RNS Number:9081O

Barclays PLC

3 August 2000

PART 1

BARCLAYS PLC 2000 HALF YEAR RESULTS

HIGHLIGHTS

- Operating income rose by 13% to #4,676 million from #4,146 million in

1999

- Operating profit after provisions rose by 24% to #1,770 million from

#1,431 million in 1999*

- Profit before tax rose to #1,842 million from #967 million in 1999.

This year's profit before tax was boosted by #178m gain on the sale of DIAL

(compared with a deficit in 1999 of #119m on the sale of Merck Finck).

Restructuring charges were #106m compared with #345m in 1999.

- Economic profit increased to #829 million from #379 million in 1999

- Earnings per share increased to 88.9p from 46.2p in 1999

- Dividend per share rose 14% to 20.0p from 17.5p in 1999

Barclays Group Chief Executive, Matthew Barrett commented: -

"We are engaged in a major transformation of the Bank, aimed at creating

benefits for customers in terms of superior products and services, thereby

creating value for shareholders. The results of this are beginning to show;

the first half of this year has been one of acquiring new customers,

increasing business from existing customers, and improving productivity.

"These results are also testament to the value we provide to a wide spectrum

of customer groups through a diverse range of products".

* Figures exclude the 1999 and 2000 restructuring charges

For further information please contact:

Media Relations

Leigh Bruce Maria Darby/Pam O'Keeffe

Director, Corporate Communications Group Media Relations

Tel: 020 7699 2658 Tel: 020 7699 2970/2659

Investor Relations

Ian Roundell

Head of Investor Relations

Tel: 020 7699 2961

Photographs of the Barclays Chairman, Chief Executive and Finance Director

will be available from www.newscast.co.uk from 1.00pm.

The full results document is available from: www.investor.barclays.com

BARCLAYS PLC - SUMMARY

RESULTS FOR SIX MONTHS TO 30TH JUNE 2000

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Operating profit before 2,145 1,808 1,751

provisions*

Provisions for bad and doubtful (376) (301) (320)

debts

Operating profit* 1,770 1,506 1,431

Restructuring charge (106) 1 (345)

Exceptional items 178 (19) (119)

Profit before tax 1,842 1,488 967

Tax charge (488) (395) (249)

Profit attributable to 1,320 1,063 696

shareholders

Earnings per share 88.9p 71.3p 46.2p

Earnings per share (based on 81.9p 72.1p 70.7p

operating profit above)*

Dividend per share 20.0p 32.5p 17.5p

Economic profit 829 607 379

*Operating profit shown above excludes the 1999 and 2000 restructuring

charges. Earnings per share and post-tax return on average shareholders'

funds based on this operating profit also excludes exceptional items.

- Operating profit rose by 24% to #1,770 million (1999: #1,431 million).

Earnings per share increased to 81.9p (1999: 70.7p).

- Operating income increased 13% to #4,676 million (1999: #4,146 million)

and operating costs rose by 6% to #2,531 million (1999: #2,395 million).

- Total costs rose by 6% to #2,531 million (1999: #2,395 million) as a

result of increases in strategic investment and revenue related costs.

Business as usual costs were maintained at #2,099 million (1999: #2,090

million).

- The post-tax return on average shareholders' funds improved to 27.2%

(1999: 25.5%).

- The interim dividend increased by 14% to 20.0p (1999: 17.5p).

- Shareholders' funds were #9.2 billion at 30th June 2000 (31st December

1999: #8.5 billion) and the tier 1 ratio was 8.0% (31st December 1999:

7.5%). The Group's economic capital requirement is estimated to be around

#7.5 billion to support its current business requirements and to allow for

future growth.

- The Group returned #309 million of capital to shareholders in the first

half of 2000.

- Retail Financial Services increased operating profit by 32% to

#822 million (1999: #621 million). Net interest income improved by 7% as a

result of growth in UK consumer lending, mortgage lending and savings

balances. Net fees and commissions grew by 8% benefiting from increases in

both Retail Customers and Wealth Management. Total costs fell 3% despite an

increase in strategic investment expenditure.

