TIDMAEP

RNS Number : 2433X

Anglo-Eastern Plantations PLC

25 August 2022

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for the six months ended 30 June

2022

The group, comprising Anglo-Eastern Plantations Plc and its

subsidiaries (the "Group"), is a major producer of palm oil and

rubber with plantations across Indonesia and Malaysia, has today

released its results for the six months ended 30 June 2022.

Financial Highlights

2021

2022 6 months 2021

6 months to 30 12 months

June (restated)

to 30 June $m to 31 December

$m (unaudited) $m

Continuing operations (unaudited) (audited)

Revenue 249.2 197.7 433.4

Profit before tax

- before biological assets

("BA") movement 94.8 56.4 132.7

- after BA movement 89.5 60.2 137.1

Basic Earnings per ordinary

share ("EPS")

- before BA movement 153.51cts 93.76cts 235.25cts

- after BA movement 144.73cts 100.11cts 242.34cts

Enquiries:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon (UK) Limited

Dominic Morley +44 (0)20 7886 2954

Chairman's Interim Statement

The interim results for the Group for the six months to 30 June

2022 are as follows:

Revenue from continuing operations for the six months to 30 June

2022 was $249.2 million, 26% higher than $197.7 million reported

for the same period of 2021. The Group's gross profit from

continuing operations was $90.3 million compared to $61.8 million

for the first six months of 2021. Overall profit before tax, after

biological assets ("BA") movement, from continuing operations for

the first half of 2022 was 49% higher at $89.5 million against

$60.2 million for the corresponding period in 2021. The overall

profit from continuing operations includes a net reversal of

impairment losses of $0.2 million for the first half of 2022

compared to a reversal of impairment loss of $0.1 million for the

first half of 2021. The BA movement adjustment from continuing

operations for the first half of 2022 was a debit of $5.3 million

compared to a credit of $3.9 million in the last period. The higher

profit was attributed to the higher Crude Palm Oil ("CPO")

prices.

Fresh Fruit Bunches ("FFB") production from continuing

operations for the first half of 2022 was 3% lower at 550,800mt

compared to 569,100mt for the same period in the prior year due to

lower production in Bengkulu and Kalimantan regions. The harvest in

Bengkulu was lower by 13% primarily due to a reduction of almost

1,000ha of matured area of which 428ha was replanted in the second

half of 2021 while another 551ha was cleared for replanting in the

first half of 2022. During 1Q 2022 the public roads in Kurun

township were closed for a month because of extremely bad weather

which affected the transportation of crops and in turn caused a 9%

decline in the harvest in Central Kalimantan. Younger palms in

North Sumatera continue to out-performed the rest of the regions by

registering a growth of 6% against last year. Bought-in crops for

the first half of 2022 also decreased by 4% to 557,600mt from

583,400mt. The increased purchase of outside crops in North

Sumatera (6%) and Kalimantan (9%) could not off-set a 19% decrease

in crop purchase in the Bengkulu region. The significant decrease

in the Bengkulu region is caused by the reopening of a mill of one

of the suppliers following a shutdown for maintenance in 2021. In

addition, some of AEP's mills had to reduce external crop purchases

due to the CPO storage tanks reaching their maximum storage

capacities as inventory built-up during the export ban.

Operational and financial performance

For the six months ended 30 June 2022, gross profit margin from

continuing operations increased to 36.2% from 31.3% as the Group

experienced higher CPO and palm kernel prices.

CPO price ex-Rotterdam averaged $1,640/mt for the first six

months to 30 June 2022, 46% higher than $1,122/mt over the same

period in 2021. As a result, the Group's average ex-mill price was

higher by 47% at $1,035/mt for the same period (H1 2021: $706/mt).

The ex-mill prices are normally at a discount to ex-Rotterdam

prices as buyers are required to pay logistic charges and

Indonesian CPO tax and levy. The Group also benefited from higher

palm kernel prices which was 66% higher at the average price of

$808/mt against $486/mt last year.

Profit after tax from continuing operations for the six months

ended 30 June 2022 was 45% higher at $68.8 million, compared to a

profit after tax from continuing operations of $47.3 million for

the first six months of 2021.

The resulting basic earnings per share from continuing

operations for the period was 144.73cts (H1 2021: 100.11cts).

The Group's balance sheet remains strong with no outstanding

bank loans. Net assets as at 30 June 2022 were $585.3 million

compared to $496.6 million as at 30 June 2021 and $542.1 million as

at 31 December 2021. The increase in net assets from the last

interim report was attributed to higher profit and higher

inventories. Inventories, comprising mainly of CPO, built up to $41

million against $15 million as at 30 June 2021 due to the CPO

export ban in Indonesia which is explained in more detail under

commodity prices below. The Indonesian Rupiah has depreciated by 4%

against the US dollar in the first half of 2022.

As at 30 June 2022, the Group had cash and cash equivalents

including all fixed deposits with banks of $246.8 million (H1 2021:

$160.7 million, 31 December 2021: $219.7 million).

Operating costs

Operating costs for the Indonesian operations were higher in the

first half of 2022 compared to the same period in 2021 mainly due

to higher prices paid for third party crops, higher costs of

maintaining plantations and mills and higher harvesting costs

arising from the increased matured area. Fertiliser costs rose

sharply by 80% in the first half of 2022 to $15.8 million from $8.8

million for the corresponding period last year. Transport costs

have also increased significantly by 56% to $2.8 million from $1.8

million for the corresponding period last year as diesel prices

have increased.

