VinaCapital Vietnam Opportunity Fd. Clarification on adjustments to Net Asset Value (6013S)

10 Março 2023 - 7:43AM

UK Regulatory

TIDMVOF

RNS Number : 6013S

VinaCapital Vietnam Opportunity Fd.

10 March 2023

VinaCapital Vietnam Opportunity Fund Limited

(the "Company" or "VOF")

Additional clarification on the valuation adjustments to Net

Asset Value (NAV) - 10 March 2023

Further to the announcement on 6 March 2023, where the Company

announced a change in daily NAV which included a decrease of USD

25.8 million (2.64% of NAV) arising from the approval by the Audit

Committee of valuation adjustments to certain public equity with

private terms and private equity investments as of 31 December

2022, the Board wish to provide some further detail.

The decline in NAV relates principally to the revaluation of

certain investments related to the NovaGroup Joint Stock Company

("NovaGroup"), which is the holding company of the listed company

Novaland Joint Stock Company ("Novaland", HOSE: NVL), and the

unlisted company Nova Consumer Group Joint Stock Company

("NCG").

On 30 December 2022, an event of default occurred on two

instruments held in VOF's "public equities with private terms"

portfolio relating to Novaland. The Investment Manager took the

appropriate steps to protect VOF's position as a creditor and is

currently in negotiations with the company to reschedule the

payments due under the instruments and improve the security

package. As a result of the default, however, the Board has asked

the Investment Manager to change the basis on which these

Novaland-related investments were valued, using a number of

possible outcomes of the negotiations and attributing probabilities

to each. This change of valuation basis has resulted in the

reduction in the valuation of the two instruments by USD 18.8

million as at 31 December 2022. These two investments were valued

at 30 June 2022 at a total of USD 58.5 million and, following the

most recent adjustments that have been approved by the Audit

Committee, are valued at USD 38.6 million as of 31 December

2022.

In addition, in April 2022 VOF made a USD 24.8 million

investment in a minority interest in Nova Consumer Group ("NCG"), a

separate company in the NovaGroup, which had expected to be listed

on the Ho Chi Minh Stock Exchange by 1 January 2023. This

investment was valued at 30 June 2022 at USD 25.2 million. Due to

adverse market conditions, NCG was unable to fulfil its listing

commitments by the agreed date and, consequently, the Investment

Manager on behalf of VOF has exercised the put option agreed at the

time of the original investment. This put option provided that VOF

could sell its shares in NCG back to NovaGroup at cost plus a

guaranteed return. However, as a result of the broader problems it

is experiencing, NovaGroup is not in a position to honour this

obligation. Again, the Investment Manager is taking the necessary

legal steps to secure VOF's position as a creditor but, in this new

light, the Board of VOF has concluded that a provision of USD 7.9

million against VOF's investment in NCG is also necessary and, with

this most recent adjustment, the investment in NCG is valued at USD

17.8 million as of 31 December 2022.

The Investment Manager continues to actively engage with

NovaGroup and its sponsors to negotiate the recovery of these

investments including the expected returns.

The reductions in the valuations of the two Novaland-related

instruments and the investment in NCG totalled USD 26.7 million as

at 31 December 2022 which were approved by the Audit Committee of

VOF and adjusted in the daily NAV of 3 March 2023.

Further information is available on the Company's website at:

https://vof.vinacapital.com/

Enquiries:

Joel Weiden

-----------------------------------------------------------

Investment Manager - Investor Relations and Communications

VinaCapital Investment Management Limited

T: +84 28 3821 9930

E: joel.weiden@vinacapital.com

David Benda / Hugh Jonathan

-----------------------------------------------------------

Broker

Numis Securities Limited

T: +44 20 7260 1000

E: funds@numis.com

Magdala Mullegadoo

-----------------------------------------------------------

Company Secretary / Administrator

Aztec Financial Services (Guernsey) Limited

T: +44 1481 748 814

E: vinacapital@aztecgroup.co.uk

Edward Livingstone-Learmonth

-----------------------------------------------------------

Public Relations (London)

Camarco

T: +44 20 3757 4980

E: edward.livingstone-learmonth@camarco.co.uk

Will Hampsey-Cook

-----------------------------------------------------------

Marketing and Distribution (London)

Frostrow Capital LLP

T: +44 (0)203 709 9281

E: Will.Hampsey-Cook@frostrow.com

Dion Di Miceli / Stuart Muress

-----------------------------------------------------------

Marketing and Investor Engagement (Global)

Barclays Bank PLC

T: +44 207 623 2323

E: BarclaysInvestmentCompanies@barclays.com

1. References to VOF or the Company in this announcement shall

mean VinaCapital Vietnam Opportunity Fund Limited, a non-cellular

company incorporated in the Bailiwick of Guernsey under The

Companies (Guernsey) Law, 2008, with registered number 61765. It is

authorised by the Guernsey Financial Services Commission (reference

number 2268242) as a registered closed-ended investment scheme

under The Protection of Investors (Bailiwick of Guernsey) Law, 2020

and in compliance with the Registered Collective Investment Scheme

Rules, as amended.

2. The registered office address of the Company is East Wing,

Trafalgar Court, Les Banques, St Peter Port, Guernsey, Channel

Islands, GY1 3PP.

3. This announcement may contain inside information as

stipulated under the Market Abuse Regulations (EU) NO. 596/2014

(MAR).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBGGDXBSBDGXG

(END) Dow Jones Newswires

March 10, 2023 05:43 ET (10:43 GMT)

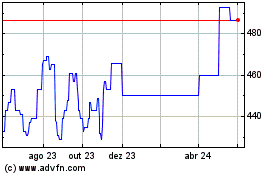

VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

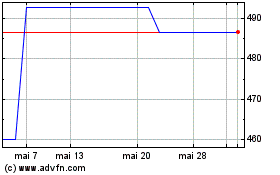

VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024