TIDMNYR

The information contained within this announcement is deemed by the Group to

constitute inside information as stipulated under the Regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations 2019/310 ("MAR"). With the

publication of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public domain.

15 September 2021

NEWBURY RACECOURSE PLC

(the "Racecourse" or the "Company")

Interim results for the 6 months ended 30 June 2021

Newbury Racecourse plc, the racing, entertainment and events business, today

announces its half year results for the six months ended 30 June 2021.

2021 Financial and Business Update

· Statutory turnover increased by 72% to £5.37m (2020: £3.12m).

· Loss before interest, tax and exceptional items reduced to £0.38m (2020:

Loss of £1.64m)

· Consolidated group loss on ordinary activities before tax of £0.32m

(2020: Loss of £1.6m).

· Raceday attendances of 4,400 (2020: 10,900). Twelve meetings (two with a

paying attendance) compared with six (three with paying attendance) in 2020.

· In 2021 the Company has continued to be severely impacted by the

COVID-19 pandemic alongside the decision by the UK Government to implement

national lockdowns which subsequently placed restrictions on our business's

ability to operate normally.

· The Company has operated all its 2021 racing fixtures, with, for the

majority, the only income coming from our betting and media rights agreements.

The nursery is trading as normal and the conference & events business has

re-opened to a cautious market. The Hotel has remained closed since 17 March

last year.

· In June 2021, the Company announced a joint-venture partnership

agreement with Levy Restaurants (a division of Compass Group) to provide all

raceday, events, hotel and nursery catering. The Board is confident that this

relationship, which became effective from 1 June 2021, will provide the

racecourse with access to innovative technology solutions, new restaurant, bar

and food outlet concepts and improved commercial benefits for many years to

come.

· On 7 July 2021, the Company announced that it had signed an all media

rights agreement with Arena Leisure Racing Ltd & At The Races Ltd (Sky Sports

Racing) to replace the existing contract with Racecourse Media Group Ltd. This

existing agreement expires in respect of retail rights on 31 March 2023 and in

respect of all other rights on 31 December 2023. It is anticipated that the new

agreement will provide the Racecourse with both financial and strategic

benefits and will run until the end of 2028.

Outlook Update

· The UK Government's lifting of all legal restrictions on public life

from 19 July 2021 means the Company is now in a position to plan accordingly.

Paying attendance with unlimited crowds is now permitted, our raceday

hospitality businesses have reopened and our nursery remains fully open to all

children.

· Providing that no new restrictions are implemented then the outlook for

the remainder of the year looks positive, but we remain cautious of the fact

that the UK Government guidance could change this situation at any time. The

business continues to manage and mitigate the risks associated with COVID-19.

· The Company is confident that it has the resources to trade through

until receipt of the David Wilson Homes final payment which is due in March

2022, within its current banking facilities. The Board anticipates being in a

position to provide a further update on capital returns to shareholders and

future prize money when our 2021 results are announced in spring next year.

Dominic Burke, Chairman of Newbury Racecourse plc commented:

"Following the challenges that 2020 presented for both the horseracing industry

and our business it is pleasing to see that in 2021 we may finally have turned

a corner. Up to 30 June we welcomed a crowd to two of our racedays and have

subsequently been able to host a paying attendance, with certain elements of

restrictions, at a subsequent eight race meetings. Whilst we were able to

generate income during the behind closed doors meetings through our media and

betting rights agreements, we lost the significant benefit of being able to

generate key revenues through catering and hospitality but this will now be

possible. Likewise, our Conference & Events business relaunched following

suspension in March last year but unfortunately the Lodge Hotel remains closed

whilst we identify the most appropriate opportunity to relaunch. We have

continued to keep our Nursery business open during the year. During the period

when the site was partially closed in the early part of this year we are proud

to have provided support to the NHS by offering our facilities as a vaccination

centre.

The Step 4 final lifting of the UK Government's restrictions means that we are

now in a position to be able to plan ahead for the remainder of 2021 and

beyond. We hosted Olly Murs at our August Party in The Paddock and look forward

to welcoming another sizeable crowd in September for Rick Astley. Likewise, we

still have some exciting National Hunt meetings this year at the racecourse

including the Ladbrokes Winter Carnival in November.