Production and Sales

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

mt mt mt

Oil palm production

FFB

- all estates from continuing

operations 550,800 569,100 1,152,400

- estates from discontinued

operations 21,500 17,400 37,200

- bought-in from third parties 557,600 583,400 1,142,200

Saleable CPO 227,800 238,700 473,200

Saleable palm kernels 54,400 57,100 97,100

Oil palm sales

CPO 200,000 237,900 477,600

Palm kernels 48,900 55,400 113,400

FFB sold outside 17,800 13,400 29,400

Rubber production 168 206 425

The Group's six mills processed a total of 1,112,100mt in FFB

for the first half of 2022, a 4% decrease compared to 1,156,500mt

for the same period last year.

Overall CPO produced for the first half of 2022 was 5% lower at

227,800mt from 238,700mt. The oil extraction rate for the first

half of 2022 was 20.5% compared to 20.6% in the same period last

year.

Commodity prices

The CPO price ex-Rotterdam for the first half of 2022 averaged

$1,640/mt, 46% higher than last year (H1 2021: $1,122/mt). The CPO

price started the year at $1,350/mt, gradually trending upwards to

peak in March 2022 at $2,000/mt before dropping to $1,420/mt

towards the middle of June, before recovering to close at $1,500/mt

at 30 June 2022. The rally in the first three months of 2022 was

built upon; speculation of unfavourable weather conditions in prime

soybean-producing countries which have adversely affected the

supply of soybean oil (of which CPO is the closest substitute), the

gradual re-opening of the world economy after the ravage of

Covid-19 and the disruption to supplies because of the

Russia-Ukraine conflict. The Indonesian government's move to ban

the export of CPO and refined palm oil from 28 April 2022 to 22 May

2022 added further volatility to global edible oil prices. CPO

prices have since retracted to lower levels due to high inventory

of CPO built up during the export ban. The Indonesian government is

constantly refining its policies to accelerate exports of CPO as

well as to contain the price of domestic cooking oil which could

trigger more volatility in prices.

Rubber price averaged $1,670/mt, 4% lower than H1 2021 at

$1,734/mt.

Development

The Group's planted areas at 30 June 2022 comprised:

Total Mature Immature

Continuing operations Ha ha Ha

North Sumatera 19,107 18,851 256

Bengkulu 16,557 14,912 1,645

Riau 4,836 4,836 -

Kalimantan 17,409 14,889 2,520

Bangka 2,564 1,065 1,499

Plasma 3,586 2,268 1,318

------- ------- ---------

Indonesia 64,059 56,821 7,238

Malaysia 3,453 3,453 -

------- ------- ---------

67,512 60,274 7,238

------- ------- ---------

Discontinued operations

South Sumatera 6,662 6,064 598

Plasma 1,065 1,020 45

------- ------- ---------

7,727 7,084 643

------- ------- ---------

Total: 30 June 2022 75,239 67,358 7,881

------- ------- ---------

Total: 31 December 2021 75,204 65,921 9,283

------- ------- ---------

Total: 30 June 2021 74,131 66,204 7,927

------- ------- ---------

The Group's new planting and replanting for the first six months

of 2022 totalled 439ha compared to 1,025ha for the same period last

year . In addition, Plasma planting for the period was 152ha (H1

2021: 187ha).

The Group remains optimistic that it will meet substantially its

reduced total planting target of 1,900ha (including replanting) in

2022. The Group's total landholding from its continuing operations

comprises some 90,690ha, of which the planted area stands at around

67,512ha (H1 2021: 66,623ha) with the balance of estimated

plantable land at 10,850ha (H1 2021: 11,590ha).

The construction of the seventh mill in North Sumatera, which

has been delayed by the frequent lockdowns caused by the pandemic

in the country, is nearing completion. It is making good progress

as most machineries have been prefabricated and are being assembled

on site. Some items like the steam turbine and decanter have

arrived at the local port and are awaiting delivery to the

construction site. The mill is expected to be completed before the

year end. The costs of construction have reached about $22 million

against an earlier estimate of $19 million.

In the meantime, an external consultant has been appointed to

undertake an environmental study to advise compliance criteria to

apply for the necessary permits to build the eighth mill in

Kalimantan.

Dividend

As in previous years, no interim dividend has been declared. A

final dividend of 5.0 cents per share in respect of the year ended

31 December 2021 was paid on 15 July 2022.

Outlook

CPO prices are expected to weaken in the second half of 2022 as

the industry enters into the high production season. In addition,

the Indonesian government's decision to waive the export levy until

the end of August 2022 in its effort to flush out and reduce its

stockpile of palm oil could push prices even lower. An agreement

between Ukraine and Russia to reopen the ports in the Black Sea to

allow the export of commodities, including sunflower oil, from the

region would also negatively impact on palm oil prices. Economists

fear that inflationary pressure arising from higher commodity

prices could trigger a worldwide recession in the coming months

which could dampen demand for CPO. It is increasingly apparent that

2022 will be a year of two halves, with record CPO prices in the

first half of 2022 and much lower prices in the second half. On a

positive note, the Indonesian government's determination to develop

and increase the biodiesel blending to B35 and B40 from B30 in the

near future would help enhance the domestic consumption and absorb

a higher production of CPO.

Tribute

The Board has previously announced its profound sadness of the

passing of our ex-Chairman, Madam Lim Siew Kim on 14 July 2022.

Madam Lim joined the Board in 1993 and was the Non-Executive

Chairman from 2011 until her recent retirement. During her tenure,

the Group grew in profitability and the business expanded to what

it is today. The Board of Directors had conveyed their condolences

to the family members at the time and would like to formally record

their appreciation and thanks for Madam Lim's invaluable guidance

and advice during her tenure on the Board.

Principal risks and uncertainties

The principal risks and uncertainties, including the risks due

to the Coronavirus pandemic, have broadly remained the same since

the publication of the annual report for the year ended 31 December

2021.

