RNS Number:9069O

Barclays PLC

3 August 2000

PART 2

BARCLAYS PLC

Earnings per ordinary share

Earnings per ordinary share is based upon the results after deducting tax,

profit attributable to minority interests and dividends on staff shares.

Half-year ended

30.6.00 31.12.99 30.6.99

Earnings in period #1,320m #1,063m #696m

Earnings in period before

restructuring and exceptional #1,215m #1,073m #1,064m

items

Weighted average of ordinary 1,484m 1,490m 1,505m

shares in issue

Earnings per ordinary share 88.9p 71.3p 46.2p

Earnings per ordinary share

before restructuring and 81.9p 72.1p 70.7p

exceptional items

Diluted earnings per share is not materially different from the basic

earnings per share figure reported above in either 2000 or 1999.

Dividends on ordinary shares

The Board has decided to pay, on 3rd October 2000, an interim dividend for

the year ending 31st December 2000 of 20.0p per ordinary share, for shares

registered in the books of the Company at the close of business on

18th August 2000.

For qualifying US and Canadian resident ADR holders, the interim dividend of

20.0p per ordinary share becomes 80.0p per ADS (representing four shares).

The ADR depositary will mail the dividend on 3rd October 2000 to ADR holders

on the record on 18th August 2000.

For qualifying Japanese shareholders, the interim dividend of 20.0p per

ordinary share will be distributed in mid October to shareholders on the

record on 18th August 2000.

Shareholders may have their dividends reinvested in Barclays PLC shares by

participating in the Barclays Dividend Reinvestment Plan. The plan is

available to all shareholders provided that they do not live in or are

subject to the jurisdiction of any country where their participation in the

plan would require Barclays or the plan administrator to take action to

comply with local government or regulatory procedures or any similar

formalities. Any shareholder wishing to obtain details and a form to join

the plan should contact the plan administrator by writing to The Plan

Administrator to Barclays, PO Box 82, The Pavilions, Bridgwater Road,

Bristol, BS99 7NH or by phoning 0870 702 0196. The completed form should be

returned to the plan administrator on or before 12th September 2000 for it

to be in time for the payment of the interim dividend on 3rd October 2000.

Shareholders who are already in the plan should take no action unless they

wish to change their instructions in which case they should write to the

plan administrator.

Balance sheet

Half-year ended

Capital resources 30.6.00 31.12.99 30.6.99

#m #m #m

Shareholders' funds 9,237 8,483 8,219

Minority interests 765 352 349

10,002 8,835 8,568

Loan capital 4,748 4,597 4,117

14,750 13,432 12,685

The Group continues to actively manage both its debt and equity capital.

Total capital resources increased over the half year by #1,081m before

favourable exchange rate translation differences of #237m.

Shareholders' funds increased by #727m before favourable exchange rate

differences of #27m. Profit retentions of #1,025m were reduced by share

buybacks, including costs, of #311m.

Loan capital and other subordinated liabilities rose by #151m consisting of

exchange movements of #162m offset by repayments of #11m.

The increase in minority interests reflects the issue by Barclays Bank PLC

of Euro 850m (#510m) Reserve Capital Instruments on 3rd May 2000.

17,920,000 outstanding Series C1 and C2 Non-cumulative Dollar Denominated

Preference Shares of $0.01 each were redeemed on 30th June 2000. The

aggregate redemption cost was $224m (#149m).

Capital ratios

Weighted risk assets and capital resources, as defined for supervisory

purposes by the Financial Services Authority, comprise:

Half-year ended

30.6.00 31.12.99 30.6.99

Weighted risk assets: #m #m #m

Banking book

on-balance sheet 89,917 84,535 83,101

off-balance sheet 18,132 15,567 16,172

associated undertakings 929 1,341 1,562

Total banking book 108,978 101,443 100,835

Trading book

market risks 5,665 6,015 5,828

counterparty and settlement 8,840 8,420 7,331

risks

Total trading book 14,505 14,435 13,159

Total weighted risk assets 123,483 115,878 113,994

Capital resources:

tier 1 capital 9,841 8,696 8,398

tier 2 capital 5,070 4,948 4,539

tier 3 capital 343 343 328

Total gross capital resources 15,254 13,987 13,265

Less: supervisory deductions (1,004) (853) (892)

Total net capital resources 14,250 13,134 12,373

% % %

Tier 1 ratio 8.0 7.5 7.4

Risk asset ratio 11.5 11.3 10.9

Total Assets

The Group's balance sheet grew by #32 billion, or 12%, in the first half of

2000 compared to 10% growth in the same period of 1999, and 6% growth in the

second half of 1999. Weighted risk assets increased by 7% in the first half

of 2000.

