Here’s Why The Bitcoin Price Could Hit $100,000 Before The End Of The Year

07 Outubro 2024 - 5:00AM

NEWSBTC

Crypto analyst Ash Crypto has outlined several reasons why the

Bitcoin price is poised to reach $100,000 by the end of the year.

This price level is one that other market experts like Standard

Chartered have predicted that the flagship crypto could hit even

before year-end. Why The Bitcoin Price Can Reach $100,000 By

Year-End Ash Crypto stated in an X post that the answer to whether

Bitcoin will reach $100,000 in the fourth quarter of this year lies

in the past halving cycles. He noted that BTC usually goes through

a consolidation phase of around six months after each halving. In

2016, the flagship crypto is said to have witnessed 161 days of

consolidation before a price breakout. Meanwhile, in 2020, Bitcoin

recorded 175 days of consolidation before its price broke

out. Related Reading: ‘FLOKI Master Plan’: Crypto Analyst

Predicts 2,000% Jump For The Shiba Inu Competitor In line with

this, Ash Crypto noted that the flagship crypto has consolidated

for 161 days since the Halving event in April earlier this year.

Therefore, the analyst claimed that there is a high probability

that the Bitcoin price could witness a breakout in the next two to

three weeks. He then went on to outline fundamentals that could

spark this price breakout. Firstly, Ash Crypto stated that

China is printing $280 billion to boost its economy. This is about

the People Bank of China’s announcement of a stimulus package to

help revive the country’s economy. China’s monetary easing policies

have been bullish for Bitcoin, historically leading to price surges

for the flagship crypto. Furthermore, the analyst noted

that the US Federal Reserve has started cutting interest rates. The

Fed announced a 50 basis points (bps) rate cut at its September

FOMC meeting. There are also expectations that there could be

another 50 bps rate cut before the year ends. This is also bullish

for the Bitcoin price since more liquidity could flow into the

flagship crypto with US investors having access to more

capital. Another macro factor that the analyst cited is the

fact that the Bank of Japan (BOJ) looks to have turned dovish and

is, in the meantime, no longer considering rate hikes. The Bitcoin

price crashed below $50,000 in the infamous August 5 crypto market

following the BOJ’s decision to raise interest rates for the first

time in 17 years. Therefore, the BOJ’s decision not to hike

rates further is positive for Bitcoin. Doing otherwise could revive

the ghosts of the yen carry trade as Japanese investors liquidate

their positions in risk assets like BTC. Other Factors That

Could Spark The Rise To $100,000 Ash Crypto also listed other

factors that could help the Bitcoin price reach $100,000. The

analyst noted that Donald Trump is again leading in the opinion

polls and looks likely to win the US presidential elections in

November. A Trump victory is considered a win for Bitcoin and the

broader crypto market because the former US President has declared

his support for cryptocurrencies. Related Reading: 72% Of

ETHUSDT Traders On Binance Go Long – Is This The Buy Signal You

Need? The analyst also cited the Spot Bitcoin ETFs, which have

started to accumulate again. The Bitcoin flow to exchange has also

reached a very low level, which indicates that investors are

choosing to hold for the long term, meaning less selling pressure.

FTX customers are also expected to receive their repayments this

quarter, which could cause more liquidity to flow into

Bitcoin. Lastly, Russia plans to use cryptocurrencies

like Bitcoin for cross-border payments starting in November, while

the global money supply has reached new highs. Therefore, the

Bitcoin price is currently bullish. Interestingly, Ash Crypto

claimed that the crypto market has still not factored in all these

bullish fundamentals. He stated that Bitcoin will reach a new

all-time high (ATH) when that happens. Featured image created

with Dall.E, chart from Tradingview.com

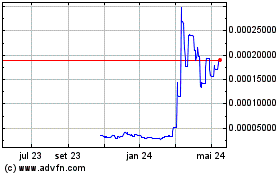

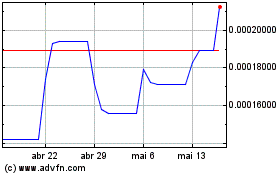

FLOKI (COIN:FLOKIUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

FLOKI (COIN:FLOKIUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024