CARBIOS announces fiscal-year 2023 financial results and confirms

2024 calendar for industrial and commercial roll-out

- CARBIOS Group’s solid

financial structure: cash position of €192 million on December 31,

2023

- Construction progress of

world’s first PET1 biorecycling

plant in France: in line with delivery targets for customers in

2026

-

Licensing: international sales teams deployed in more than

ten countries, with several partnerships feasible for

2024

Clermont-Ferrand, France, April 11, 2024

(6:45 a.m. CEST) - CARBIOS

(Euronext Growth Paris: ALCRB), a biotech company

developing and industrializing biological solutions to reinvent the

life cycle of plastic and textiles, today reported its operating

and financial results for the financial year 2023. The financial

statements as of December 31, 2023, were approved by the Company’s

Board of Directors at their meeting on April 10, 2024.

Emmanuel Ladent, CEO of

CARBIOS: “2023 was marked by major scientific and

operational achievements, most prominently, the start of the

construction, in France, of the world’s first industrial PET

biorecycling plant which is due to go into production in 2026 and

will serve the many customers who expect our products. We also

signed a mutually exclusive alliance with Novonesis ensuring enzyme

supply for our Longlaville plant and all future plants operated

under license. In addition, we reached an important milestone for

the recycling of polyester textiles with the development and

implementation of a fully automated and integrated textile

preparation line. I would like to thank the commitment of our

employees, as well as all our partners’ contributions in making

CARBIOS a future world leader in the r-PET market.”

Pascal Bricout, Chief of Strategy and

Financial Officer of CARBIOS: “In fiscal year 2023, we

consolidated our financial structure to support the industrial and

commercial deployment of our technologies and accelerate our

R&D on other polymer families, notably polyamides and

polyolefins. We successfully completed a capital increase with

preferential subscription rights for a gross amount of €141

million, the largest fundraising on Euronext Growth since 2015. In

addition, we were granted funding totaling €54 million from French

State via France 2030 and Grand-Est Region, of the majority of

which will be allocated to the construction of our plant in

Longlaville. The official groundbreaking ceremony will take place

on 25 April. We now have the resources required to press ahead with

the construction of our first plant and ensure the commercial and

international deployment of our activities.”

A webcast and

conference call will take place today at 11:00 am

(CEST)

Emmanuel LADENT – CEO /

Pascal BRICOUT – Chief of Strategy and Finance

Access to the

webcast: https://edge.media-server.com/mmc/p/cyrcdmu8

France Dial-in: +33

170918704 UK

Dial-in: +44 1

212818004 US

Dial-in: +1 718 7058796

2023 Financial highlights

The consolidated financial statements of the

Company as of December 31, 2023, are presented in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB) and adopted by the

European Union.

For 2022 and 2023,

these IFRS consolidated financial statements include the financial

statements of CARBIOS, the parent company, and the financial

statements of its fully integrated subsidiaries Carbiolice and

CARBIOS 542. The group formed by CARBIOS, Carbiolice and CARBIOS 54

is hereinafter referred to as the “Group”.

These IFRS financial

statements for the Group have been prepared to provide high quality

information in line with that of similar companies and based on

international standards.

Consolidated Statement of income

|

Consolidated statement of income (in

thousand euros) |

|

December31, 2023 |

December 31, 2022 |

|

|

|

12 months |

12 months |

|

Income |

|

24 |

70 |

| Net Research

and Development expenses |

|

(10,958) |

(12,993) |

|

Research and Development expenses |

|

(18,830) |

(19,057) |

|

Subsidies and other income from activities |

|

5,385 |

4,776 |

|

Capitalisation of development costs |

|

2,487 |

1,287 |

| Sales and

marketing expenses |

|

(5,809) |

(4,373) |

|

General and administrative expenses |

|

(12,134) |

(8,807) |

|

Operating expenses |

|

(28,902) |

(26,173) |

|

Other operating income and expenses |

|

- |

2 |

|

Operating income |

|

(28,878) |

(26,101) |

|

Financial income |

|

1,655 |

(1,640) |

|

Income before tax |

|

(27,224) |

(27,741) |

| Income tax |

|

- |

- |

|

Share and profit (loss) of equity affiliates |

|

- |

- |

|

Net income (loss) for the period |

|

(27,224) |

(27,741) |

- Income according to IFRS 15

standards

For the financial years 2022 and 2023, income

accounted under IFRS 15 is related to feasibility studies, tests,

and research services with performance obligation, as well as

deliveries of raw materials and samples of CARBIOS Active by

Carbiolice.

