Arcadis Trading Update Q3 2022

Continued strong client demand and

improved

performance

- Strong client demand for energy transition solutions, new

mobility and industrial manufacturing

- Net revenue at €740 million; organic growth of 10.9%1)

- Organic backlog growth year-on-year of 5.0%1)

- Operating EBITA margin improved to 10.3% (Q3‘21: 9.5%)

- Net Working Capital improved to 13.8% (Q3‘21: 14.0%) and DSO to

72 days (Q3‘21: 74 days)

- Accelerating strategy through the acquisitions of IBI Group,

DPS Group and Giftge Consult, and the divestments of a number of

non-core operations

Amsterdam, 27

October

2022 –

Arcadis (EURONEXT: ARCAD), the leading global Design &

Consultancy organization for natural and built assets,

sees a continued growing client

demand across its Global Business

Areas (GBAs), resulting in

an organic net revenue growth

of

10.9%,

and an organic

backlog growth of

5.0%.

Operating EBITA margin

increased to

10.3%

(last year:

9.5%),

driven by improved performance

across the GBAs.

Peter Oosterveer, CEO Arcadis, comments:

“During the last quarter, we have continued to see growing

client demand across our three Global Business Areas. Our

Resilience business continues to benefit from increased client

demand for sustainability advisory, energy transition and climate

adaptation solutions. In our Places business we have enjoyed large

wins in North America and Germany, and increased demand from

manufacturing and governmental clients. For our Mobility business,

significant rail wins in the Netherlands and a growing demand for

smart mobility solutions from highways and public transport clients

created strong results.

We have also made significant progress in optimizing our

portfolio and focusing our efforts on geographies where we see the

most attractive opportunities. This has resulted in the divestments

of operations in Singapore, Malaysia, our Design and Engineering

business in Hong Kong, Switzerland and our environmental

restoration business in France. These follow the divestments made

earlier on in the year; of our operations in Thailand, Czech

Republic and Slovakia.

As we look ahead to 2023, our focus is on fully embedding both

IBI and DPS into our four Global Business Areas, and the shaping of

our fourth GBA “Intelligence”. Through these acquisitions, we not

only significantly grow our presence in North America and Europe,

but we will also be in the position to provide complementary client

services and solutions in high growth markets, including life

sciences, semiconductors, and industrial manufacturing.

Although the evolving geo-political situation and inflationary

headwinds remain firmly on our radar, our record backlog and

continued focus on the optimization of our portfolio, combined with

the exciting new growth opportunities IBI, DPS and Giftge

Consulting offer, position us well to meet our strategic targets. I

can only be very proud of all the teams across Arcadis that have

kept the right focus on our clients in these busy and exciting

times for our company.”

KEY FIGURES As the acquisition of the IBI Group has been

formally closed on 27th of September 2022, the Arcadis consolidated

financial statements include IBI consolidated data for balance

sheet items (those items having an impact on NWC% and DSO

calculated for Arcadis as a whole). Arcadis backlog includes IBI

backlog as well. As the three days of P&L of IBI Group between

September 27th and September 30th have been considered as

non-significant, P&L data and corresponding KPI’s (e.g. EBITDA,

order intake, FCF) for the third quarter represent Arcadis

standalone data.

| in €

millions |

Third quarter |

|

Year-to-date |

|

Period ended 30 September 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Gross revenues |

1,003 |

828 |

21% |

|

2,851 |

2,489 |

15% |

|

Net revenues |

740 |

636 |

16% |

|

2,158 |

1,912 |

13% |

|

Organic growth1) |

10.9% |

4.8% |

|

|

8.2% |

3.9% |

|

|

Operating EBITDA2) |

101 |

83 |

21% |

|

284 |

252 |

12% |

|

Operating EBITDA margin |

13.6% |

13.1% |

|

|

13.2% |

13.2% |

|

|

EBITA |

27 |

57 |

-52% |

|

158 |

171 |

-8% |

|

EBITA margin |

3.7% |

9.0% |

|

|

7.3% |

9.0% |

|

|

Operating EBITA2) |

76 |

60 |

26% |

|

208 |

177 |

18% |

|

Operating EBITA margin |

10.3% |

9.5% |

|

|

9.7% |

9.2% |

|

|

Free Cash Flow3) |

38 |

75 |

-50% |

|

27 |

105 |

-74% |

|

Net Working Capital %4) |

13.8% |

14.0% |

|

|

|

|

|

|

Days Sales Outstanding4) |

72 |

74 |

|

|

|

|

|

|

Net Debt4) |

880 |

298 |

195% |

|

|

|

|

|

Backlog net revenues4) |

2,813 |

2,126 |

32% |

|

|

|

|

|

Backlog organic growth (y-o-y)1) |

5.0% |

|

|

|

|

|

|

1) Underlying growth excluding the impact of currency

movements, acquisitions or footprint reductions, such as the

Middle East, winddowns or divestments2) This excludes the net

result on divestment of consolidated companies, and acquisitions,

restructuring, and integration-related costs. The Operating EBITDA

is used when calculating the strategic target: average net debt /

(Operating) EBITDA, guided for 1.5-2.5x3) Free Cash flow: Cash Flow

from Operations corrected for Capex and Lease liabilities4)

