Adams PLC Investment in Seeing Machines Limited (8476X)

07 Maio 2021 - 3:00AM

UK Regulatory

TIDMADA

RNS Number : 8476X

Adams PLC

07 May 2021

Adams plc

("Adams" or the "Company")

Investment in Seeing Machines Limited ("Seeing Machines")

The Directors announce that, on 6 May 2021, Adams purchased 8

million ordinary shares of no par value in Seeing Machines on the

AIM market of the London Stock Exchange at an average price of

11.35 pence per share for a total cash consideration of

GBP908,000.

The Company's holding of 8,000,000 ordinary shares in Seeing

Machines represents 0.21% of the currently issued ordinary share

capital of Seeing Machines of 3,805,617,804 shares. Following this

investment, the Company will have cash balances of approximately

GBP3.19 million.

About Seeing Machines

Seeing Machines is an industry leader in advanced computer

vision technologies and designs AI-powered Operator Monitoring

Systems to improve transport safety in automotive, commercial

fleet, aviation, rail and off-road markets. The company has

pioneered such technology through algorithm development, extensive

behavioural research and data, expertise in camera-based optics and

embedded processing to deliver true AI driven human machine

interaction. The technology in corporates warnings when human state

attention impairment, distraction and other measures are

identified, in order to re-engage the operator or driver. Seeing

Machines continues to grow as an automotive leader in such

technology, having now won contracts with a total of seven

automotive Tier 1 global customers.

From its base in Canberra, Australia, Seeing Machines serves a

growing market in Europe, North America, Latin America, the Middle

East and Asia Pacific, and counts Caterpillar, General Motors,

Emirates, Venoeer, Progress Rail, Coach USA and Transport for

London among its major clients.

In the 6 months ended 31 December 2020, Seeing Machines reported

a loss for the period of A$16.8 million on revenue of A$18.1

million (year ended 30 June 2020: loss of A$46.7 million on revenue

of A$40.0 million). Seeing Machines's net assets at 31 December

2020 amounted to A$58.9 million inclusive of cash and cash

equivalent balances of A$52.4 million .

Subsequent to that 31 December 2020 half year end, Seeing

Machines announced on 22 March 2021 that it had raised gross

proceeds of approximately US$10 million through the issue of

68,403,430 new ordinary shares of no par value in order to further

strengthen the company's balance sheet and which is expected to

fund the business through to profitability.

Further information on Seeing Machines is available on its

website www.seeingmachines.com.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Enquiries:

Adams plc

Mike Bretherton Tel: +44 1534 719761

Nomad - Cairn Financial Advisers LLP

Sandy Jamieson, James Caithie Tel: +44 207 213 0880

Broker - Peterhouse Capital Limited

Heena Karani/Duncan Vasey Tel: +44 207 469 0933

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBCGDUGSGDGBL

(END) Dow Jones Newswires

May 07, 2021 02:00 ET (06:00 GMT)

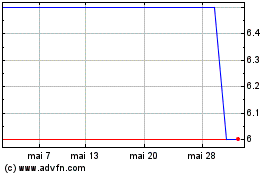

Adams (LSE:ADA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

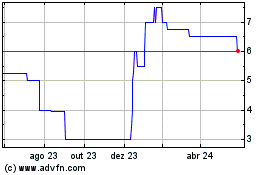

Adams (LSE:ADA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024