Alumasc Group PLC Acquisition of ARP Group (0220H)

25 Julho 2023 - 3:00AM

UK Regulatory

TIDMALU

RNS Number : 0220H

Alumasc Group PLC

25 July 2023

25 July 2023

The Alumasc Group plc

("Alumasc" the "Group", or the "Company")

Acquisition of ARP Group

Accelerating the growth strategy through M&A

Alumasc, the sustainable building products, systems and

solutions group, is pleased to announce that it has agreed, subject

to regulatory approval, to acquire the entire issued share capital

of ARP Group(1) ("ARP"), a manufacturer and distributor of

specialist metal rainwater and architectural aluminium goods, for a

maximum cash consideration of GBP10.0m on a cash and debt free

basis, and subject to adjustments for normalised working capital

(the "Acquisition"). The consideration comprises an initial

GBP8.5m, adjusted for net cash/debt and normalised working capital,

payable at completion; with additional consideration, capped at

GBP1.5m, payable subject to ARP's performance over the two years

ending November 2024.

ARP marks the first acquisition by Alumasc since 2018 and

demonstrates the Group's strategy to supplement organic growth

through earnings accretive acquisitions. ARP shares many qualities

with Alumasc, including strong relationships with contractors which

will complement Alumasc's business model. ARP will broaden the

Group's existing product offerings, and augment the routes to

market and bring attractive scaling opportunities for both

businesses.

Based in Leicester, ARP was established in 1987, and operates

from four facilities totalling over 47,000 square feet, with a team

of over 70 experienced staff. ARP's consolidated unaudited results

for the year ended February 2023 showed revenue of GBP10.8m and

adjusted EBITDA of GBP1.3m. Consolidated net assets were GBP4.5m.

The acquisition multiple based on the initial consideration is

approximately 6.8x, which is expected to reduce to below 5.0x over

the medium term, assuming full payment of the earn out

consideration, and achievement of expected operating synergies.

ARP is expected to be immediately accretive to underlying

earnings and will be funded from current cash and debt facilities.

Following completion of the Acquisition, Alumasc's balance sheet

will remain strong, with 30 June 2023 pro-forma net debt

representing approximately 0.75x EBITDA.

The Acquisition remains conditional upon the UK Competition and

Markets Authority ("CMA") having indicated that it has no further

questions in relation to the Company's submission regarding the

Acquisition, and that it does not intend to make a Phase 2

referral. The Directors expect this process to conclude, and the

Acquisition to complete, within 3 months of today's date. Further

announcements will be made as appropriate.

Paul Hooper, Chief Executive of Alumasc, said: "We are delighted

to welcome ARP, along with all our new colleagues to the Alumasc

Group. This acquisition aligns with our strategy of accelerating

our organic growth with complementary bolt-on acquisitions. ARP

will broaden the Group's existing product offerings, and augment

the routes to market for both businesses."

(1) ARP Group comprises ARP Group Holdings Ltd and its

subsidiary Aluminium Roofline Products Ltd; together with Rainwater

Online Holdings Ltd and its subsidiaries Envelope Solutions Ltd and

Cast Iron Superstore Ltd.

For further information, visit the ARP website at

https://www.arp-ltd.com/

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligations under Article 17 of those

Regulations. The person responsible for making this announcement on

behalf of the Company is Helen Ashton, Group Company Secretary.

END

Enquiries:

The Alumasc Group plc

Paul Hooper (Chief Executive) +44 (0)1536 383844

Simon Dray (Group Finance Director)

Peel Hunt (Broker)

Mike Bell +44 (0)207 418 8831

Ed Allsopp

finnCap (Nominated Adviser)

Julian Blunt +44 (0)207 220 0561

Camarco:

Ginny Pulbrook +44 (0)203 757 4992

Rosie Driscoll +44 (0) 203 757 4981

alumasc@camarco.co.uk

LEI: 2138002MV11VKZFJ4359

Notes to Editors:

Alumasc is a UK-based supplier of premium building products,

systems, and solutions. Almost 80% of group sales are driven by

building regulations and specifications (architects and structural

engineers) because of the performance characteristics offered.

The Group has three business segments with strong positions and

brands in their individual markets. The three segments are:

Building Envelope; Water Management; and Housebuilding

Products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUSOBROWUBUAR

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

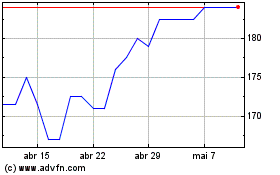

Alumasc (LSE:ALU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Alumasc (LSE:ALU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025