However, the Board remains fully aware that the effects of the pandemic and its

potential impact could remain with us for some while to come, so we are

prepared for this and have proven that we can adapt the business accordingly.

The impact of the financial operating losses from 2020 and the first half of

2021 remain substantial.

Recently we have signed two major strategic agreements, with Levy Restaurants

becoming our Catering partner with effect from 1 June 2021 and all our media

rights transferring to Arena Leisure Racing (Sky Sports Racing) in two separate

stages starting with retail rights from 1 April 2023 followed by all other

rights from 1 January 2024. We anticipate that both of these changes will

influence our ability to improve the financial performance of the Company. I

also remain confident that the redevelopment of the racecourse has provided us

with an exceptional venue which, following a particularly challenging 18

months, will continue to enable us to host racing and other events of the

highest quality in the future.

Unfortunately, I end this update on a very sad note. Long-standing supporter of

Newbury Racecourse and former Chairman, Christopher Spence, has sadly passed

away this week aged 84. Christopher was a special man and great friend to many

at Newbury and within the horseracing industry. He will be sadly missed. Our

thoughts go out to everyone who knew him and to his family at this difficult

time."

For further information please contact:

Newbury Racecourse plc

Tel: 01635 40015

Julian Thick, Chief Executive

Harriet Collins, Marcomms & Sponsorship Director

Allenby Capital

Limited Tel: 0203 328

5656

Nick Naylor/Liz Kirchner (Corporate Finance)

Hudson Sandler

Tel: 0207

796 4133

Charlie Jack

CHAIRMAN'S STATEMENT

2021 Trading

The Company was initially forced to cease all of its trading activities in

March 2020 but has subsequently adapted to changes in restrictions during the

different lockdown stages through to mid-2021. After a year of behind closed

doors racing, and with the exception of a restricted raceday in December, our

first meeting with a limited paying crowd in attendance took place on 10 June

2021. In the first half of 2021 we held a total of 12 racedays with only two

being able to host a paying public attendance and both with limited

hospitality. Licenced Betting Shops, which when fully operational are an

important factor in our income generation, have also been closed in various

forms and only became fully open with no restrictions from 17 May 2021.

Whilst the Rocking Horse Nursery has remained opened throughout this year, our

Conference and Events business only re-opened during April when restriction

easing permitted whereas The Lodge Hotel remains closed and we continue to

monitor the market to identify the most appropriate time to relaunch.

In the meantime, we are proud to have played our part in helping the local West

Berkshire community at this difficult time by allowing the NHS use of our

facilities as a local vaccine centre from January. During the period of

occupation they administered 66,500 COVID-19 vaccinations.

In the first six months of 2021, total turnover has increased by 72%, compared

to the same period in 2020, to £5.37m (2020: £3.12m). Overall operating losses

to 30 June 2021 were £0.38m (2020: loss of £1.64m). Losses after tax for the

period were £0.06m (2020: loss of £1.6m). There were 12 racedays in the first

half of 2021 compared with six in 2020.

These results were mitigated by a number of actions to manage overheads. Last

year the Company undertook the difficult decision to reduce headcount by 30%,

which has helped to control fixed overheads, whilst we have also carefully

managed establishment and discretionary costs. The Company has made limited use

of the Government Coronavirus Job Retention Scheme in 2021, has accepted the

Business Rates discount but made no other use of any direct Government support

package.

Financing and Liquidity

During the first half of 2021 we repaid £1.5m of the previously fully drawn

revolving credit facility to National Westminster Bank plc ("NWB") as a result

of our improved cash position and outlook given the easing of restrictions on

the business. During 2020 we agreed with NWB to replace the covenants in place

with a single measure, based on minimum liquidity levels, which continue to be

tested through to April 2022, by which time we expect to receive £10.7m (being

the final payment in relation to the residential development at the racecourse)

from David Wilson Homes, a wholly owned subsidiary of Barratt Developments plc.

The final repayment of the loan to Compton Beauchamp Estates Limited remains

set for April 2022.

Outlook

Following the UK Government's lifting of all legal restrictions from 19 July

2021, the Company is now in a position to plan accordingly for the remainder of

this year and beyond. Paying attendance with unlimited crowds is now permitted,

our raceday hospitality businesses have reopened and our nursery continues to

operate normally. However, the Lodge Hotel remains closed whilst we regularly

monitor the market for the appropriate time to relaunch. Licenced Betting Shops

are now able to fully open back to pre-COVID levels. Despite the easing of

restrictions the Company responsibly ensures that a safe environment for

racegoers and other attendees to our site is maintained.

