Second quarter and half year results 2022

Arcadis reports solid

set of results and sees continued strong client

demand

SECOND QUARTER RESULTS

- Accelerated organic net revenue growth of 8.1%1), total net

revenues of €729M

- Improved operating EBITA margin of 9.3% (Q2 ‘21: 9.1%)

- Free Cash flow of €41M (Q2 ‘21: €68M)

- Strong client demand results in organic backlog growth of

5.9%1)

- Net Working Capital improved to 13.3%, Days Sales Outstanding

down to 69 days

- Intended acquisition of IBI Group to strengthen our Digital

Leadership, enhance geographic presence in North America, and add

strategic complementary capabilities to Places and Mobility

Amsterdam, 28 July 2022

– Arcadis (EURONEXT: ARCAD)

reports organic net revenue growth of

8.1%, with an improved operating EBITA margin of

9.3%, and sees

continued strong client demand resulting in organic backlog growth

of 5.9% for the second

quarter.

CEO STATEMENTPeter Oosterveer, CEO Arcadis,

comments: “I am pleased to report a solid set of results

in the first half of 2022, fueled by growing client demand across

our three Global Business Areas. This demand led to an organic net

revenue growth of 8.1% in the quarter, continued strong order

intake, resulting in an organic backlog growth of 5.9%, and a

healthy pipeline of opportunities.

Our new operating model, launched in January 2022 and focused on

the Global Business Areas (GBAs): Resilience, Places and Mobility,

is yielding the expected results. We are seeing increased

global collaboration, and scaling and cross selling of services

across the business areas, which is helping to serve our clients

more efficiently and effectively. We delivered continued

strong performance particularly with clients in transportation,

energy & resources, and industrial manufacturing, driving

margin improvement to 9.3% for the quarter, while making further

investments in Digital solutions for clients, and in the

attraction, retention and development of key industry talent.

As we look to the remainder of the year, we are encouraged by

increasing order intake from clients to support their Net Zero

ambitions, the increased focus on global electric vehicle roll-out

and the need for sustainable industrial manufacturing solutions,

particularly in North America. In the current geopolitical reality,

both public and private clients are looking to reduce their energy

dependencies, leading to a growing appetite for energy transition

solutions and sustainability advisory. The recently announced

intended acquisition of the Canadian IBI Group will bring increased

presence in the highly attractive North American market, enhances

our Digital capabilities and positions us well for further

acceleration of our profitable growth, all fully supporting our

strategic agenda.

We will continue to closely watch the geo-political situation as

well as the economic developments and outlook. I am confident that

with the accelerated demand we are experiencing combined with the

pipeline of private and public sector opportunities and our

financial discipline, we are on track to deliver on our strategic

targets.”

KEY FIGURES

| in €

millions |

Half year |

|

Second quarter |

|

Period ended 30 June 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

| Gross

revenues |

1,847 |

1,660 |

11% |

|

968 |

848 |

14% |

|

Net revenues |

1,418 |

1,276 |

11% |

|

729 |

644 |

13% |

|

Organic growth (%)1) |

6.9% |

|

|

|

8.1% |

|

|

|

EBITDA |

178 |

167 |

7% |

|

91 |

83 |

10% |

|

EBITDA margin (%) |

12.6% |

13.1% |

|

|

12.5% |

12.9% |

|

|

EBITA |

130 |

113 |

15% |

|

65 |

57 |

13% |

|

EBITA margin (%) |

9.2% |

8.9% |

|

|

8.9% |

8.9% |

|

|

Operating EBITA2) |

133 |

116 |

14% |

|

68 |

58 |

16% |

|

Operating EBITA margin (%) |

9.3% |

9.1% |

|

|

9.3% |

9.1% |

|

|

Net Income |

86 |

77 |

12% |

|

44 |

31 |

40% |

|

Net Income from Ops. (NIfO)3) |

93 |

80 |

16% |

|

47 |

32 |

49% |

|

Avg. number of shares (millions) |

89.2 |

89.6 |

0% |

|

89.2 |

89.6 |

0% |

|

Net Working Capital (%) |

13.3% |

14.3% |

|

|

|

|

|

|

Days Sales Outstanding (days) |

69 |

74 |

|

|

|

|

|

|

Free Cash Flow |

-10 |

29 |

-135% |

|

41 |

68 |

-40% |

|

Net Debt |

283 |

368 |

-23% |

|

|

|

|

|

Backlog net revenues (millions) |

2,331 |

2,125 |

10% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

5.9% |

|

|

|

|

|

|

REVIEW OF THE SECOND QUARTER 2022Net revenues totaled €729

million and increased organically by 8.1%, driven by all GBAs.

