RNS Number:5632F

Barclays PLC

15 February 2000

Part 3

ADDITIONAL INFORMATION

CHANGES IN REPORTING OF GROUP STRUCTURE IN 1999

Since 1st January 1999, a number of changes have been made to the Group's

reporting structure. Major changes, for which comparative figures have been

restated as appropriate, are:

Retail Financial Services has re-organised the management of its business

around customer segments to deliver services and products. For reporting

purposes it is organised into Retail Customers, Wealth Management and

Barclaycard. Retail Customers and Wealth Management have absorbed the

relevant customer segments from the previous business groupings of UK Retail

Banking, International Premier, Private, Savings and Investment and Africa

and Caribbean, with Barclaycard remaining unaffected.

Retail Customers comprises UK Retail Banking (excluding UK Premier), the

African business, UK retail mutual funds and Barclays Life. Wealth

Management comprises the former International Premier, Private, Savings and

Investment business (excluding UK retail mutual funds and Barclays Life), UK

Premier and the Caribbean business.

The Structured Export Finance business and a number of large corporate

assets have been transferred from Barclays Capital to Corporate Banking.

Certain internal charges and costs have been re-allocated between Retail

Financial Services and Corporate Banking. In addition, Retail Financial

Services has revised its presentation of income and costs within its profit

and loss account. There is no effect on total Group revenue or costs as a

result of these changes. Where appropriate, staff numbers have been

restated.

Management of central information technology and operations' services for

Retail Financial Services, Corporate Banking and Group central functions in

the UK has been transferred to Retail Financial Services in the year. Prior

periods have been restated accordingly.

Head Office functions now include certain costs previously reported in

Central Services. In addition, Brand programme costs, previously reported

in Head Office functions, are now reported in Central Services. Prior

periods have been restated accordingly.

ACQUISITIONS AND DISPOSALS

In June 1999 the Group increased its holding in Banque du Caire Barclays

International (subsequently renamed Cairo Barclays SAE) from 49% to 60%.

This entity is now accounted for as a subsidiary.

Details of significant disposals in the period are set out under exceptional

items on page 20.

ACCOUNTING POLICIES

A change in accounting policy has arisen from the adoption in 1999 of

Financial Reporting Standard 12 'Provisions, Liabilities and Assets' (FRS

12). The Group has a number of vacant leasehold properties where

unavoidable costs exceed anticipated income for which a provision is now

required under FRS 12.

The change in policy has resulted in a prior year adjustment and the profit

and loss accounts and balance sheets for previous years have been restated.

This has resulted in a net charge to shareholders' funds of #81m as at 1st

January 1999 comprising the cumulative impact of prior year reductions in

net interest income, net provisions for property costs and associated tax

credits. Comparative figures have been restated with the effect that

shareholders' funds have been reduced by #63m at 1st January 1998. Profit

before tax for the year ended 31st December 1998 has been reduced by #23m.

CHANGES IN ACCOUNTING PRESENTATION

The classification of certain items of income and costs have been reviewed

and #50m has been offset between costs and income to more appropriately

reflect the nature of the transactions involved. In view of the amounts

involved no restatements have been made.

Weighted risk assets of associated companies, reported on a consolidated

basis in accordance with supervisory rules, are now included on page 8 in

the totals for the business grouping concerned. Previously these were

reported in Other operations. Comparatives have been restated.

There have been no other changes in accounting presentation from that

reflected in the 1998 Annual Report.

GROUP SHARE SCHEMES

The trustees of the Group's employee benefit trusts may make purchases of

Barclays PLC ordinary shares in the market following the announcement of the

Group's results in February 2000 for the purposes of the Group's employee

share schemes' current and future requirements. The total number of

ordinary shares purchased would not be material in relation to the issued

share capital of Barclays PLC.

NOTES

1. Loans and advances to banks 1999 1998

#m #m

Banking business

Loans and advances to banks 13,095 20,357

Less - provisions (24) (41)

13,071 20,316

Trading business 29,585 16,296

Total loans and advances to 42,656 36,612

banks

Of the total loans and advances to banks, placings with banks were

#39.1bn at 31st December 1999 (1998: #32.8bn). Placings with banks

include reverse repos of #29.1bn (1998: #13.9bn). The majority of the

placings have a residual maturity of less than one year.

