Alumasc Group PLC AGM Trading Update (3020R)

26 Outubro 2023 - 3:00AM

UK Regulatory

TIDMALU

RNS Number : 3020R

Alumasc Group PLC

26 October 2023

26 October 2023

THE ALUMASC GROUP PLC

('Alumasc' or 'the Group')

AGM Trading Update

Resilient performance, full year expectations unchanged

Alumasc, the premium sustainable building products, systems and

solutions group, provides the following trading update ahead of its

Annual General Meeting, to be held this morning at 10am:

The Group is pleased to report that, despite well-publicised

market headwinds, trading has remained resilient, and performance

in the first quarter of the financial year ending 30 June 2024 has

been in line with the Board's expectations.

As expected, demand remains subdued in a number of construction

sectors, particularly in new build residential. Offsetting this,

the Group has seen an increase in overseas sales, including a

resumption in deliveries to the Chek Lap Kok airport expansion

project in Hong Kong. Demand for new products launched in the

Housebuilding Products division in the last eighteen months has

also been robust, helping to mitigate the general slowdown in new

housebuilding activity.

The Group continues to invest prudently in areas which enhance

revenue growth and improve customer service, operational

capability, efficiency and new product development. The Group also

continues to manage costs carefully while market conditions in some

parts of our business remain subdued, and management have

restructured the commercial and sales teams in the Water Management

division. This will deliver annualised savings of around GBP0.8m,

while simplifying the management structure and improving capability

and customer service.

The Group continues to engage with the Competition and Markets

Authority on its proposed acquisition of ARP Group, announced on 23

July 2023, and expects this process to conclude during December

2023.

The Group's balance sheet remains strong, with good cash

generation in the first three months of the new financial year,

supported by management's focus on working capital.

As noted, the Board is mindful of the current demand headwinds,

however it remains confident in the resilience of the Group's

business model and management's ability to take effective action to

reduce costs where necessary. Consequently their expectations for

the year ending 30 June 2024 remain unchanged.

Paul Hooper, Chief Executive of Alumasc, commented:

"I am pleased with the Group's performance, in challenging

trading conditions. Our excellent customer service and leading

positions in a diverse range of end markets provide resilience, and

we are continuing to progress our strategy, investing in areas

where we see growth opportunities while controlling costs prudently

where appropriate. With a strong balance sheet and a product

portfolio which delivers environmental benefits to our customers,

we remain well positioned to benefit from the eventual recovery in

our end markets."

Enquiries:

The Alumasc Group plc +44 (0)1536 383844

Paul Hooper (Chief Executive)

Simon Dray (Group Finance Director)

Peel Hunt LLP (Broker) +44 (0)207 418 8831

Mike Bell

Ed Allsopp

Cavendish Capital Markets Ltd (Nominated

Adviser) +44 (0)207 220 0561

Julian Blunt

Edward Whiley

Camarco (Financial PR)

Ginny Pulbrook +44 (0)203 757 4992

Rosie Driscoll +44 (0)203 757 4981

Email: alumasc@camarco.co.uk

Notes to Editors:

1 Alumasc is a UK-based supplier of premium sustainable building

products, systems and solutions. Almost 80% of Group sales are

driven by building regulations and specifications (architects and

structural engineers) because of the performance characteristics

offered.

2 The Group has three business segments with strong positions

and brands in their individual markets. The three segments are:

Water Management; Building Envelope; and Housebuilding

Products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEELFLXBLFFBF

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

Alumasc (LSE:ALU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

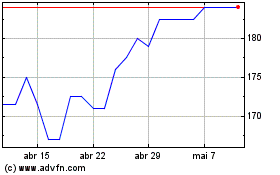

Alumasc (LSE:ALU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025