Portugal's BCP Confident It Will Pass EU Stress Test - CFO

13 Junho 2011 - 6:27PM

Dow Jones News

Banco Comercial Portugues SA's (BCP.LB, BPCGY, BPCGF) chief

financial officer said Monday he is confident that BCP will pass

the European Union's stress test on banks.

The tests, which have been underway since March, are designed to

gauge the financial health of 91 banks from 21 countries across the

European Union.

"We are confident" that BCP will pass the stress test after

raising capital, Antonio Ramalho said on the sidelines of a press

briefing regarding the completion of the Core Tier I ratio

recapitalization program.

The European Banking Authority had planned to release the

stress-test results later this month but the results will now be

disclosed in July due to haggling among European regulators, the

banks and their national supervisors over whether the banks

submitted overly optimistic data, according to people familiar with

the matter.

The goal is for the stress tests to help defuse the continent's

financial crisis by easing fears that many banks are vulnerable to

huge unseen losses.

BCP on Monday said it successfully concluded its EUR259.9

million rights issue, marking the last stage of a three-pronged

plan to meet the recapitalization requirements outlined in

Portugal's financial-bailout program.

BCP Chief Executive Carlos Santos Ferreira said that the program

was executed successfully and that demand for the company's rights

issue was 1.6 times larger than the 721,813,850 shares on

offer.

"This operation was done in a situation...that was complex and

complicated," given the credit-ratings downgrade and

bailout-package request that occurred during the 80 days in which

the recapitalization program was carried out, he said.

The company increased its capital by EUR1.37 billion and boosted

its core Tier I ratio to a pro-forma 8.8% as of the end of March

from 6.7% at the end of 2010.

The bank wasn't able to provide a more updated ratio because it

hasn't closed its books for the quarter although Ramalho said it

would be around the pro-forma level.

The bank still needs to reach a 9% core Tier I ratio by the end

of the year and 10% by the end of 2012, according to terms of the

country's EUR78 billion financial-bailout program.

Ramalho said the bank expects to reach the 9% level at the end

of the year through deleveraging its loan portfolio and accrued

earnings.

Plans to reach the 10% core Tier I ratio are also in the works

but haven't been posted publicly, Ferreira said.

He said the bank will make every effort to avoid tapping into

the EUR12 billion set aside in the bailout package for Portugal's

banking sector. The European Union and the International Monetary

Fund have allotted the cash in case banks need help in meeting

their capital requirements.

-By Alex MacDonald, Dow Jones Newswires; 44-0-7776-200-924,

alex.macdonald@dowjones.com

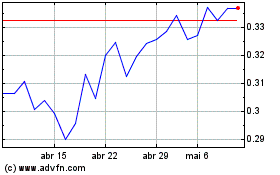

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024