Barclays PLC - Re Analysts Mtg,etc-Replacmnt

06 Dezembro 1999 - 7:33AM

UK Regulatory

RNS Number:9848B

Barclays PLC

6 December 1999

The issuer has advised that the Barclays PLC 'Re Analysts Meeting etc'

announcement released at 07:01 today under RNS No 9569b contained typographical

errors. The full corrected text is shown below.

BARCLAYS PLC

PRE-CLOSE BRIEFINGS WITH ANALYSTS

Barclays PLC ("Barclays") will be meeting analysts ahead of its close period

for the year ended 31st December 1999.

In the third quarter of 1999, all the Group's businesses continued the good

performance experienced in the first half of 1999. Key trends affecting the

performance are as follows:

Net interest income: Within Retail Financial Services consumer lending growth

has continued, albeit at a slower rate than the first half of 1999 reflecting

lower market growth trends. At 30th September 1999, UK credit card receivable

outstandings were #6.1bn (30th June 1999: #5.8bn). In Corporate Banking there

has been modest growth in loans to corporates in the United Kingdom during the

third quarter of the year.

In the third quarter UK retail deposits have seen steady growth in line with

the market and at a similar rate to the first half of the year, while UK

corporate deposits remained broadly flat.

Within Retail Financial Services in the third quarter, the overall UK lending

margin improved slightly as a result of a change in business mix and the

overall UK deposit margin narrowed as a result of some pricing pressure.

During the third quarter in Corporate Banking, the overall UK lending margin

was broadly maintained and the overall UK deposit margin narrowed slightly.

Net fees and commissions: In Retail Financial Services, fees and commissions

continued to grow in the third quarter predominantly as a result of an

increase in assets under management during 1999. In Corporate Banking

improved levels of lending and acquisition finance fees reflected continued

growth in demand from corporates in the United Kingdom. Money transmission

income levels in Corporate Banking remained flat as a result of pricing

pressure and the switch to electronic products.

Barclays Capital produced good third quarter results, following its strong

performance in the first half of the year. Dealing profits are still expected

to be somewhat lower in the second half, reflecting an anticipated slow down

in market activity in the run up to the millennium.

Barclays Global Investors' assets under management at 31st October 1999 were

at a similar level to 30th June 1999 (#434bn). In this four month period,

underlying net new business and market growth was offset by adverse exchange

rate translation movements.

Group total costs of the ongoing business in 1999 are expected to be no higher

than the 1998 level (#4,877 million), excluding the restructuring charge in

respect of the programme to reduce job numbers primarily in Retail Financial

Services and Corporate Banking.

Provisions for bad and doubtful debts: The overall Group net charge for the

second half is expected to be at a similar level to the first half of 1999.

Weighted risk assets in the third quarter within Retail Financial Services and

Corporate Banking have continued to grow at a similar rate to the first half

1999. Barclays Capital continues to operate at weighted risk asset levels

between #30 billion and #35 billion.

Barclays completed its proposed #500 million share buy back programme for the

year, purchasing for cancellation 27.8 million of its ordinary shares.

In summary, Barclays continues to build on its strong first half performance,

is set to meet its objectives of growing income and controlling costs to

deliver a good performance for the year.

The 1999 full year results will be announced on Tuesday 15th February 2000.

For further information please contact:

Investor Relations Media Relations

Ian Roundell Leigh Bruce

0171 699 2961 0171 699 2658

Emma Savage Maria Darby

0171 699 2960 0171 699 2970

This document contains certain forward-looking statements with respect to the

financial condition and results of operations of Barclays, which by their

nature involve risk and uncertainty because they relate to events and depend

on circumstances that may occur in the future. There are a number of factors

that could cause actual results and developments to differ materially from

those expressed or implied by these forward-looking statements. These factors

include, but are not limited to, changes in economic conditions in countries

in which Barclays conducts its business and internationally elsewhere, as well

as future exchange and interest rates, interest margins, the level of deposits

taken and the level of lending by Barclays. A more detailed list of these

factors is contained on page 1 of Barclays Annual Report for 1998.

END

MSCANAKKKOKURRA

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

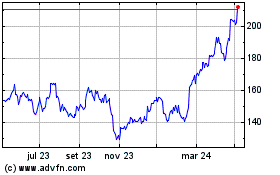

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024