Barclays Capital assets increased by 18%, or #26bn, to #171bn in the first

half of 2000. There was a #10bn increase in the level of reverse repos,

mainly in the collateralised equity financing business which continues to

build customer inventory financing positions. The other increases were in

debt securities, equity securities and settlement balances. The weakening

of sterling, primarily against the US dollar, contributed #3bn of the

increase. Total risk weighted assets increased by only 4% reflecting the

low weightings attached to the reverse repos.

Within Corporate Banking, assets grew by 8% to #51bn in the first half of

2000. Weighted risk assets increased by 9% during the same period. UK

middle market lending grew strongly reflecting a concentration of lending

growth towards larger and higher quality customers. Lending volumes in the

international business continued to grow strongly in Europe and the Middle

East whilst volumes in Latin America reduced.

Retail Financial Services assets grew 3% in the first half of 2000, compared

with 2% growth in the same period last year (adjusted for the impact of the

sale of Merck Finck). Weighted risk assets were 5% higher at #27.5bn.

Consumer lending balances in the United Kingdom increased by 4% to #6.5bn

during the first half of 2000 and mortgage outstandings grew by 2% to

#17.1bn. Wealth Management assets have grown steadily across all business

units, with particularly high growth in the Caribbean and UK Premier

Banking.

Barclaycard assets grew by #353m, or 5%, to #7.7bn in the first half of 2000

compared with 3% growth in the first half of 1999. Weighted risk assets

increased by 7%.

The reduction in retail life-fund assets is as a result of adverse stock

market movements in the first half of the year.

Repo transactions

Under a repo (sale and repurchase agreement), an asset is sold to a

counterparty with a commitment to repurchase it at a future date at an

agreed price. The Group engages in repos and also in reverse repos, which

are the same transaction from the opposite viewpoint, the Group buying an

asset with a fixed commitment to resell. The Group aims to earn spread and

trading income from these activities as well as funding its own holdings of

securities.

The following amounts are included in the balance sheet for repos and

reverse repos:

Half-year ended

30.6.00 31.12.99 30.6.99

Reverse repos (assets) #m #m #m

Loans and advances to banks 27,774 26,040 18,778

Loans and advances to customers 28,192 19,910 14,744

55,966 45,950 33,522

Repos (liabilities)

Deposits by banks 18,378 16,631 12,713

Customer accounts 21,894 17,422 14,071

40,272 34,053 26,784

Analysis of operating profit by business

Retail Financial Services

Retail Financial Services provides a broad range of financial services to

its customers worldwide. Its purpose is to serve customers by understanding

their needs as individuals and by offering services and products that

anticipate and satisfy their requirements.

Retail Financial Services is organised into two major business groupings:

Retail Customers and Wealth Management.

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 1,306 1,249 1,222

Net fees and commissions 694 660 640

Income from long-term assurance 79 26 18

business*

Other operating income 79 79 64

Total income * 2,158 2,014 1,944

Total costs (1,135) (1,161) (1,165)

Provisions for bad and doubtful (201) (162) (158)

debts

Operating profit* 822 691 621

* Half year ended 30th June 1999 includes a #40m provision (half year ended

31st December 1999: #35m) for possible redress for personal pension

customers.

Retail Financial Services achieved a strong performance with a 32%, or

#201m, increase in operating profit to #822m. Total income increased by 11%

to #2,158m. Adjusted for the impact of the personal pension redress

provision of #40m during the half year ended 30th June 1999, operating

profit and total income rose by 24% and 9%, respectively.

Net interest income increased by 7%, to #1,306m (1999: #1,222m), primarily

as a result of growth in average UK consumer lending, average mortgage

lending (particularly in UK Premier Banking) and an increase in average UK

savings balances. UK lending and deposit margins fell slightly. The UK

lending margin reduced primarily as a result of pricing decisions in respect

of consumer lending products. The deposit margin fell primarily as a result

of a change in mix.

Net fees and commissions grew by 8%, or #54m, to #694m. This increase was

primarily within the Retail Customers business, which improved 9% to #391m.

Increased activity on current accounts and a significant increase in the

number of Additions accounts more than offset the absence of #11m of ATM

commissions received in the first half of 1999. This followed the abolition

in the final quarter of last year of charges for customers use of non-

affiliated ATM machines. In Wealth Management, there were good increases in

the contributions from Stockbrokers, Private Banking and Offshore Services.