We hosted Olly Murs at our August Party in The Paddock and look forward to

welcoming another sizeable crowd in September for Rick Astley. Likewise, we

still have some exciting National Hunt meetings this year at the racecourse

including the Ladbrokes Winter Carnival in November and December's Challow

Hurdle. However, the Board remains fully aware that the effects of the pandemic

and its potential impact could remain with us for some while to come, so we are

prepared for this and have proved during the past 18 months that we can adapt

the business accordingly.

Recently we have signed two major strategic agreements. Firstly, Levy

Restaurants have become our Catering partner with effect from 1 June 2021 and

we look forward to working with them and developing this important segment of

the business. Secondly, all our media rights will transfer to Arena Leisure

Racing (broadcast on Sky Sports Racing) in two separate stages starting with

retail rights from 1 April 2023, with all other rights from 1 January 2024. We

anticipate that both of these changes will influence our ability to improve the

financial performance of the company. The Board anticipates being in a position

to provide a further update on capital returns to shareholders and future prize

money when our 2021 results are announced in spring next year.

The impact of the financial losses from 2020 and the first half of 2021 remains

substantial. The Board remains confident that the Company has the financial

resources in place to trade through the period until the loans are due for

repayment which coincides with the final receipt from David Wilson Homes in

spring 2022.

On behalf of the Board, I would like to thank all the staff for their continued

hard work, resolve and commitment to the business during this extraordinary and

challenging period.

DOMINIC J BURKE

Chairman

15 September 2021

CHIEF EXECUTIVE'S REPORT

Performance Review

Due to the UK Government's restrictions affecting our ability to operate as

normal since spring 2020, the business remains substantially behind 2019

levels. However, in the first half of 2021 we have experienced a 72% increase

in group turnover to £5.37m (2020: £3.12m) compared to last year, which also

demonstrates the significant impact that the initial lockdown had during the

early part of 2020 once all trading was ceased on 17th March.

Revenues across all our businesses were higher than 2020 but that in no way

represents a positive position for the business compared with expectations

under normal circumstances. Racing with a paying crowd resumed on 10 June 2021,

which along with Licenced Betting Shops fully re-opening, has resulted in

revenue being up 44% on 2020. Our Conference & Events business re-opened on 12

April 2021 with income down 22% and the Nursery has seen a 56% increase in

income compared with the same period last year.

Despite these revenue improvements, the Company is reporting mid-year operating

losses before exceptional items of £0.38m (2020: loss of £1.64m).

Exceptional items in the first six months of 2021 were a credit of £0.06m

(2020: credit of £0.03m) being the fair value movement on the David Wilson

Homes debtor, based upon the expected timing and value of future receipts.

The loss on ordinary activities after interest and tax was £0.06m (2020: loss £

1.6m).

Racing

The racecourse has hosted 12 racedays to 30th June 2021, ten of which were

Behind Closed Doors ("BCD"). This compares to six staged during the same period

in 2020, of which three were BCD.

Total media related revenues of £2.12m, were up 120% on the same period in

2020, as a direct consequence of the higher number of racedays being hosted.

We are grateful for the continued and significant support from all of our

sponsors for the racedays that we were able to host in the first half of the

year, with particular thanks to Al Shaqab, Dubai Duty Free, Betfair,

Mansionbet, Greatwood and West Berkshire Mencap for their ongoing support.

Catering, Hospitality and Conference & Events

Conference & Events started well in 2020 until the March COVID shutdown

resulted in the cancellation of much of this business in a key trading period.

2021 has seen the opposite with the business re-opening in April following

almost a year of enforced closure. Consequently, revenues up to 30 June 2021

were £0.12m compared with £0.5m in 2020, resulting in an operating loss of £

0.03m (2020: loss £0.26m).

Our Catering business transferred to a joint venture partnership with Levy

Restaurants on 1 June 2021 which will result in the Company receiving royalty

income from the shared arrangement rather than reporting the full income and

costs. Prior to that date there was minimal trading whilst the business

remained closed, although we have continued with the outdoor pop-up Pub concept

that we introduced last year in order to generate income within restriction

guidelines.