2. Loans and advances to customers 1999 1998

#m #m

Banking business

Loans subject to non-recourse

finance arrangements 333 278

Less: non returnable finance (268) (269)

65 9

Loans and advances to customers 91,320 77,663

Finance lease receivables 5,660 5,776

97,045 83,448

Less - provisions (1,959) (1,902)

- interest in suspense (80) (77)

95,006 81,469

Trading business 18,532 14,641

Total loans and advances to 113,538 96,110

customers

Of the total loans and advances to customers, reverse repos were #16.9bn

at 31st December 1999 (1998: #11.7bn).

3. Provisions for bad and doubtful debts

1999 1998

Credit risk provisions #m #m

Provisions at beginning of year 1,862 1,761

Exchange and other adjustments (12) 5

Amounts written off

United Kingdom (546) (506)

Other European Union (44) (43)

United States (40) (7)

Rest of the World (21) (9)

(651) (565)

Recoveries (analysed below) 93 176

Sub-total 1,292 1,377

Provisions charged against

profit:

New and increased specific

provisions

United Kingdom 768 751

Other European Union 27 31

United States 45 11

Rest of the World 47 23

887 816

Less: Releases of specific

provisions

United Kingdom (114) (81)

Other European Union (21) (31)

United States (7) (8)

Rest of the World (15) (15)

(157) (135)

Less: Recoveries

United Kingdom (85) (156)

Other European Union (4) (4)

United States (4) (13)

Rest of the World - (3)

(93) (176)

Net specific provisions charge 637 505

General provision - release (16) (20)

Net credit risk charge to 621 485

profit

Provisions at end of year 1,913 1,862

Country risk provisions

Provisions at beginning of year 81 89

Exchange and other adjustments (11) 1

Amounts written off (net of - (16)

recoveries)

Net specific provision releases (2) (13)

General provision charge 2 20

Provisions at end of year 70 81

Total provisions at end of year 1,983 1,943

Total provisions for bad and doubtful debts at end of year comprise:

1999 1998

Specific - credit risk #m #m

United Kingdom 1,075 928

Other European Union 126 213

United States 23 23

Rest of the World 74 35

1,298 1,199

Specific - country risk 13 16

Total specific provisions 1,311 1,215

General provisions

- credit risk 615 663

- country risk 57 65

1,983 1,943

The geographic analysis of provisions shown above is based on location

of office.

4. Other assets 1999 1998

#m #m

Own shares 5 43

Balances arising from off-

balance sheet

financial instruments 13,390 13,725

Shareholders' interest in long- 555 530

term assurance fund

London Metal Exchange warrants

and other

metals trading positions 331 457

Sundry debtors 1,629 1,862

Prepayments and accrued income 2,203 2,552

18,113 19,169

'Own shares' represent Barclays PLC shares held in employee benefit trusts

that have not been expensed.

5. Other liabilities 1999 1998

#m #m

Obligations under finance 140 141

leases payable

Balances arising from off-

balance sheet

financial instruments 13,619 15,849

Short positions in securities 16,813 13,682

Current tax 462 479

Cash receipts from 1,049 -

securitisation

Sundry creditors 3,036 3,199

Accruals and deferred income 3,290 3,074

Provisions for liabilities and 1,247 1,353

charges

Dividend 484 414

40,140 38,191

Cash receipts from securitisation are in respect of a portfolio of

investment debt securities which did not qualify for linked presentation

under Financial Reporting Standard 5.

6. Potential credit risk lendings

The following table presents an analysis of potential credit risk

lendings in accordance with the US Securities and Exchange Commission

guidelines. Additional categories of disclosure are included, however,

to record lendings where interest continues to be accrued and where

either interest is being suspended or specific provisions have been

raised. Normal US banking practice would be to place such lendings on

non-accrual status.

The amounts, the geographical presentation of which is based on the

location of the office recording the transaction, are stated before

deduction of the value of security held, specific provisions carried or

interest suspended.

Non-performing lendings 1999 1998

#m #m

Non-accrual lendings:

United Kingdom 1,007 985

Foreign 244 282

Accruing lendings where

interest is being suspended:

United Kingdom 326 266

Foreign 110 118

Other accruing lendings against

which provisions have been

made:

United Kingdom 423 457

Foreign 130 134

Sub-totals:

United Kingdom 1,756 1,708

Foreign 484 534

Accruing lendings 90 days

overdue, against which no

provisions have been made:

United Kingdom 343 309

Foreign 18 19

Reduced rate lendings:

United Kingdom 6 7

Foreign 2 -

Total non-performing lendings

United Kingdom 2,105 2,024

Foreign 504 553

2,609 2,577

UK non-performing lendings increased by #81m due to growth in consumer

balances (including credit card receivables).