As of December 31, 2023, the Group’s income

stood at €24 thousand, compared to €70 thousand for the year ended

December 31, 2022.

- Current operating

expenses

With regards to the presentation of its IFRS

consolidated statements, the Group shows a statement of income by

destination. Thus, current operating expenses are categorized and

presented as: Net Research and Development expenses, Sales and

Marketing expenses, as well as General and Administrative

expenses.

Operating expenses stood at €28,902 thousand for

2023, compared to €26,173 thousand in 2022.

To support the growth of its activities, the

average number of employees within the Group increased from 104 in

2022 to 134 in 2023.

Net Research and Development expenses: The Group

pursued its research and development efforts on all its proprietary

pipeline of innovations and notably on its biorecycling technology

for PET plastic and polyester fibers. For 2023, the Group’s Net

R&D expenses stood at €10,958 thousand, compared to €12,993

thousand for 2022.

For FY 2023:

- On R&D, the Group spent €18,958

thousand. The slight decrease in R&D expenses is mainly due to

the launch of the OPTI-ZYME project financed by ADEME, under which

the Group’s academic partners are funded directly through the

project. In addition, as the plant construction project has

progressed, engineering costs are no longer accounted as expenses

but capitalized directly to fixed asset accounts. Also, to

successfully complete its R&D and industrial projects, the

Company is continuing to strengthen its teams, which explains the

increase in personnel costs.

- On Subsidies and other income from

operations, the Group recorded €5,385 thousand, partially

offsetting its R&D expenses. This item includes notably

research tax credits to be received of respectively €2,543 thousand

for CARBIOS and €672 thousand for Carbiolice in 2023 (as opposed to

respectively €2,538 thousand and €655 thousand in 2022), as well as

grants received during the year linked to the launch of the

OPTI-ZYME project financed by ADEME.

- Finally, the Group has capitalized

€2,487 thousand development expenses related to the Company’s PET

enzymatic recycling project in 2023.

Sales and Marketing expenses: Sales and

marketing expenses stood at €5,809 thousand in 2023, compared to

€4,373 thousand in 2022. This increase mainly comes from

strengthened efforts to address market demand and sell licences in

a near future. The Group is also continuing its structuring work

with a reinforcement of its teams to achieve its development goals

in France and internationally.

General and Administrative expenses: General and

administrative expenses stood at €12,134 thousand in 2023, as

opposed to €8,807 thousand in 2022. This increase is mainly due to

the strengthening of the teams dedicated to the Longlaville plant

construction and increased use of external consulting services to

continue structuring the Group in a variety of areas (recruitment,

QHSE, CSR, IT, etc.)

