Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the first quarter of fiscal 2023.

Revenue for the three months ended September 30, 2022 increased

17% to $11,939,000 compared to $10,171,000 for the three months

ended September 30, 2021, highlighted by a 38% increase in testing

services revenue.

Overall gross margin increased 14%, but declined to 30% of

revenue compared to 31% of revenue in the same quarter last year,

primarily related to lower margin product mix at testing services

and manufacturing operations.

Net income for the first quarter of fiscal 2023 was $882,000, or

$0.21 per diluted share, compared to net income of $917,000, or

$0.23 per diluted share, for the first quarter last year.

Shareholders' equity at September 30, 2022 decreased to

$27,818,000, or $6.82 per outstanding share, compared to

$28,002,000, or $6.88 per outstanding share at June 30, 2022. There

were approximately 4,077,000 and 4,072,000 common shares

outstanding at September 30, 2022 and June 30, 2022,

respectively.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, “Remarkable revenue growth in

our testing services business was the key to another successful

quarter for our company, and our manufacturing segment delivered

modest revenue growth as well. With encouraging backlog and a

strong balance sheet, including cash and short-term deposits of

$12,257,000, or about $3.00 per outstanding share, we remain

cautiously optimistic about Trio-Tech’s financial performance for

fiscal 2023.”

About Trio‑Tech

Established in 1958, Trio-Tech International is located in Van

Nuys, California, with its Principal Executive Office and regional

headquarters in Singapore. Trio-Tech International is a diversified

business group with interests in semiconductor testing services,

manufacturing and distribution of semiconductor testing equipment,

and real estate. Our subsidiary locations include Tianjin, Suzhou,

Chongqing and Jiangsu in China, as well as Kuala Lumpur Malaysia

and Bangkok Thailand. Further information about Trio-Tech's

semiconductor products and services can be obtained from the

Company's Web site at www.triotech.com and

www.universalfareast.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company's products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications which could affect the market for

the Company's products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Asia, including currency fluctuations and devaluation, currency

restrictions, local laws and restrictions and possible social,

political and economic instability; changes in U.S. and global

financial and equity markets, including market disruptions and

significant interest rate fluctuations; public health issues

related to the COVID-19 pandemic; geopolitical conflicts, including

the war in Ukraine; trade tension between U.S. and China and other

economic, financial and regulatory factors beyond the Company's

control. Other than statements of historical fact, all statements

made in this release are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward looking statements by the use of

terminology such as "may," "will," "expects," "plans,"

"anticipates," "estimates," "potential," "believes," "can impact,"

"continue," or the negative thereof or other comparable

terminology. Forward looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions. Many of these risks and

uncertainties are beyond the Company's control. Reference is made

to the discussion of risk factors detailed in the Company's filings

with the Securities and Exchange Commission including its reports

on Form 10-K and 10-Q. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the dates on which they are made.

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

September 30,

Revenue

2022

2021

Manufacturing

$

3,585

$

3,562

Testing services

6,364

4,600

Distribution

1,982

1,998

Real estate

8

11

11,939

10,171

Cost of Sales

Cost of manufactured products sold

2,525

2,434

Cost of testing services rendered

4,126

2,883

Cost of distribution

1,648

1,656

Cost of real estate

18

19

8,317

6,992

Gross Margin

3,622

3,179

Operating Expense:

General and administrative

2,305

1,980

Selling

173

147

Research and development

73

82

Gain on disposal of property, plant and

equipment

4

--

Total operating expense

2,555

2,209

Income from Operations

1,067

970

Other Income / (Expense)

Interest expense

(44

)

(28

)

Other income, net

179

161

Total other income

135

133

Income from Continuing Operations before

Income Taxes

1,202

1,103

Income Tax Expense

(225

)

(180

)

Income from Continuing Operations before

Non-controlling Interest, net of tax

977

923

Income from Discontinued Operations, net

of tax

1

5

NET INCOME

978

928

Less: Net Income Attributable to the

Non-controlling Interest

96

11

Net Income Attributable to Trio-Tech

International

882

917

Net Income Attributable to Trio-Tech

International:

Income from continuing operations, net of

tax

882

914

Income from discontinued operations, net

of tax

--

3

Net Income Attributable to Trio-Tech

International

$

882

$

917

Earnings per share

Basic earnings per share

$

0.22

$

0.23

Diluted earnings per share

$

0.21

$

0.23

Weighted Average Shares Outstanding -

Basic

4,077

3,913

Weighted Average Shares Outstanding -

Diluted

4,158

4,007

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

September 30,

2022

2021

Comprehensive Income Attributable to

Trio-Tech International:

Net Income

$

978

$

928

Foreign Currency Translation, net of

tax

(1,213

)

(289

)

Comprehensive (Loss) / Income

(235

)

639

Less: Comprehensive Income Attributable to

Non-controlling Interests

79

4

Comprehensive (Loss) / Income Attributable

to Trio-Tech International

$

(314

)

$

635

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(IN THOUSANDS, EXCEPT NUMBER OF

SHARES)

Sep. 30,

June 30,

2022

2022

ASSETS

(Unaudited)

(Audited)

CURRENT ASSETS:

Cash and cash equivalents

$

9,428

$

7,698

Short-term deposits

2,829

5,420

Trade account receivables, net

12,491

11,592

Other receivables

942

998

Inventories, net

3,548

2,258

Prepaid expenses and other current

assets

631

1,215

Financed sales receivable

20

21

Total current assets

29,889

29,202

Deferred tax assets

173

169

Investment properties, net

533

585

Property, plant and equipment, net

8,687

8,481

Operating lease right-of-use assets

2,759

3,152

Other assets

121

137

Financed sales receivable

11

17

Restricted term deposits

1,632

1,678

Total non-current assets

13,916

14,219

TOTAL ASSETS

$

43,805

$

43,421

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Lines of credit

$

482

$

929

Accounts payable

3,469

2,401

Accrued expense

6,179

6,004

Income taxes payable

968

787

Current portion of bank loans payable

491

472

Current portion of finance leases

104

118

Current portion of operating leases

1,130

1,218

Total current liabilities

12,823

11,929

Bank loans payable, net of current

portion

1,251

1,272

Finance leases, net of current portion

91

119

Operating leases, net of current

portion

1,629

1,934

Income taxes payable

137

137

Deferred tax liabilities

30

--

Other non-current liabilities

26

28

Total non-current liabilities

3,164

3,490

TOTAL LIABILITIES

15,987

15,419

EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS'

EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 4,076,680 and 4,071,680

shares issued and outstanding at September

30, 2022 and June 30, 2022, respectively

12,769

12,750

Paid-in capital

4,740

4,708

Accumulated retained earnings

10,101

9,219

Accumulated other comprehensive

gain-translation adjustments

1

1,197

Total Trio-Tech International

shareholders' equity

27,611

27,874

Non-controlling interest

207

128

TOTAL EQUITY

27,818

28,002

TOTAL LIABILITIES AND EQUITY

$

43,805

$

43,421

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221110005530/en/

Company Contact: A. Charles Wilson Chairman (818)

787-7000

Investor Contact: Berkman Associates (310) 927-3108

robert.jacobs@jacobscon.com

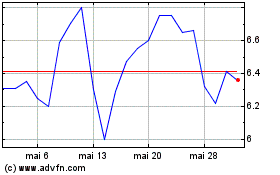

Trio Tech (AMEX:TRT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Trio Tech (AMEX:TRT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025