Total customer funds, which include assets under management and on-balance

sheet deposits, grew by 3% to #122bn (31st December 1999: #118bn). Assets

under management increased by 2% to #56bn (31st December 1999: #55bn)

primarily attributable to net new business. Loans to customers rose by 6%

to #35bn (31st December 1999: #33bn).

Total costs fell by 3% to #1,135m (1999: #1,165m), despite increases in

strategic investment expenditure of #14m and higher revenue related costs.

Total staff costs, excluding restructuring costs, were down 6% compared with

the first half of 1999.

Provisions rose by 27% to #201m (1999: #158m). Adjusted for a one-off #11m

release of general provision, the underlying increase in provisions was 19%

which was mainly attributable to the volume growth in UK consumer lending.

Retail Customers

This business provides a wide range of services and products to personal and

small business customers throughout the United Kingdom and to personal and

corporate customers in parts of Africa.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 1,003 971 945

Net fees and commissions 391 377 358

Income from long-term assurance 75 21 11

business *

Other operating income 67 66 48

Total income * 1,536 1,435 1,362

Total costs (782) (794) (794)

Provisions for bad and doubtful (198) (157) (168)

debts

Operating profit * 556 484 400

* Half year ended 30th June 1999 includes a #40m provision (half year ended

31st December 1999: #35m provision) for possible redress for personal

pension customers.

Operating profit in Retail Customers increased by 39%, or #156m, to #556m.

Adjusted for the impact of the provision for the personal pension redress of

#40m during the half year ended 30th June 1999, operating profit increased

by 26%. Total income rose by 13% to #1,536m compared with the same period

in 1999. Costs fell by 2% to #782m (1999: #794m), largely as a result of

centralisation of processing activity. This was achieved despite the

additional costs associated with increased investment in on-line banking.

Provisions for bad and doubtful debts increased by 18% to #198m (1999:

#168m), mainly as a result of volume growth in UK consumer lending.

Total customer funds, which include assets under management and on-balance

sheet deposits, increased to #49bn (31st December 1999: #48bn). Loans to

customers grew slightly to #24bn (31st December 1999: #23bn).

UK Personal Customers

Average consumer lending balances grew by 8% to #6.4bn (1999: 13% to

#5.9bn). The reduced growth rate compared with 1999 is a result of a

tightening in the risk assessment criteria reflecting the steady increase in

borrowing as a percentage of household income.

Average UK mortgage lending outstandings increased by 8% to #17.0bn (1999:

#15.7bn). Gross new lending was #2.2bn (1999: #2.1bn) and market share was

broadly maintained at 3.7% (1999: 3.8%). Margins in the first half of the

year remained stable.

Average UK savings balances grew by 6% to #20.5bn (1999: #19.4bn), in line

with market growth. Margins reduced slightly as a result of continued

competition and changes in portfolio mix.

Fees and commissions increased by 11% mainly due to additional current

account and overdraft lending activity and as a result of higher fee income

from the Additions accounts. The number of Additions account holders

increased by 10% to 958,000 (31st December 1999: 871,000). Income from

payment protection underwriting benefited in line with improved volumes of

consumer lending, overdraft, mortgages and credit card lending.

Progress continued in long term savings and investment activities with

annual premium income arising on sales of unit trusts, managed portfolios

and pension products remaining strong at #97m (1999: #91m).

Demand for on-line banking continued to grow rapidly with the number of

registered personal and small business internet banking users now 1,110,000

(31st December 1999: 500,000). Around 1 in 8 personal current account

customers are now registered for on-line banking.

The number of customers registered for telephone banking continued to grow,

increasing by 11% to 1,109,000 (31st December 1999: 1,000,000).

UK Small Business

Total income grew 11% during the first half of 2000 as a result of 12%

growth in average deposits, and growth in average lending balances of 18%.

Fees and commissions remained at similar levels despite increased activity,

reflecting continued pressure on money transmission tariffs.

Total costs fell by 1% compared with the first half of 1999, primarily as a

result of efficiency benefits from the continued centralisation of

activities.

Internet initiatives within Small Business included the launch of a joint e-

commerce development with Freeserve to provide a small business portal in

the UK for services, information and advice needed to start up and run a

successful small business. The number of Small Business customers

registered for on-line banking continued to grow, up 73% to 116,000 (31st

December 1999: 67,000).

Africa

Operating profit rose by 41%, or #17m, to #58m reflecting strong

performances in Ghana and Mauritius and despite difficult economic

conditions in Zimbabwe and Kenya. Income across Africa rose by 28% to

#142m. Overall costs increased #6m to #73m.