Balance Sheet items

|

Consolidated statement of financial

position(in thousand euros) |

|

December31, 2023 |

|

December31, 2022 |

|

| |

12 months |

|

12 months |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

20,583 |

|

20,583 |

|

| Intangible

assets |

|

21,874 |

|

22,457 |

|

| Tangible

assets |

|

49,199 |

|

24,965 |

|

| Right-of-use

assets |

|

6,175 |

|

6,765 |

|

| Financial

assets |

|

1,219 |

|

906 |

|

|

Non-current assets |

|

99,049 |

|

75,674 |

|

|

|

|

|

|

|

|

| Trade

receivables |

|

6 |

|

57 |

|

| Inventory |

|

511 |

|

- |

|

| Other current

assets |

|

10,621 |

|

7,670 |

|

| Cash and cash

equivalents |

|

191,821 |

|

100,557 |

|

|

Current assets |

|

202,009 |

|

108,284 |

|

|

|

|

|

|

|

|

|

Total assets |

|

302,009 |

|

183,959 |

|

|

Consolidated statement of financial position

(in thousand euros) |

|

December31, 2023 |

|

December31, 2022 |

|

| |

|

|

|

|

| EQUITY

AND LIABILITIES |

|

|

|

|

|

| |

|

|

|

|

|

| Share

capital |

|

11,786 |

|

7,870 |

|

| Share and

contribution premium |

|

276,569 |

|

146,968 |

|

| Consolidated

reserves |

|

(2,900) |

|

(5,482) |

|

| Retained

earnings |

|

(23,917) |

|

3,826 |

|

| Net

income – share attributable to equity holders of the parent

company |

|

(27,224) |

|

(27,741) |

|

| |

|

|

|

|

Shareholders’ equity |

|

234,314 |

|

125,441 |

|

|

|

|

|

|

|

|

| Provisions –

Non-current portion |

|

216 |

|

184 |

|

| Loans and

financial liabilities – Non-current portion |

|

39,226 |

|

35,395 |

|

| Lease

liabilities – Non-current portion |

|

4,639 |

|

5,142 |

|

| Other

liabilities – Non-current portion |

|

449 |

|

546 |

|

| Deferred tax

liabilities |

|

1,694 |

|

1,694 |

|

|

Non-current liabilities |

|

46,224 |

|

42,961 |

|

|

|

|

|

|

|

|

| Provisions -

Current portion |

|

- |

|

- |

|

| Loans and

financial liabilities – Current portion |

|

3,524 |

|

2,782 |

|

| Lease

liabilities – Current portion |

|

1,232 |

|

1,346 |

|

| Trade

payables |

|

4,829 |

|

4,021 |

|

| Other current

liabilities |

|

11,888 |

|

7,408 |

|

|

Current liabilities |

|

21,472 |

|

15,557 |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

302,009 |

|

183,959 |

|

As of December 31, 2023, cash and cash

equivalents amounted to €192 million, compared to €101 million for

the year ended December 31, 2022.

The other key balance sheet items as of December

31, 2023 are:

- €20,6 million corresponding to the

Goodwill calculated between the market value of Carbiolice and the

net assets acquired; the impairment tests carried out in 2023 do

not call this amount into question.

- Intangible assets for a net book

value of €21.9 million for the year ended December 31, 2023.

Pursuing on its active policy of securing its

Intellectual Property, CARBIOS continued to enrich its IP portfolio

with the filing of 5 new patent families. The Group’s intellectual

property portfolio at the end of 2023 included 58 patent

families.As a result of the full integration of Carbiolice in 2021,

€22.3 million were also recognized for the purchase price of

Carbiolice, with a net amortization position of €18 million as of

December 31, 2023, including:

- €10.1 million net (€12.5 million

gross) for the technology license (or “reacquired rights”). Under

IFRS 3, the technology license between CARBIOS and Carbiolice is

assimilated to a pre-existing relationship giving rise to the

recognition of a “reacquired rights” asset that has been valued

using the expected cash flow method; and

- €7.9 million net (€9.8 million

gross) market value of the acquired technology (Masterbatch) valued

using the royalty and restoration cost method.

- Tangible assets for a net book

value of €49.2 million, as compared to €25 million for the year

ended December 31, 2022.

This strong increase

is mainly due to:

- €21 million investment related to

the construction project of the first PET biorecycling plant

through CARBIOS 54;

- continued investment in the

industrial demonstration facility. These tangible assets also

include leasebacks relating to the industrial demonstration

facility. As of December 31, 2023, the operation covers €4.3

million of equipment depreciated over 10 years, in addition to the

€1.5 million for the previous year; and

- €2.1 million invested in renovating

the building housing the production line of Carbiolice and the

textile preparation line, at the Cataroux site in

Clermont-Ferrand.

- Rights-of-use asset for a net book

value of €6.2 million corresponding to the market value of the

tangible and intangible assets benefiting to the Group through its

various lease contracts. In return, “lease debts” are recorded on

the liabilities side of the balance sheet as financing for these

assets; and

- Shareholder’s equity of €234.3

million, including the net proceeds of the €141 million capital

increase successfully completed in July 2023 with French and

International investors, as compared to €125.4 million for the year

ended December 31, 2022.