- Barclaycard's operating profit of #195 million was at the same level as

the first half of 1999. Net interest income rose by 12% and benefited from

increased extended credit balances. Fees and commissions grew 10% as a

result of increased transaction volumes. Total costs increased by 12% to

#218 million (1999: #195 million) primarily reflecting higher strategic

investment expenditure of #33 million (1999: #16 million).

- Corporate Banking produced a strong performance with an improvement in

operating profit of 18% to #541 million (1999: #458 million). Net interest

income rose 8% reflecting the growth in customer lending balances. Fees and

commissions increased 12% as a result of higher volumes of lending related

fees and foreign exchange related income.

- Overall banking margins fell to 3.17% (1999: 3.50%), reflecting the

impact of increased levels of wholesale business and some reductions in

overall UK margins in Retail Financial Services, Corporate Banking and

Barclaycard.

- Barclays Capital increased operating profit by 25% to #218 million

(1999: #175 million) reflecting strong performance in both the Rates and

Credit businesses.

- Barclays Global Investors' operating profit rose by 18% to #33 million

(1999: #28 million) benefiting from new business growth in assets under

management and increased sales of higher margin products. Total assets

under management increased to #529 billion (31st December 1999: #486

billion).

- Total provisions for bad and doubtful debts rose by #56 million to #376

million, primarily as a result of higher levels of new and increased

provisions reflecting increased volumes of new business in Retail Financial

Services and Barclaycard.

- The exceptional profit of #178 million reflected a #186 million profit

on the sale of the Dial business in June 2000.

- Economic profit increased to #829 million (1999: #379 million).

BARCLAYS PLC

HALF YEAR REVIEW

We have built on our 1999 performance with strong results in the first half

of 2000. Operating profit improved to #1,664 million. Earnings per share

increased to 88.9p from 46.2p and post tax return on equity rose to 29.6%.

As a result the interim dividend is being increased by 14% to 20p.

Total revenues were up 13% to #4,676 million. We have seen revenue growth

across all of our main businesses as they continue to build momentum.

The diversification of our portfolio of businesses, customer segments and

geographic coverage makes us less vulnerable as a Group to market

discontinuity in any one product line or market place.

Retail Financial Services profit improved by over 30% to #822 million

reflecting good performances in consumer lending, mortgages and savings.

Wealth Management is an important area of focus. In the last six months the

Wealth Management business made a good contribution, particularly in

Stockbrokers, Private Banking and Offshore Services.

Barclaycard's profit was flat at #195 million with an 11% increase in

revenues to #523 million partly offset by increased strategic investment

spend in developing information management capabilities, international

expansion and e-commerce initiatives.

Corporate Banking recorded an 18% rise in profit to #541 million. We

continue to develop the quality of our customer proposition in the United

Kingdom. Our improved customer service approach to the UK middle market is

generating record satisfaction levels with customers and helping us win new

customers and improve product penetration in an increasingly competitive

market.

Barclays Capital increased profits by 25% to #218 million, with both the

Rates and Credit Businesses performing well. Our unique debt-focused

approach and global model is gaining us new and repeat business from clients

in the United Kingdom, United States, Asia and the rest of Europe. As

European credit markets expand we benefit from a leading market position in

loans and bonds.

Barclays Global Investors (BGI) profit increased by 18% to #33 million,

reflecting strong new business volumes in the core United States and United

Kingdom businesses offset by continuing investment in key strategic

initiatives, including exchange traded funds. Assets under management

increased to #529 billion, from #486 billion at 31st December 1999.

The first six months saw good progress in the overhaul of everything we do

for customers to achieve superiority in service quality and product

proposition. Customers can expect to see continuing improvement in the

range of products and channels. We have gained new customers across all

businesses and our existing customers showed a trend of increased business

with us.

Technology will play an important part in our plans. We are bringing new

customer applications to market at scale. Our small business joint venture

with Freeserve provides a broad range of on-line information and services to

UK small businesses. In addition, Barclays B2B.com will provide a direct

channel for the sale and delivery of business services.

