TIDMADB

RNS Number : 9782X

Adnams PLC

03 September 2020

ADNAMS SOUTHWOLD

Adnams plc

Interim Accounts 2020

RESILIENT ADNAMS SPIRIT

Chairman's Statement

OUR FOCUS ON

RESILIENCE, RECOVERY AND DOING THE RIGHT THING

RESULTS

The impact of the Covid-19 pandemic was just starting to become

apparent as we finalised our 2019 full year Report & Accounts

and we have since provided two updates on trading in 2020. The

hospitality sector was one of the hardest hit as socialising became

heavily restricted and pubs were required to close their doors. As

a pub owner and pub operator ourselves, and with a drinks business

heavily orientated towards the on-trade, our business was focussed

on our online sales, to our supermarket partners and other shops.

These sales represented only about one fifth of our normal

trade.

The Government support schemes, particularly the Coronavirus Job

Retention Scheme (furlough), discretionary grants, business rates

relief and cut in VAT, have been enormously important to us. The

Treasury should be commended for their urgent and timely response.

However, there remain substantial hurdles ahead before UK pubs can

return to anything like their previous trading on a sustainable

basis.

I would like to thank my Board colleagues and senior management

who volunteered to take up to a 50% pay cut from lockdown and

through the depth of the crisis.

As we noted in our AGM announcement, this backdrop means that

these half year accounts show a loss. EBITDA (Earnings before

Interest, Tax, Depreciation and Amortisation, a commonly used proxy

for cash generation before capital expenditure) for the period was

-GBP1.6m compared to GBP1.0m in 2019. Our 2020 operating loss was

GBP3.5m against a loss of GBP0.8m in 2019, a year that was itself

subject to disruption following a change to our core computer

systems at the end of March 2019. 2020 first half turnover was

GBP21.0m, which compares to GBP34.7m in 2019.

In light of the onset of Covid-19 no final dividend was paid for

2019 and no interim dividend is proposed for 2020. The company

benefits from a hugely supportive and loyal shareholder base. The

Directors will keep the dividend policy under continuous review and

return to paying dividends as soon as is appropriate.

We were delighted in April 2020 to be awarded the Queen's Award

for Enterprise in Sustainable Development. This is the third time

that Adnams has won this award, a true testament to our continuing

leadership in the field of sustainability.

THE DRINKS BUSINESS

The Adnams drinks business has seen good growth in recent years

in its sales to supermarkets and shops (our "Take Home" business).

The dominant element of our drinks sales remains sales to pubs and

other on-trade outlets and the closure of these outlets from 23rd

March until beyond the first half of the year had a serious impact

on this business.

As at the end of February our beer volumes were running just

under 3% behind the prior year, but March sales were 25% behind and

April 34%. Our on-trade business became restricted to small

deliveries to pubs running a takeaway operation. We saw very strong

growth in our Take Home sales where April volumes were ahead of

2019 by 57%. In the first half of the year, volumes in Take Home

were ahead by 25%, whereas overall beer volumes were down by 25%.

These numbers compare to industry volumes which show the total beer

market down by 15%, cask ale sales down by 62%, and sales of

premium bottled ales up by 19%.

Our export business performed strongly in the first two months

of the year but not surprisingly faced tough trading conditions,

yet it is seeing demand grow in our established markets.

A similar picture is apparent in our spirits business where

total volumes sold for the first half of the year were down by 17%,

however Take Home volumes rose by 25%.

In terms of products sold, Ghost Ship remains our most popular

beer, and Ghost Ship 0.5% continues to show strong growth. Likewise

with spirits, Copper House Gin is our bestseller. We continue to

see strong customer and trade reviews for our products in the press

and online which helps build awareness and drive sales.

Our investment in new brewing equipment, allowing us to produce

beer ready for bottling and canning, has proved its worth at a time

when the beer market has moved to selling the vast majority of its

products in these formats. The implementation of JD Edwards in 2019

enabled us to respond positively to the significant growth in

online orders during lockdown.

3RD TIME

The best gins you can drink in 2020

1ST Adnams Orange & Seabuckthorn

Adnams is so much more than just beer, and this limited-edition

gin is a winner - fresh, zingy but dry nonetheless, with the only

sweetness coming in the form of citrus and tropical fruit flavours

(orange, mango, pineapple). Garnish with a fresh orange slice.

