Chainlink (LINK) Rejected At $9.20 But Picks Up Steam – Levels To Watch

08 Novembro 2022 - 9:54AM

NEWSBTC

While the broader crypto market is currently trying to recover from

the shock surrounding FTX and the accompanying fears of a contagion

effect, Chainlink has recorded the highest price increase within

the top-100 by market cap within the last 24 hours. At press time,

the LINK price was up 6.2% from the previous day, trading at $8.71.

Over the past seven days, Chainlink has even posting a whopping

plus of around 13%. Trading volume has grown to $1.435 billion in

the last 24 hours, up 161% from the previous day. Related Reading:

Will Binance Oracle Hamper Chainlink Growth Amid The Bullish Run

According to on-chain analysis service Santiment, the LINK price

has risen to just above $9.20 for the first time since August 13, a

3-month high despite very volatile markets. The data aggregator

believes the reason for the surge is the large volume of active

LINK addresses for the past 5 weeks. Chainlink (LINK) Showing

Strength Back on October 30, Santiment wrote that whales “got

pretty active this weekend” after the LINK price cracked the $8

mark a couple of times. Santiment wrote: Saturday saw 33 different

$LINK transactions exceeding a value of $1 million. This was the

highest whale activity day since June 27th. By the end of October,

the number of wallets with more than 100,000 LINK aka whales has

increased to 459. This is the highest level since 2017. A look at

the 1-day chart reveals that Chainlink (LINK) stopped just shy of

the important $9.53 level today. LINK broke through this level to

the downside on May 09. In the 1-day chart, the price bounced off

this mark for the third time over the last six months. Related

Reading: Chainlink (LINK) Breaks Out Of Range; Will Bulls Push The

Price To $12? At the current level, LINK is trading well above the

100- and 200-day simple moving average (SMA). In addition, the

LINK/USD pair is about to form a golden cross, which is often a

bullish technical sign. It is formed whenever the chart’s 50-day

moving average line crosses the 200-day moving average line from

the bottom to the top. The RSI is neutral at 63. If LINK manages to

punch through the key $9.53 level in the next few days, the next

major resistance could be in the $12.30 region. Anonymous trader

Kaleo with 500,000 followers noted, “The accumulation base for the

$LINK USD chart is so clean – though I attribute the HTF resistance

breakout to BTC moving more than anything else, I still wouldn’t

fade it. Those type of moves are typically the precursors to the

BTC pair outpacing.” The popular analyst also says that LINK/BTC

has bounced back off higher time frame support, suggesting that

LINK will outperform Bitcoin over the upcoming weeks. $LINK / $BTC

pair continuing to pick up steam pic.twitter.com/q4mw8YXqjo — K A L

E O (@CryptoKaleo) November 7, 2022

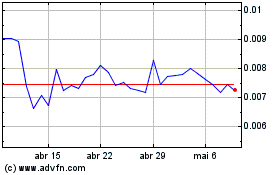

Amp (COIN:AMPUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Amp (COIN:AMPUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025