UPDATE: Amcor Fiscal Year Profit Down 13.6%; Large Tax Expenses On Alcan

25 Agosto 2010 - 11:33PM

Dow Jones News

Amcor Ltd. (AMC.AU), the world's largest maker of plastic soft

drink bottles, on Thursday reported a 13.6% drop in full-year net

profit, hurt by costs associated with its early year purchase of

the Alcan packaging business.

The Melbourne-based company posted net profit for the year to

June 30 of A$183.0 million, down from A$211.7 million a year

earlier. The earnings were damped by after tax expenses of A$226.2

million, primarily related to restructuring and the acquisition of

parts of Rio Tinto Ltd.'s (RTP) Alcan Packaging unit. Excluding

these charges, profit was A$409.2 million, up 13.5% from adjusted

earnings a year earlier.

In a statement, Chief Executive Ken MacKenzie said Amcor was

"well positioned for strong earnings growth in the 2011 financial

year", driven partly by two recent acquisitions.

Macquarie Equities said the underlying profit was below the

market consensus of A$418 million and just below its own forecast

of A$411 million, while Goldman Sachs said was above its estimate

of A$402 million.

"We remain comfortable with our (guidance for) A$594 million in

fiscal 2011 net profit after tax, which is similar to consensus,"

Macquarie analyst Brett O'Malley said.

Revenue for the year rose 3.3% to A$9.85 billion from A$9.54

billion, and MacKenzie expects substantial synergies with

Alcan.

"We remain confident of achieving A$200 million to A$250 million

in synergies relating to overhead cost reductions, procurement cost

savings and improved operational efficiencies," MacKenzie said.

"There is no doubt this acquisition is an exciting opportunity for

Amcor and one we believe will create substantial shareholder

value."

On a conference call with journalists, MacKenzie forecast A$100

million-A$120 million in cost synergies on the Alcan acquisition

for the upcoming financial year.

On the company's recent purchase of Ball Plastic Packaging

Americas for US$280 million, MacKenzie said "significant synergy

opportunities will underpin strong returns from the first full year

of acquisition."

As part of the two acquisitions, Amcor said Thursday it will

close four plants, including one in Australia, in an effort to cut

costs and streamline its operations.

Amcor, which earns most of its revenue offshore, said the

translation impact of the higher Australian dollar reduced

underlying earnings by A$58 million.

The Australian dollar averaged 88.2 U.S. cents in the 12 months

to the end of June 2010, an 18% increase on the 74.7 U.S. cent

average the previous year, although slightly below the 89.6 cents

average in 2008.

Amcor will pay a final dividend of 17 cents a share, in line

with the previous year.

On its rigid plastics business, Amcor said an improved

performance in Latin America offset lower volumes in North America,

though it added volumes in North America have been seasonally

stronger in the fourth quarter and into the start of fiscal

2011.

MacKenzie said Amcor wasn't exploring any possible debt

issuance, adding "our balance sheet is in really good shape."

-By Geoffrey Rogow, Dow Jones Newswires; +61-2-8272-4686;

geoffrey.rogow@dowjones.com

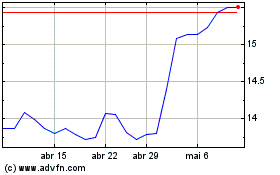

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

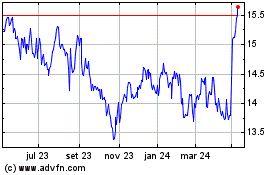

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024