A more detailed explanation of the risks relevant to the Group

is on pages 42 to 47 and from pages 130 to 135 of the 2021 annual

report which is available at https:// www.angloeastern.co.uk /

.

Mr Jonathan Law Ngee Song

Chairman

25 August 2022

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with International Accounting Standards ("IAS") 34:

Interim Financial Reporting as adopted by the European Union;

b) The Chairman's interim statement includes a fair review of

the information required by Disclosure and Transparency Rule

("DTR") 4.2.7R (an indication of important events during the first

six months and a description of the principal risks and

uncertainties for the remaining six months of the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R ( material related party

transactions in the six months ended 30 June 2022 and any material

changes in the related party transactions described in the last

Annual Report) of the DTR of the United Kingdom Financial Conduct

Authority.

By order of the Board

Dato' John Lim Ewe Chuan

Executive Director, Corporate Finance and Corporate Affairs

25 August 2022

Condensed Consolidated Income Statement

2022 2021 2021

6 months to 30 June 6 months to 30 June (restated) Year to 31 December

(unaudited) (unaudited) (audited)

---------------------------------- ------------------------------------- --------------------------------

Notes Result

Result before Result

before BA BA BA BA before BA BA

movement* movement Total movement* movement Total movement* movement Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

----------------- ------- ---------- --------- ------------ ---------- ----------- ---------- --------- -------------

Continuing

operations

Revenue 4 249,229 - 249,229 197,678 - 197,678 433,421 - 433,421

Cost of sales (153,633) (5,314) (158,947) (139,743) 3,865 (135,878) (300,354) 4,349 (296,005)

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Gross profit 95,596 (5,314) 90,282 57,935 3,865 61,800 133,067 4,349 137,416

Administration

expenses (3,015) - (3,015) (3,317) - (3,317) (8,764) - (8,764)

Reversal of

impairment 622 - 622 133 - 133 5,437 - 5,437

Impairment losses (366) - (366) - - - (585) - (585)

(Provision) /

Reversal

for expected

credit

loss (6) - (6) (1) - (1) 177 - 177

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Operating profit 92,831 (5,314) 87,517 54,750 3,865 58,615 129,332 4,349 133,681

Exchange gains 311 - 311 298 - 298 212 - 212

Finance income 5 1,714 - 1,714 1,331 - 1,331 3,214 - 3,214

Finance expense 5 (8) - (8) (12) - (12) (24) - (24)

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit before tax 6 94,848 (5,314) 89,534 56,367 3,865 60,232 132,734 4,349 137,083

Tax expense 7 (21,865) 1,169 (20,696) (12,128) (854) (12,982) (24,784) (958) (25,742)

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit for the

period

from continuing

operations 72,983 (4,145) 68,838 44,239 3,011 47,250 107,950 3,391 111,341

( Loss) / gain on

discontinued

operations,

net of tax (297) (75) (372) (1,512) 67 (1,445) (28,471) 50 (28,421)

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

72,686 (4,220) 68,466 42,727 3,078 45,805 79,479 3,441 82,920

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit for the

period

attributable to:

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- Owners of the

parent 60,582 (3,551) 57,031 35,746 2,581 38,327 65,485 2,856 68,341

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- Non-controlling

interests 12,104 (669) 11,435 6,981 497 7,478 13,994 585 14,579

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

72,686 (4,220) 68,466 42,727 3,078 45,805 79,479 3,441 82,920

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit for the

period

from continuing

operations

attributable to:

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- Owners of the

parent 60,845 (3,480) 57,365 37,163 2,517 39,680 93,245 2,809 96,054

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- Non-controlling

interests 12,138 (665) 11,473 7,076 494 7,570 14,705 582 15,287

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

72,983 (4,145) 68,838 44,239 3,011 47,250 107,950 3,391 111,341

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Earnings per

share

attributable to

the

owners of the

parent

during the

period

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- basic and 9 143.89cts 96.70cts 172.42cts

diluted

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

Profit from

continuing

operations

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

- basic and 9 144.73cts 100.11cts 242.34cts

diluted

------------------ ------ ---------- --------- ----------- ------------ ---------- ----------- ---------- --------- -------------

* The total column represents the IFRS figures and the result

before BA movement is an Alternative Performance Measure ("APM")

which reflects the Group's results before the movement in fair

value of biological assets has been applied. We have opted to

additionally disclose this APM as the BA movement is considered to

be a fair value calculation which does not appropriately represent

the Group's result for the year.

Condensed Consolidated Statement of Comprehensive Income

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------------------------ ------------ ------------ ---------------

Profit for the period 68,466 45,805 82,920

------------------------------------------------------------ ------------ ------------ ---------------

Other comprehensive expenses:

Items may be reclassified to profit or loss:

Loss on exchange translation of foreign operations (22,933) (13,110) (5,429)

------------------------------------------------------------ ------------ ------------ ---------------

Net other comprehensive expenses may be reclassified

to profit or loss (22,933) (13,110) (5,429)

------------------------------------------------------------ ------------ ------------ ---------------

Items not to be reclassified to profit or loss:

Remeasurement of retirement benefits plan, net

of tax - - 1,086

------------------------------------------------------------ ------------ ------------ ---------------

Net other comprehensive income not being reclassified

to profit or loss - - 1,086

------------------------------------------------------------ ------------ ------------ ---------------

Total other comprehensive expenses for the period,

net of tax (22,933) (13,110) (4,343)

Total comprehensive income for the period 45,533 32,695 78,577

Attributable to:

- Owners of the parent 38,570 27,815 64,993

- Non-controlling interests 6,963 4,880 13,584

------------------------------------------------------------ ------------ ------------ ---------------