Wealth Management

Wealth Management serves affluent and high net worth clients globally with

relationship based services and bespoke products, particularly in the areas

of banking, asset management and long-term financial planning. Wealth

Management includes Private Banking, Offshore Services, UK Premier Banking,

Stockbrokers, continental European retail businesses and the Caribbean.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 303 278 277

Net fees and commissions 303 283 282

Income from long-term assurance 4 5 7

business

Other operating income 12 13 16

Total income 622 579 582

Total costs (353) (367) (371)

Provisions for bad and doubtful (3) (5) 10

debts

Operating profit 266 207 221

Operating profit in Wealth Management rose by 20%, or #45m, (27% adjusting

for the sale of Merck Finck in the first half of 1999) to #266m driven by

strong growth across the businesses. Total income grew by 7%, or #40m, to

#622m (10% adjusting for the sale of Merck Finck) reflecting particularly

good income growth in Stockbrokers, up 15% to #76m, Private Banking by 9% to

#83m and Offshore Services up 13% to #127m.

Total costs fell by 5% (2% adjusting for the sale of Merck Finck) to #353m.

Total customer funds, which include assets under management and on balance

sheet deposits, grew by 4% to #73bn (31st December 1999: #70bn). Loans to

customers grew by 10% to #11bn (31st December 1999: #10bn).

UK Premier Banking operating profit grew by 20% to #42m benefiting from

increased customer volumes, with customer loans and mortgages increasing 60%

and 43% respectively, compared with the first half of 1999.

Offshore Services operating profit rose 14% to #84m, with overall average

funds under management growing by 3% to #13bn (31st December 1999: #12.6bn).

Asset and liability margins were maintained.

Operating profit in the continental European retail businesses benefited

from the continued application of sophisticated customer knowledge and

behaviour tools. Operating profit, excluding the contribution from Merck

Finck, was up 38% to #44m (1999: #32m). Fees and commissions also grew as a

result of a good performance in French mutual fund and unit linked insurance

sales, together with higher stock exchange commissions and increased growth

in mortgage products.

On-line banking facilities are also available to European customers, with

over 17,000 customers in France, Spain and Portugal now registered to bank

on-line. On-line share dealing facilities are available to customers in

France and Spain. On-line banking in Offshore Services (with full multi-

currency functionality) was launched in June.

Operating profit for the Caribbean business increased by 50% to #36m, aided

by the strong offshore market and increased lending volumes in the domestic

business, up 24% compared with the first half of 1999.

Private Banking operating profit rose 38% to #29m, reflecting increased

clients' funds which rose 4% to #25.6bn (31st December 1999: #24.7bn).

Stockbrokers' operating profit grew by 52% to #32m as a result of good

growth in investment management income and increased dealing activity.

Average daily deal volumes increased to 8,900 in the first half of this year

(1999: 6,400). Around 30% of retail private customer deals are now executed

across the internet.

Barclaycard

Barclaycard is the largest credit card business in Europe with a presence in

the United Kingdom, Germany, France and Spain. It offers a full range of

credit card services to individual customers, together with card payment

facilities to retailers and other businesses. Barclaycard was the first UK

credit card to offer internet account services and continues to expand its e-

commerce operations.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 269 247 241

Net fees and commissions 254 249 231

Total income 523 496 472

Total costs (218) (202) (195)

Provisions for bad and doubtful (110) (88) (82)

debts

Operating profit 195 206 195

Operating profit at #195m was at the same level as the first half of 1999.

Net interest income rose 12% to #269m benefiting from a 17% increase in

average UK extended credit balances to #5.2bn, with Barclaycard's share of

the UK credit card market being maintained. The proportion of interest

earning balances to non-interest earning balances was maintained at more

than 70%. The interest margin has reduced slightly as a result of a rise in

funding costs and the introduction of a competitive range of customer rates.

During the first half of this year customer recruitment rose 39% to 388,000

(1999: 280,000) and self closure attrition rates reduced by 17%.

Fees and commissions increased 10% to #254m (1999: #231m) as a result of a

12% growth in transaction volumes compared to the first half of 1999. This

was slightly offset by continued pressure on merchant acquisition fees.

Barclaycard's international business in Germany, France and Spain continued

to grow with average outstanding balances increasing by 59% over the first

half of last year. The number of cards in issue overseas increased 10% to

1.1 million (31st December 1999: 1.0 million).

Total costs in Barclaycard increased by 12%, or #23m, to #218m mainly as a

result of increased strategic investment costs of #33m (1999: #16m)

including the development of information management capabilities,

international expansion and e-commerce businesses. Staff costs in the UK

were held at the same level as last year.

