MARKET COMMENT: S&P/ASX 200 Up 1.5% Amid High Yield, Defensives Surge

04 Março 2013 - 9:36PM

Dow Jones News

0006 GMT [Dow Jones] Australia's S&P/ASX 200 is up 1.5% at

5083.1 as high-yield and defensive stocks surge after Fed Vice

Chair Yellen reiterated commitment to U.S. quantitative easing

overnight. After steep declines Monday as China's share market

dived on increased curbs on property speculation, major banks are

up 2.1%-2.7%, Woolworths (WOW.AU) jumps 2.8%, CSL (CSL.AU) gains

0.3% ex-dividend and AMP (AMP.AU) surges 2.3% after trading

ex-dividend Monday. Defensive standouts include Amcor (AMC.AU), up

3.4%, while in the oil sector Woodside (WPL.AU) jumps 2.1%. BHP

(BHP.AU), Rio Tinto (RIO.AU) and Fortescue (FMG.AU) fall 0.1%-0.9%

after spot iron ore fell 1.2%. "We are still seeing strong support

on dips," says Macquarie Private Wealth investment adviser James

Rosenberg. "While there's been no significant upgrade in earnings

estimates after reporting season, the downgrades look to be behind

us, and that's giving investors a lot of confidence." He expects a

bounce in China's share market after Monday's 3.7% fall. "It was a

huge overreaction (Monday) to news that has been around for some

time." david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

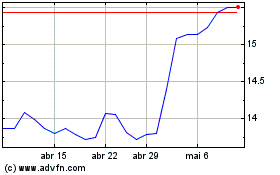

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

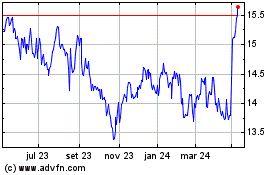

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024

Notícias em tempo-real sobre Amcor PLC da Australian Stock Exchange bolsa de valores: 0 artigos recentes

Mais Notícias de Amcor