45,533 32,695 78,577

------------------------------------------------------------ ------------ ------------ ---------------

Condensed Consolidated Statement of Financial Position

2022 2021 2021

as at 30 June as at 30 June as at 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------ -------------- -------------- ------------------

Non-current assets

Property, plant and equipment 259,545 275,177 260,532

Investment 49 - 49

Receivables 22,591 24,153 22,000

Deferred tax assets 1,674 14,730 4,324

------------------------------------------- -------------- -------------- ------------------

283,859 314,060 286,905

------------------------------------------ -------------- -------------- ------------------

Current assets

Inventories 41,012 15,038 14,316

Income tax receivables 4,766 10,034 5,072

Other tax receivables 52,054 34,717 45,423

Biological assets 7,133 12,443 12,803

Trade and other receivables 4,457 5,492 5,182

Short-term investments 59,495 1,539 1,439

Cash and cash equivalents 187,339 159,140 218,249

------------------------------------------- -------------- -------------- ------------------

356,256 238,403 302,484

Assets in disposal groups classified

as held for sale 13,000 - 13,210

------------------------------------------- -------------- -------------- ------------------

369,256 238,403 315,694

------------------------------------------ -------------- -------------- ------------------

Current liabilities

Trade and other payables (40,175) (27,223) (32,533)

Income tax liabilities (11,474) (11,863) (13,139)

Other tax liabilities (566) (1,171) (1,615)

Dividend payables (2,007) (420) (25)

Lease liabilities (152) (244) (240)

------------------------------------------- -------------- -------------- ------------------

(54,374) (40,921) (47,552)

------------------------------------------ -------------- -------------- ------------------

Net current assets 314,882 197,482 268,142

------------------------------------------- -------------- -------------- ------------------

Non-current liabilities

Deferred tax liabilities (1,259) (625) (1,330)

Retirement benefits - net liabilities (12,089) (14,220) (11,499)

Lease liabilities (68) (90) (110)

------------------------------------------- -------------- -------------- ------------------

(13,416) (14,935) (12,939)

------------------------------------------ -------------- -------------- ------------------

Net assets 585,325 496,607 542,108

------------------------------------------- -------------- -------------- ------------------

Issued capital and reserves attributable

to owners of the parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium 23,935 23,935 23,935

Capital redemption reserve 1,087 1,087 1,087

Exchange reserves (260,368) (248,111) (241,907)

Retained earnings 697,631 611,608 642,582

------------------------------------------- -------------- -------------- ------------------

476,618 402,852 440,030

Non-controlling interests 108,707 93,755 102,078

------------------------------------------- -------------- -------------- ------------------

Total equity 585,325 496,607 542,108

------------------------------------------- -------------- -------------- ------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

Capital Non-controlling

Share Treasury Share redemption Exchange Retained interests Total

capital shares premium reserve Reserves earnings Total equity

$000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- --------

Balance at 31 December 2020 15,504 (1,171) 23,935 1,087 (237,599) 573,677 375,433 88,875 464,308

Items of other comprehensive

income:

* Remeasurement of retirement benefits plan, net of

tax - - - - - 960 960 126 1,086

* Loss on exchange translation of foreign operations - - - - (4,308) - (4,308) (1,121) (5,429)

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Total other comprehensive

(expenses) / income - - - - (4,308) 960 (3,348) (995) (4,343)

Profit for the year - - - - - 68,341 68,341 14,579 82,920

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Total comprehensive (expenses)

/ income for the year - - - - (4,308) 69,301 64,993 13,584 78,577

Dividends paid - - - - - (396) (396) (381) (777)

----------------------------------------------------------

Balance at 31 December

2021 15,504 (1,171) 23,935 1,087 (241,907) 642,582 440,030 102,078 542,108

--------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Items of other comprehensive

income:

-Remeasurement of retirement

benefits plan, net of tax - - - - - - - - -

-Loss on exchange translation

of foreign operations - - - - (18,461) - (18,461) (4,472) (22,933)

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Total other comprehensive

(expenses) / income - - - - (18,461) - (18,461) (4,472) (22,933)

Profit for the period - - - - - 57,031 57,031 11,435 68,466

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Total comprehensive (expenses)

/ income for the period - - - (18,461) 57,031 38,570 6,963 45,533

Dividends payable - - - - - (1,982) (1,982) (334) (2,316)

Balance at 30 June 2022 15,504 (1,171) 23,935 1,087 (260,368) 697,631 476,618 108,707 585,325

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Attributable to owners of the parent

Capital Non-controlling

Share Treasury Share redemption Exchange Retained interests Total

capital shares premium reserve reserves earnings Total Equity

$000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December

2020 15,504 (1,171) 23,935 1,087 (237,599) 573,677 375,433 88,875 464,308

Items of other comprehensive

income:

* Loss on exchange translation of foreign operations - - - - (10,512) - (10,512) (2,598) (13,110)

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Total other comprehensive

expenses - - - - (10,512) - (10,512) (2,598) (13,110)

Profit for the period - - - - - 38,327 38,327 7,478 45,805

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Total comprehensive (expenses)

/ income for the period - - - - (10,512) 38,327 27,815 4,880 32,695

Dividends payable - - - - - (396) (396) - (396)

Balance at 30 June 2021

(after restatement) 15,504 (1,171) 23,935 1,087 (248,111) 611,608 402,852 93,755 496,607

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Condensed Consolidated Statement of Cash Flows

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

-------------------------------------- ------------ ------------ ---------------

Cash flows from operating

activities

Profit before tax 89,534 60,232 137,083

Adjustments for:

Biological assets movement 5,314 (3,865) (4,349)