Including IBI Group, transaction closing per 27th of September

2022

INCOME STATEMENTNet revenues totaled €740 million and increased

organically by 10.9%. Growth was driven by all three GBAs, with

Resilience and Mobility being exceptionally strong in North America

and the UK. The currency impact was 9%. The operating EBITA margin

improved to 10.3% (Q3‘21: 9.5%), driven by all three GBAs, and a

significant year-on-year improvement driven by Places from improved

operational efficiencies, despite lower working days in the UK and

Australia due to Queen Elizabeth’s funeral.

Non-operating costs were €49 million and include transaction

costs related to the three recently announced acquisitions, and a

net loss on divestments of operations in Singapore, Malaysia, Hong

Kong (Design & Engineering business), Switzerland and France

(Environmental Restoration business). These net losses had no

impact on Free Cash Flow.

ORDER INTAKE &BACKLOGAt the end of September 2022 backlog

reached a record high level of €2,813 million (Q3‘21: €2,126

million), of which €530 million was added through the acquisition

of the IBI Group. Strong order intake, with almost no cancellations

in the quarter resulted in a solid organic backlog growth of 5.0%

year-over-year, with a positive contribution of all three GBAs.

BALANCE SHEET & CASH FLOWNet working capital as a percentage

of annualized gross revenues was 13.8% (Q3‘21: 14.0%),

globally in line with last year performance. Days Sales

Outstanding (DSO) decreased to 72 days

(Q3‘21: 74 days). Net debt increased to €880 million

(Q3‘21: €298 million), including the €600 million bridge loan for

IBI acquisition and IBI net debt of €54 million.

Free cash flow generation during the quarter was €38 million and

below last year’s (Q3‘21: €75 million), driven by sharp revenue

growth elevating working capital levels, and some transaction costs

relating to the recent acquisitions. Free cash flow generation

year-to-date was €27 million (Q3‘21: €105 million), which was

impacted by a normalization of working capital levels compared to

2021.

STRATEGIC PROGRESSFocus & Scale is one of the three key

pillars of our “Maximizing Impact” business strategy for 2021-2023.

Arcadis has focused on driving operational efficiencies through the

implementation of the GBA model, focus on key clients, and greater

use of the Global Excellence Centers (GECs), as well as investing

in high growth markets, for instance through the acquisitions of

IBI, DPS and Giftge Consult.

At the same time, “Focus & Scale” triggered a portfolio

assessment, reviewing operations on their scalability, growth

potential, financial performance, and scope of services. This has

resulted in the following divestment of non-core operations, from a

geographic or business point of view: Singapore, Malaysia, Hong

Kong (Design & Engineering business), Switzerland and France

(Environmental Restoration business), representing ~900 people and

€47 million of annual net revenues. This was in addition to the

divestments of Czech Republic, Slovakia and Thailand that occurred

in the first half of 2022, representing ~190 people and €11 million

of annual net revenues.

The recent acquisitions of IBI, DPS and Giftge, together with

the divestments, have rebalanced the geographic and business

portfolio, and repositioned Arcadis towards high growth and

resilient markets such as placemaking and urban planning in North

America, and industrial manufacturing engineering in the US and

Europe. The creation of the fourth GBA “Intelligence", will enhance

Arcadis’ position as a digital leader, and ability to serve its

clients in a more efficient way across all phases of the asset

lifecycle. The backlog for Intelligence at the end of the third

quarter was €112 million, representing 4% of the total Arcadis

backlog.

PERFORMANCE BY GLOBAL BUSINESS AREA

RESILIENCE

| (43% of net

revenues) |

|

|

|

|

|

|

|

| in €

millions |

Third quarter |

|

Year-to-date |

|

Period ended 30 September 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

320 |

259 |

24% |

|

909 |

771 |

18% |

|

Organic growth1) |

13.7% |

|

|

|

9.7% |

|

|

|

Backlog net revenues |

943 |

|

|

|

|

|

|

|

Backlog organic growth (y-o-y)1) |

5.4% |

|

|

|

|

|

|

Resilience showed continued solid revenue and backlog growth for

the third quarter, driven by continued strong client demand in

energy transition, climate adaptation and mitigation, including a

new commission as lead designer of a flood defense for Battery

Park, New York City, complementing resiliency work for southeast

and lower Manhattan. Revenue growth was supported by the successful

onboarding of new hires, especially in the US.The Resilience

business closed the quarter at a backlog of €943 million,

representing 34% of total Arcadis backlog.

