RNS No 1031u

BARCLAYS PLC

17th February 1998

PART 1

BARCLAYS PLC

PRELIMINARY ANNOUNCEMENT OF RESULTS FOR 1997

Page

Summary 1

Financial highlights 3

Chief Executive's review 4

Summary of results 7

Consolidated profit and loss account 8

Consolidated balance sheet 9

Financial review 10

Additional information 33

Notes 35

Consolidated statement of changes in

shareholders' funds 44

Statement of total recognised gains and losses 44

Other information 45

The information in this announcement does not comprise statutory accounts

within the meaning of Section 240 of the Companies Act 1985. Statutory

accounts, which are combined with the Group's Annual report on Form 20-F to

the US Securities and Exchange Commission and which contain an unqualified

audit report, will be delivered to the Registrar of Companies in accordance

with Section 242 of the Companies Act 1985. The annual report will be

posted to shareholders on 25th March 1998.

BARCLAYS PLC, 54 LOMBARD STREET, LONDON EC3P 3AH, TELEPHONE 0171 699 5000

BARCLAYS PLC - SUMMARY

RESULTS FOR YEAR TO 31ST DECEMBER 1997

1997 1996

#m #m

Operating profit before 2,715 2,471

provisions*

Provisions for bad and 227 215

doubtful debts

Operating profit for the 2,484 2,247

ongoing business*

Former BZW businesses** (219) (11)

Exceptional items (425) 70

Write-down of leases (77) -

Life-fund charge (28) -

Write-down of fixed asset (19) -

investments

Profit before tax 1,716 2,306

Tax charge (542) (620)

Profit attributable to 1,130 1,639

shareholders

Earnings per share 74.4p 104.2p

Earnings per share for the 109.1p 100.2p

ongoing business

Dividend per share 37.0p 31.5p

* Figures are stated prior to the impact of the Finance (No. 2) Act 1997

("Finance Act") and excluding the operating loss of the former BZW

businesses.

** Former BZW businesses is made up of the equities, equity capital

markets and mergers and acquisition advisory businesses together with all

of the investment banking business in Australasia. Since October 1997

these businesses have either been sold or closed, or are subject to a sale

contract or are being restructured.

- Earnings per share for the ongoing business rose by 9% to 109.1 pence

and operating profit by 11% to #2,484 million.

- The post-tax return on average shareholders' funds for the ongoing

business remained high at 21.8% (1996: 22.1%).

- The dividend increased by 17% with a final dividend of 23.5p per share

(1996: 20p) making 37p per share for the year (1996: 31.5p).

BARCLAYS PLC - SUMMARY

- Within Personal Banking operating profit rose by 12% to #832 million*

(1996: #745 million) with improvements in both net interest income and fees

and commissions. Operating profit for Business Banking increased by 25% to

#974 million* (1996: #778 million) benefiting in particular from continued

high levels of releases and recoveries as well as lower levels of new and

increased provisions, reflecting both the current stage in the economic

cycle and improved asset quality and risk control procedures.

- There were increased contributions from Cross-border Services and the

Asset Management Group, where assets under management and advice grew to

#308 billion from #237 billion. Adjusting for the reduction in the

contribution from problem country debt management, operating profit for

International and Private Banking rose by 9% to #201 million (1996: #184

million). The successful managing down of transition portfolios in France

and the United States continued; Businesses in Transition produced an

operating profit of #99 million (1996: #75 million).

- Total provisions for bad and doubtful debts rose by 6% to #227 million.

Risk tendency fell to around #670 million (1996: around #700 million).

- The Group's total exposure to South Korea, Indonesia and Thailand was

#1.2 billion of which #10 million was non-performing. The Group raised an

additional #45 million of general provision in 1997 to cover country risk.

- In October 1997, Barclays announced a reorganisation of its investment

banking business. The Group has refocused its continuing investment banking

business and renamed it Barclays Capital. In 1997 Barclays Capital

increased operating profit by 23% to #248 million (1996: #201 million).

- The former BZW businesses reported a #219 million operating loss (1996:

operating loss of #11 million) as a result of uncertainty surrounding their

future and difficult market conditions. The bulk of the 1997 loss occurred

in the last quarter.

- Exceptional items included the #340 million loss on sale and

restructuring of BZW, plus associated goodwill written-off of #129 million.

It also included a #44 million profit on disposal of undertakings elsewhere

in the Group.

- UK profit sharing for eligible staff increased to #101 million (1996:

#96 million), equivalent to 9.5% (1996: 9%) of salary for eligible staff.

- At 31st December 1997 shareholders' funds stood at #7.6 billion (1996:

#7.3 billion) and the Tier 1 ratio at 7.3% (1996: 7.6%). As a result of

further progress made during 1997 in managing down the bad debt book, the

Group now estimates that it needs shareholders' funds of #6.4 billion to

#6.8 billion to support its current business.

- The Group intends to resume its programme of returning capital to

shareholders. In the absence of compelling alternative uses for the money,

it plans to return capital of around #500 million to shareholders in 1998.