(Gain) / Loss on disposal

of property, plant and equipment (49) (1) 24

Depreciation 8,370 8,460 16,994

Retirement benefit provisions 1,100 1,222 103

Net finance income (1,706) (1,319) (3,190)

Unrealised gain in foreign

exchange (311) (298) (212)

Property, plant and equipment

written off 80 169 72

Reversal of impairment (256) (133) (4,852)

Provision / (Reversal) for

expected credit loss 6 1 (177)

Operating cash flows before

changes in working capital 102,082 64,468 141,496

(Increase) in inventories (27,157) (2,579) (2,649)

Decrease / (Increase) in

non-current, trade and other

receivables 584 (3,322) (517)

Increase in trade and other

payables 8,849 1,039 6,683

-------------------------------------- ------------ ------------ ---------------

Cash inflows from operations 84,358 59,606 145,013

Retirement benefits paid (137) (132) (487)

Overseas tax paid (28,935) (1,286) (12,359)

-------------------------------------- ------------ ------------ ---------------

Operating cash flows from

continuing operations 55,286 58,188 132,167

Operating cash flows (used

in) / from discontinued

operations (850) 2,884 (821)

-------------------------------------- ------------ ------------ ---------------

Net cash flows from operating

activities 54,436 61,072 131,346

Investing activities

Property, plant and equipment

* purchases (17,763) (10,592) (26,374)

* sales 51 1 413

Interest received 1,714 1,331 3,214

Increase in receivables

from cooperatives under

plasma scheme (1,395) (2,032) (1,985)

Investment in share equity - - (49)

Placement of fixed deposits

with original maturity of

more than three months (59,495) - (1,439)

Withdrawal of fixed deposits

with original maturity of

more than three months 1,439 418 1,957

-------------------------------------- ------------ ------------ ---------------

Cash used in investing activities

from continuing operations (75,449) (10,874) (24,263)

Cash used in investing activities

from discontinued operations (887) (2,988) (1,594)

-------------------------------------- ------------ ------------ ---------------

Net cash used in investing

activities (76,336) (13,862) (25,857)

-------------------------------------- ------------ ------------ ---------------

Financing activities

Dividends paid to the holders

of the parent - - (395)

Dividends paid to non-controlling

interests (334) - (381)

Repayment of lease liabilities

- principal (112) (106) (228)

Repayment of lease liabilities

- interest (8) (12) (24)

-------------------------------------- ------------ ------------ ---------------

Cash used in financing activities

from continuing operations (454) (118) (1,028)

Cash used in financing activities

from discontinued operations - - -

-------------------------------------- ------------ ------------ ---------------

Net cash used in financing

activities (454) (118) (1,028)

-------------------------------------- ------------ ------------ ---------------

Net (decrease) / increase

in cash and cash equivalents (22,354) 47,092 104,461

Cash and cash equivalents

At beginning of period 218,249 115,211 115,211

Exchange losses (8,556) (3,163) (1,423)

-------------------------------------- ------------ ------------ ---------------

At end of period 187,339 159,140 218,249

-------------------------------------- ------------ ------------ ---------------

Comprising:

Cash at end of period 187,339 159,140 218,249

-------------------------------------- ------------ ------------ ---------------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34, "Interim Financial Reporting".

They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the 2021 Annual Report. The financial

information for the half years ended 30 June 2022 and 30 June 2021

does not constitute statutory accounts within the meaning of

Section 434(3) of the Companies Act 2006 and has been neither

audited nor reviewed pursuant to guidance issued by the Auditing

Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with UK adopted International Accounting

Standards. The comparative financial information for the year ended

31 December 2021 included within this report does not constitute

the full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2021 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for 2021 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under Sections 498(2) or 498(3) of the

Companies Act 2006.

The Directors have a reasonable expectation, having made the

appropriate enquiries, that the Group has control of the monthly

cashflows and that the Group has sufficient cash resources to cover

the fixed cashflows for a period of at least 12 months from the

date of approval of this interim report. For these reasons, the

Directors adopted a going concern basis in the preparation of the

interim report. The Directors have made this assessment after

consideration of the Group's budgeted cash flows and related

assumptions including appropriate stress testing of identified

uncertainties, specifically on the potential shut down of the

entire operations if all the plantations are infected with

Coronavirus as well as the impact on the demand for palm oil due to

the Coronavirus pandemic. Stress testing of other identified

uncertainties was undertaken on primarily commodity prices and

currency exchange rates.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements.

2. Foreign exchange

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Closing exchange rates

Rp : $ 14,848 14,496 14,269

$ : GBP 1.21 1.38 1.35

RM : $ 4.41 4.15 4.17

Average exchange rates

Rp : $ 14,445 14,298 14,312

$ : GBP 1.30 1.39 1.38

RM : $ 4.27 4.10 4.15

3. Prior year restatement

With effect from 31 December 2021 and applied retrospectively,

the Group have opted for a change in accounting policy in respect

of the treatment of land in the Group's financial statements which

is accounted for in accordance with IAS 16 Property, Plant and

Equipment. The Group has historically recognised land under the

revaluation model however, following an analysis of the Group's

peers in the UK, it was apparent that the majority reported their

land at historical cost and therefore the decision was made to

change the accounting policy to make the financial information more

comparable and provide a more relevant result. Land has always been

recognised in the local Indonesian financial statements at

historical cost. The Group now recognises land at cost initially

and is not depreciated except for the land in Malaysia as the

possibility to renew the leasehold land in Malaysia is minimal.