ADNAMS PROPERTIES

UK pubs were already experiencing potentially serious cost

pressures before Covid-19 arrived, rates bills and increases in the

National Living Wage substantially ahead of inflation being

particularly notable. Enforced closure followed by restricted

reopening requirements and customer caution in visiting hospitality

venues will inevitably have far reaching effects on the pub

landscape. At this point it is very difficult to know the extent of

these changes; and the way in which government support evolves will

undoubtedly also affect the position.

The Adnams property estate, managed, leased and tenanted, was

all closed from 23rd March until beyond the end of the half year,

though some of the leased and tenanted pubs have offered a takeaway

business. Most staff employed in the Adnams managed properties were

placed on furlough following closure in March.

In 2019 the Adnams managed estate gained the Cross Keys at

Aldeburgh by transfer from our leased and tenanted estate whilst

the Ship at Levington moved in the reverse direction. There were no

changes to either estate in the first half of 2020. The Cardinal's

Hat in Harleston was sold at the end of 2019, though the proceeds

were received in 2020.

The half year result for our managed properties shows a loss,

with full trading only possible up to March 23rd with costs of

maintaining a closed estate continuing after that. The decision was

taken that it was not appropriate or right to charge rents to our

leased and tenanted estate whilst these properties were closed, so

earnings here were reduced too.

We've helped clean 1.3 million pairs of hands by supplying

alcohol to the UEA. Over 5000 care packages have been delivered to

front line workers and the local community.

ADNAMS SHOPS AND ONLINE

As drinks retailers Adnams was not required to close its shop

estate when other properties closed in March, however we took the

decision to do this in the interests of staff and customer welfare

and because our online offering provided a strong alternative. We

started reopening our shops in early June and whilst they are still

building towards the turnover levels of last year, early signs are

promising.

The Adnams online sales have represented a true highlight in a

difficult half year. We have seen sales rise four fold compared to

2019 and whilst the reopening of other retail outlets, including

pubs, will present a challenge in maintaining these sales, we have

served many new customers and will have the opportunity to firmly

establish this business in its improved position.

"AS EVER, IF ADNAMS DOES SOMETHING, IT DOES IT WELL"

MELISSA COLE, TELEGRAPH

FINANCE

Covid-19 struck at a point when Adnams was looking to harness

the benefits of its relatively recent capital investments.

Our bank debt at 30th June 2020 was GBP14m compared to 30th June

2019 debt of GBP21.0m. The improvement is driven by strong cost and

working capital management as well as utilising opportunities in

deferring various taxes and duties.

Focused control of cash and spending has ensured that Adnams

banking facilities, which are all provided through Barclays Bank,

have remained at GBP22m, GBP10m of which is in the form of term

loans whose maturity has been extended to over a year as at 30th

June 2020.

The pension scheme valuation has been updated for movements in

the six months since the year end valuation. No revaluation is

undertaken at the half year. The half year deficit is GBP6.2m which

compares to GBP8.0m at 30th June 2019 and GBP6.2m at 31st December

2019. However, the triennial valuation, on which company

contributions are based, showed a small surplus as at 31st March

2019 and the contributions have been adjusted accordingly with our

trading levels.

THE FUTURE

Our diversified strategy has enabled the business to pivot and

adapt to the changing environment quickly. Through controlling

costs, maximising opportunities, and delivering operational

excellence at pace has ensured that we have continued to grow the

parts of the business that could operate. Our focus on resilience,

recovery and doing the right thing has continued to grow our social

capital with our incredible team, customers and others - as we

approach the Adnams' 150th anniversary in 2022 we can look forward

to building back better.

Jonathan Adnams OBE

Chairman

PROFIT AND LOSS ACCOUNT

Unaudited Unaudited

6 months 6 months 12 months

to 30 to 30 to 31

June June December

2020 2019 2019

For the six months ended 30 June 2020 Notes GBP000 GBP000 GBP000

----------------------------------------------------- ----- --------- --------- ------------

Turnover 20,951 34,704 74,749

Operating expenses (24,462) (35,487) (74,030)

----------------------------------------------------- ----- --------- --------- ------------

Operating loss (3,511) (783) 719

Profit/(loss) on disposal of assets - - 62

----------------------------------------------------- ----- --------- --------- ------------