Cash flow statement

|

Consolidated cash flow statement (in thousand

euros) |

|

December31, 2023 |

|

December31, 2022 |

|

|

|

|

|

|

|

Cash at beginning of year |

|

100,556 |

|

104,956 |

|

Cash flow from operating activities |

|

(22,589) |

|

(21,820) |

|

Cash flow from investing activities |

|

(22,391) |

|

(9,327) |

|

Cash flow from financing activities |

|

136,246 |

|

26,747 |

|

Change in cash position |

|

91,265 |

|

(4,398) |

|

Cash at end of year |

|

191,821 |

|

100,557 |

Benefiting from the net proceeds of the €141

million raised in 2023, the Group closed out with a net cash

position of €192 million at year-end 2023, enabling it to pursue

current developments beyond the next 12 months.

FY 2023 and post-closing highlights

Construction of the world’s first industrial PET

biorecycling plant in France

In fiscal year 2023,

we have established the necessary partnerships to successfully

build the world's first PET biorecycling plant in France. This

industrial plant, which is currently under construction in

Longlaville (permit granted in October 2023 and groundbreaking

ceremony to be held on April 25, 2024) is located at the borders of

Luxembourg, Germany and Belgium, some of the most advanced

waste-sorting countries. It is designed to process 50,000 tons of

PET waste annually, equivalent to 2 billion bottles or 2.5 billion

food trays. This plant will also serve to bolster the Company's

business model of licensing its technology to manufacturers who

will build their own plants, as well as reinforce the Company's

know-how in its industrial and commercial deployment strategy

through international licensing.

In June 2023, we

signed a non-binding Memorandum of Understanding

(“MOU”) with Indorama Ventures,

with a view to acquiring a minority stake in this first PET

biorecycling plant.

In October 2023, we

were granted the building permit and

operating authorization for the PET biorecycling plant,

allowing construction to start. In addition, in February 2024,

we completed the acquisition from Indorama

Ventures of a 13.7-hectare site adjacent to their

existing PET production plant in Longlaville. The land

area acquired by CARBIOS gives the possibility to double the

facility's capacity.

By simultaneously acquiring construction and

operating permits, construction work as well as recruitment and

training of plant staff can continue as planned. The

state-of-the-art facility will pave the way for PET circular

economy by providing an industrial-scale enzymatic recycling

solution for PET waste. Our PET recycling technology offers an

alternative raw material to virgin fossil-based monomers, allowing

PET producers, chemical companies, waste management firms, public

entities, and brands to meet regulatory requirements and fulfill

given sustainability commitments.

In February 2024, CARBIOS and

De Smet Engineers & Contractors (DSEC)

announced their collaboration to spearhead the

construction of the plant. Under the agreement, De Smet has been

entrusted with the project management and detailed engineering,

including procurement assistance and CARBIOS partners’ management,

to ensure the execution of the plant's construction in Longlaville,

France.

Financing of plant

In May 2023, CARBIOS

announced that its project has been selected by the French

government for funding for an amount of €30 million from

the French State via France 2030 and €12.5 million from the

Grand-Est Region3.

Alongside this

support, CARBIOS has been granted total funding of €11.4

million from the French State as part of France 2030, of which €8.2

million directly for CARBIOS (€5 million in repayable

advances) and €3.2 million for its academic partners INRAE,

INSA and CNRS via the TWB and TBI joint service and

research units. This funding will enable the Group to continue its

research into the optimization and continuous improvement of

CARBIOS’ enzymatic technologies.

In July 2023, CARBIOS

announced the success of its capital increase in cash with

preferential subscription rights (“PSR”) maintained for a gross

amount of approximately €141 million4. Approximately 85%

of the net proceeds of this capital increase are to be used to

finance the construction of the industrial PET biorecycling plant,

for which the investment was estimated in June 2023 at around €230

million (FEL 3).