The effects of the restatements are summarised as follows:

6 months to 30

June 2021

$000

Impact on consolidated income statement

Profit for the year before restatement 45,869

-----------------------

Effect of change in restatement:

Cost of sales (64)

------------------------------------------------------ ----------------------

(64)

---------------------------

Profit for the year after restatement 45,805

------------------------------------------------------ ----------------------

The effect of the prior year adjustments had a negative impact

on the earnings per share before BA of 0.08cts and a negative

impact on the earnings per share after BA of 0 .09 cts for the

period to 30 June 2021.

6 months to 30 June

2021

$000

Impact on consolidated statement of comprehensive income

Other comprehensive expenses for the year

before restatement (15,893)

-------------------------------------------------- ------------------------

Effect of change in restatement:

Unrealised gain on revaluation of leasehold

land, net of tax 1,014

Gain on exchange translation of foreign

operations 1,769

2,783

-------------------------------------------------- ------------------------

Other comprehensive expenses for the year

after restatement (13,110)

-------------------------------------------------- ------------------------

The following table summarises the impact of this prior year

restatement on the Consolidated Statement of Financial

Position:

Balance as Restated

reported balance

at

30 June 2021 30 June

2021

$000 Effect of $000

restatement

$000

Impact on consolidated statement

of financial position

Property, plant and equipment 356,170 (80,993) 275,177

Deferred tax assets 9,317 5,413 14,730

Deferred tax liabilities (14,659) 14,034 (625)

Revaluation reserves 48,465 (48,465) -

Exchange reserves (245,502) (2,609) (248,111)

Retained earnings 611,459 149 611,608

Non-controlling interests 104,376 (10,621) 93,755

The restatement of land from fair value to historical cost has

decreased the value of the property, plant and equipment and

eliminated the revaluation reserves. Deferred tax liabilities

previously recognised on the revaluation of land have been reversed

resulting in a decrease in deferred tax liabilities, but also an

increase in deferred tax assets where individual entities have

moved from a net deferred tax liability position to a net deferred

tax asset position. Depreciation of the land in Malaysia recognised

retrospectively and the reversal of the deferred tax liabilities

previously recognised has resulted in a small increase in retained

earnings. All entities for which these adjustments relate have

non-controlling interests and therefore the impact on those

non-controlling interests has also been recognised.

4. Revenue

Disaggregation of Revenue

The Group has disaggregated revenue into various categories in

the following table which is intended to:

-- Depict how the nature, amount and uncertainty of revenue and

cash flows are affected by timing of revenue recognition; and

-- Enable users to understand the relationship with revenue

segment information provided in note 6.

There is no right of return and warranty provided to the

customers on the sale of products and services rendered.

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2022 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 540 - 540

Non-government

- Wholesalers 245,456 280 2,605 24 - 324 248,689

---------- --------- -------- ---------- ---------- --------- ----------

245,456 280 2,605 24 540 324 249,229

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 3,569 280 - - - - 3,849

Delivery to port of

departure - - - 24 - - 24

Customer collect from

our mills / estates 241,887 - 2,605 - - - 244,492

Upon generation /

others - - - - 540 324 864

---------- --------- -------- ---------- ---------- --------- ----------

245,456 280 2,605 24 540 324 249,229

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2021 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 423 - 423

Non-government

- Wholesalers 194,213 356 2,187 218 - 281 197,255

194,213 356 2,187 218 423 281 197,678

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 2,304 356 - - - - 2,660

Delivery to port of

departure - - - 218 - - 218

Customer collect from

our mills / estates 191,909 - 2,187 - - - 194,096

Upon generation / others - - - - 423 281 704

194,213 356 2,187 218 423 281 197,678

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

Year to 31 December kernel Rubber Shell Biomass Biogas Others

2021 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 999 - 999

Non-government

- Wholesalers 426,436 695 4,036 336 - 919 432,422

---------- --------- -------- ---------- ---------- --------- ----------

426,436 695 4,036 336 999 919 433,421

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 4,995 695 - - - - 5,690

Delivery to port of

departure - - - 336 - - 336

Customer collect from

our mills / estates 421,441 - 4,036 - - - 425,477

Upon generation / others - - - - 999 919 1,918

---------- --------- -------- ---------- ---------- --------- ----------

426,436 695 4,036 336 999 919 433,421

---------- --------- -------- ---------- ---------- --------- ----------

5. Finance income and expense

2022 2021 2021

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Finance income

Interest receivable on:

Credit bank balances and time

deposits 1,714 1,331 3,214

Finance expense

Interest payable on:

Interest expense on lease liabilities (8) (12) (24)

------------ ------------ ---------------

(8) (12) (24)

------------ ------------ ---------------

Net finance income recognized

in income statement 1,706 1,319 3,190

------------ ------------ ---------------

6. Segment information

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2022

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 82,911 70,778 42,666 1,662 45,875 243,892 1,564 - 245,456 5,290

* Rubber 280 - - - - 280 - - 280 -

* Shell nut 1,017 614 909 - 65 2,605 - - 2,605 -

* Biomass products 24 - - - - 24 - - 24 -

* Biogas products 149 241 - - 150 540 - - 540 -

* Others 110 49 36 20 106 321 3 - 324 63

Total revenue 84,491 71,682 43,611 1,682 46,196 247,662 1,567 - 249,229 5,353

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- ---------

Profit / (loss)

before

tax 35,009 23,688 14,233 484 22,156 95,570 (87) (635) 94,848 401

BA movement (1,523) (1,176) (872) (114) (1,645) (5,330) 16 - (5,314) (96)

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- ---------

Profit / (loss) for

the

period before tax

per consolidated

income statement 33,486 22,512 13,361 370 20,511 90,240 (71) (635) 89,534 305

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- ---------

Interest income 1,180 429 85 - 17 1,711 3 - 1,714 2

Interest expense (4) - - - - (4) (4) - (8) -

Depreciation (2,669) (1,969) (411) (196) (2,963) (8,208) (162) - (8,370) -

Reversal of

impairment - - - - 622 622 - - 622 -

Impairment losses - - - - - - (366) - (366) -

(Provision) /

Reversal

of expected credit

loss (10) (1) - 1 2 (8) - 2 (6) (9)