The Lodge

Our 36 bedroom onsite hotel has remained closed to the public since March 2020.

Now that UK Government restrictions have been lifted on accommodation stays we

continue to monitor the market for the most appropriate opportunity to re-open

and relaunch this business, which was previously delivering good growth in

occupancy levels and average room rates.

Rocking Horse Nursery

The Rocking Horse Nursery has traded at normal levels throughout 2021,

returning to those experienced in 2019. Revenues in the first six months of

2021 were £0.8m, up 56% on the comparative period in 2020. This business unit

reported an operating profit of £0.31m (2020: loss of £0.17m).

The Development

The 2020 restoration and refurbishment of the Royal Box completed the final

stage of the racecourse heartspace redevelopment. Under the circumstances all

other investment projects remain on hold until the trading and cash position of

the business permits.

The David Wilson Homes ("DWH") residential development continues to progress

with the Central Area apartments now fully completed and sold, with the Company

now owning the freeholds of a further ten apartment blocks. DWH is continuing

with construction in the Eastern Area of the site. Approximately 1,000 homes

out of the planned total of c.1,500 are now built. The final date for the

balance of the guaranteed minimum land value due from DWH is March 2022 and as

at 30 June 2021 the balance outstanding was £10.8m.

JULIAN THICK

Chief Executive

15 September 2021

Consolidated Profit and Loss Account

Six months ended 30 June 2021

Note Unaudited Restated*

6 months 30/06/ Unaudited

21 6 months

£'000 30/06/20

£'000

Turnover 7 5,365 3,124

Cost of sales (4,662) (4,103)

Gross (loss) / profit 7 703 (979)

Administrative expenses (1,152) (1,150)

Other operating income 8 66 494

Operating loss before exceptional items (383) (1,635)

Exceptional Items 9 62 34

Loss before interest and tax (321) (1,601)

Interest receivable and similar income 85 85

Interest payable and similar charges (100) (86)

Loss before taxation (336) (1,602)

Tax credit 10 280 9

Loss after taxation (56) (1,593)

Loss per share (basic and diluted) (See Note (1.67p) (47.6p)

11)

All amounts derived from continuing operations

*Refer to Note 16.

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2021

Unaudited Restated*

6 months Unaudited

30/06/21 6 months

£'000 30/06/20

£'000

Total comprehensive loss for the period (56) (1,593)

*Refer to Note 16.

Consolidated Balance Sheet

As at 30 June 2021

Unaudited

30/06/21 Audited

£'000 31/12/20

Note £'000

Fixed assets

Tangible assets 12 41,213 41,549

Investments 117 117

41,330 41,666

Current assets

Stocks 27 177

Debtors: amounts falling due after more than one 3,675 14,046

year

Debtors: amounts falling due within one year 15,006 4,130

Cash at bank and in hand 4,932 5,529

23,640 23,882

Creditors: amounts falling due within one year (10,434) (2,304)

Net current assets 13,206 21,578

Total assets less current liabilities 54,536 63,244

Creditors: amounts falling due after more than - (8,611)

one year

Provisions for liabilities

Provisions (4,178) (4,169)

Pension liability 14 (1,497) (1,538)

Net assets 48,861 48,926

Capital grants

Deferred capital grants 43 52

Capital and reserves

Called up share capital 13 335 335

Share premium account 10,202 10,202

Revaluation reserve 75 75

Equity reserve 143 143

Profit and loss account surplus 38,063 38,119

Shareholders' funds 48,818 48,874

Net assets 48,861 48,926

The unaudited half year financial statements of Newbury Racecourse PLC, company

registration 00080774, were approved by the Board of Directors on 15 September

2021 and signed on its behalf by:

D J Burke (Chairman)

J M Thick

(Chief Executive)

