Maker Market Heats Up: Over 600 Addresses Complete MKR Trades In Single Day

05 Janeiro 2024 - 11:00AM

NEWSBTC

The starting point of 2024 has a positive outlook for the Maker

(MKR) coin, suggesting that the year may be productive. Activity

has increased, according to on-chain data, indicating a potential

positive trend. Since the start of the year, the number of active

addresses on a daily basis—a crucial indicator of user

engagement—has increased significantly. Related Reading: Falling

Down: XRP Sheds 10% As Short-Term Recovery Prospects Remain Dim

Presently, there are more than 600 addresses trading MKR, which is

a 4% rise from the original 590. This increase in involvement

suggests that there is increasing momentum and interest in the

token. Moreover, since the beginning of the year, there has been an

over 5% increase in the establishment of new addresses only for MKR

trading. This inflow of new players gives the ecosystem more

room to flourish and more liquidity. MKR Daily Active Addresses.

Source: Santiment 2024 is off to a good start for MakerDAO, the

driving force behind the DAI stablecoin in the decentralized

finance (DeFi) space. Analysts are upbeat, projecting steady

returns and even calling it a safe pick given the volatile state of

the cryptocurrency market. Still, let’s examine this more closely

before jumping on the MKR bandwagon. One of MakerDAO’s strongest

points is its mature ecosystem. A key component of DeFi lending and

borrowing is the MKR token, which controls the DAI stablecoin. MKR

market cap currently at $1.6 billion. Chart: TradingView.com This

mutually advantageous association has bestowed MakerDAO with

considerable sway and a foothold in the market. However, to

attribute its future exclusively to the Bitcoin ETF decision, as

some contend, offers an inadequate perspective. Although the crypto

markets could benefit from an authorized Bitcoin ETF, it’s

important to understand how complex and interwoven the sector is.

Regulations, the general use of DeFi, and even rivals’ actions

impact MakerDAO’s trajectory. Ignoring these things could result in

unrealistic expectations. According to Coinglass data, there has

been a notable spike in liquidations as a result of Maker’s hike

from a minimum of $1,826 to a maximum of $1,928. Source: Coinglass

The sudden surge in MKR’s value has forced the liquidation of more

than $500,000 worth of short bets, defying the sellers’ gloomy

projections. There could be both good and negative effects on

Maker’s pricing if the number of profitable addresses rises. Some

74% of addresses, or 69,400 addresses, are in profit, which is a

two-year high, according to IntoTheBlock data. Related Reading:

Celestia Adds 35% More To Its Value As TIA Guns For $20 This

increase could lift buying pressure for the cryptocurrency as

hopeful Maker holders may want to stockpile more tokens in

expectation of future price improvements. As the Maker market

witnesses a surge with over 600 addresses completing MKR trades in

a single day, the momentum appears robust and promising. This

heightened activity signifies growing interest and participation in

the MKR ecosystem. Featured image from Freepik

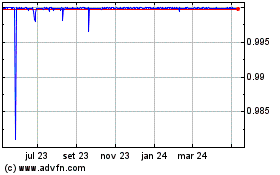

Dai Stablecoin (COIN:DAIUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

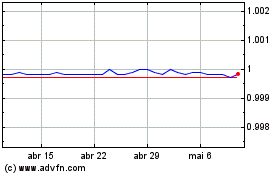

Dai Stablecoin (COIN:DAIUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024