Barclaycard continues to build its technology capability. It was the first

UK credit card company to post products on the web. Over 235,000 customers

are registered to use the Barclaycard website for on-line account servicing,

growing at a rate of 5,000 per week. It also has 80,000 active retailers,

with 4,000 already providing shopping facilities on-line.

Provisions for bad and doubtful debts increased by 34%, to #110m (1999:

#82m). This was primarily attributable to the increased volumes of new

business within UK extended credit balances and relatively stronger growth

in international interest earning balances.

Corporate Banking

Corporate Banking provides relationship banking to the Group's middle

market, large corporate and institutional customers. Customers are served

by a network of 1,200 specialist relationship managers across the United

Kingdom who provide access to an extensive range of products. Corporate

Banking also offers its customers access to business centres in the rest of

Europe, the United States and the Middle East. In addition, an office in

Miami provides finance and correspondent banking services to the Group's

customers in Latin America.

Corporate Banking's close working relationships with Barclays Capital

ensures that large corporate and institutional customers have access to the

capital markets and to specialist investment banking products which

complement Corporate Banking's product and service range.

Corporate Banking has a strong competitive position in the United Kingdom,

where around a quarter of middle market companies bank with Barclays.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 658 642 610

Net fees and commissions 366 362 328

Other operating income (5) (17) 5

Total income 1,019 987 943

Total costs (434) (443) (420)

Provisions for bad and doubtful (44) (55) (65)

debts

Operating profit 541 489 458

Corporate Banking operating profit increased by 18%, or #83m, to #541m.

Net interest income rose by 8% to #658m. Average customer lending balances

increased by 11% to #46bn. This reflected strong growth in average UK

lending and continued growth in average international business volumes which

increased by 17% to #8bn.

High levels of origination have continued within large corporate banking in

the United Kingdom largely as a result of acquisition linked activity. UK

middle market lending volumes grew strongly, resulting from the

implementation of the new sales strategy, providing relationship managers

with a more focused sales management approach, together with mobile working

technology. Lending growth has been concentrated towards larger and higher

quality customers and as a result the overall quality of the portfolio has

improved. The Sales Financing product range, which includes factoring and

confidential invoice discounting, has seen particularly rapid growth in

total volumes, up 63% to #3.1bn, as a result of an ongoing investment

programme to develop this business.

Growth in customer lending within the rest of Europe has been predominantly

in the established operations in Germany and France, although the new

representative office in the Netherlands has also made encouraging progress.

The Middle East also saw a good flow of new business. Exposure to Latin

America remains carefully managed and fell 16% compared with the average for

the first half of 1999.

Overall lending margins have eased slightly. UK lending margins continued

to narrow, reflecting the concentration of growth in the larger and higher

quality customer segment. Overseas margins fell as stability returned to

Latin American markets.

Average deposit volumes increased by 5% to #36bn albeit at a slower rate

than 1999, reflecting a contraction in corporate liquidity. Growth has been

stronger in higher margin branch based deposits compared to lower margin

Treasury deposits. As a result the overall deposit margin has been

maintained, despite competitive pressure in some products and lower margins

on non-interest bearing current accounts.

Net fees and commissions increased by 12% to #366m (1999: #328m). Lending

related fees rose strongly reflecting a higher volume of arrangement fees in

respect of on and off-balance sheet financing products. Money transmission

income remained at a similar level as a result of continued pricing

pressure. Strong growth in electronic products has resulted in over 30% of

UK corporate customers being registered for these services. Foreign

exchange related income increased as a result of volume growth.

Other operating income fell as a result of increased credit provisions in

the Group's Brazilian associate, Banco Barclays e Galicia SA. There was no

contribution in the first half of 2000 (1999: #3m) from Cairo Barclays SAE,

which became a subsidiary from June 1999.

Costs increased by #14m, or 3%, to #434m as a result of higher investment in

the business and the impact of the consolidation of Cairo Barclays, which

added #5m to costs in the first half of 2000. Strategic investment costs

increased to #41m (1999: #16m). This increase was in respect of the new

business to business e-commerce initiative Barclays B2B.com, the UK's first

secure "purchase-to-payment" e-procurement system and continued investment

to enhance Corporate Banking's middle market franchise.

Costs (excluding strategic investment costs and the impact of the

consolidation of Cairo Barclays) fell by 4% with staff costs down compared

to the first half of 1999 reflecting continuing efficiency programmes.

The net provisions charge remained at a relatively low level of #44m (1999:

#65m). Releases and recoveries were #37m (1999: #39m).