Potential problem lendings: In addition to the above, the following

table shows lendings which are current as to payment of principal and

interest, but where serious doubt exists as to the ability of the

borrower to comply with repayment terms in the near future.

1999 1998

#bn #bn

United Kingdom 0.6 0.6

Foreign 0.1 0.1

0.7 0.7

1999 1998

Credit risk provision coverage % %

of:

- credit risk non-performing 76.4 75.2

lendings

- total potential credit risk 60.0 59.4

lendings

1999 1998

Interest forgone on non- #m #m

performing lendings:

Interest income that would have

been recognised under original 165 182

contractual terms

Interest income included in (45) (63)

profit

Interest forgone 120 119

7. Exposure to countries subject to International Monetary Fund liquidity

support programmes

Amounts outstanding, net of provisions, and commitments to

counterparties in countries which make significant use of International

Monetary Fund liquidity support programmes were as follows:

1999 1998

Asia #bn #bn

Indonesia 0.1 0.1

South Korea 0.4 0.5

Thailand 0.1 0.1

0.6 0.7

Latin America

Brazil 0.8 0.9

1.4 1.6

Of the total of #1.4bn, #0.8bn (1998: #1.0bn) was related to banks,

#0.4bn (1998: #0.4bn) to governments and #0.2bn (1998: #0.2bn) to other

corporate bodies including project finance companies. The total was

mainly in respect of loans, off-balance sheet financial instruments and

debt securities. Off-balance sheet financial instruments and debt

securities are marked to market.

The Group has a Brazilian associate, Banco Barclays e Galicia SA, which

is equity accounted. At 31st December 1999 the 50% holding was included

in the balance sheet at a value of #33m (not included in the figures

above).

During the year the Group released a general provision of #8m in respect

of country transfer risk arising from its business world wide, including

exposure in these countries, reducing the total of such provisions to

#57m at 31st December 1999. This is in addition to #615m of general

provision held against credit risk.

8. European Economic and Monetary Union

The euro has been in existence for over twelve months. As expected the

introduction of the euro saw a rapid transition in the wholesale markets

from trading in national domestic currencies to trading in the euro.

The Group's operating infrastructure and euro settlement systems have

been working very effectively since the implementation of EMU at the

start of 1999.

UK Entry to EMU

Barclays incurred expenditure of #4m during 1999 across the Group in

developing plans for the possibility of the introduction of the euro in

the United Kingdom.

Given the considerable uncertainty around UK entry to EMU it is not

possible to estimate the final overall cost of preparing the Group's

systems and operations.

Costs in 2000 are likely to be incurred in maintaining a prudent

programme to validate and develop further our existing plans and to

conduct feasibility studies with selected suppliers and partners.

9. Year 2000

After more than three years of preparation the Barclays Group managed

the transition into the Year 2000 with no material disruption to

customers, staff or the Group's businesses around the world.

Activity during 1999

The principal focus during the year was risk mitigation and contingency

planning. The Group also finalised internal testing and correction, and

continued to work with other banks and external network providers

towards industry readiness of the key clearing, payment and settlement

infrastructures in the UK and, where appropriate, overseas.

Costs and benefits

The total amount spent on the Year 2000 Programme up to 31st December

1999 was #209m (including #15m of capitalised costs) of which #65m was

incurred in the year to December 1999. Year 2000 costs include

correction, testing, third party assurance and contingency planning.

In addition to the successful transition, the Group has benefited from

enhanced business resumption plans and contingency arrangements, updated

and rationalised systems and coding, and improved inventories of

hardware, software and suppliers.

10.Legal proceedings

Barclays is party to various legal proceedings, the ultimate resolution

of which is not expected to have a material adverse effect on the

financial position of the Group.

11. Geographical analysis

1999 1998

Profit before tax #m #m

United Kingdom 1,872 1,483

Other European Union 318 241

United States 131 67

Rest of the World 139 104

2,460 1,895

1999 1998

Total assets #m #m

United Kingdom 171,772 154,446

Other European Union 17,017 18,490

United States 39,536 24,886

Rest of the World 26,468 21,672

254,793 219,494

12. Contingent liabilities and commitments

1999 1998

Contingent liabilities #m #m

Acceptances and endorsements 1,530 1,384

Guarantees and assets pledged

as collateral security 12,044 8,784

Other contingent liabilities 5,360 5,069

18,934 15,237

Commitments

Standby facilities, credit

lines and other commitments 82,479 68,191

13. Off-balance sheet financial instruments, including derivatives

The tables set out below analyse the contract or underlying principal

amounts of derivative financial instruments held for trading purposes

and for the purposes of managing the Group's structural exposures.