In the future, technology will enable us to provide much wider functionality

and information plus the capability to deliver our services over mobile

devices and interactive TV. WAP-enabled mobile phone services will be

operational for both Barclaycard and Stockbrokers by the end of the year.

The level of investment required over the next few years will be

substantial. We believe we have a proper fully integrated e-enablement

strategy which will be vital in determining success in this market.

As a foundation for implementing value-based management, we have identified

an initial structure of key lines of business in the Group, each of which

will be tasked with achieving the highest possible value within the Group.

Accordingly, each of these businesses and the corporate centre will

explicitly base decision making on the standard of maximising shareholder

value creation.

As we look forward to another challenging period ahead, we are immensely

encouraged by the continued dedication, support and sheer hard work of all

the Group's staff. Together we will continue to drive hard towards our goal

of doubling economic profit every four years.

SIR PETER MIDDLETON MATTHEW W. BARRETT

GROUP CHAIRMAN GROUP CHIEF EXECUTIVE

FINANCIAL HIGHLIGHTS

Half-year ended

30.6.00 31.12.99 30.6.99

RESULTS #m #m #m

Net interest income 2,471 2,349 2,278

Non-interest income 2,205 1,864 1,868

Operating income 4,676 4,213 4,146

Operating expenses* (2,531) (2,405) (2,395)

Operating profit before 2,145 1,808 1,751

provisions*

Provisions for bad and doubtful (376) (301) (320)

debts

Provisions for contingent 1 (1) -

liabilities and commitments

Operating profit* 1,770 1,506 1,431

Restructuring charge (106) 1 (345)

Exceptional items 178 (19) (119)

Profit before tax 1,842 1,488 967

Profit retained 1,025 579 434

Economic profit 829 607 379

BALANCE SHEET

Shareholders' funds 9,237 8,483 8,219

Loan capital 4,748 4,597 4,117

Total capital resources 14,750 13,432 12,685

Total assets 286,385 254,793 241,265

Weighted risk assets 123,483 115,878 113,994

PER ORDINARY SHARE P P P

Earnings 88.9 71.3 46.2

Earnings (based on operating 81.9 72.1 70.7

profit above)*

Dividend 20.0 32.5 17.5

Net asset value 626 568 547

PERFORMANCE RATIO % % %

Post-tax return on average 29.6 25.6 16.8

shareholders' funds

Post-tax return on average

shareholders' funds (based on 27.2 24.4 25.5

operating profit above)*

RISK ASSET RATIO

Tier 1 8.0 7.5 7.4

Total 11.5 11.3 10.9

GROUP YIELDS, SPREADS & MARGINS % % %

Gross yield 7.04 6.78 6.90

Interest spread 2.60 2.81 2.96

Interest margin 3.17 3.30 3.50

EXCHANGE RATES US$/# US$/# US$/#

Period end 1.51 1.62 1.58

Average 1.57 1.62 1.62

* Operating profit shown above excludes the 1999 and 2000 restructuring

charges. Earnings per share and post-tax return on average shareholders'

funds based on this operating profit also excludes exceptional items.

SUMMARY OF RESULTS

Half-year ended

PROFIT BEFORE TAX 30.6.00 31.12.99 30.6.99

#m #m #m

Retail Financial Services 822 691 621

Barclaycard 195 206 195

Corporate Banking 541 489 458

Barclays Capital 218 136 175

Barclays Global Investors 33 15 28

Other operations 6 23 (10)

Head office functions (39) (47) (30)

Goodwill amortisation (6) (7) (6)

Operating profit 1,770 1,506 1,431

Restructuring charge (106) 1 (345)

Exceptional items 178 (19) (119)

