Mozambique Should Revisit Mega Project Contracts -Millenium bim

21 Fevereiro 2011 - 1:33PM

Dow Jones News

Mozambique should revisit the terms of its mega project

contracts with a view to ensuring that the country's citizens

derive more benefits, the new CEO of Millenium bim, Mozambique's

largest bank, said in a recent interview.

"I think the mega projects have to be revised for the (benefit

of the) people of this country," Manuel Marecos Duarte told Dow

Jones Newswires Thursday. "There's a need to review these great

projects."

A debate is currently being disputed in local media regarding

whether mega projects such as the Mozal aluminum smelter, the

largest single contributor to the country's gross domestic product,

contribute enough taxes to the country.

The Governor of Mozambique's central bank Ernesto Gove said

earlier this month that the economic and social conditions now

exist for the government to renegotiate contracts signed with some

of the mega projects, according to a report from the Agencia de

Informacao de Mozambique.

The early mega projects, including BHP Billiton Ltd's (BHP)

Mozal joint venture in Maputo and the processing of natural gas in

Inhambane province by the South African petrochemical giant Sasol

(SAS.JO), have come under frequent criticisms for the generous tax

exemptions granted by the government.

A new slate of mega projects such as Brazilian miner Vale SA's

(VALE) $1.66 billion Moatize coal project have also come under fire

for tax schemes that favor lower payments at the beginning of a

project and higher tax payments later on.

Fiscal incentives were granted to Mozal in order to attract the

flagship investment to the country. The plant was built in 2000 and

was seen as a showcase to the world that Mozambique was a safe

place to invest after nearly a decade and a half of civil war. In

Vale's case, such tax regimes are routine fiscal incentives use by

governments around the world to attract investors; they allow

investors to recoup their return on investment more quickly.

Duarte, who assumed the helm of Millenium bim in early February,

said he didn't dispute the overall benefits of mega projects but

noted that the terms of the contracts could be revised in order to

provide greater benefits to Mozambique.

He said the mega projects are a boon to the economy because of

the commerce that emerges around these projects. "It is this

business around the mega projects that (we) want to have. This is

(our) market," Duarte added.

Millenium bim, a unit of Portugal's Millenium bcp or Banco

Comercial Portugues SA (BCP.LB), is Mozambique's largest retail

bank accounting for almost 40% of the country's bank credit and 35%

of its assets. The bank has the largest retail network in the

country with 126 branches spread throughout the country. It wants

to increase its number of retail bank accounts in a country of more

than 22 million people to more than 1 million accounts in 2011, up

from about 900,000 accounts in 2010.

Duarte said the bank's expansion strategy is closely aligned

with the government's desire to see financial services expand into

rural areas. The bank plans to open 13 new branches in 2011, up

from 10 openings in 2010. Three of the new openings will occur in

urban areas and 10 will be in sub-urban areas.

In the western province of Tete, the bank is adding three new

branches to its existing network of six branches. The new branches

will cater to the growing number of people and capital flocking to

Tete as large mining companies such as Vale and Australia-based

Riversdale Mining Ltd (RIV.AU) begin to exploit the province's vast

coal reserves.

Millenium bim is also reaching out to more inaccessible

customers via mobile phone banking. "We want to be the bank of the

Mozambicans," Duarte said. He noted that the bank was solely

focused on retail banking and had no ambition to expand into

corporate or investment banking in Mozambique.

When asked if there was room for consolidation in Mozambique's

banking sector, Duarte said there wasn't much interest on Millenium

bim's part to take part in that consolidation. He noted that the

top four banks already account for about 90% of the retail market

while the remaining 18 banks are mostly micro-credit banks that

charge very high rates for their loans.

-By Alex MacDonald, Dow Jones Newswires; +44(0)7776 200 924;

alex.macdonald@dowjones.com

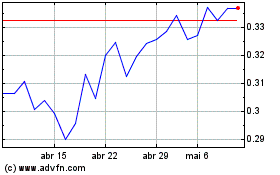

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024