Textile preparation line

In October 2023, CARBIOS inaugurated its

textile preparation line at our demonstration plant in

Clermont-Ferrand. Polyester textiles account for 2/3 of

the global PET market of around 100 million tons. Only 13% of

textile waste is currently recycled, and only 1% is recycled

"fiber-to-fiber"5,6. To streamline the textile preparation phase,

CARBIOS has developed a fully integrated and automated line that

transforms textile waste from used garments or cutting scraps into

raw material suitable for depolymerization with its enzymatic

biorecycling process. This patented line integrates all preparation

stages (shredding and extraction of hard points such as buttons or

fasteners), and provides CARBIOS with a high-performance, scalable

development tool.

Other operational highlights

-

Strategic alliance with Novonesis

In January 2023, CARBIOS strengthened its

strategic partnership with Novonesis by signing an

exclusive and long-term agreement which ensures the production and

supply of CARBIOS’ proprietary PET degrading enzymes at industrial

scale for our first plant, as well as for our future licensees.

-

Licensing documentation ready

In April 2023, we finalized the

engineering documentation7 enabling us to provide our

licensees with the necessary information for future industrial

plants. This new industrial milestone on schedule in the deployment

of our PET biorecycling technology is the result of our successful

operations conducted in our demonstration plant and is the starting

point to enter first licensing agreements in 2024. It will enable

CARBIOS’ future licensees to reliably engineer, construct and

operate their own PET biorecycling facilities.

- Supply

agreements secured with Citeo and Landbell Group

In April 2023, we secured a first supply

agreement with Citeo for our PET biorecycling plant. This

long-term agreement covers the supply of PET waste from multilayer

and monolayer trays. This PET waste will be recycled in our

industrial plant, which is due to go into production in 2026.

In February 2024, CARBIOS and

Landbell Group, a leading provider for compliance

solutions and global operator of more than 40 takeback schemes,

announce the signing of a non-binding Memorandum of Understanding

(MOU) to supply 15kt/year of post-consumer PET waste to CARBIOS'

first commercial plant in Longlaville starting 2026.

Through the partnership with Landbell Group in

Germany, the supply agreement with Citeo in France and the MOU with

Indorama Ventures, CARBIOS will have covered over 70% of

its feedstock required for the 50kt/year capacity when its

first commercial plant in Longlaville, France, will operate at full

capacity.

Textile consortium

In February 2023,

PVH Corp., a leading fashion company joined our

fiber-to-fiber consortium founded by CARBIOS with

On, Patagonia, PUMA, and Salomon. Committed to

accelerating the transition of the textile industry toward a

circular economy, consortium members collaborate to test and

enhance CARBIOS’ breakthrough biological recycling technology on

their own products. The common goal of the consortium members is to

create real circularity in this industry by innovating to recycle

fibers from one product into another and so reduce the problem of

textile waste in a collaborative approach that helps create a more

sustainable future.

Ellen

MacArthur Foundation and Paris Good Fashion

In March 2023,

CARBIOS became a member of the Ellen MacArthur Foundation’s

Network. CARBIOS shares the Foundation’s commitment to

accelerate the transition to a circular economy, especially in the

areas of plastic and fashion. By joining the Ellen MacArthur

Foundation’s Network, CARBIOS will connect with other leaders

within the Foundation’s leading circular economy network of

businesses, policymakers, academia, innovators, and thought leaders

worldwide.

In March 2024,

CARBIOS became a member of Paris Good Fashion, the

association that unites over 100 French players in the sector -

brands, designers and experts - around their commitment to

sustainable fashion. CARBIOS is the first recycling technology

supplier to join, demonstrating the importance given to recycling

to achieve textile circularity. CARBIOS will be particularly

involved in the association's project to set up a working group

dedicated to the development of a "fiber-to-fiber" industry, one of

Paris Good Fashion's top priorities over the next five years. While

only 1% of textiles are currently recycled fiber-to-fiber

(circular), this working group will identify levers for

significantly increasing the share of recycled fibers in the

industry.