Inter-segment

transactions 2,503 (988) (283) (149) (1,004) 79 299 10 388 (388)

Inter-segmental

revenue 25,434 580 - - 5,527 31,541 - - 31,541 4,608

Tax expense (8,617) (4,864) (2,873) (52) (3,998) (20,404) (119) (173) (20,696) 339

Total assets 273,345 135,559 42,725 17,045 151,209 619,883 12,735 6,613 639,231 13,884

Property, plant and

equipment 81,387 41,272 8,206 14,938 105,917 251,720 7,825 - 259,545 4,726

Non-current assets

- additions 10,146 2,897 201 773 3,707 17,724 39 - 17,763 367

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2021

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 57,451 66,910 31,239 925 36,442 192,967 1,246 - 194,213 3,339

* Rubber 356 - - - - 356 - - 356 -

* Shell nut 663 648 746 - 130 2,187 - - 2,187 -

* Biomass products 218 - - - - 218 - - 218 -

* Biogas products - 220 - - 203 423 - - 423 -

* Others 45 48 21 11 143 268 13 - 281 88

Total revenue 58,733 67,826 32,006 936 36,918 196,419 1,259 - 197,678 3,427

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Profit / (loss)

before

tax 16,480 16,640 8,441 131 15,503 57,195 (232) (596) 56,367 (2,198)

BA movement 1,550 770 206 54 1,132 3,712 153 - 3,865 86

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Profit / (loss) for

the

period before tax

per consolidated

income statement 18,030 17,410 8,647 185 16,635 60,907 (79) (596) 60,232 (2,112)

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Interest income 969 297 52 - 10 1,328 3 - 1,331 2

Interest expense (9) - - - - (9) (3) - (12) -

Depreciation (2,601) (2,075) (452) (172) (2,829) (8,129) (331) - (8,460) (982)

Reversal of

impairment - - - - 133 133 - - 133 -

Impairment losses - - - - - - - - - (79)

(Provision) /

Reversal

of expected credit

loss - (1) - - (1) (2) - 1 (1) 1

Inter-segment

transactions 2,549 (1,002) (288) (141) (968) 150 218 10 378 (378)

Inter-segmental

revenue 18,561 637 - - 4,075 23,273 - - 23,273 3,140

Tax expense (4,484) (3,402) (1,800) (17) (3,153) (12,856) (127) (1) (12,984) 670

Total assets 213,172 97,145 28,481 16,227 138,868 493,893 13,746 6,846 514,485 37,978

Property, plant and

equipment 73,013 41,130 8,875 14,245 102,175 239,438 9,137 - 248,575 26,602

Non-current assets

- additions 2,683 2,285 391 930 3,949 10,238 370 - 10,608 1,308

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2021 (audited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 127,216 141,070 73,827 2,178 79,470 423,761 2,675 - 426,436 7,999

* Rubber 695 - - - - 695 - - 695 -

* Shell nut 1,173 1,191 1,440 - 232 4,036 - - 4,036 -

* Biomass products 336 - - - - 336 - - 336 -

* Biogas products 114 485 - - 400 999 - - 999 -

* Others 93 20 89 16 583 801 27 91 919 270

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Total revenue 129,627 142,766 75,356 2,194 80,685 430,628 2,702 91 433,421 8,269

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Profit / (loss)

before

tax 40,160 35,769 20,555 553 37,539 134,576 (517) (1,325) 132,734 (4,786)

BA movement 1,660 700 574 111 1,273 4,318 31 - 4,349 64

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Profit / (loss) for

the

year before tax

per consolidated

income statement 41,820 36,469 21,129 664 38,812 138,894 (486) (1,325) 137,083 (4,722)

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Interest income 2,323 720 133 1 22 3,199 15 - 3,214 5

Interest expense (15) - - - - (15) (9) - (24) -

Depreciation (5,270) (4,132) (905) (356) (5,660) (16,323) (671) - (16,994) (1,978)

Reversal of

impairment - - - - 5,437 5,437 - - 5,437 -

Impairment losses - - - - (452) (452) (133) - (585) (716)

(Provision) /

Reversal

for expected

credit loss (4) - - - 180 176 - 1 177 (1,231)

Inter-segment

transactions 902 (2,001) (11,754) (282) (1,934) (15,069) 476 74 (14,519) 14,519

Inter-segmental

revenue 42,566 2,641 - - 9,431 54,638 - - 54,638 7,438

Tax expense (8,939) (7,831) (2,153) (109) (6,379) (25,411) (112) (219) (25,742) (1,927)

Total assets 252,633 117,748 34,580 17,095 145,578 567,634 13,758 7,152 588,544 14,055

Property, plant and

equipment 77,170 42,027 8,751 14,960 108,844 251,752 8,780 - 260,532 5,653

Non-current assets

-

additions 8,490 4,727 608 1,600 7,072 22,497 517 - 23,014 3,424

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

In the 6 months to 30 June 2022, revenue from 4 customers of the

Indonesian segment represent approximately $156.8m (H1 2021:

$112.6m) of the Group's total revenue. In the year 2021, revenue

from 4 customers of the Indonesian segment represent approximately

$266.3m of the Group's total revenue. An analysis of this revenue

is provided below. Although Customers 1 to 2 each contribute over

10% of the Group's total revenue, there was no over reliance on

these Customers as tenders were performed on a weekly basis. Three

of the top four customers were the same as in the year to 31

December 2021.