A limiting factor in this decision has been the Group's advance corporation

tax capacity; the proposed abolition of this tax in April 1999 is likely to

allow more flexibility in the management of the capital base.

BARCLAYS PLC

FINANCIAL HIGHLIGHTS

1997 1996 Change

RESULTS #m #m %

Net interest income* 4,107 3,943 4

Non-interest income* 3,216 3,126 3

Operating income* 7,323 7,069 4

Operating expenses* (4,608) (4,598) 0

Operating profit before 2,715 2,471 10

provisions*

Provisions for bad and doubtful (227) (215) 6

debts

Operating profit for the ongoing 2,484 2,247 11

business*

Former BZW businesses (219) (11) -

Exceptional items (425) 70 -

Write-down of leases (77) - -

Life-fund charge (28) - -

Write down of fixed asset (19) - -

investments

Profit before tax 1,716 2,306 (26)

Profit attributable to 1,130 1,639 (31)

shareholders

Profit retained 567 1,160 (51)

*Figures are stated prior to the impact of the Finance Act and excluding

results of the former BZW businesses.

BALANCE SHEET

Shareholders' funds 7,620 7,267 5

Loan capital 2,868 3,031 (5)

Total capital resources 10,873 10,674 2

Total assets 234,657 186,002 26

Weighted risk assets 108,327 98,391 10

PER ORDINARY SHARE p p

Earnings 74.4 104.2 (29)

Earnings for the ongoing business 109.1 100.2 9

Dividend 37.0 31.5 17

Net asset value 498 472 6

PERFORMANCE RATIO % %

Post-tax return on average 15.0 22.8

shareholders' funds

Post-tax return on average

shareholders' funds for the 21.8 22.1

ongoing business

RISK ASSET RATIO

Tier 1 7.3 7.6

Total 10.0 10.4

GROUP YIELDS, SPREADS & MARGINS % %

Gross yield 7.64 7.43

Interest spread 2.67 2.64

Interest margin 3.42 3.33

BARCLAYS PLC

CHIEF EXECUTIVE'S REVIEW

1997 was a year of sound underlying progress for Barclays, with particularly

pleasing performances from Business Banking, Personal Banking and Barclays

Capital. Adjusting for the operating loss of the former BZW businesses and

other one-off items, operating profit rose by 11% to #2,484 million and

earnings per share by 9% to 109.1 pence. On the same basis, return on

equity remained high at 21.8%. The dividend is being increased by 17% to a

total of 37 pence.

For the most part, economic conditions - especially in the UK - remained as

favourable as in the last few years. Such conditions foster intensified

competition, a feature of all areas of our business in 1997. This

competition is increasingly international in nature. It is linked to some

extent to the planned introduction of the single European currency and is

likely to accelerate industry consolidation, both domestic and cross-border.

In addition, the economic problems of East Asia, coming at a time when the

UK business cycle has reached a fairly mature stage, suggest that conditions

may become a little more difficult in the next couple of years.

Against this background we continue to work on further product and service

improvements, while managing both costs and capital usage as vigorously as

ever. The pace and nature of competition, our commitment to offer customers

the best through improved service and innovation, and the need to ensure an

appropriate return to shareholders, have led us to make a number of changes

to the Group over recent months. Above all, we aim to concentrate rather

than dissipate resources.

In early autumn we concluded that our plans to create a full service

investment bank in BZW were unlikely to succeed, given the rapidly changing

economics of the industry and structural weaknesses particularly within our

equity business. We therefore took the decision to dispose of our equities,

equity capital markets and mergers and acquisition advisory businesses. We

agreed a series of sales, to CSFB of operations in Europe and parts of Asia,

and to ABN-Amro of the investment banking business in Australasia, around

the end of the year.

The disposal process was not easy - not least because the complexity of the

BZW infrastructure necessitated that we disentangle the business in the

public gaze - and the withdrawal was costly. We took a charge of #340

million in 1997 to cover these costs. Additionally, the trading performance

of those parts of BZW offered for sale - an operating loss of #219 million -

reflected the inevitable uncertainty surrounding those businesses following

the announcement of the sale. We are convinced that shareholders will be

better off as a result of our decision; it makes strategic and economic

sense, will remove a major distraction and will allow us to run the Group

more cohesively.

The majority of BZW's capital and profitability has been retained and

brought together as Barclays Capital, which comprises our fixed income,

foreign exchange, derivatives, debt-related structuring, lending and private

equity operations. With its strong positions in credit markets and its

improving franchise in government bonds, foreign exchange and derivatives,

Barclays Capital will not only be developed in its own right but will work

powerfully with other activities across the Group.

Considerable management effort over the last few years has been directed at

reshaping the Group's business to reflect customer requirements. In 1995 we

separated our biggest single business, UK Banking Services, into three

sectors: Personal Banking, Business Banking and Cross-border Services,

enabling us to focus on the very different needs and dynamics of each. We

also moved the asset management business out of the investment bank,

recognising the different pattern of the earnings streams.