Technology and

IP update

In February 2023,

CARBIOS successfully validated the final key stage of the

CE-PET research project supported by the French State as

part of the Investments for the Future Program, now integrated into

France 2030, and operated by ADEME, and for which CARBIOS was

coordinator alongside its academic partner INRAE -TWB (Toulouse

Biotechnology Institute). The CE-PET project, which lasted four

years, confirmed CARBIOS ability to enzymatically recycle complex

waste to produce bottles and fibers.

In March 2023,

biotechnology researchers from CARBIOS and its academic partner

Toulouse Biotechnology Institute (TBI), as well as two eminent

professors in polymer science from the University of Bordeaux

published in Chemical Reviews an article entitled “Enzymes’

power for plastics degradation”. The article is a

comprehensive and critical review of research published to date on

the enzymatic degradation of all types of plastics (PET, PLA,

polyolefins, polyurethanes, polyamides) and includes almost 700

references.

In April 2023, we

announced the development of an ultra-high throughput

microfluidic screening of PET-depolymerizing enzymes in

partnership with the Paul Pascal Research Centre (a joint research

unit of the CNRS and the University of Bordeaux,

which specializes in microfluidics). This cutting-edge technology

enables the screening of millions of enzymes in just one day,

speeding up the process to optimize enzymes breaking down

PET. This competitive advantage enables CARBIOS to reduce the

time between the R&D phase and the production of its

proprietary enzymes, and therefore to develop concrete solutions to

plastic pollution even faster.

Also, in October 2023, CARBIOS announced the

publication in ACS Catalysis of an article

entitled "Assessment of Four Engineered PET Degrading Enzymes

Considering Large-Scale Industrial Applications". The

article demonstrates that under industrial conditions CARBIOS'

enzyme LCCICCG (published in Nature in 2020) outperforms all three

competitors considered most promising in scientific literature: two

variants of the IsPETase enzyme produced by Ideonella sakaiensis

described by the University of Manchester and the University of

Austin (Texas) and a variant of PES-H1 (also known as PHL7)

described by the University of Greifswald.

As of today, CARBIOS’ intellectual

property portfolio covered 398 titles worldwide divided

into 58 patent families for its innovation in enzymatic recycling

of PET plastics and fibers, and its PLA biodegradation

technology.

CSR policy

In June 2023, we integrated our Purpose

into the bylaws of the Company, as permitted by the PACTE

Act of 2019, following the vote at the Annual General Meeting held

on 22 June 2023, namely "to generate a positive and

significant social, societal and environmental impact in the

conduct of its activities". This Purpose underpins

CARBIOS' business, which provides solutions to the environmental

emergency of tackling plastic pollution.

In December 2023, we published our

second Sustainability Report. Like the

first, this report is not subject to any publication obligation for

the company but confirms CARBIOS' commitment and desire for

transparency in terms of environmental, social and governance (ESG)

initiatives. Going beyond the industrial development of its

innovative technologies, the company shares its progress and

ambitions for the future.

In April 2024, CARBIOS announced the

success of its first employee share scheme for all

employees of the Group who are members of the savings plan in

France. Launched on 12 February 2024, 123 employees subscribed,

representing 88.49% of the eligible workforce, thereby enabling

employees to participate in the Group’s growth and performance. As

a result, CARBIOS’ employee share ownership, within the meaning of

the Article L. 225-102 of the French Commercial Code, now stands at

around 0,08% of the share capital.

Strengthening governance

Change in the Board of

Directors

In February 2023,

CARBIOS announced the cooptation, within its Board of Directors, of

Karine Auclair, professor of Chemistry at McGill

University, Mateus Schreiner Garcez Lopes, Global

Director for Energy Transition and Investments at Raizen,

Amandine De Souza, General Manager of leboncoin

and Sandrine Conseiller, CEO of De Beers Brands

and former CEO of Aigle, as independent members of CARBIOS’ Board

of Directors.

To date, the Company

has seven independent Directors, i.e. 63.64% of the total number of

Directors.

