Barclays Launches US$ Tier 1

13 Setembro 2000 - 2:32PM

UK Regulatory

RNS Number:9079Q

Barclays Bank PLC

13 September 2000

BARCLAYS LAUNCHES US$1.25 BILLION OF TIER 1 PREFERRED SECURITIES

Barclays Bank PLC today has launched an offer of US$1.25 billion of Reserve

Capital Instruments (RCIs), tier 1 capital as defined for regulatory purposes

by the Financial Services Authority. The securities will be issued by

Barclays Bank PLC, a wholly owned subsidiary of Barclays PLC, and listed on

the London Stock Exchange.

The issue, which will have broadly the same structure as the euro-denominated

RCIs issued by Barclays earlier this year, consists of US$1.25 billion of

perpetual fixed rate securities that are callable in June 2011. If they are

not called, the coupon steps up and the RCIs become floating rate securities.

The RCIs are expected to be rated aa2/A+ by Moody's Investor Services Limited

and Standard and Poor's respectively.

Hugh Graham, Deputy Group Treasurer said "This issue forms part of Barclays

regular capital management programme. Raising non-sterling tier 1 capital

achieves a better currency match of assets and capital which reduces the

volatility in the capital ratios that can result from exchange rate movements.

This issue complements neatly the euro-denominated RCI issue made in April".

Barclays Capital, the investment banking division of the Barclays Group, is

lead managing the deal.

For further Information:

Ian Roundell, Head of Investor Relations

Barclays PLC

Tel: 020 7699 2961

Leigh Bruce, Director, Corporate Communications

Barclays PLC

Tel: 020 7699 2658

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

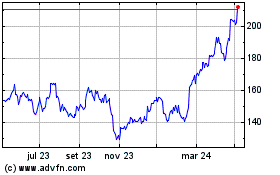

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024