Barclays Capital

Barclays Capital conducts the Group's international investment banking

business. The business focuses on areas where it has a competitive

advantage and which are integral to the Group. It serves as the Group's

principal point of access to the wholesale markets and also deals in these

markets with governments, supranational organisations, corporates, banks,

insurance companies and other institutional investors.

The activities of Barclays Capital are grouped into two principal areas:

Rates which includes sales, trading and research relating to government

bonds, money markets, foreign exchange, commodities, and their related

derivative instruments and Credit which includes origination, sales, trading

and research relating to loans, securitised assets, corporate bonds and

their related derivative instruments and private equity investment and

equity derivatives.

Barclays Capital is an important component of the overall Group, providing a

variety of complementary services and products to all of the Group's

businesses and customers. It also provides a counterbalance to

disintermediation of the traditional corporate lending businesses.

Barclays Capital, with its leading European loan business and strong client

franchise, is well positioned to benefit from the continued strong growth in

the European capital markets. In addition, the globalisation of investment

flows creates significant opportunities for investment banks like Barclays

Capital which have global capability for providing financing solutions to

companies.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net interest income 222 199 201

Dealing profits 415 233 316

Net fees and commissions 105 80 83

Other operating income 23 19 21

Total income 765 531 621

Total costs (509) (382) (423)

Provisions for bad and doubtful (38) (13) (23)

debts

Operating profit 218 136 175

Operating profit increased by 25% to #218m (1999: #175m) reflecting strong

performances in both the Rates businesses and the Credit businesses despite

a continued challenging trading environment.

Dealing profits rose by 31% to #415m (1999: #316m). The Rates businesses

continued to perform strongly with good contributions from interest rate

derivatives and government bonds. In the Credit businesses, there was

strong growth in equity derivatives from increased customer related

activities. Dealing profits in the second half of 1999 were adversely

affected by widening credit spreads which continued to affect secondary

corporate bonds in the first half of 2000. The average daily value at risk

level during the period was #17.9m (1999: #13.0m).

Net interest income increased 10% to #222m (1999: #201m) as a result of good

performances from structured capital markets and the money markets business.

Net fees and commissions rose by #22m to #105m (1999: #83m) reflecting the

increased number and size of transactions in the Credit businesses, in

particular from large acquisition related loans. These included high

profile transactions such as Vodafone AirTouch PLC's purchase of Mannesmann

AG, France Telecom's purchase of Orange PLC, Pacific Century CyberWork

Limited's bid for Cable and Wireless HKT in Asia and Nisource Inc's

acquisition of Columbia Energy Group in the United States.

Other operating income increased by #2m to #23m and includes a profit

arising from further distributions from Long Term Capital Portfolio, which

have now resulted in the full repayment of the original amount invested.

Realisations in the Private Equity business continued to make a good

contribution.

Provisions for bad and doubtful debts increased to #38m and were mainly in

respect of overseas exposures.

Costs rose by 20% to #509m (1999: #423m), reflecting a higher level of

performance-related pay in line with improved profitability. Other costs

remained at a similar level to the first half of 1999. This was achieved

while continuing to hire a broad range of staff as part of the strategic

expansion of Barclays Capital's European franchise and despite increased

investment in e-commerce.

Through e-commerce, Barclays Capital supplies electronic research,

analytical, trading and reporting systems to clients in a range of products

including exchange traded futures, commercial paper and foreign exchange.

This e-enablement capability has made a range of initiatives possible, such

as working with the Charles Schwab Corporation to develop automated foreign

exchange facilities which would enable retail investors to buy and sell

multi-currency securities, lead managing the first e-bond issue for the

European Investment Bank and being a founding provider of fixed income

credit products through SWX, an electronic exchange for Swiss retail

clients.

Barclays Global Investors

Barclays Global Investors (BGI) is the largest institutional asset manager

in the world counting some of the world's most sophisticated investing

institutions amongst its 1,600 clients. BGI offers quantitative active and

indexed asset management services for clients in thirty four countries from

offices located in seven countries around the world. BGI is also a leading

global lender of securities to qualified financial institutions who borrow

securities on a fully collateralised basis as a financing tool and to

support customer activities.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Net fees and commissions 196 166 152

Net interest income 4 3 3

Total income 200 169 155

Total costs (167) (154) (127)

Operating profit 33 15 28

Operating profit has increased by 18% to #33m (1999: #28m).

Fees and commissions increased 29% to #196m (1999: #152m) as a result of

management fees from new business growth in assets under management and

increased sales of higher margin products in advanced active and exchange

traded funds. New business volumes were particularly strong in the United

States, United Kingdom and Japan, with good growth in Canada and Australia.