Change in the Executive Committee

In October 2023, we strengthened our leadership

team with the appointment of Bénédicte Garbil as Senior

Vice President of Corporate Affairs, Sustainability and

Communication. As a member of the CARBIOS Executive

Committee, Bénédicte Garbil oversees three strategic areas: Public

Affairs, Corporate Affairs, and Sustainability. In her Corporate

Affairs role, she supervises Communication, Regulatory, Project

Management, and Innovation Funding functions. In her Sustainability

role, she oversees CSR8, QHSE9, and LCA10 functions.

Awards

In May 2023, CARBIOS

was selected to represent French innovation at the

6th “Choose France”

Summit at the Château de Versailles. “Choose France”

is an international business summit dedicated to the attractiveness

of France launched at the initiative of the French President,

Emmanuel Macron. On this occasion, CARBIOS announced that it had

joined the Coq Vert community launched by

Bpifrance in partnership with ADEME and the Ministry of Ecological

Transition, to connect with other environmentally committed

business leaders and advance its international deployment.

In November 2023,

together with our partner L'Oréal, the world’s leading beauty

player, we won the "Pioneer Awards" in the

Industry category, presented by the Solar

Impulse Foundation at the first World Alliance

Summit. This prestigious prize was awarded to CARBIOS for

its enzymatic PET recycling solution, labeled "Efficient Solution"

by the Solar Impulse Foundation since 2019, and to L'Oréal for

using this breakthrough technology for the first time in a

cosmetics bottle prototype. CARBIOS' solution offers brands an

alternative to petro-sourced plastic that helps them meet their

sustainability commitments.

In March 2024, CARBIOS

has been awarded the Small & Mid Cap 2023 Secondary

Transaction award by Euronext. This award recognizes the

success of CARBIOS’ €141 million rights issue, which was the

largest transaction carried out on Euronext Growth since 2015.

Outlook – confirmation of industrial and

commercial objectives

Given the significant

progress made by the Group during 2023 and the success of the

financing operation closed in July 2023 as well as the received

grants, CARBIOS confirms its operating targets and the provisional

calendar of the industrial and commercial deployment of its PET

biorecycling technology11.

2024 • Construction

of the Longlaville plant further to permits obtained in October

20232024 •

Recruitment of plant operations team and training at demonstration

facility2026 • First

significant deliveries to clients

Alongside this

project, CARBIOS aims to sign its first licensing contracts for its

PET biorecycling technology in 2024.

###

About CARBIOS:

CARBIOS is a biotech company developing and

industrializing biological solutions to reinvent the life cycle of

plastic and textiles. Inspired by nature, CARBIOS develops

enzyme-based processes to break down plastic with a mission to

avoid plastic and textile pollution, and accelerate the transition

to a circular economy. Its two disruptive technologies for the

biorecycling of PET and the biodegradation of PLA are reaching

industrial and commercial scale. Its biorecycling

demonstration plant has been operational since 2021 and a first

industrial plant is currently under construction in partnership

with Indorama Ventures. CARBIOS has received scientific

recognition, notably with the cover of Nature, and is supported by

prestigious brands in the cosmetics, Food & Beverage and

apparel industries to enhance their products’ recyclability and

circularity. Nestlé Waters, PepsiCo and Suntory Beverage & Food

Europe are members of a packaging consortium founded by CARBIOS and

L’Oréal. On, Patagonia, PUMA, PVH Corp. and Salomon collaborate

with CARBIOS in a textile consortium.Visit www.CARBIOS.com/en to

find out more about biotechnology powering plastic and textile

circularity.Twitter: CARBIOS / LinkedIn: CARBIOS / Instagram:

insideCARBIOS

Information on CARBIOS shares:

ISIN Code

FR0011648716Ticker

Code

Euronext

Growth: ALCRBLEI:

969500M2RCIWO4NO5F08

CARBIOS, founded in 2011 by Truffle Capital, is eligible for the

PEA-PME, a government program allowing French residents investing

in SMEs to benefit from income tax rebates.

Disclaimer on forward-looking statements

and risk factors:This press release contains

forward-looking statements, not historical data, and should not be

construed as a guarantee that the facts and data stated will occur.