Foreign exchange derivatives 1999 1998

#m #m

Contract or underlying

principal amount

Forward foreign exchange 225,518 263,958

Currency swaps 88,453 79,447

Other exchange rate related 65,456 101,310

contracts

379,427 444,715

Interest rate derivatives

Contract or underlying

principal amount

Interest rate swaps 975,720 787,486

Forward rate agreements 49,577 99,960

OTC options bought and sold 266,085 222,589

Other interest rate related 72,390 104,003

contracts

1,363,772 1,214,038

Equity, stock index and

commodity derivatives

Contract or underlying 63,105 51,347

principal amount

Other exchange rate related contracts are primarily OTC options. Other

interest rate related contracts are primarily exchange traded options

and futures.

Derivatives entered into as trading transactions, together with any

associated hedging thereof, are measured at fair value and the resultant

profits and losses are included in dealing profits. The tables below

summarise the positive and negative fair values of such derivatives,

including an adjustment for netting where the Group has the ability to

insist on net settlement which is assured beyond doubt, based on a legal

right that would survive the insolvency of the counterparty.

Positive fair values 1999 1998

#m #m

Foreign exchange derivatives 7,178 9,913

Interest rate derivatives 16,160 20,083

Equity, stock index and 2,872 2,240

commodity derivatives

Effect of netting (12,820) (18,511)

13,390 13,725

Negative fair values

Foreign exchange derivatives 7,583 12,062

Interest rate derivatives 15,590 19,603

Equity, stock index and 3,266 2,695

commodity derivatives

Effect of netting (12,820) (18,511)

13,619 15,849

14. Market risk

Market risk is the risk of loss arising from adverse movements in the

level or volatility of market prices, which can occur in the interest

rate, foreign exchange, equity and commodity markets. It is incurred as

a result of both trading and asset/liability management activities.

The market risk management policies of the Group are determined by the

Group Risk Management Committee, which also determines overall market

risk appetite. The Group's policy is that exposure to market risk

arising from trading activities is concentrated in Barclays Capital.

The Group's banking businesses are also subject to market risk, which

arises in relation to non-trading positions, such as capital balances,

demand deposits and customer originated transactions and flows.

The Group uses a daily 'value at risk' measure as the primary mechanism

for controlling market risk. Daily Value at Risk (DVAR) is an estimate,

with a confidence level of 98%, of the potential loss which might arise

if the current positions were to be held unchanged for one business day.

Daily losses exceeding the DVAR figure are likely to occur, on average,

only twice in every one hundred business days. Actual outcomes are

monitored regularly to test the validity of the assumptions made in the

calculation of DVAR.

Barclays Capital Trading Activities

In Barclays Capital, the formal process for the management of risk is

through the Barclays Capital Risk Management Committee. Day-to-day

responsibility for market risk lies with the Chief Executive of Barclays

Capital, supported by a dedicated global market risk management unit

that operates independently of the business areas.

In the fourth quarter of 1998, Barclays Capital closed its non-client

related proprietary trading businesses and substantially reduced its

secondary market corporate bond inventory. The lower risk appetite,

with the focus on the major currency fixed income markets, was

maintained in the first half of 1999, with DVAR utilisation remaining

broadly at the end 1998 level. DVAR utilisation increased in the second

half of 1999 due to increased position sizes to take advantage of

specific market opportunities and increases in the volatility of key

risk factors. Year-end DVAR was #20.2m.

The daily average, maximum and minimum values of DVAR were estimated as

below.

DVAR

Twelve months to

31st December 1999

Average High* Low*

#m #m #m

Interest rate 13.7 30.2 6.2

risk

Foreign exchange 2.8 11.7 0.8

risk

Equities risk 1.7 3.7 0.6

Commodities risk 1.2 2.2 0.5

Diversification (3.3)

effect

Total DVAR 16.1 32.5 7.7

* The high (and low) DVAR figures reported for each category did not

necessarily occur on the same day as the high (and low) DVAR reported

as a whole. A corresponding diversification effect cannot be

calculated and is therefore omitted from the above table.

During 1999, Barclays Capital adopted historical simulation as the

standard method for calculating DVAR, having previously used mainly

variance/covariance calculations. The figures provided above are based

on daily data for the full year produced using the new method.

The decision to change the methodology was based on research which

showed that, compared with the previous approach, historical simulation

gives better risk aggregation, a more accurate estimate of options risk,

and a more realistic assessment of the statistical distribution of low

probability extreme losses. The method, along with the market risk

management and control infrastructure, has been approved by the

Financial Services Authority under the internal models approach for

calculating regulatory capital for general market risk.