Consolidated Statement of Changes in Equity

At 30 June 2021

GROUP Share Share Capital Revaluation Profit and Total

Capital £ Premium redemption reserve £ loss account £'000

'000 £'000 Reserve '000 £'000

£'000

At 1 January 335 10,202 143 75 40,640 51,395

2020

Loss for the - - - - (1,593) (1,593)

period to 30

June 2020

Other - - - - - -

comprehensive

income

At 30 June 2020 335 10,202 143 75 39,047 49,802

GROUP Share Share Capital Revaluation Profit and Total

Capital £ Premium redemption reserve £ loss account £'000

'000 £'000 Reserve '000 £'000

£'000

At 1 January 335 10,202 143 75 38,119 48,874

2021

Loss for the - - - - (56) (56)

period to 30

June 2021

Other - - - - - -

comprehensive

income

At 30 June 2021 335 10,202 143 75 38,063 48,818

Consolidated Cash Flow Statement

Six months ended 30 June 2021

Unaudited Restated

6 months 30/06/21 Unaudited

6 months 30/06/20

£000 £000

Cash flows from operating activities

Loss for the financial period (56) (1,593)

Adjustments for:

Exceptional items (62) (34)

Amortisation of capital grants (9) (9)

Depreciation charges 625 602

Interest paid 100 86

Interest received (85) (85)

Tax credit (280) (9)

Decrease in stocks 151 49

(Increase)/decrease in debtors (190) 338

Increase/(decrease) in creditors 989 (398)

Corporation tax paid - -

Other associated property receipts 7 53

Pension funding deficit payments (55) (55)

Net cash generated from operating activities

1,135 (1,055)

Cash flows from investing activities

Receipts from David Wilson Homes 112 84

Purchase of fixed assets (299) (1,621)

Interest received - 2

Net cash from investing activities (187) (1,535)

Cash flows from financing activities

Repayment of bank loan (1,500) 5,500

Interest paid (45) (39)

Net cash used in financing activities (1,545) 5,461

Net (Decrease)/increase in cash and cash (597) 2,871

equivalents

5,529 1,269

Cash and cash equivalents at beginning of

period

Cash and cash equivalents at the end of 4,932 4,140

period

Cash and cash equivalents at the end of

period comprise:

4,932 4,140

Cash at bank and in hand

4,932 4,140

Advantage has been taken of the exemption under FRS102 not to disclose the

individual cash flow statements of the company and of its subsidiaries.

Notes to the Interim Financial Statements

Six months ended 30 June 2021

1. BASIS OF PREPARATION

Newbury Racecourse PLC (the "Company") is a public company incorporated,

domiciled and registered in England in the UK. The registered number is

00080774 and the registered address is The Racecourse, Newbury, Berkshire, RG14

7NZ.

These Group and parent company financial statements were prepared in accordance

with Financial Reporting Standard 102 The Financial Reporting Standard

applicable in the UK and Republic of Ireland ("FRS 102").

These interim financial statements do not include all of the notes and

disclosures required to comply with FRS102, as they have been prepared in

accordance with the content, recognition and measurement principles for interim

financial reports, Financial Reporting Standard 104 (FRS 104).

The abridged results for the six months ended 30 June 2021 do not constitute

statutory accounts within the meaning of S434 of the Companies Act 2006. The

auditor's report on the accounts of Newbury Racecourse plc for the 12 months to

31 December 2020 was unqualified, did not draw attention to any matters by way

of emphasis and did not contain any statement under S498 (2) or (3) of the

Companies Act 2006 and has been delivered to the Registrar of Companies.

2. SIGNIFICANT ACCOUNTING POLICIES

The Interim Financial Statements have been prepared in accordance with the

accounting policies adopted in the Group's most recent annual financial

statements for the year ended 31 December 2020 and those expected to be applied

for the year ending 31 December 2021.

3. ESTIMATES

When preparing the Interim Financial Statements, management undertakes a number

of judgements, estimates and assumptions about recognition and measurement of

assets, liabilities, income and expenses. The actual results may differ from

the judgements, estimates and assumptions made by management, and will seldom

equal the estimated results.

The judgements, estimates and assumptions applied in the Interim Financial

Statements, including the key sources of estimation uncertainty, were the same

as those applied in the Group's last annual financial statements for the year

ended 31 December 2020. The only exceptions are the estimate of income tax

liabilities which is determined in the Interim Financial Statements using the

estimated average annual effective income tax rate applied to the pre-tax

income of the interim period.

4. GOING CONCERN

The Board has undertaken a full, thorough and continual review of the Group's

forecasts and associated risks and sensitivities, over the next twelve months.

The extent of this review reflects the 19th July 2021 easing of lockdown

guidance from the Government as well as specific financial circumstances of the

Group.

