VGP completes largest brownfield acquisition in company history near Frankfurt Airport, in the heart of Germany

22 Novembro 2023 - 3:00AM

VGP completes largest brownfield acquisition in company history

near Frankfurt Airport, in the heart of Germany

Regulated Information - Inside Information

- VGP acquires over 700,000 m²

from Opel, a brand of Stellantis group, in

Rüsselsheim

- The redevelopment will be realised in close

coordination with Opel and the city of Rüsselsheim

- The project represents one of the largest and most

central industrial property developments in Germany

22 November 2023, 7:00 am, Antwerp,

Belgium: VGP NV ("VGP"), a European provider of

high-quality logistics and semi-industrial real estate, announces

its largest brownfield acquisition to date. The Group successfully

purchased three plots of land in Rüsselsheim am Main, strategically

located at less than a 15 minutes’ drive from Frankfurt

Airport.

With a total area exceeding 700,000 m², these

plots were procured from Stellantis, a globally recognized

automotive group and mobility provider. Stellantis is in the

process of optimising its historic Opel production site in

Rüsselsheim, a site with over a century of history. Initially,

Stellantis will lease back the properties, gradually releasing them

for redevelopment.

VGP’s vision for this acquisition involves the

creation of a business park spanning approximately 350,000

m2 tailored for industrial companies and small and

medium-sized value-added businesses. In line with its commitment to

responsible development, VGP will operate with care to optimize the

benefits of the development for the local community in close

coordination with the responsible authorities.

This prime location offers unparalleled

advantages, with Frankfurt Airport accessible within a 15-minute

drive and through a direct connection from the railway station on

the site. Furthermore the international finance centre of

Frankfurt, Wiesbaden or Mainz can be reached within 20 minutes

(direct connections from the railway station or by motorway),

offering links to ICE railway stations. The site’s strategic

location is further enhanced by direct access to the State-B43

through road and convenient proximity to four national motorways

(A3, A60, A67, A671). Additionally, with direct harbour access to

the river Main, the site boasts tri-modality transport

potential.

VGP aims for an ambitious environmental approach

for the park, committing to achieving a minimum DGNB Gold

certification for all buildings. The new park will be largely

independent from the grid as it will benefit from existing

electricity facilities and water treatment and recycling services.

Rooftops are expected to be equipped with photovoltaic panels and a

geothermal system is projected to contribute to the facility’s

energy and heating needs by 2025.

This marks VGP’s second significant brownfield

acquisition this month, following the purchase of a 194,000 m2 land

plot in Vélizy, Paris region, France. The redevelopment of

old industrial sites in collaboration with local communities is a

core expertise of VGP and the Group has recently indicated to be

working on several notable acquisitions in the pipeline as

foundation stones of an ambitious future growth plan.

With a growing presence, the Group now

encompasses 40 locations in Germany and operates in seventeen

European countries. The family-owned company is headquartered in

Antwerp, Belgium, and operates a total of 112 parks across

Europe.

CONTACT DETAILS VGP

|

Investor Relations |

Tel: +32 (0)3 289

1433 investor.relations@vgpparks.eu |

|

Karen Huybrechts Head of Marketing |

Tel: +32 (0)3 289 1432 |

ABOUT VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi-industrial properties

as well as a provider of renewable energy solutions. VGP has a

fully integrated business model with extensive expertise and many

years of experience along the entire value chain. VGP was founded

in 1998 as a family-owned Belgian property developer in the Czech

Republic and today operates with around 371 full-time employees in

17 European countries directly and through several 50:50 joint

ventures. In June 2023, the gross asset value of VGP, including the

100% joint ventures, amounted to € 6.76 billion and the company had

a net asset value (EPRA NTA) of € 2.2 billion. VGP is listed on

Euronext Brussels (ISIN: BE0003878957).

For further information please

visit:

http://www.vgpparks.eu/en

- 20231122_Press Release_Rüsselsheim_EN

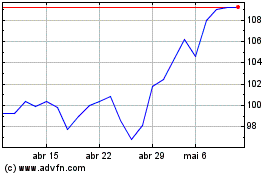

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

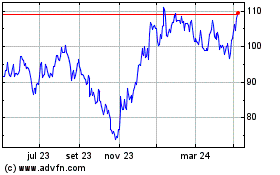

VGP NV (EU:VGP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024