These forward-looking statements are based on data, assumptions and

estimates considered reasonable by CARBIOS. CARBIOS operates in a

competitive and rapidly evolving environment. It is therefore not

in a position to anticipate all risks, uncertainties or other

factors that may affect its business, their potential impact on its

business or the extent to which the materialization of a risk or

combination of risks could lead to results that differ

significantly from those mentioned in any forward-looking

statement. CARBIOS draws your attention to the fact that

forward-looking statements are in no way a guarantee of its future

performance and that its actual financial position, results and

cash flows and the development of the sector in which CARBIOS

operates may differ significantly from those proposed or suggested

by the forward-looking statements contained in this document. In

addition, even if CARBIOS’ financial position, results, cash flows

and developments in the industry in which it operates are

consistent with the forward-looking information contained in this

document, such results or developments may not be a reliable

indication of CARBIOS’ future results or developments. Readers are

advised to carefully consider the risk factors described in the

Universal registration document filed with the French Market

Authority (“AMF”), as well as in the half-year financial report

available free of charge on the Company’s website. Should all or

any part of these risk factors materialize or others, in no case

whatsoever will CARBIOS be liable to anyone for any decision made

or action taken in conjunction with the information and/or

statements in this press release or for any related damages. This

information is given only as of the date of this press release.

CARBIOS makes no commitment to publish updates to this information

or on the assumptions on which it is based, except in accordance

with any legal or regulatory obligation applicable to it.

For additional information, please

contact:

|

CARBIOS |

Press Relations (France) |

Press Relations (U.S) |

Press Relations (DACH & UK) |

|

Melissa Flauraud |

Iconic |

Rooney Partners |

MC Services |

|

Press Relations |

Marie-Virginie Klein |

Kate L. Barrette |

Anne-Hennecke |

|

Melissa.flauraud@corbios.com |

mvk@iconic-conseil.com |

kbarrette@rooneyco.com |

carbios@mc-services.eu |

|

+33 (0)6 30 26 50 04 |

+33 (0)1 44 14 99 96 |

+1 212 223 0561 |

+49 (0)211 529 252 22 |

|

Benjamin Audebert |

|

|

|

|

Investor Relations |

|

|

|

|

contact@carbios.com |

|

|

|

|

+33 (0)4 73 86 51 76 |

|

|

|

This press release does not constitute and cannot

be regarded as constituting an offer to the public, an offer to

sell or a subscription offer or as a solicitation to solicit a buy

or sell order in any country.

Translation for information purposes only. In

case of discrepancy between the French and the English version of

this press release, the French version shall prevail.

1 PET = polyethylene terephthalate2 Wholly-owned subsidiary of

Carbios for its industrial operations in Longlaville3 The

implementation of this funding is conditional to the European

Commission's approval of the corresponding state aid scheme,

followed by the conclusion of national aid agreements.4 Further

information on the capital increase, successfully completed in July

2023, can be found in the prospectus approved by the Autorité des

marchés financiers (AMF) on June 21, 2023, under number 23-236,

which is available free of charge from the CARBIOS

(https://investir.CARBIOS.com) and the AMF (www.amf-france.org/fr)

websites.

5 Ellen MacArthur Foundation, 20176

Fiber-to-fiber recycling transforms textile waste into new fibers

for clothing and textiles, with no loss in quality7 Technological

Information Summary8 CSR = Corporate Social Responsibility9 QHSE =

Quality, Health, Security, Environment10 LCA = Life Cycle

Analysis11 Estimated dates subject to the terms remaining to be

defined for the collaboration between CARBIOS and Indorama

Ventures

- 2024 04 11_PR_FY Results 2023 Final

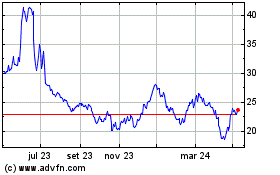

Carbios (EU:ALCRB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

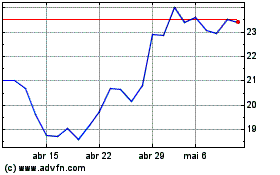

Carbios (EU:ALCRB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024