Growth was very strong in the UK, North America, and Australia,

with Continental Europe and Brazil contributing as well. Organic

growth was slightly offset by a decline in Greater China, as a

result of ongoing lockdowns. The currency impact was 7.0%, mainly

driven by a strong US Dollar. The operating EBITA improved to 9.3%

(Q2 2021: 9.1%), driven by a better year-on-year performance from

Places. Globally, the margin improved while we increased our

investments in both Digital Solutions and People.

REVIEW OF THE HALF YEAR 2022Net revenues totaled €1,418 million

and increased organically by 6.9%, driven by all GBAs. The currency

impact was 5.9% driven by a strong US Dollar. Non-operating costs

were in line with last year and driven by restructuring costs for

the wind-down of our business in the Middle East. The income tax

rate was 28% (Q2 2021: 21%) and was impacted by, amongst others,

non-deductible expenses and non-taxable income from divestitures.

Net finance expenses decreased to €5.6 million (HY 2021: €12.5

million), driven by a lower net debt position. Net income from

operations increased by 16% to €93 million (HY 2021: €80 million),

or €1.04 per share (HY 2021: €0.89), driven by higher revenues, and

lower interest expenses.

1) Underlying growth excluding the impact of currency movements,

acquisitions or footprint reductions, such as the Middle East,

winddowns or divestments2) Excluding restructuring, acquisition

& divestment costs3) Net income before non-recurring items

(e.g. valuation changes of acquisition-related provisions,

acquisition & divestment costs, expected credit loss on

shareholder loans and corporate guarantees and one-off pension

costs)

OPERATIONAL HIGHLIGHTS

RESILIENCE42% of net revenues

| in €

millions |

Half year |

|

Second quarter |

|

Period ended 30 June 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

589 |

513 |

14.9% |

|

308 |

261 |

17.8% |

|

Organic growth (%)1) |

7.7% |

|

|

|

8.5% |

|

|

|

Operating EBITA |

60 |

55 |

7.8% |

|

|

|

|

|

Operating EBITA margin (%) |

10.1% |

10.8% |

|

|

|

|

|

|

Backlog net revenues (millions) |

842 |

746 |

|

|

|

|

|

|

Backlog organic growth (yoy)1) |

5.5% |

|

|

|

|

|

|

Resilience showed continued solid revenue and backlog

growth for the second quarter, driven by both public and private

clients in North America, UK, Australia and Brazil. Client demand

and performance continues to be strong in environmental

restoration, e.g. caused by clients adhering to their environmental

obligations and tightening regulation around PFAS. The current

economic and geopolitical unrest has further driven public as well

as private investments in climate adaptation, energy transition and

water optimization, which was reflected in solid organic backlog

growth. The margin for the half year was in line with our strategic

margin target set for 2023, and driven by good performance from

North America and Europe. The margin decrease versus last year was

to a large extent driven by increased investments in Digital

Solutions and People, as we continue to invest in attracting and

retaining key industry talent to execute our growing backlog.

PLACES33% of net revenues

| in €

millions |

Half year |

|

Second quarter |

|

Period ended 30 June 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

463 |

447 |

3.7% |

|

235 |

228 |

3.1% |

|

Organic growth (%)1) |

3.1% |

|

|

|

5.1% |

|

|

|

Operating EBITA |

41 |

30 |

36.0% |

|

|

|

|

|

Operating EBITA margin (%) |

8.9% |

6.8% |

|

|

|

|

|

|

Backlog net revenues (millions) |

968 |

961 |

|

|

|

|

|

|

Backlog organic growth (yoy)1) |

3.1% |

|

|

|

|

|

|

Places demonstrated good revenue growth in the second quarter in

particular driven by UK, North America and Australia, further

supported by good growth in Continental Europe and partially offset

by COVID-19 lockdowns in China and CallisonRTKL. Key clients in

Industrial Manufacturing (e.g. Life Sciences, Automotive and

Technology), Government and Energy & Resources, were main

contributors to the revenue and backlog growth, as they made

investments in creating sustainable manufacturing facilities, EV

giga factories, energy efficient data centres or resilient public

transport places. The margin improved year-on-year and was driven

by strong performance, and a higher contribution from UK and North

America, last year’s margin was impacted by losses on projects in

Asia. We see a healthy pipeline of opportunities across a resilient

client and solutions portfolio, with very strong demand and

investments in EV giga factory space for support in permitting,

D&E and program management, but also increasing capex

investments in industrial manufacturing driving resource efficiency

and productivity.