Profit/(loss) on ordinary activities before interest

and taxation (3,511) (783) 781

Interest (303) (257) (525)

Other finance charge on pension scheme (59) (112) (217)

----------------------------------------------------- ----- --------- --------- ------------

Profit/(Loss) on ordinary activities before taxation (3,873) (1,152) 39

Tax on profit on ordinary activities 2 667 213 (10)

----------------------------------------------------- ----- --------- --------- ------------

Profit/(loss) for the financial year (3,206) (939) 29

----------------------------------------------------- ----- --------- --------- ------------

(Loss)/earnings per share basic and diluted 3

'A' Shares of 25p each (169.8)p (49.8)p 1.5p

'B' Shares of GBP1 each (679.4)p (199.0)p 6.1p

----------------------------------------------------- ----- --------- --------- ------------

BALANCE SHEET

Unaudited Unaudited

30 June 30 June 31 December

2020 2019 2019

As at 30 June 2020 GBP000 GBP000 GBP000

----------------------------------------------- --------- ---------- -----------

Fixed assets

Tangible assets 42,014 45,129 43,791

----------------------------------------------- --------- ---------- -----------

Current assets

Stocks 8,688 10,039 9,185

Debtors 6,063 10,475 9,706

Cash at bank and in hand 2 23 24

----------------------------------------------- --------- ---------- -----------

14,753 20,537 18,915

----------------------------------------------- --------- ---------- -----------

Creditors: amounts falling due within one year (14,793) (25,993) (17,411)

----------------------------------------------- --------- ---------- -----------

Net current assets (40) (5,456) 1,504

----------------------------------------------- --------- ---------- -----------

Total assets less current liabilities 41,974 39,673 45,290

----------------------------------------------- --------- ---------- -----------

Creditors: amounts falling due after more than

one year (10,198) (5,196) (10,196)

----------------------------------------------- --------- ---------- -----------

Provision for liabilities (996) (742) (1,114)

----------------------------------------------- --------- ---------- -----------

(11,194) (5,938) (11,310)

----------------------------------------------- --------- ---------- -----------

Net assets excluding pension liability 30,870 33,735 33,985

Pension liability (6,157) (7,795) (6,198)

----------------------------------------------- --------- ---------- -----------

Net assets including pension liability 24,623 25,940 27,787

----------------------------------------------- --------- ---------- -----------

Capital and reserves

Called up share capital 472 472 472

Share premium 144 144 144

Profit and loss account 24,007 25,324 27,171

----------------------------------------------- --------- ---------- -----------

Equity shareholders' funds 24,623 25,940 27,787

----------------------------------------------- --------- ---------- -----------

Notes

1 Basis of preparation

The interim accounts, which have not been audited, have been

prepared under the recognition and measurement principles of FRS

102. The 2019 full year accounts were audited. The accounting

policies are unchanged from 2019.

Given the major uncertainties at this time, few businesses can

have absolute confidence in their long-term position. We continue

to manage cash carefully in the business and have concluded, based

on our cashflow management over the past few months and our current

projections, that Adnams continues to be soundly based thus the

adoption of the going concern basis in these accounts is

justified.

2 Taxation

The taxation charge is based on the estimated tax rate for the

year. Profit on sale of assets includes property profits which are

assumed to be reinvested and the tax rolled-over.

3 Earnings per share

Earnings per share is calculated by dividing the earnings

available to ordinary shareholders by the issued ordinary share

capital of GBP471,842. The earnings per share calculation is the

same for basic and diluted earnings.

4 Impairment review

At the reporting date, our pubs, after 3 months of closure, were

planning to reopen following changes to government guidelines. We

considered the carrying value of our estate and due to the

subsequent trading being ahead of internal forecasts, no impairment

was deemed necessary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGZGGLMFDGGZM

(END) Dow Jones Newswires

September 03, 2020 07:08 ET (11:08 GMT)

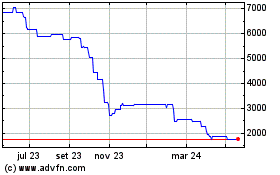

Adnams (AQSE:ADB)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

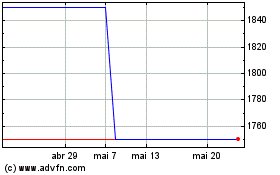

Adnams (AQSE:ADB)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025