In contrast to the previous method, the new method gives equal weighting

to all of the historic data used in the calculation, and therefore does

not respond as quickly to changes in market volatility. During periods

of low market volatility, the new method therefore gives a higher DVAR

estimate than the old method, and vice versa. Market volatility was

particularly low at the end of 1999. Although DVAR utilisation as at

31st December 1999 was recorded as #20.2m under the new method, the

utilisation under the old method would only have been #11.2m (1998:

#12.2m). There is a similar, albeit smaller, impact on average

utilisation, which was higher with the new method than the old method.

The table below provides comparative data for 1998 and 1999 using the

previous approach.

DVAR calculated using previous approach

Twelve months to Twelve months to

31st December 1999 31st December 1998

Average High* Low* Average High* Low*

#m #m #m #m #m #m

Interest rate 10.7 28.5 4.8 15.1 36.6 9.5

risk

Foreign exchange 1.8 6.9 0.7 5.8 13.9 1.2

risk

Equities risk 1.6 3.7 0.6 3.0 7.9 1.3

Commodities risk 1.2 2.2 0.5 1.2 2.9 0.6

Diversification (2.1) (4.2)

effect

Total DVAR 13.2 31.0 7.7 20.9 43.3 12.2

* The high (and low) DVAR figures reported for each category did not

necessarily occur on the same day as the high (and low) DVAR

reported as a whole. A corresponding diversification effect cannot

be calculated and is therefore omitted from the above table.

15. US GAAP

There are some significant differences between accounting practices in

the United States (US GAAP) and those in the United Kingdom (UK GAAP).

Key figures on a UK GAAP basis and as estimated on a US GAAP basis are:

1999 1999 1998 1998

#m #m #m #m

UK GAAP US GAAP UK GAAP US GAAP

Net income 1,759 1,695 1,317 1,370

Shareholders' funds 8,483 8,262 7,842 7,781

AVERAGE BALANCE SHEET AND NET INTEREST INCOME

31.12.99 31.12.99 31.12.99 31.12.98 31.12.98 31.12.98

Average Interest Average Average Interest Average

Balance Rate Balance Rate

Assets #m #m % #m #m %

Treasury bills and

other eligible bills:

in offices in the UK 3,697 175 4.7 2,445 154 6.3

in offices outside the 898 90 10.0 963 103 10.7

UK

Loans and advances to

banks:

in offices in the UK 7,762 361 4.7 10,561 605 5.7

in offices outside the 8,224 442 5.4 11,138 535 4.8

UK

Loans and advances to

customers:

in offices in the UK 68,752 5,549 8.1 62,304 5,757 9.2

in offices outside the 16,154 893 5.5 11,596 863 7.4

UK

Lease receivables:

in offices in the UK 5,059 346 6.8 5,499 452 8.2

in offices outside the 537 67 12.5 240 21 8.8

UK

Debt securities:

in offices in the UK 15,256 851 5.6 13,804 910 6.6

in offices outside the 9,928 546 5.5 8,846 552 6.2

UK

Average assets of 136,267 9,320 6.8 127,396 9,952 7.8

banking business

Average assets of 67,278 3,655 5.4 77,599 3,809 4.9

trading business

Total average interest 203,545 12,975 6.4 204,995 13,761 6.7

earning assets

Provisions (1,955) (1,847)

Non-interest earning 42,526 39,957

assets

Total average assets

and interest income 244,116 12,975 5.3 243,105 13,761 5.7

Percentage of total

average assets in 31.0 29.6

offices outside the UK

Average interest

earning assets and net

interest income:

Banking business 136,267 4,630 3.4 127,396 4,352 3.4

Trading business 67,278 (31) - 77,599 (25) -

Write-down of leases - - (40) -

Discount rate

adjustment on (6) - (4) -

provisions

Profit on

redemption/repurchase 3 - 3 -

of loan capital

Total average interest

earning assets and net 203,545 4,596 2.3 204,995 4,286 2.1

interest income

Total average interest

earning assets related

to:

Interest income 12,975 6.4 13,761 6.7

Interest expense (8,376) (4.1) (9,434) (4.6)

Write-down of leases - - (40) -

Discount rate

adjustment on (6) - (4) -

provisions

Profit on

redemption/repurchase 3 - 3 -

of loan capital

4,596 2.3 4,286 2.1

Notes

(i) Loans and advances to customers and banks include all doubtful

lendings, including non-accrual lendings. Interest receivable on such

lendings has been included to the extent to which either cash payments have

been received or interest has been accrued in accordance with the income

recognition policy of the Group.