MOBILITY25% of net revenues

|

Period ended 30 June 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

366 |

317 |

15.4% |

|

187 |

155 |

20.2% |

|

Organic growth (%)1) |

10.2% |

|

|

|

11.1% |

|

|

|

Operating EBITA |

35 |

33 |

6.6% |

|

|

|

|

|

Operating EBITA margin (%) |

9.5% |

10.3% |

|

|

|

|

|

|

Backlog net revenues (millions) |

521 |

418 |

|

|

|

|

|

|

Backlog organic growth (yoy)1) |

11.9% |

|

|

|

|

|

|

Revenue and backlog growth was very strong in Mobility for the

first half year, particularly for public and private clients in the

UK and Australia, with additional contribution from North America

and Continental Europe. Highways and Rail clients increasingly

looked to improve efficiency and reliability of travel with the use

of digital tools to reduce disruption and congestion, ultimately

lowering cost and improving quality of life. The client demand for

New Mobility was also strong, with increased investments in

additional capacity for EV charging infrastructure, amongst others.

We experienced increased GBA cross selling as Mobility clients look

for Resilience solutions, driving transport decarbonization for

highways, ports, airports, and rail. The margin was very strong in

UK and Australia, and slightly offset by performance in Greater

China, again caused by ongoing lockdowns. The margin decrease

versus last year was driven by increased investments in Digital

Solutions and People, as well as the ramp up of large projects.

BALANCE SHEET & CASH FLOWNet working capital as a percentage

of annualized gross revenues improved to 13.3% (Q2

2021: 14.3%) and Days Sales Outstanding (DSO) improved

to 69 days (Q2 2021: 74 days), resulting from

disciplined working capital management. Both well within the

strategic targets set for 2023. The balance sheet strengthened

year-on-year, resulting in a significantly lower net debt of €283

million (Q2 2021: €368 million).

Free cash flow was €41 million during the second quarter (Q2

2021: €68 million), improved EBITDA performance versus last year

was offset by cash outflow from high unbilled receivables, a result

of a sharp increase in gross revenues for June 2022.

STRATEGIC HIGHLIGHTSOn July 18, 2022, Arcadis announced the

acquisition of IBI Group: a forward thinking, technology-driven

design firm, which will:

- Accelerate Arcadis’ Digital Leadership strategy with technology

driven industry talent from IBI Group, and enable Arcadis to

combine all of its digitally enabled client solutions and software

products in a new fourth Global Business Area “Intelligence”

- Complement and strengthen our position in North America,

leveraging on the Global Key Client program and use of GECs.

- Our Places clients in Industrial

Manufacturing, Government and Energy & Resources are key

drivers of revenue and backlog growth, which will be a strong match

with IBI Buildings’ expertise in master planning, smart city design

and structural & electrical engineering (e.g. in Automotive and

Aerospace)

- In our Mobility GBA we see very

strong demand across our client base with, for example, a critical

ask for more efficient and reliable Highways and Rail solutions and

public transport places. IBI Group’s solutions such as Transport

Planning and -Engineering and -Management with a strong

digitally-enabled solutions and state of the art Transport

Information Systems are expected to improve our client

proposition

- Our Resilience GBA will benefit from

increasing further scale through IBI Group’s water and wastewater

as well as its environmental services activities

- Provide a strong position in the highly attractive Canadian

market

During the first half 2022 and as part as its ‘Focus and Scale’

strategic axis, Arcadis divested its activities in Czech Republic,

Slovakia, and Thailand. Given the limited financial size of these

businesses, these divestments have no significant impact on group

metrics.

FINANCIAL CALENDAR

|

27 October 2022 |

2022 Q3 Trading update |

|

16 February 2023 |

2022 Q4 & full year Results |

ARCADIS INVESTOR RELATIONSChristine DischMobile: +31 6

15376020E-mail: christine.disch@arcadis.com

ARCADIS CORPORATE COMMUNICATIONS

Tanno Massar Mobile: +31 6 11589121E-mail:

tanno.massar@arcadis.com

ABOUT ARCADISArcadis is the leading global design &

consultancy organization for natural and built assets. We maximize

impact for our clients and the communities they serve by providing

effective solutions through sustainable outcomes, focus and scale,

and digitalization. We are 29,000 people, active in more than 70

countries that generate €3.4 billion in revenues. We support

UN-Habitat with knowledge and expertise to improve the quality of

life in rapidly growing cities around the world.

www.arcadis.com

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

- Arcadis Q2 and HY 2022 results press release

- Arcadis Q2 and half year 2022 results analyst presentation

- Arcadis 2022 interim financial statements

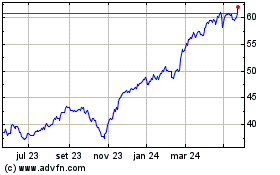

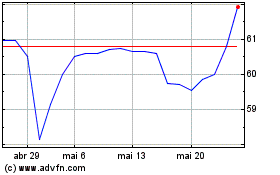

Arcadis NV (EU:ARCAD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Arcadis NV (EU:ARCAD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025