TIDMAJAX

RNS Number : 0684I

Ajax Resources PLC

30 November 2022

November 30, 2022

AJAX RESOURCES PLC

("Ajax" or the "Company")

Interim Results for the period ended August 31, 2022

Ajax [LSE: AJAX], the UK listed special purpose acquisition

company with a focus on natural resources, is pleased to publish

its unaudited interim financial statements for the six months ended

August 31, 2022 (the "Interim Results"). A copy of the Interim

Results will shortly be available for download on the Company's

website, www.ajaxresources.com , and can also be viewed here:

http://www.rns-pdf.londonstockexchange.com/rns/0684I_1-2022-11-30.pdf

Key elements from the Interim Results have been extracted and

can be viewed below.

-S -

Further Information:

Ajax Resources Plc Tel: + 44 (0) 208 146 6345

Ippolito Cattaneo, Chief info@ajaxresources.com

Executive Officer

Clear Capital Markets (Corporate Tel: +44 (0)20 3869 6080

Broker) keithswann@clear-cm.co.uk;

Jonathan Critchley/ Keith jonathancritchley@clear-cm.co.uk

Swann

----------------------------------

Allenby Capital Limited Tel: + 44 (0) 203 328 5656

(Financial Adviser) n.harriss@allenbycapital.com

Nick Harriss

----------------------------------

Chairman's Statement

The energy transition from fossil fuels towards a low-carbon

economy has created a growing number of attractive opportunities

for junior independent energy companies, both in the renewable and

non-renewable domains.

We have maintained an open approach in our assessment of various

opportunities across the natural resource spectrum, ranging from

battery metals such as Lithium and Cobalt, to Critical Metals, as

well as Hydrocarbons. This is because our assessment strategy has

been guided by an overreaching attention towards achieving the most

commercially advantageous transaction to achieve Ajax's long-term

growth in accordance with stringent due diligence criteria.

The Company's management is, as outlined in Ajax's IPO

prospectus document, engaged in seeking to identify and acquire a

target company or business that can return significant value to

shareholders by enabling Ajax to become a revenue generating,

fully-fledged natural resource production and exploration entity

with significant potential.

I am pleased to report that during the period, in view of our

current development stage, effective cost control has been

rigorously enforced and will continue to be maintained until such

time as an acquisition is identified and completed.

It is the Board's opinion, in consideration of the opportunities

currently under review, that Ajax is well positioned to achieve

transformational growth once it successfully completes an

acquisition.

We thank shareholders for their continued support, evidenced by

the Company's recent share price performance, and we look forward

to building on this momentum as we move forward in taking Ajax to

the next key milestone in its development.

Michael Hutchinson, Non-Executive Chairman

November 30, 2022

STATEMENT OF COMPREHENSIVE INCOME

Notes 31/08/2022 28/02/2022

Unaudited Audited

6 months GBP FY

GBP

------------------------------------- ------ -------------- -----------

Revenue -

Cost of sales -

------------------------------------- ------ -------------- -----------

Gross profit - -

Administrative expenses (97,876) (79,625)

------------------------------------- ------ -------------- -----------

Operating loss and loss before

income tax 4 (97,876) (79,625)

Taxation 5 -

Loss and total comprehensive loss

for the period (97,876) (79,625)

------------------------------------- ------ -------------- -----------

Loss per share (basic and diluted)

attributable to the equity holders

(pence) 6 (0.21) (0.66)

------------------------------------- ------ -------------- -----------

The notes to the financial statements form an integral part of

these financial statements.

STATEMENT OF FINANCIAL POSITION

Notes 31/08/2022 28 February 2022

Unaudited 6 months Audited FY

GBP GBP

----------------------------- ----- ------------------- ----------------

Current assets

Receivables 8 - 663,585

VAT Credit 8 25,884 11,952

Cash and cash equivalents 9 1,249,546 -

----------------------------- ----- ------------------- ----------------

1,275,430 675,537

Total assets 1,275,430 675,537

----------------------------- ----- ------------------- ----------------

Equity

Ordinary shares 10 1,436,660 120,000

Retained earnings/(loss) (177,501) (79,625)

----------------------------- ----- ------------------- ----------------

Total equity 1,259,159 40,375

Current Liability

Other payables 16,271 635,162

Total equity and liabilities 1,275,430 675,537

----------------------------- ----- ------------------- ----------------

The notes to the financial statements form an integral part of

these financial statements.

These financial statements were approved by the board of

directors and recognized for issue on 30 November 2022, and are

signed on its behalf by:

Michel Hutchinson

Chairman & Director

Company Registration No. 13467546

STATEMENT OF CHANGES IN EQUITY

Ordinary Retained

share capital losses Total

GBP GBP GBP

---------------------------------------------------- --------------- ---------- ----------

Balance at incorporation at 21 June 2021 12,500 - 12,500

---------------------------------------------------- --------------- ---------- ----------

Share issue 107,500 - 107,500

Loss and total comprehensive loss for the period - (79,625) (79,625)

---------------------------------------------------- --------------- ---------- ----------

Balance at 28 February 2022 120,000 (79,625) 40,375

---------------------------------------------------- --------------- ---------- ----------

Share issue 1,342,000 - 1,342,000

Share issue costs (25,340) (25,340)

Loss and total comprehensive income for the period - (97,876) (97,876)

---------------------------------------------------- --------------- ---------- ----------

Balance at 28 February 2022 1,436,660 (177,501) 1,259,159

---------------------------------------------------- --------------- ---------- ----------

Share capital is the amount subscribed for shares at nominal

value.

The retained earnings represent the cumulative results of the

company attributable to equity shareholders.

STATEMENT OF CASH FLOWS

31/08/2022 28 February 2022

Unaudited 6 months Audited FY

GBP GBP

Cash flows from operating activities

Loss before tax (97,876) (79,625)

(Increase)/Decrease in receivables 11,952 (11,952)

Increase/(Decrease) in payables (6,109) 10,162

------------------------------------------------------------------ --------------------- -----------------

Net cash used in operating activities (92,033) (81,415)

------------------------------------------------------------------ --------------------- -----------------

Cash flows from investing activities -

Net cash used in investing activities -

----------------------------------------------------------------- --------------------- -----------------

Cash flows from financing activities

Proceeds from the issue of ordinary shares (net of issue costs) 1,341,579 81,415

Net cash from financing activities 1,341,579 81,415

------------------------------------------------------------------ --------------------- -----------------

Net increase / (decrease) in cash and cash equivalents 1,249,546 -

Cash and cash equivalents at the start of the period - -

------------------------------------------------------------------ --------------------- -----------------

Cash and cash equivalents at the end of the period 1,249,546 -

------------------------------------------------------------------ -------------------- -----------------

Cautionary Statement

The Interim Results have been prepared solely to provide

additional information to shareholders to assess the Company's

strategy and performance. The Interim Results should not be relied

on by any other party or for any other purpose.

The Interim Results are unaudited and do not constitute full

accounts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFVTLRLIVIF

(END) Dow Jones Newswires

November 30, 2022 13:30 ET (18:30 GMT)

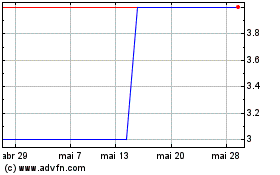

Ajax Resources (LSE:AJAX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Ajax Resources (LSE:AJAX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024