(ii) Average balances are based upon daily averages for most UK banking

operations and monthly averages elsewhere.

(iii) The average balance sheet does not include the retail life-fund

assets attributable to policyholders nor the related liabilities.

AVERAGE BALANCE SHEET AND NET INTEREST INCOME

31.12.99 31.12.99 31.12.99 31.12.98 31.12.98 31.12.98

Average Interest Average Average Interest Average

Balance Rate Balance Rate

Liabilities and #m #m % #m #m %

shareholders' funds

Deposits by banks:

in offices in the UK 14,210 479 3.4 17,911 719 4.0

in offices outside the 11,506 460 4.0 11,726 505 4.3

UK

Customer accounts -

demand accounts:

in offices in the UK 12,786 168 1.3 11,072 201 1.8

in offices outside the 1,827 35 1.9 2,088 44 2.1

UK

Customer accounts -

savings accounts:

in offices in the UK 24,517 772 3.1 22,635 1,110 4.9

in offices outside the 1,307 55 4.2 1,120 63 5.6

UK

Customer accounts -

other time deposits -

retail:

in offices in the UK 23,998 1,231 5.1 22,703 1,574 6.9

in offices outside the 5,076 234 4.6 5,262 266 5.1

UK

Customer accounts -

other time deposits -

wholesale:

in offices in the UK 19,555 848 4.3 17,379 890 5.1

in offices outside the 6,067 306 5.0 5,904 307 5.2

UK

Debt securities in

issue:

in offices in the UK 15,656 777 5.0 14,554 913 6.3

in offices outside the 7,130 379 5.3 6,181 340 5.5

UK

Dated and undated loan

capital and other

subordinated 4,092 263 6.4 3,372 244 7.2

liabilities principally

in offices in the UK

Internal funding of (29,231) (1,317) 4.5 (32,682) (1,576) 4.8

trading business

Average liabilities of 118,496 4,690 4.0 109,225 5,600 5.1

banking business

Average liabilities of 71,535 3,686 5.2 79,513 3,834 4.8

trading business

Total average interest

bearing liabilities 190,031 8,376 4.4 188,738 9,434 5.0

Interest free customer

deposits:

in offices in the UK 8,677 8,333

in offices outside the 1,597 1,278

UK

Other non-interest 35,190 36,652

bearing liabilities

Minority interests and

shareholders' funds 8,621 8,104

Total average

liabilities, 244,116 8,376 3.4 243,105 9,434 3.9

shareholders' funds and

interest expense

Percentage of total

average non-capital

liabilities in offices 30.3 30.0

outside the UK

CONSOLIDATED STATEMENT OF CHANGES IN

SHAREHOLDERS' FUNDS

1999 1998

#m #m

At beginning of year 7,842 7,557

Proceeds of shares issued (net of 214 110

expenses)

Exchange rate translation (70) 32

differences

Repurchase of ordinary shares* (504) (501)

Goodwill written back on disposals 138 10

Shares issued to the QUEST; in

relation to share option schemes (154) (67)

for staff

Other items 4 30

Profit retained 1,013 671

At end of year 8,483 7,842

* Including nominal amount of #28m (1998: #29m).

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

1999 1998

#m #m

Profit attributable to the members 1,759 1,317

of Barclays PLC

Exchange rate translation (70) 32

differences

Other items 4 30

Total recognised gains relating to 1,693 1,379

the period

Prior period adjustment (as (81)

explained on page 41)

Total gains and losses recognised

since 31st December 1998 1,612

Historical cost profits and losses

There is no material difference between profit before tax and profit

retained, as reported, and historical cost profits.

SUMMARY CONSOLIDATED CASH FLOW STATEMENT

Note 1999 1998

#m #m

Net cash inflow/(outflow)

from operating activities 1 8,923 (1,337)

Dividends received from 5 3

associated undertakings

Net cash outflow from returns

on investment and servicing (290) (252)

of finance

Tax paid (636) (547)

Net cash (outflow)/inflow

from capital expenditure and (7,890) 2,333

financial investment

Acquisitions and disposals 242 584

Equity dividend paid (676) (591)

Net cash (outflow)/inflow (322) 193

before financing

Net cash inflow from 400 264

financing

Increase in cash 78 457

NOTE TO CONSOLIDATED CASHFLOW STATEMENT

1. Reconciliation of operating profit to net operating cashflows

1999 1998

#m #m

Operating profit 2,598 1,898

Provisions for bad and doubtful 621 492

debts

Depreciation and amortisation 276 270

Net decrease in accrued

expenditure and prepayments (149) (719)

