WATCH: Daily Technical Analysis August 24, 2022: Total Crypto Market Cap (TOTAL)

24 Agosto 2022 - 12:12PM

NEWSBTC

In this episode of NewsBTC’s all-new daily technical analysis

videos, we are looking at the total crypto market cap using Elliott

Wave Theory. Specifically, this episode looks at where the current

corrective phase may be along with where the cryptocurrency market

is in its overall bull cycle. Take a look at the video below.

VIDEO: Total Crypto Market Cap Analysis (TOTAL): August 24,

2022 Looking at the total cryptocurrency weekly chart, we examine

the different types of corrections the crypto market might be in

according to common Elliott Wave corrective patterns. Elliott

Wave Theory was developed in the 1930s by Ralph Nelson Elliott and

is based on the idea that markets move in specific patterns called

waves. Prices move upward in a five-wave pattern called a motive

wave where each odd numbered wave moves with the primary trend.

Even numbered waves correct against the primary trend. These

patterns appear on various timeframes and are what power primary,

secondary, and minor trends. Related Reading: WATCH: Crypto

Technical Analysis August 23, 2022: Ethereum Versus Bitcoin

(ETHBTC) Double-Three Complex Zig-Zag Correction Could Be Completed

We first look at the recent corrective phase, starting with the

late 2021 higher high. Typically a higher high suggests an uptrend

should continue. However, certain Elliott Wave corrective patterns

can be incredibly deceptive. The corrective phase may or may not be

over yet. There are two types of Elliott Wave corrective patterns

possibly in play: a double-three complex correction with a nasty

zig-zag that chopped up the crypto market –– or a simple expanded

flat correction that isn’t finished crushing crypto into dust. The

more bullish scenario would be the double-three, which could

suggest the correction has completed. We also explain why this

could indicate that cryptocurrency as an asset class is earlier in

its market cycle than most expect. Interestingly, the pattern would

have terminated at two key levels: a former retest of all-time high

resistance turned support, and at the 0.764 Fibonacci retracement

level. Is the bottom in? | Source: CRYPTOCAP-TOTAL on

TradingView.com Related Reading: Did A Bitcoin “Zig-Zag” Shake Out

The Crypto Market? Simple Expanded Flat Correction Has Another Wave

To Go Fibonacci retracement and extension levels play a key role in

projecting Elliott Wave Theory targets and can help identify what

wave the market is in. The more bearish alternative count

would be an expanded flat, as noted. The expanded flat has a

corrective ABC count, with the C-wave acting as a separate

five-wave impulse correction against the primary trend. Currently,

the total crypto market has only completed waves 1, 2, 3, and could

have just completed the 4th wave and is about to start a 5th wave

down to the final bottom. Both of these corrective patterns imply

that the overall bullish cycle in crypto isn’t finished and either

a wave five, or a wave three and five are left. Or do we have a lot

more to go? | Source: CRYPTOCAP-TOTAL on TradingView.com Related

Reading: Bitcoin Falls Flat: Examining A Rare Bull Market

Corrective Pattern Is Another Crypto Bull Run About To Begin? After

switching to the daily chart, we walk you through what might be the

start of a bullish impulse. If the market can establish support at

the current level and move up, we could have a leading diagonal in

play. Like Elliott Wave corrective patterns, even bullish patterns

can be deceiving. Before you rule out what initially looks like an

ascending wedge breaking down as a clear sign there is more

downside ahead, we compare the current price action to the last

bullish impulse to see how it started. Is a new bull phase

beginning? | Source: CRYPTOCAP-TOTAL on TradingView.com Learn

crypto technical analysis yourself with the NewsBTC Trading Course.

Click here to access the free educational program. All this week at

Elliott Wave International is Trader Education Week. Here is free

access to five exclusive videos from one of the world’s best

Elliott Wave analysts. You can also get the Elliott Wave book for

free with a no cost signup. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

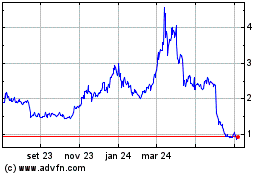

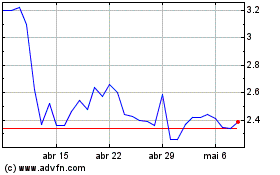

Waves (COIN:WAVESUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Waves (COIN:WAVESUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024