Adams PLC Assignment of Shareholder Loan Facility (5494Q)

19 Junho 2020 - 11:24AM

UK Regulatory

TIDMADA

RNS Number : 5494Q

Adams PLC

19 June 2020

Adams plc

("Adams" or the "Company")

Assignment of Shareholder Loan Facility

Adams is an investing company with an investing policy under

which the Board is seeking to acquire interests in special

situation investment opportunities that have an element of

distress, dislocation, dysfunction or other special situation

attributes and that the Board perceives to be undervalued. The

principal focus is in the small to middle-market capitalisation

sectors in the UK or Europe, but the directors will also consider

possible special situation opportunities anywhere in the world.

The Company believes there is potential to yield increased

investment returns if Adams has access to further cash resources to

finance additional special situation investment opportunities. As

announced on 29 January 2019, in support of the Company's

investment strategy, the Company entered into a facility loan

agreement (the "Loan Agreement") with the Company's largest

shareholder, Richard Griffiths, and his controlled company, Blake

Holdings Limited ("Blake"), for the provision of an unsecured loan

facility of up to GBP3 million in total (the "Loan Facility").The

Loan Facility may be drawn down by the Company in minimum tranches

of GBP500,000 and has no fixed term, but is repayable in full or in

part six months after any repayment notice issued by either Blake

or the Company. Interest accrues daily based on a rate of 7 per

cent. per annum and is paid six monthly in arrears. No arrangement,

commitment or exit fees have or will be charged.

There have been no draw downs on the Loan Facility to date but

Blake recently requested to assign the Loan Agreement to Richard

Griffiths and Richard Griffiths has agreed to the assignment to him

of the Loan Agreement without change and to assume all of the

rights and obligations in respect thereof, under the terms of a

loan assignment agreement (the "Loan Assignment Agreement) dated

today 19 June 2020.

As Richard Griffiths and Blake are substantial shareholders in

the Company, they are both deemed to be a related party pursuant to

the AIM Rules for Companies (the "AIM Rules"). The entering into

the Loan Assignment Agreement is therefore a related party

transaction for the purposes of Rule 13 of the AIM Rules.

Michael Bretherton, Chairman, is not independent for the

purposes of the related party transaction given that he is also a

director of Blake, in which he holds no shares. The other directors

of Adams, Nick Woolard and Andy Mitchell, are both deemed

independent for these purposes and consider, having consulted with

the Company's nominated adviser, Cairn Financial Advisers LLP, that

the terms of the Loan Assignment Agreement are fair and reasonable

insofar as the shareholders of Adams are concerned.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Enquiries:

Adams plc

Mike Bretherton Tel: +44 1534 719 761

Nomad

Cairn Financial Advisers LLP

Sandy Jamieson, James Caithie Tel: +44 207 213 0880

Broker

Peterhouse Corporate Finance Limited

Lucy Williams, Duncan Vasey Tel: +44 207 469 0930

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGPUWPQUPUGCB

(END) Dow Jones Newswires

June 19, 2020 10:24 ET (14:24 GMT)

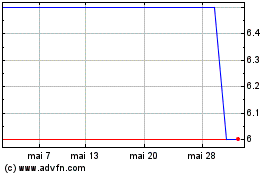

Adams (LSE:ADA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

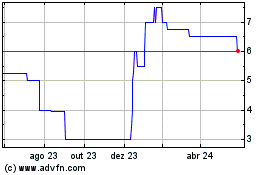

Adams (LSE:ADA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024