Over a third of assets under management are now sourced outside the US. The

introduction of securities lending in Japan last year and the volume growth

in the US also contributed to the revenue improvements.

Total assets under management grew to #529bn from #486bn at 31st December

1999; #23bn of the increase is attributable to net new business and #20bn is

attributable to market and exchange rate translation movements. Assets

under management consist of #418bn of indexed funds and #111bn under

quantitative active management.

Costs rose by #40m to #167m partly reflecting continued investment in the

development of the business and increased staff costs. Staff costs

increased by 28% mainly as a result of an increase in staff by 200 to 1,900

during the first half of 2000 to support the growth in the business and also

increased performance related payments.

In the first half of 2000, BGI launched 28 new ishares (exchange traded

funds) in the US, bringing the total number now listed to 45 and over #5bn

of funds under management globally. The iFTSE 100, the UK's first exchange

traded fund was launched in April. BGI's UK Defined Contribution business

grew rapidly, experiencing a 36% and 39% increase in client numbers and

assets under management to 137 and #1.3bn respectively, at 30th June 2000.

Other operations

Property costs include Barclays Group Property Services which is responsible

for the management of the Group's operational premises and property related

services. Property costs also include the central administration of certain

operational property costs.

Central services includes a variety of activities which support the

operating businesses and Service Provision which provides central

information technology services and recovers the full cost of these by way

of charges to the businesses receiving the service.

Management of Group capital is the balance of earnings on the Group's

capital remaining after allocations to business groups, based generally on

weighted risk assets. The Group maintains hedges with respect to its

capital and its current account balances, which are designed both to reduce

the impact of short-term interest rate fluctuations on profits and to

increase profitability over the interest rate cycle. The hedges increase

profitability when average short-term interest rates are lower than average

medium-term interest rates and depress profitability when average short-term

interest rates are higher than average medium-term interest rates.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Property costs 9 11 10

Central services (28) (23) (29)

Management of Group capital 25 35 9

Operating profit 6 23 (10)

The surplus reported in Management of Group Capital is attributable to

credits arising in transition businesses that are managed centrally. This

has been partly offset by a deficit from the central management of Group

capital, compared with a surplus in 1999. The deficit is mainly

attributable to allocations to business groups, reflecting higher short-term

interest rates. The basis of allocation to the businesses remains in line

with previous years. Lower average medium-term rates have had an adverse

effect on the earnings from capital balances as have the costs of share buy

backs.

Head office functions

Head office functions comprise the Group's central executive, Group finance,

corporate communications, human resources and Group risk.

Group finance includes Group general counsel's office, the Group corporate

secretariat and the treasury, financial control, investor relations,

economics and taxation functions.

Group risk includes risk management, Group Credit Policy Unit and internal

audit operations.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Operating cost (39) (47) (30)

Restructuring charge

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Staff costs 92 (55) 247

Administrative expenses - other 14 54 98

106 (1) 345

A significant element of the restructuring charge of #106m relates to Retail

Financial Services with the remainder arising primarily in Corporate Banking

and Central services.

The staff costs charge of #92m includes some 1,000 staff reductions in the

first half of 2000. The charge also includes costs associated with some

3,200 further affected staff.

In the first half of 2000 expenditure of #119m was incurred in respect of

the 1999 provision. The majority of the remaining element of #71m relates

to property costs.

Expenditure of #33m has been incurred in respect of the restructuring charge

for 2000.

Value Based Management

Barclays is introducing Value Based Management (VBM), the principles of

which are designed to align management decision taking at all levels of the

Group with the interests of its shareholders. The VBM framework is designed

to identify and reward performance that maximises shareholder return. The

basic principle is to establish a robust financial framework that provides a

consistent evaluation of the risk and return characteristics that can be

applied to all business activities. VBM will also have a significant impact

on key processes such as strategy development, management decision taking

and performance-linked incentivisation.

Economic profit

VBM is based on the concept of economic profit - the post-tax attributable

profit generated by a business over and above the cost of capital. A

business or activity that generates a positive economic profit creates value

for our shareholders, whereas a business that generates a negative economic

profit destroys value. To avoid the problems of short-term optimisation of

business performance that have sometimes been associated with VBM

frameworks, the strategy and performance of business will be assessed on a

multi-year basis by discounting future projected economic profits.

Economic profit is defined as profit after tax and minority interests less a

charge for the cost of average shareholders' funds. This is calculated

using a capital asset pricing model. The assumptions made include estimates

of the future equity market risk premium of 4.5% and the relative risk of

Barclays shares compared to the FTSE, measured by beta. A forward looking

beta of 1.2 has been used. The Group's target is to double economic profit

every four years.