The Board reviews the cash flow and working capital requirements in detail on a

frequent basis, whilst during the past eighteen months under the current COVID

19 circumstances the regularity of this scrutiny has increased

The Board also identifies that the Group's cash flow forecasts are sensitive to

fluctuating revenue streams from ticket sales, corporate hospitality,

conference and event income and the timing of receipts and payments in respect

of the property redevelopment. A system of regular reviews of forecast business

and expected property receipts has been implemented to ensure all variable

costs are flexed to match anticipated revenues. In addition, a number of race

meetings have been insured for adverse weather conditions, reducing the levels

of risk carried by the Group.

At the balance sheet date, the Company has adequate cash reserves, together

with banking facilities which are in place through to the end of March 2022 to

support trading requirements and committed loan repayments and covenants.

Following this review the Board has concluded that it has a reasonable

expectation that the Group has adequate resources and banking facilities in

place to continue in operational existence for the foreseeable future and on

that basis the going concern basis has been adopted in preparing the financial

statements.

5. REVENUE RECOGNITION

Services rendered, raceday income including admissions, catering revenues,

sponsorship and licence fee income is recognised on the relevant raceday.

Annual membership income and box rental is recognised over the period to which

they relate.

Other income streams are also recognised over the period to which they relate,

for example, conference income is recognised on the day of the conference, the

Lodge hotel income is recognised over the duration of the guests stay and

nursery income is recognised as the child attends the nursery.

Sale of goods revenue is recognised for the sale of food and liquor when the

transaction occurs.

6. PROPERTY RECEIPTS

Property receipts are recognised in accordance with the nature of the

transaction being that of an exceptional sale of land. The minimum guaranteed

sum, as set out in the agreement with David Wilson Homes, is recognised at the

point of sale. In accordance with FRS102, at each reporting date, the sum

receivable is re-estimated based upon currently projected land value with the

difference between this value and the discounted net present value recorded in

the profit and loss account.

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

a. The condensed set of financial statements has been prepared in accordance

with FRS 104 'Interim Financial Reporting' giving a true and fair value of the

assets, liabilities, financial position and profit or loss of the undertakings

included in the consolidation as a whole as required by DTR 4.2.4R.

a. The interim report includes a fair review of the information required by

DTR 4.2.7R (indication of important events during the first six months and

description of principal risks and uncertainties for the remaining six months

of the year); and

a. The interim management report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions and changes

therein).

By order of the Board,

J M Thick M Leigh

Chief Executive Finance Director

15 September 2021 15 September 2021

7. SEGMENTAL ANALYSIS

30 June 2021 Turnover Gross Operating (Loss)/profit (Loss)/profit *Net

£'000 Profit/ before exceptional items before tax £ Assets

(Loss) £'000 '000 £'000

£'000

Trading 4,527 368 (655) (670) 31,610

Nursery 800 314 314 314 2,637

Lodge 8 (9) (9) (9) 1,543

Property 30 30 (33) 29 13,071

Total 5,365 703 (383) (336) 48,861

30 June 2020 Turnover Gross Operating (Loss)/profit (Loss)/profit *Net

- restated £'000 Profit/ before exceptional items before tax £ Assets

(Loss) £'000 '000 £'000

£'000

Trading 2,458 (1,141) (1,787) (1,793) 33,139

Nursery 514 170 170 170 2,674

Lodge 125 (35) (35) (35) 1,363

Property 27 27 17 56 12,687

Total 3,124 (979) (1,635) (1,602) 49,863

* Net assets represents fixed assets less deferred income and term loans for

property, nursery and lodge; all working capital is included within the

'Trading' segment.

8. OTHER OPERATING INCOME

6 months

6 months 30/06/20

30/06/21 £'000

£'000

Other Operating Income 66 494

Total 66 494

Other operating income is attributable to government grants received from the

Coronavirus Job Retention Scheme.

9. EXCEPTIONAL ITEMS

6 months

6 months 30/06/20

30/06/21 £'000

£'000

DWH debtor movement in fair value 62 39

Loss on sale of fixed assets - (5)

Total 62 34

In accordance with the audited financial statements, accounting transactions

related to the DWH agreement are considered outside the ordinary course of

business.