PLACES

| (32% of net

revenues) |

|

|

|

|

|

|

|

| in €

millions |

Third quarter |

|

Year-to-date |

|

Period ended 30 September 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

234 |

209 |

12% |

|

697 |

656 |

6% |

|

Organic growth1) |

3.6% |

|

|

|

2.8% |

|

|

|

Backlog net revenues |

1,216 |

|

|

|

|

|

|

|

Backlog organic growth (y-o-y)1) |

2.1% |

|

|

|

|

|

|

Revenue and backlog growth in the third quarter were driven by a

strong Continental Europe and US, with good demand for sustainable

and intelligent buildings, including the development of datacenters

and automotive giga-factories for electric vehicle battery

production. Revenue and backlog growth was somewhat hampered by

weakening market circumstances in China.

The absolute backlog of Places increased by 29% year-on-year to

€1,216 million. The position includes the backlog of IBI Group,

which was marked by strong order intake in the third quarter and

excludes the divested countries in Southeast Asia. These strategic

decisions led to a significant repositioning of the Places backlog,

now representing 43% of total Arcadis backlog, with an increased

focus on North America and Europe.

MOBILITY

| (25% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Third quarter |

|

Year-to-date |

|

Period ended 30 September 2022 |

2022 |

2021 |

change |

|

2022 |

2021 |

change |

|

Net revenues |

186 |

168 |

11% |

|

552 |

485 |

14% |

|

Organic growth1) |

15.4% |

|

|

|

12.5% |

|

|

|

Backlog net revenues |

542 |

|

|

|

|

|

|

|

Backlog organic growth (y-o-y)1) |

9.0% |

|

|

|

|

|

|

Stellar revenue growth for Mobility in the third quarter was

driven by the UK, Australia and the US. A strong backlog

development came from large highway and rail wins; such as for

ProRail in the Netherlands, and a growing demand for smart mobility

solutions from highways and public transport clients. At the end of

Q3, mobility backlog amounted to €542 million, representing 19% of

total Arcadis backlog.

IBI’s experience in developing digital tools including Travel-IQ

will further help to pursue new opportunities and strengthen our

Mobility business both in North America and across the world.

Financial calendar:

- 16 February 2023 – Q4 & FY 2022 Results

- 4 May 2023 – Q1 2023 Trading Update

- 27 July 2023 – Q2 & HY 2023 Results

- 26 October 2023 – Q3 2023 Trading Update

For further information please contact:Arcadis Investor

RelationsChristine DischMobile: +31 (0)6 1537 6020E-mail:

christine.disch@arcadis.com

Arcadis Corporate CommunicationsTanno MassarMobile: +31 (0)6

1158 9121E-mail: tanno.massar@arcadis.com

Analyst meetingArcadis will hold an analyst webcast to discuss

the Q3results for 2022. The analyst meeting will be held at 10.00

hours CET today. The webcast can be accessed via the investor

relations section on the company’s website at:

https://channel.royalcast.com/landingpage/arcadisinvestors/20221027_1/

About ArcadisArcadis is a leading global Design &

Consultancy organization for natural and built assets. Applying our

deep market sector insights and collective design, consultancy,

engineering, project and management services we work in partnership

with our clients to deliver exceptional and sustainable outcomes

throughout the lifecycle of their natural and built assets. We are

33,000 people, active in over 70 countries that generate €3.8

billion in revenues. We support UN-Habitat with knowledge

and expertise to improve the quality of life in rapidly

growing cities around the world. www.arcadis.com.

Regulated informationThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward looking statementsStatements included in this press

release that are not historical facts (including any statements

concerning investment objectives, other plans and objectives of

management for future operations or economic performance, or

assumptions or forecasts related thereto) are forward-looking

statements. These statements are only predictions and are not

guarantees. Actual events or the results of our operations could

differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements are

typically identified by the use of terms such as “may”, “will”,

“should”, “expect”, “could”, “intend”, “plan”, “anticipate”,

“estimate”, “believe”, “continue”, “predict”, “potential” or the

negative of such terms and other comparable terminology. The

forward-looking statements are based upon our current expectations,

plans, estimates, assumptions and beliefs that involve numerous

risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Although we

believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results

and performance could differ materially from those set forth in the

forward-looking statements.

- Arcadis Q3 2022 Trading Update - press release

- Arcadis Q3 2022 Trading Update - analyst presentation

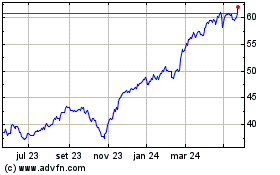

Arcadis NV (EU:ARCAD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

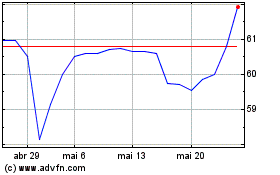

Arcadis NV (EU:ARCAD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025