1,842 1,488 967

TOTAL ASSETS 30.6.00 31.12.99 30.6.99

#m #m #m

Retail Financial Services 42,799 41,383 39,375

Barclaycard 7,696 7,343 6,401

Corporate Banking 51,209 47,422 46,662

Barclays Capital 170,950 144,811 135,941

Barclays Global Investors 255 232 199

Other operations and Head office 5,462 5,562 5,174

functions

Retail life-fund assets 8,014 8,040 7,513

attributable to policyholders

286,385 254,793 241,265

WEIGHTED RISK ASSETS 30.6.00 31.12.99 30.6.99

#m #m #m

Retail Financial Services 27,503 26,152 25,354

Barclaycard 7,697 7,210 6,333

Corporate Banking 52,502 48,218 47,683

Barclays Capital 33,388 32,032 31,652

Barclays Global Investors 653 456 297

Other operations 1,740 1,810 2,675

123,483 115,878 113,994

CONSOLIDATED PROFIT AND LOSS ACCOUNT (UNAUDITED)

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Interest receivable 5,491 4,823 4,497

Interest payable (3,022) (2,477) (2,219)

Profit on redemption/repurchase 2 3 -

of loan capital

Net interest income 2,471 2,349 2,278

Net fees and commissions 1,602 1,515 1,417

receivable

Dealing profits 415 234 322

Other operating income 188 115 129

Total non-interest income 2,205 1,864 1,868

Operating income 4,676 4,213 4,146

Administration expenses - staff (1,606) (1,389) (1,668)

costs

Administration expenses - other (902) (872) (935)

Depreciation and amortisation (129) (143) (137)

Operating expenses (2,637) (2,404) (2,740)

Operating profit before 2,039 1,809 1,406

provisions

Provisions for bad and doubtful (376) (301) (320)

debts

Provisions for contingent 1 (1) -

liabilities and commitments

Operating profit 1,664 1,507 1,086

Exceptional items 178 (19) (119)

Profit on ordinary activities 1,842 1,488 967

before tax

Tax on profit on ordinary (488) (395) (249)

activities

Profit on ordinary activities 1,354 1,093 718

after tax

Minority interests (equity and (34) (30) (22)

non-equity)

Profit for the period

attributable to the members of 1,320 1,063 696

Barclays PLC

Dividends (295) (484) (262)

Profit retained for the period 1,025 579 434

Earnings per ordinary share 88.9p 71.3p 46.2p

Earnings per ordinary share 72.1p

before restructuring charge and 81.9p 70.7p

exceptional items

Dividend per ordinary share:

First interim (payable 3rd 20.0p - 17.5p

October 2000)

Second interim - 32.5p -

CONSOLIDATED PROFIT AND LOSS ACCOUNT

BEFORE RESTRUCTURING CHARGE (UNAUDITED)

Half-year ended

30.6.00 31.12.99 30.6.99

#m #m #m

Interest receivable 5,491 4,823 4,497

Interest payable (3,022) (2,477) (2,219)

Profit on redemption/repurchase 2 3 -

of loan capital

Net interest income 2,471 2,349 2,278

Net fees and commissions 1,602 1,515 1,417

receivable

Dealing profits 415 234 322

Other operating income 188 115 129

Total non-interest income 2,205 1,864 1,868

Operating income 4,676 4,213 4,146

Administration expenses - staff (1,514) (1,444) (1,421)

costs

Administration expenses - other (888) (818) (837)

Depreciation and amortisation (129) (143) (137)

Operating expenses (2,531) (2,405) (2,395)

Operating profit before 2,145 1,808 1,751

provisions

Provisions for bad and doubtful (376) (301) (320)

debts

Provisions for contingent 1 (1) -

liabilities and commitments

Operating profit before 1,770 1,506 1,431

restructuring charge

Restructuring charge (106) 1 (345)

Exceptional items 178 (19) (119)

Profit on ordinary activities 1,842 1,488 967

before tax

The results shown on page 8 include the 1999 and 2000 restructuring charges

within operating expenses. The table above presents operating expenses

excluding the restructuring charge.

