,000 |

| |

|

|

|

| January 2023(1) |

$0.83 |

|

255,500 |

| |

|

|

|

| January 2023(2) |

$2.40 |

|

1,597,177 |

| |

|

|

|

| March 2023(1) |

$1.09 |

|

71,000 |

Notes:

(1) Issued pursuant to exercise of options

(2) Issued pursuant to settlement of PSUs

The following table sets out details of all securities convertible or exercisable into Common Shares that were issued or granted by the Company during the 12 months prior to the date of this Prospectus.

| Date |

|

Type of Security Issued |

|

Exercise or Conversion

Price Per Common

Share |

|

Number of Common

Shares Issuable Upon

Exercise or Conversion |

| |

|

|

|

|

|

|

| January 16, 2023 |

|

Stock Options |

|

$2.38 |

|

2,629,000 |

| |

|

|

|

|

|

|

| January 16, 2023 |

|

DSUs |

|

$2.38 (1) |

|

342,750 |

| |

|

|

|

|

|

|

| January 16, 2023 |

|

PSUs |

|

$2.38 (1) |

|

830,000 |

Note:

(1) Weighted average fair value calculated as at the grant date.

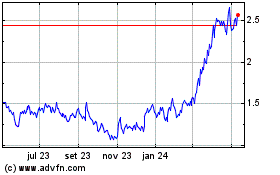

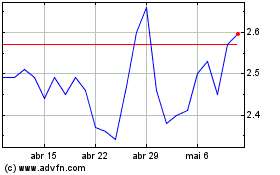

TRADING PRICE AND VOLUME

Our common shares are listed on the TSX, NYSE American, and LSE under the trading symbol "TKO" and "TGB", respectively. The following tables set forth information relating to the trading of the common shares on the TSX and NYSE American for the months indicated.

| |

|

TSX Price Range ($) |

|

|

| Month |

|

High |

|

Low |

|

Total Volume |

| April 2022 |

|

3.00 |

|

2.39 |

|

7,031,213 |

| May 2022 |

|

2.53 |

|

1.71 |

|

18,598,907 |

| June 2022 |

|

2.19 |

|

1.37 |

|

7,073,386 |

| July 2022 |

|

1.43 |

|

1.15 |

|

7,623,456 |

| August 2022 |

|

1.62 |

|

1.26 |

|

8,324,298 |

| September 2022 |

|

1.80 |

|

1.25 |

|

7,236,032 |

| October 2022 |

|

1.75 |

|

1.40 |

|

5,575,070 |

| November 2022 |

|

1.94 |

|

1.45 |

|

10,023,546 |

| December 2022 |

|

2.16 |

|

1.66 |

|

6,422,858 |

| January 2023 |

|

2.53 |

|

2.00 |

|

7,076,453 |

| February 2023 |

|

2.45 |

|

2.08 |

|

7,915,630 |

| March 2023 |

|

2.51 |

|

1.95 |

|

8,217,665 |

| April 1 to 24, 2023 |

|

2.39 |

|

2.17 |

|

3,681,000 |

| |

|

NYSE American Price Range (in US$)(1) |

|

|

| Month |

|

High |

|

Low |

|

Total Volume |

| April 2022 |

|

2.41 |

|

1.87 |

|

40,630,186 |

| May 2022 |

|

2.00 |

|

1.30 |

|

56,099,333 |

| June 2022 |

|

1.75 |

|

1.06 |

|

34,304,805 |

| July 2022 |

|

1.11 |

|

0.89 |

|

24,976,648 |

| August 2022 |

|

1.26 |

|

0.98 |

|

42,217,271 |

| September 2022 |

|

1.34 |

|

0.91 |

|

37,657,965 |

| October 2022 |

|

1.30 |

|

0.98 |

|

28,181,896 |

| November 2022 |

|

1.45 |

|

1.07 |

|

34,025,505 |

| December 2022 |

|

1.60 |

|

1.21 |

|

30,517,683 |

| January 2023 |

|

1.90 |

|

1.46 |

|

25,779,805 |

| February 2023 |

|

1.85 |

|

1.54 |

|

26,102,860 |

| March 2023 |

|

1.84 |

|

1.40 |

|

31,901,930 |

| April 1 to 24, 2023 |

|

1.79 |

|

1.61 |

|

16,267,987 |

Note:

