Banco Comercial Português, S.A. informs about Bank Millennium (Poland) results in 1Q 2020

11 Maio 2020 - 4:31AM

Banco Comercial Português, S.A. informs about Bank Millennium

(Poland) results in 1Q 2020

Banco Comercial Português, S.A. informs about

Bank Millennium (Poland) results in 1Q 2020

Banco Comercial Português, S.A. hereby informs

that Bank Millennium in Poland, in which it has a 50.1% holding and

whose accounts are fully consolidated at BCP group level, released

today its results for 1Q 2020. Main highlights are as follows:

Profitability affected by integration costs and

extraordinary provisions

- Net profit reached 18.1 million PLN (4.2 million EUR) in 1Q

2020, or 190 million PLN (43.7 million EUR) when adjusted to

extraordinary items/one-offs* (stable y/y)

- 30.1 million PLN (6.9 million EUR) of integration costs related

to Euro Bank, with synergies reaching 24 million PLN (5.5 million

EUR)

- 55.3 million PLN (12.7 million EUR) increase of provisions

related to foreign exchange (FX) mortgages legal risks

- 60 million PLN (13.8 million EUR), or 49 million PLN (11.3

million EUR) after tax, of pre-emptive Covid-19 related

provisions

- Adjusted* ROE of 8.4% and Cost/income ratio of 48.3%

Higher operating income and costs influenced by the

merger of Euro Bank

- Operating income grew 24% y/y

- Net interest income grew 38% y/y

- Net commission income grew 19% y/y

- Operating costs grew 35% y/y (28%, excluding integration

costs), and decreased 5% q/q (excluding integration and Bank

Guarantee Fund costs)

High asset quality and liquidity kept

- Impaired loans (stage 3) ratio at 4.75%

- Cost of Risk** at 108 b.p. (75 b.p., excluding pre-emptive

Covid-19 provisions)

- Loans to deposits ratio at 86%

Solid capital position and lower regulatory

buffers

- Group’s Total Capital Ratio (TCR) at 19.5%, and CET1 ratio at

16.5% after incorporating full 2H 2019 profits, comfortably above

requirements (15.4% and 12.2%, respectively)

- Reduction by the KNF of the FX mortgage related Pillar 2 buffer

to 4.9%, in November 2019, and cut of the Systemic risk buffer to

0%, from 3%, in March 2020

Retail business

- 2.6 million active clients, a 34% y/y growth, +708 thousand new

clients after one year, including +494 thousand due to the Euro

Bank acquisition

- Deposits grew 32% y/y

- Loans grew 47% y/y (72%, excluding FX mortgages)

- 1.3 billion PLN (285 million EUR) in mortgages and cash loans

origination, which translates in a high y/y growth of the

respective loan books: 57% and 31%, respectively

- Accelerating the new microbusiness accounts acquisition pace,

+20 thousand net growth of active accounts (24% of new accounts

were opened online)

- 96 thousand microbusiness clients

Companies business

- Current accounts volumes grew 39% y/y

- Growth of loans to companies: 7% y/y

- Growth in factoring turnover of 6% y/y

- Growing number and volume of transactions in corporate

business

Support for Clients during the Covid-19

epidemic

Retail Clients:

- Credit moratoria, temporary deferral of principal and interest

instalments

- Contactless card transactions up to PLN100 (23 EUR) without PIN

confirmation

- Most transactions can be done safely and remotely from

home

- Fully online current account opening, with the use of

selfie

- Website and banner communication on the portal, dedicated to

this thematic

Micro-companies and corporate customers:

- Applications for the Polish Development Fund financial support

(subsidy with redemption possibility) in Millenet, available for

micro businesses and SMEs

- Temporary suspension of loan instalments, including factoring,

leasing and charge cards, available for all companies

- Quick and simplified process of credit renewal, available for

SMEs and large companies

- State Development Bank (BGK) guarantees under new and more

favourable conditions for micro businesses and SMEs (de minimis

guarantee)

- Credit lines supported by BGK’s Liquidity Guaranties Fund,

available for medium and large companies

- Possibility of remote signing of all agreements, available for

SMEs and large companies

Quality and Innovations

- Highest NPS ratio (52) among Polish banks

- Best Trade Finance Provider in Poland for 2020, according to

Global Finance

- 1.7 million downloads of the Millennium Goodie app –

smartshopping platform

(*) without one-offs: in 1Q20: 1) integration costs: PLN 30.1mn

(6.9 million EUR), 2) PLN 55.3mn (12.7 million EUR) provisions for

FX mortgage legal risk, 3) proactive Covid-19 provision of PLN 60mn

(13.8 million EUR), 4) linear distribution of BFG resolution fund

fee of PLN 58.2mn (13.4 million EUR); in 1Q19: 1) integration

costs: PLN 2mn (459 thousand EUR), 2) PLN 26.9mn (6.2 million EUR)

release of tax asset provision, 3) linear distribution of BFG

resolution fund fee of PLN 73.3mn (16.8 million EUR)

(**) on gross loans.

End of announcementBanco Comercial

Português, S.A.

- Resultados Polónia 1T20 EN

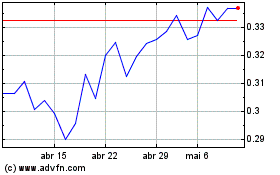

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Banco Comercial Portugues (EU:BCP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024