Provisions for contingent

liabilities and commitments 1 76

Other provisions for 401 79

liabilities and charges

Interest on dated and undated

loan capital and other 263 244

subordinated liabilities

Associated undertakings - 14 (22)

loss/(profit) included

Increase in shareholders'

interest in the long-term (32) (95)

assurance fund

Profit on redemption/repurchase (3) (3)

of loan capital

Net decrease/(increase) in net

interest and commission 691 (23)

receivable

Net profit on disposal of

investments and fixed assets (51) (106)

Other non-cash movements 7 53

4,637 2,144

Net change in items in transit

and items in course of 96 (311)

collection

Net increase/(decrease) in 560 (4,253)

other credit balances

Net (increase)/decrease in

loans and advances to banks and (23,862) 8,652

customers

Net increase/(decrease) in

deposits and debt securities in 32,100 (14,958)

issue

Net (increase)/decrease in (307) 3,215

other assets

Net (increase)/decrease in

other debt securities and (1,922) 3,642

equity shares

Net (increase)/decrease in

treasury and other eligible (2,462) 777

bills

Other non-cash movements 83 (245)

Net cash inflow/(outflow) from 8,923 (1,337)

operating activities

BARCLAYS PLC

OTHER INFORMATION

Financial Summary 1999 1998 1997 1996 1995

#m #m #m #m #m

Profit before tax 2,460 1,895 1,719 2,293 2,021

Profit after tax 1,811 1,362 1,177 1,677 1,410

Total capital resources 13,432 11,890 10,810 10,608 10,964

P p P p P

Earnings per ordinary 117.5 87.2 74.6 103.6 83.8

share

Dividends per ordinary 50.0 43.0 37.0 31.5 26.0

share

Net asset value per 568 519 494 467 429

ordinary share

Dividend cover (times) 2.4 2.0 2.0 3.4 3.2

Risk asset ratios: % % % % %

Tier 1 ratio 7.5 7.3 7.2 7.5 7.6

Total ratio 11.3 10.6 9.9 10.3 10.8

Performance ratios

Return on average % % % % %

shareholders' funds:

Pre-tax 29.0 23.6 22.3 31.4 30.1

Post-tax 21.2 16.9 15.2 22.9 20.9

Return on average total

assets:

Pre-tax 1.0 0.8 0.8 1.3 1.2

Post-tax 0.7 0.5 0.5 0.9 0.8

Return on average

weighted risk assets:

Pre-tax 2.2 1.7 1.6 2.3 2.3

Post-tax 1.6 1.2 1.1 1.7 1.5

Non interest income/total 44.7 41.4* 46.6** 47.8 47.4

income

Operating expenses/total 57.4 65.8 62.9 65.2 69.6

income***

* Excluding the impact of the Finance Act 1998.

** Excluding the impact of the Finance (No 2) Act 1997.

*** Excluding the 1999 restructuring charge, the results of the former BZW

businesses and the impact of the Finance Act 1998 and the Finance (No

2) Act 1997.

The financial information above is extracted from the published accounts for

the last five years, restated where appropriate to accord with the current

accounting policies of the Group.

PROFIT BEFORE TAX 31.12.99 30.6.99 31.12.98 30.6.98

(half-year ended - unaudited) #m #m #m #m

Retail Financial Services 897 816 767 710

Corporate Banking* 489 458 447 544

Barclays Capital 138 178 (426) 156

Barclays Global Investors 15 28 23 29

Businesses in Transition** - - 24 24

Other operations 23 (10) (93) (74)

Head office functions (47) (30) (40) (32)

Goodwill amortisation (7) (6) (6) (6)

Provision for litigation - - (76) -

settlement***

1,508 1,434 620 1,351

Restructuring charge 1 (345) - -

Exceptional items (19) (119) 5 (4)

Former BZW businesses - - (14) (19)

Write-down of leases - - - (40)

Write-down of fixed asset - - (4) -

investments

1,490 970 607 1,288

31.12.99 30.6.99 31.12.98 30.6.98

TOTAL ASSETS #m #m #m #m

Retail Financial Services 48,726 45,776 46,197 42,729

Corporate Banking 47,422 46,662 45,341 42,519

Barclays Capital 144,811 135,941 114,706 150,094

Barclays Global Investors 232 199 183 167

Businesses in Transition - - 554 531

Other operations and Head 5,562 5,174 5,428 6,165

office functions

Retail life-fund assets

attributable to policyholders 8,040 7,513 7,085 6,751

254,793 241,265 219,494 248,956

WEIGHTED RISK ASSETS

Retail Financial Services 33,362 31,687 31,546 29,770

Corporate Banking 48,218 47,683 45,869 42,489

Barclays Capital 32,032 31,652 29,344 36,053

Barclays Global Investors 456 297 207 150

Businesses in Transition - - 594 531

Other operations 1,810 2,675 2,240 2,528

115,878 113,994 109,800 111,521

* Figures are stated prior to the write-down of leases.