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 89.7 36.0 53.7 27.2 120.9 27.8

Customer 2 31.0 12.4 23.5 11.9 50.8 11.8

Customer 3 18.5 7.4 18.4 9.3 48.3 11.2

Customer 4 17.6 7.0 17.0 8.6 46.3 10.7

------------------ --------- --------- ---------- -------- -------- --------

Total 156.8 62.8 112.6 57.0 266.3 61.5

------------------ --------- --------- ---------- -------- -------- --------

7. Tax expense

2022 2021 2021

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Foreign corporation tax

- current year 18,224 13,194 20,404

Foreign corporation tax

- prior year (57) - 258

Deferred tax adjustment

- origination and reversal

of temporary differences 2,529 (212) 5,080

Recognition of previously

unrecognised deferred tax -

assets - -

20,696 12,982 25,742

------------ ------------ ---------------

Corporation tax rate in Indonesia is at 22% (H1 2021: 22%, 2021:

22%) whereas Malaysia is at 24% (H1 2021: 24%, 2021: 24%). The

standard rate of corporation tax in the UK for the current year is

19% (H1 2021: 19%, 2021: 19%).

8. Dividend

The final and only dividend in respect of 2021, amounting to 5.0

cents per share, or $1,981,819 was paid on 15 July 2022 (2020: 1.0

cents per share, or $396,364, paid on 16 July 2021). As in previous

years, no interim dividend has been declared.

9. Earnings per ordinary share ("EPS")

2022 2021 2021

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Total operations

Profit for the period attributable

to owners of the Company before

BA movement 60,582 35,746 65,485

BA movement (3,551) 2,581 2,856

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 57,031 38,327 68,341

------------ ------------ ---------------

Continuing operations

Profit for the period attributable

to owners of the Company before

BA movement 60,845 37,163 93,245

BA movement (3,480) 2,517 2,809

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 57,365 39,680 96,054

------------ ------------ ---------------

Discontinued operations

Profit for the period attributable

to owners of the Company before

BA movement (263) (1,417) (27,760)

BA movement (71) 64 47

------------ ------------ ---------------

Earnings used in basic and

diluted EPS (334) (1,353) (27,713)

------------ ------------ ---------------

Number Number Number

'000 '000 '000

Weighted average number of

shares in issue in the period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of outstanding

share options - - -

------------ ------------ ---------------

- used in diluted EPS 39,636 39,636 39,636

------------ ------------ ---------------

Total operations

- Basic and diluted EPS before

BA movement 152.85cts 90.19cts 165.22cts

- Basic and diluted EPS after

BA movement 143.89cts 96.70cts 172.42cts

Continuing operations

- Basic and diluted EPS before

BA movement 153.51cts 93.76cts 235.25cts

- Basic and diluted EPS after

BA movement 144.73cts 100.11cts 242.34cts

Discontinued operations

- Basic and diluted EPS before

BA movement (0.66)cts (3.58)cts (70.04)cts

- Basic and diluted EPS after

BA movement (0.84)cts (3.41)cts (69.92)cts

10. Fair value measurement of financial instruments

The carrying amounts and fair values of the financial

instruments which are not recognised at fair value in the Statement

of Financial Position are exhibited below:

2022 2021 2021

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

$000 $000 $000 $000 $000 $000

Non-current

receivables

Due from non-controlling

interests 5,345 3,016 5,413 3,032 5,459 3,042

Due from cooperatives

under Plasma

scheme 17,246 12,373 18,740 17,061 19,879 13,122

--------- ------- --------- ------- ---------- ----------

22,591 15,389 24,153 20,093 25,338 16,164

Transfer to assets

held for sale - - - - (3,338) (2,079)

--------- ------- --------- ------- ---------- ----------

22,591 15,389 24,153 20,093 22,000 14,085

--------- ------- --------- ------- ---------- ----------

Financial instruments not measured at fair value include cash

and cash equivalents, trade and other receivables, trade and other

payables, and borrowings due within one year.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, trade and other

payables and borrowings due within one year approximates their fair

value.

All non-current assets, non-current receivables and long-term

loan are classified as Level 3 in the fair value hierarchy.

The valuation techniques and significant unobservable inputs

used in determining the fair value measurement of non-current

receivables and borrowings due after one year, as well as the

inter-relationship between key unobservable inputs and fair value,

are set out in the table below:

Item Valuation approach Inputs Inter-relationship

used between key unobservable

inputs and fair

value

----------------- ------------------------- --------- ---------------------------

Non-current receivables

Due from Based on cash flows Discount The higher the

non-controlling discounted using rate discount rate,

interests current lending rate the lower the

of 6% (H1 2021 and fair value.

2021: 6%).

Due from Based on cash flows Discount The higher the

cooperatives discounted using rate discount rate,

under Plasma an estimated current the lower the

scheme lending rate of 7.00% fair value.

(H1 2021: 6.75%,

2021: 7.00%).

11. Report and financial information

Copies of the interim report for the Group for the period ended

30 June 2022 are available on the AEP website at

https://www.angloeastern.co.uk/.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUCURUPPGUA

(END) Dow Jones Newswires

August 25, 2022 06:06 ET (10:06 GMT)

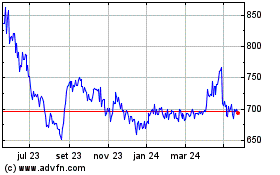

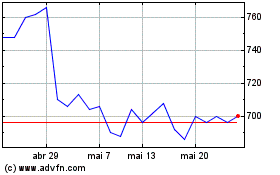

Anglo-eastern Plantations (LSE:AEP)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Anglo-eastern Plantations (LSE:AEP)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024