10. TAXATION

The tax has been computed in accordance with FRS 104 Interim Financial

Reporting. This requires the company to apply the estimated annual effective

tax rate to the loss for the interim period and recognise a tax credit only to

the extent that the resulting tax asset is more likely than not to reverse.

11. PROFIT PER SHARE

Basic and diluted loss per share of 1.7p (2020: 47.6p) is calculated by

dividing the loss attributable to ordinary shareholders for the period ended 30

June 2021 of £56,000 (2020 restated: loss £1,593,000) by the weighted average

number of ordinary shares during the period of 3,348,326 (2020: 3,348,326).

12. TANGIBLE FIXED ASSETS

GROUP Freehold Fixtures Tractors and motor Total

property and vehicles £'000

£'000 fittings £'000

£'000

Cost or valuation

As at 1 January 2021 53,795 9,497 313 63,605

Additions 9 280 289

Disposals - - -

At 30 June 2021 53,804 9,777 313 63,894

Depreciation

At 1 January 2021 16,777 5,120 159 22,056

Charge for year 342 272 11 625

Disposals - - - -

At 30 June 2021 17,119 5,392 170 22,680

Net book value at 30 36,685 4,385 143 41,213

June 2021

Net book value at 31 37,018 4,377 154 41,549

December 2020

In 1959 a revaluation of part of the freehold land at £117,864 gave rise to an

excess of £75,486 over its cost and this sum is included in the total value of

this asset. The excess on revaluation is credited to the Revaluation Reserve.

The net book value of freehold land and buildings (and excluding outdoor

fixtures) determined by the historical cost convention is £36,609,000 (2019: £

36,350,000).

In 2018 the board revisited the residual values and useful economic lives of

the land enhancements and major buildings on the site. Savills were instructed

to provide an estimate of the residual values and these were applied in re

estimating the depreciation charge for those assets. There was no further

change in the residual values or useful economic lives during 2021.

13. SHARE CAPITAL

30/06/21 30/06/20

£'000 £'000

Authorised

Ordinary shares of 10p each 600 600

Total 600 600

30/06/21 30/06/20

£'000 £'000

Allotted and fully paid

Ordinary shares of 10p each 335 335

Total 335 335

14. RETIREMENT BENEFIT OBLIGATIONS

The defined benefit obligation at 30 June 2021 has been determined with

reference to the figures recorded at 31 December 2020, which were calculated in

accordance with FRS102 s.28, as in the Directors' opinion there have not been

any significant fluctuations in the key assumptions. The movement in the

defined benefit deficit relates to the top-up payment made during the period

ended 30 June 2021 of £0.05m, net of interest charges accrued.

15. RELATED PARTY TRANSACTIONS

There are no significant changes to the nature and treatment of related party

transactions for the period to those reported in the 2020 Annual Report and

Accounts.

16. EXPLANATION OF PRIOR YEAR ADJUSTMENTS

As at 31 December 2020 the group restated comparative financial information in

order to bring the accounting treatment of the leasehold asset receivable in

line with the requirements of FRS 102.

In 2012, under the terms of the David Wilson Homes land sale agreement, part of

the consideration arising from David Wilson Homes was an option to purchase, at

a substantial discount to market value, the interest in the ground rents of the

new residential apartment buildings. This had been recognised in the financial

statements as a lease receivable of £3.56m for the present value of all

expected future rentals is recognised at 31 December 2016, with any ground

rents received being netted off against the debtor.

On further consideration, the accounting of the present value of the lease

receivable has been updated to reflect the length of the leasehold period of

125 years, and to split out the value of the exercised freehold option that has

been purchased, to be held as freehold property.

The impact on 2020 profit for the period to 30 June 2020 is to increase the

profit by £0.08m, which is the amount applicable to the effective interest on

the unwinding of the discount applied to lease receivable.

END

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

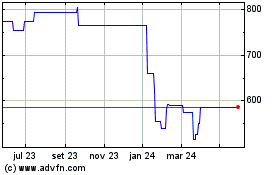

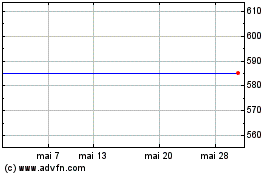

Newbury Racecourse (AQSE:NYR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Newbury Racecourse (AQSE:NYR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025