** Businesses in Transition 1998 profit before tax excludes the residual

losses of the former BZW businesses which are shown separately.

*** The 1998 provision relates to the settlement of the Atlantic

litigation.

Consolidated profit and loss account by half-year (unaudited)

31.12.99 30.6.99 31.12.98 30.6.98

#m #m #m #m

Interest receivable 4,823 4,497 4,938 5,014

Interest payable (2,477) (2,219) (2,728) (2,876)

Write-down of leases - - - (40)

Profit on

redemption/repurchase of 3 - - 3

loan capital

Net interest income 2,349 2,278 2,210 2,101

Net fees and commissions 1,515 1,417 1,429 1,350

receivable

Dealing profits 236 325 (230) 197

Other operating income 115 129 168 156

Total non-interest income 1,866 1,871 1,367 1,703

Operating income 4,215 4,149 3,577 3,804

Administration expenses - (1,389) (1,668) (1,425) (1,386)

staff costs

Administration expenses - (872) (935) (969) (860)

other

Depreciation and (143) (137) (138) (137)

amortisation

Operating expenses (2,404) (2,740) (2,532) (2,383)

Operating profit before 1,811 1,409 1,045 1,421

provisions

Provisions for bad and (301) (320) (363) (129)

doubtful debts

Provisions for contingent (1) - (76) -

liabilities etc

Operating profit 1,509 1,089 606 1,292

Exceptional items (19) (119) 5 (4)

Write-down of fixed asset - - (4) -

investments

Profit on ordinary 1,490 970 607 1,288

activities before tax

Tax on profit on ordinary (397) (252) (153) (380)

activities

Profit on ordinary 1,093 718 454 908

activities after tax

Minority interests (equity (30) (22) (23) (22)

and non-equity)

Profit attributable to the

members of Barclays PLC 1,063 696 431 886

Dividends (484) (262) (414) (232)

Profit retained 579 434 17 654

Earnings per ordinary 71.3 p 46.2 p 28.9 p 58.3 p

share

Dividends per ordinary 32.5 p 17.5 p 27.5 p 15.5 p

share

Results by half year for the ongoing business (unaudited)

31.12.99 30.6.99 31.12.98 30.6.98

#m #m #m #m

Net interest income 2,349 2,278 2,211 2,142

Net fees and commissions 1,515 1,417 1,431 1,340

receivable

Dealing profits 236 325 (225) 198

Other operating income 115 129 165 154

Total non-interest 1,866 1,871 1,371 1,692

income

Operating income 4,215 4,149 3,582 3,834

Operating expenses (2,405) (2,395) (2,523) (2,354)

Operating profit before 1,810 1,754 1,059 1,480

provisions

Provisions for bad and (301) (320) (363) (129)

doubtful debts

Provisions for contingent

liabilities and (1) - (76) -

commitments

Operating profit 1,508 1,434 620 1,351

Restructuring charge 1 (345) - -

Exceptional items (19) (119) 5 (4)

Former BZW businesses - - (14) (19)

Write-down of leases - - - (40)

Write-down of fixed asset - - (4) -

investments

Profit before tax 1,490 970 607 1,288

The above table presents the consolidated profit and loss account for the

ongoing business. The restructuring charge in 1999 and the residual losses

relating to the former BZW businesses and the impact of the Finance Act 1998

are shown separately.

For further information; please contact:

David Allvey

Finance Director

020 7699 3564 - Direct Line

020 7699 5000 - Switchboard

Ian Roundell

Head of Investor Relations

020 7699 2961 - Direct Line

Leigh Bruce

Director, Corporate Communications

020 7699 2658 - Direct Line

More information on Barclays, including the 1999 results, can be found on

our website at the following address: http://www.investor.barclays.com

END

FRCILFLTFIISLII

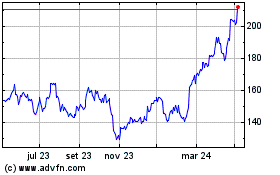

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024