Bitcoin Price Rockets Past $38,000, Hits Highest Peak Since May 2022 – Details

25 Novembro 2023 - 5:48AM

NEWSBTC

In a dramatic twist, a mere 48 hours after the United States laid

out a hefty $4.3 billion settlement proposal with the major player

in the crypto market, Binance, Bitcoin price defied expectations by

catapulting to a new peak for the year. Breaking the $38,000

barrier in the early stages of the New York trading session on

Friday, the cryptocurrency sector, witnessed the long-anticipated

surge. Bitcoin’s recent consolidation within a pennant pattern had

hinted at the prospect of a bullish upswing, and it seems those

predictions have materialized. Related Reading: BLUR Token Rules

Today’s Top 100 Crypto Ranking With 88% Rally – Details Bitcoin

Price Hits Highest Peak Since 2022 Bitcoin’s rally also occurred

following the Thanksgiving holiday in the US, marking its highest

point since May 2022. This surge took place in the face of subdued

activity in conventional markets. Although the top coin has

experienced a slight pullback, it still holds a 1.5% gain for the

day. Traders are incredibly excited by Friday’s surge in Bitcoin’s

price, which has rekindled the fear of missing out (FOMO) feeling.

Because of this spike, Bitcoin may be able to reach the next major

resistance level, which is located at about $42,000, in the next

few weeks. Still so far, so good on #Bitcoin. Slowly grinding

upwards to a new resistance point and a break above $38K

immediately means $40K is next. pic.twitter.com/3ZUkS72I6g —

Michaël van de Poppe (@CryptoMichNL) November 24, 2023 Some market

watchers are optimistic about its short-term trajectory, with

trader Michael Van Pope suggesting in a tweet that the next

milestone for Bitcoin is set at $40,000. The US Department of

Justice and Binance reached an agreement, which is undoubtedly the

most significant development of the month. Changpeng Zhao was

forced to resign as the CEO of the company, and the exchange was

forced to pay a punishment totaling around $4.3 billion. Binance,

the biggest cryptocurrency exchange in the world, has named Richard

Teng as its new CEO. Bitcoin poised to reclaim the $38K territory

today. Chart: TradingView.com Bitcoin Circulating Supply In Profit

Region A recent uptick in market liquidations is another important

component impacting the Bitcoin price. Long and short position

liquidations have increased significantly across different time

frames, with a total of $80.29 million in liquidations in the last

24 hours, according to statistics from Coinglass. Related Reading:

Analyst’s Crystal Ball: XRP Bulls Eyeing $40 Price Target, Despite

Doubts Source: Coinglass In a related development, during last

week’s gain, the proportion of Bitcoin’s circulating supply that is

currently in profit hit 84%, or 16.36 million BTC. Additionally,

Glassnode noted that this is historically noteworthy because it is

significantly higher than the 74% all-time mean number. With

#Bitcoin trading at yearly highs above $37k last week, over 83% of

the coin supply was driven back into profitable territory. However,

the magnitude of unrealized profit remains modest, and is not yet

sufficient for long-term investors to

divest.https://t.co/IGJpglF20J — glassnode (@glassnode) November

22, 2023 Meanwhile, further fueling the positive outlook is the

heightened expectation surrounding the potential approval of spot

bitcoin exchange-traded funds (ETFs) by the US Securities and

Exchange Commission. With a looming deadline of January 10, the SEC

is tasked with evaluating numerous pending applications for these

ETFs. If given the green light, these ETFs are poised to provide

investors with a more cost-effective avenue to tap into the Bitcoin

market, adding another layer of optimism to the current bullish

sentiment. (This site’s content should not be construed as

investment advice. Investing involves risk. When you invest, your

capital is subject to risk). Featured image from Freepik

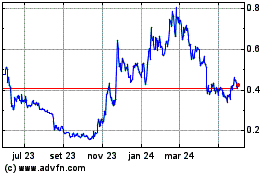

Blur (COIN:BLURUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Blur (COIN:BLURUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024