Possible Offer for Woolwich

09 Agosto 2000 - 4:03AM

UK Regulatory

RNS Number:2041P

Barclays PLC

9 August 2000

POSSIBLE OFFER BY

BARCLAYS PLC FOR WOOLWICH PLC

In the light of market speculation, Barclays and Woolwich announce that they

are in discussions which may or may not lead to a recommended offer by

Barclays for Woolwich.

The offer, if made, would comprise 164p in cash and 0.1175 Barclays shares (ex

the interim dividend of 20.0p per Barclays share) per Woolwich share.

Woolwich shareholders would retain the Woolwich interim dividend of 4.4p per

share. The offer, together with the Woolwich interim dividend, would value

Woolwich at 362p per share (based on Barclays closing price of 1667p as at 8

August 2000), a premium of 34 per cent to Woolwich's closing price of 269.25p

at that date, and on this basis would value the whole of the issued share

capital of Woolwich at approximately #5.5 billion.

The transaction would be expected to be earnings enhancing for Barclays in

2001 and beyond (before accounting for goodwill and restructuring charges but

after the inclusion of synergies)*.

In February 2000, Barclays Chief Executive, Matthew Barrett, set out his

vision for the transformation of Barclays to achieve the following principal

objectives:

- superiority in the range of products, services and value propositions

available to customers

- value maximisation through the application of leading edge management

sciences and great people and leadership

- innovation in the use of technology for the benefit of customers and to

transform internal business models

- outstanding productivity

The incorporation of Woolwich's brand, management, products and capabilities

within the Barclays group would accelerate the achievement of Barclays

strategic ambitions - particularly in personal financial services.

Both brands, supported by Barclays and Woolwich branches, would be retained.

In time, the products and services would be made available to the combined

customer base through their channel of choice.

The combination of Barclays and Woolwich would:

- have as its vision the creation of customer advantage by making available

enhanced value, greater convenience and increased access

- serve one of the largest customer bases in the United Kingdom financial

services industry

- bring together two acknowledged leaders in e-commerce

- accelerate the expansion of Woolwich's innovative Open Plan service

- achieve a major presence for the enlarged group in the mortgage market - an

important gateway for customer relationship development

- give Barclays access to Woolwich's successful IFA channel

The potential transaction would be expected to generate substantial synergies,

both in terms of additional revenues and of cost savings.

A further announcement is expected to be made as soon as practicable.

Barclays is being advised by Credit Suisse First Boston and Woolwich is being

advised by Schroder Salomon Smith Barney.

Credit Suisse First Boston, which is regulated in the United Kingdom by The

Securities and Futures Authority Limited, is acting for Barclays and for no

one else in connection with this matter and will not be responsible to anyone

other than Barclays for providing the protections afforded to customers of

Credit Suisse First Boston or for giving advice in relation to the

transaction.

Schroder Salomon Smith Barney, which is regulated in the United Kingdom by The

Securities and Futures Authority Limited, is acting for Woolwich and for no

one else in connection with this matter and will not be responsible to anyone

other than Woolwich for providing the protections afforded to customers of

Schroder Salomon Smith Barney or for giving advice in relation to the

transaction.

This announcement does not constitute an offer to sell or an invitation to

purchase any securities.

In order to utilise the "Safe Harbor" provisions of the United States Private

Securities Litigation Reform Act of 1995, Barclays and Woolwich are providing

the following cautionary statement:

This announcement contains certain forward looking statements with respect to

the financial condition, results of operations and businesses of Barclays and

Woolwich, synergies and cost savings and management's plans and objectives for

the enlarged Barclays group. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon circumstances that

will occur in the future. There are a number of factors that could cause

actual results and developments to differ materially from those expressed or

implied by these forward looking statements and forecasts, such as the ability

of Barclays and Woolwich to integrate their large and complex businesses and

realise synergies and achieve cost savings, delays in new product launches,

exposure to fluctuations in exchange rates for foreign currencies, the impact

of competition, price controls and price reductions and inflation, adverse

economic conditions, and the inability of the enlarged Barclays group to

market existing and new products effectively.

*Nothing in this announcement should be construed as a profit forecast or be

interpreted to mean that the future earnings per share of the enlarged

Barclays group will necessarily be greater than the historic published

earnings per share of the Barclays group.

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

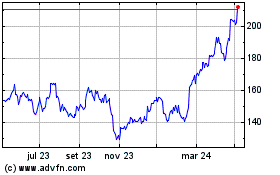

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024