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Profit after tax and minority 1,320 1,063 834

interests

Average shareholders' funds 8,924 8,307 8,265

Post tax cost of equity 11% 11% 11%

Cost of average shareholders' (491) (456) (455)

funds

Economic profit 829 607 379

Profit after tax and minority interests excludes the charge for the write-

back of goodwill on disposals of #138m in the first half of 1999.

Economic profit as defined above but risk adjusted (replacing credit risk

provisions with risk tendency (see page 37) was #802m (half year to 31st

December 1999: #556m, half year to 30th June 1999: #355m).

Economic capital

Economic capital, which is distinct from regulatory capital, is a management

tool that estimates risk on the basis of the volatility of earnings around

their predicted level and therefore their contribution to overall Group

risk. The higher the volatility, and hence risk, the more capital is

required. Capital is calculated for each business based on its contribution

to the overall risk of the Group. The major factor affecting profit

volatility is credit risk. The calculation also reflects market risk and

business and operational risk.

The calculation of economic capital is an integral part of the work to

introduce the VBM principles and is being further developed as part of that

process.

Risk tendency

The Group uses a corporate grading structure which shows the probability of

future default by the borrower. This, together with similar risk

calibration of categories of personal sector lendings, is used to estimate

levels of annualised future credit losses from the overall lending portfolio

averaged across the economic cycle (termed risk tendency). Risk tendency

estimates assist in portfolio management decisions, such as exposure limits

to any single counterparty or borrower, the desired aggregate exposure

levels to individual sectors and pricing policy and also provide a guide to

changes in the underlying credit quality of the lending portfolio over time.

Based upon the composition of the lending portfolio as at 30th June 2000,

the underlying level of risk tendency, averaged across the economic cycle,

is estimated at around #830m (31st December 1999: #750m).

Risk tendency rose by #80m during the first half of the year primarily as a

result of growth in Barclaycard and the consumer loan portfolio within

Retail Financial Services. There has also been an increase at Barclays

Capital reflecting methodology enhancements and some asset growth.

The growth in UK corporate lending has been concentrated towards large and

high quality customers and this has resulted in Corporate Banking's risk

tendency being maintained at last year's level.

Risk Tendency

30.6.00 31.12.99 30.6.99

#m #m #m

Retail Financial Services 360 325 305

Barclaycard 200 170 165

Corporate Banking 210 210 210

Barclays Capital 60 45 45

830 750 725

BARCLAYS PLC

ADDITIONAL INFORMATION (UNAUDITED)

KEY FACTS

Half-year ended

30.6.00 31.12.99 30.6.99

RETAIL FINANCIAL SERVICES

Number of UK branches 1,728 1,899 1,945

Retail Customers

UK current account customers 8.1m 8.1m 8.0m

UK savings account customers 4.0m 3.8m 3.7m

UK Small Business customers 442,000 440,000 440,000

UK customers registered for 1,109,000 1,000,000 943,000

Barclaycall

UK customers registered for 1,110,000 500,000 342,000

on-line banking

Africa - number of countries 10 9 10

represented

Africa - customer deposits #1.7bn #1.6bn #1.5bn

Wealth Management

Customers in continental Europe 311,000 307,000 304,000

Total customer funds #69.3bn #66.0bn #61.2bn

Stockbrokers - deal volumes per 8,900 6,600 6,400

day

Caribbean - number of countries 14 14 14

represented

Caribbean - customer deposits #3.4bn #3.1bn #3.0bn

BARCLAYCARD

UK Barclaycards in issue 10.1m 9.7m 9.5m

International cards in issue 1.1m 1.0m 0.8m

Number of merchant transactions 560m 600m 500m

processed

Customers registered for internet 235,000 111,000 52,000

account services

CORPORATE BANKING

Number of UK Corporate Banking 112,000 112,000 112,000

connections

- Mid corporate connections 96,000 96,000 96,000

- Larger business connections 14,000 14,000 14,000

- Large corporate connections 2,400 2,200 2,100

Customers registered for 36,000 29,000 25,000

electronic banking

Number of current accounts 234,000 231,000 226,000

Number of deposit accounts 101,000 102,000 100,000

MORE TO FOLLOW

IRCBIGDIUGGGGGD

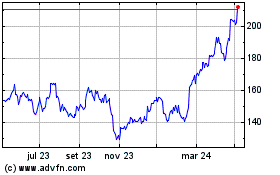

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024