CONSOLIDATED BALANCE SHEET (UNAUDITED)

Half-year ended

30.6.00 31.12.99 30.6.99

Assets: #m #m #m

Cash and balances at central 588 1,166 780

banks

Items in course of collection 2,660 2,492 2,709

from other banks

Treasury bills and other eligible 9,584 7,176 8,321

bills

Loans and advances to banks

- banking 9,678 13,071 14,214

- trading 30,607 26,555 23,228

40,285 39,626 37,442

Loans and advances to customers

- banking 99,893 95,006 88,952

- trading 34,547 21,562 19,671

134,440 116,568 108,623

Debt securities 61,380 53,919 48,756

Equity shares 9,947 5,604 8,011

Interests in associated 97 106 131

undertakings and joint ventures

Intangible fixed assets - 188 183 209

goodwill

Tangible fixed assets 1,731 1,800 1,878

Other assets 17,471 18,113 16,892

278,371 246,753 233,752

Retail life-fund assets 8,014 8,040 7,513

attributable to policyholders

Total assets 286,385 254,793 241,265

Liabilities:

Deposits by banks - banking 39,624 26,915 24,863

- trading 19,908 17,571 14,213

59,532 44,486 39,076

Customer accounts - banking 112,464 105,027 98,629

- trading 27,875 18,939 18,316

140,339 123,966 116,945

Debt securities in issue 18,388 23,329 22,976

Items in course of collection due 1,252 1,400 1,308

to other banks

Other liabilities 44,110 40,140 40,762

Undated loan capital - 330 309 317

convertible to preference shares

Undated loan capital - non- 1,475 1,440 1,463

convertible

Dated loan capital - non- 2,943 2,848 2,337

convertible

268,369 237,918 225,184

Minority interests and

shareholders' funds:

Minority interests: equity 86 82 72

Minority interests: non-equity 679 270 277

Called up share capital 1,477 1,495 1,503

Reserves 7,760 6,988 6,716

Shareholders' funds: equity 9,237 8,483 8,219

10,002 8,835 8,568

278,371 246,753 233,752

Retail life-fund liabilities 8,014 8,040 7,513

attributable to policyholders

Total liabilities and 286,385 254,793 241,265

shareholders' funds

ADDITIONAL INFORMATION (UNAUDITED)

KEY FACTS

Half-year ended

30.6.00 31.12.99 30.6.99

RETAIL FINANCIAL SERVICES

Number of UK branches 1,728 1,899 1,945

Retail Customers

UK current account customers 8.1m 8.1m 8.0m

UK savings account customers 4.0m 3.8m 3.7m

UK Small Business customers 442,000 440,000 440,000

UK customers registered for 1,109,000 1,000,000 943,000

Barclaycall

UK customers registered for on- 1,110,000 500,000 342,000

line banking

Africa - number of countries 10 9 10

represented

Africa - customer deposits #1.7bn #1.6bn #1.5bn

Wealth Management

Customers in continental Europe 311,000 307,000 304,000

Total customer funds #69.3bn #66.0bn #61.2bn

Stockbrokers - deal volumes per 8,900 6,600 6,400

day

Caribbean - number of countries 14 14 14

represented

Caribbean - customer deposits #3.4bn #3.1bn #3.0bn

BARCLAYCARD

UK Barclaycards in issue 10.1m 9.7m 9.5m

International cards in issue 1.1m 1.0m 0.8m

Number of merchant transactions 560m 600m 500m

processed

Customers registered for internet 235,000 111,000 52,000

account services

CORPORATE BANKING

Number of UK Corporate Banking 112,000 112,000 112,000

connections

- Mid corporate connections 96,000 96,000 96,000

- Larger business connections 14,000 14,000 14,000

- Large corporate connections 2,400 2,200 2,100

Customers registered for 36,000 29,000 25,000

electronic banking

Number of current accounts 234,000 231,000 226,000

Number of deposit accounts 101,000 102,000 100,000

MORE TO FOLLOW

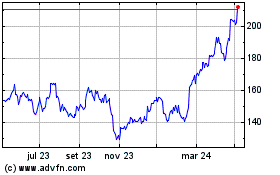

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024