(1) The price ranges noted in the NYSE American table are rounded to the nearest $0.01.

|

Month

|

|

LSE Price Range (in GB£)

|

|

Total Volume

|

| |

High

|

|

Low

|

|

April 2022

|

|

1.81

|

|

1.50

|

|

502,723

|

|

May 2022

|

|

1.50

|

|

1.15

|

|

74,446

|

|

June 2022

|

|

1.32

|

|

0.88

|

|

47,747

|

|

July 2022

|

|

0.93

|

|

0.83

|

|

182,685

|

|

August 2022

|

|

1.01

|

|

0.84

|

|

215,073

|

|

September 2022

|

|

1.11

|

|

0.90

|

|

58,184

|

|

October 2022

|

|

1.06

|

|

0.95

|

|

521,268

|

|

November 2022

|

|

1.15

|

|

0.98

|

|

51,516

|

|

December 2022

|

|

1.26

|

|

1.06

|

|

46,692

|

|

January 2023

|

|

1.53

|

|

1.18

|

|

109,586

|

|

February 2023

|

|

1.45

|

|

1.33

|

|

39,996

|

|

March 2023

|

|

1.45

|

|

1.13

|

|

135,858

|

| April 1 to 24, 2023 |

|

1.40 |

|

1.28 |

|

94,920 |

PLAN OF DISTRIBUTION

We may sell the Securities to or through underwriters or dealers, and also may sell Securities to one or more other purchasers directly or through agents, including sales pursuant to ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers. Underwriters may sell Securities to or through dealers. We will file a Prospectus Supplement in connection with each offering of Securities. Each Prospectus Supplement will set forth the terms of the offering, including the type of Security to be sold, the name or names of any underwriters, dealers or agents and any fees or compensation payable to them in connection with the offering and sale of a particular series or issue of Securities, the public offering price or prices of the Securities and the proceeds to the Company from the sale of the Securities.

The Securities may be sold, from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices, including sales in transactions that are deemed to be "at-the-market distributions" which may be made directly on the TSX, NYSE American or other existing trading markets for the Securities. The prices at which the Securities may be offered may vary as between purchasers and during the period of distribution. If, in connection with the offering of Securities at a fixed price or prices, the underwriters have made a bona fide effort to sell all of the Securities at the initial offering price fixed in the applicable Prospectus Supplement, the public offering price may be decreased and thereafter further changed, from time to time, to an amount not greater than the initial public offering price fixed in such Prospectus Supplement, in which case the compensation realized by the underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Securities is less than the gross proceeds paid by the underwriters to the Company.

If underwriters are used in an offering, the Securities offered thereby will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase Securities will be subject to the conditions precedent agreed upon by the parties and the underwriters will be obligated to purchase all Securities under that offering if any are purchased. Any public offering price and any discounts or concessions allowed or re-allowed or paid to agents, underwriters or dealers may be changed from time to time.

Underwriters, dealers and agents who participate in the distribution of the Securities may be entitled under agreements to be entered into with the Company to indemnification by the Company against certain liabilities, including liabilities under the U.S. Securities Act and Canadian securities legislation, or to contribution with respect to payments which such underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for, the Company in the ordinary course of business.

In connection with any offering of Securities, other than an "at-the-market distribution", the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. No underwriter of an at-the-market distribution, and no person or company acting jointly or in concert with such underwriter, may, in connection with an at-the-market distribution, enter into any transaction that is intended to stabilize or maintain the market price of the security or securities of the same class as the securities distributed in an at-the-market distribution under this Prospectus, including selling an aggregate number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities.

Unless otherwise specified in the applicable Prospectus Supplement, we do not intend to list any of the Securities other than the Common Shares on any securities exchange. Any underwriters, dealers or agents to or through which Securities other than the Common Shares are sold by us for public offering and sale may make a market in such Securities, but such underwriters, dealers or agents will not be obligated to do so and may discontinue any such market making at any time and without notice. No assurance can be given that a market for trading in Securities of any series or issue will develop or as to the liquidity of any such market, whether or not the Securities are listed on a securities exchange.