Barclays PLC - Re BZW Reorganisation, etc

02 Fevereiro 1998 - 5:30AM

UK Regulatory

RNS No 4281a

BARCLAYS PLC

2nd February 1998

BARCLAYS PLC

STRATEGIC REORGANISATION OF BZW

FINANCIAL EFFECT

In October 1997 Barclays announced its decision to reorganise

its investment banking business and withdraw from equities,

equity capital markets and the mergers and acquisition

advisory business, together with all of its investment banking

business in Australasia.

Barclays today announces that the subsequent sale of certain

parts of BZW and associated restructuring will result in a

loss of #340 million to the Group. This loss will be

accounted for in Barclays 1997 full year results.

The #340 million loss includes the #57 million discount on the

sale of net assets arising from the disposal of the UK,

continental European and Asian businesses. The other major

items included relate to staff, property, infrastructure and

IT costs. It is expected that tax relief at approximately 24%

will be obtained on the #340 million loss. There will be an

additional charge of #129 million to the profit and loss

account in 1997 in respect of goodwill. This was written off

directly to reserves in previous years following the

acquisition of certain of the BZW businesses and therefore it

has no effect on the Group's capital base.

The effects of the sale of the Australasian investment banking

business will be accounted for in 1998 but will not be

significant. There may be certain other costs during 1998

associated with the sale or reorganisation of parts of BZW but

they are not expected to be material.

Trading performance

The trading performance of those parts of BZW offered for sale

was affected by uncertainty surrounding their future and

difficult market conditions. These businesses will report an

operating loss of #219 million for the year ended 31 December

1997 (1996: operating loss of #11 million). The bulk of the

1997 loss arose in the last quarter.

Barclays Capital, the continuing investment banking business

of the Group, performed

well during the year and will report an operating profit of

#248 million in 1997

(1996: #201 million).

Strategic decision

In October 1997, following a strategic review of the

businesses and in the light of the rapidly changing market

environment, Barclays announced the reorganisation of BZW, its

investment banking business. The Group refocused its

investment banking business to concentrate on activities in

which it believes it has competitive advantage and which are

integral to its broader business strategy. As a result, BZW's

markets division, debt-related structuring, lending and

private equity businesses were brought together as Barclays

Capital. Barclays sought a purchaser for the equities, equity

capital markets and mergers and acquisitions advisory

businesses, together with all of the investment banking

business in Australasia.

Martin Taylor, chief executive of Barclays, said: "We made a

strategic decision to redefine our investment banking business

in the autumn, because continuing to invest in parts of the

business no longer made commercial sense for us; this decision

has been reinforced by subsequent market developments.

"Although the process of withdrawal has not been easy, it has

been achieved without letting our clients down, and in

Barclays Capital we have a new business with great strength

and potential. We expect this concentration of resources and

management effort on sound and relevant businesses to be very

positive for shareholders."

Sale process

Following the October 1997 announcement, the Group

subsequently announced that it had reached agreement to sell:

i)the UK and continental European equities, equity capital

markets and mergers and acquisition advisory businesses to

Credit Suisse First Boston (CSFB). The sale of these

businesses is being completed in a number of stages;

completion has already occurred in relation to the equity

capital markets and mergers and acquisitions advisory

businesses and part of the continental European equities

business. The aggregate net assets of these businesses,

including the parts which have already been completed, are

expected to total #150m, for which Barclays will receive

#100m;

ii)the Australian and New Zealand investment banking

business to ABN Amro for

AU$177 million (#71 million), representing a premium to net

assets of AU$36 million

(#14 million); and,

iii)parts of the Asian equities, equity capital markets

and mergers and acquisition advisory businesses to CSFB.

The businesses being sold had net assets of #14 million as

at 30 November 1997.

The decision was also taken to retain and restructure the

equity derivatives business and this has been integrated

within Barclays Capital with effect from 1 January 1998.

In addition, as a direct consequence of its decision to

reorganise BZW, Barclays is closing down certain of BZW's

Asian equities businesses.

The Barclays Group will report its 1997 results in full on 17

February 1998.

For further information please contact:

Elizabeth Wade Susan Cottam

Investor Relations Group Public Relations

Barclays PLC Barclays PLC

Tel: 0171 699 2874 Tel: 0171 699 2658

Ian Roundell

Investor Relations

Barclays PLC

Tel: 0171 699 2961

END

MSCUBUMGPBGRUMP

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

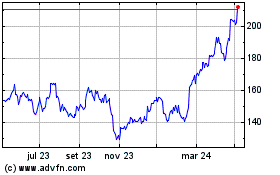

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024