BARCLAYS PLC

In 1998 we have begun to develop this thinking further, refining the

structure of the Group to reflect our customers' needs and the pace and

nature of competition. From April, businesses from around the Group that

serve the same markets will be brought together into four management

groupings, transcending national boundaries. Together with Barclays Capital

these businesses are retail financial services, corporate banking and

Barclays Global Investors.

We are creating a new retail financial services group bringing together all

our retail interests around the world. It will comprise Personal Banking

within the UK, the offshore personal element of Cross-border Services, our

continental European Retail Banking Group, private banking, our African and

Caribbean operations and the retail elements of the Asset Management Group.

Our UK small business activities, which share many characteristics with the

personal sector, will also be included. The retail financial services group

will be a very significant business, allowing us to address our customers'

needs in a much more co-ordinated way. In pro-forma terms it would have

accounted for 52% of the ongoing operating profit in 1997.

UK Business Banking, together with the business banking elements of Cross-

border Services and the Middle East and Latin American operations, will form

a corporate banking group with international reach and will work closely

with Barclays Capital to build wider access to capital markets for its

customers. In pro-forma terms the business would have accounted for 37% of

the ongoing operating profit in 1997.

Barclays Global Investors, our institutional asset management operation,

will continue to be run as a distinct business. At 31st December 1997 it

had #308 billion of assets under management and advice.

All of this change within the Group is underpinned by our relentless focus

on the management of costs and capital. In 1997 our net investment spend

taken to the profit and loss account or capitalised was #645 million. This

large figure reflects our determination to drive forward business

development: essential in an increasingly demanding competitive environment.

We are investing to ensure that our systems are Year 2000 compliant; this

spend is expected to be around #250 million in the period from 1st January

1997 to the end of 2000. We anticipate investment of around #150 million to

seek to ensure that from 1st January 1999 Barclays can provide a full range

of services and products in the Euro to UK business customers and the retail

customers of our continental European network. Most of this investment will

occur in 1998. The Group is absorbing these costs as part of its ongoing

investment spend.

The improvement in our risk management has contributed a great deal to the

performance of the Group over the last few years. Our measurement

techniques continue to improve as does the quality of our lending book. As

a result we estimate that the risk tendency - a prediction of the cyclically

adjusted average annual credit loss levels in future years - has fallen from

around #700 million to around #670 million.

We have taken a rigorous and conservative approach to the management of all

aspects of our lending business. In 1997, the Group's total exposure to

Korea, Indonesia and Thailand - the three countries in which IMF support

programmes are in place - was #1.2 billion of which only #10 million was non-

performing. The Group raised an additional #45 million of general provision

to cover country risk.

Rigour in the management of capital remains of fundamental importance to the

Group. As a result of further progress made during 1997 in managing down

our bad debt book, we now estimate that we need shareholders' funds of #6.4

billion to #6.8 billion, compared with a figure at 31st December 1997 of

#7.6 billion.

BARCLAYS PLC

We continued to buy back shares in 1997. As a result of the BZW sale

announcement and subsequent disposal process, however, it was not possible

for the Group to repurchase shares in the latter part of the year. We

therefore completed some #350 million of our planned #700 million

buy-back target for the year.

We intend to resume our programme of returning capital to shareholders. In

the absence of compelling alternative uses for the money, we plan to return

capital of around #500 million to shareholders in 1998. A limiting factor

in this decision has been the Group's advance corporation tax capacity; the

proposed abolition of the tax in April 1999 is likely to allow more

flexibility in the way we manage our capital base.

It is impossible to disregard the pace of change in the financial services

industry. 1997 proved that this change is both very real and very fast.

Our competitors in retail banking now include organisations which have very

different starting points in terms of their relationships with customers.

We are redefining our own relationships with customers through the progress

we have made, and continue to strive for, in improvements in customer choice

and service. We are building on our understanding and experience of

customers' often complex financial needs to provide a co-ordinated range of

products and services that is second to none. Trust, convenience and value

lie at the heart of our relationship with customers.

Our staff play a crucial part in delivering this. Their roles are

increasingly customer focused, requiring new skills and greater flexibility

in working methods. We have recognised this through the introduction of new

pay and personnel policies which seek to reward personal achievement and

enable all employees to be eligible for performance-related bonuses. Change

brings a degree of uncertainty for us all but it also brings greater

opportunities - opportunities we must and will seize in order to protect and

advance the progress we have made.

Martin Taylor

Chief Executive

BARCLAYS PLC

SUMMARY OF RESULTS

PROFIT BEFORE TAX 1997 1996

UK Banking Services #m #m

- Personal Banking - before impact 832 745

of Finance Act

- Business Banking - before impact 974 778

of Finance Act

- Cross-border Services 150 138

Barclays Capital 248 201

Asset Management Group 72 70

International and Private Banking 229 242

Businesses in Transition 99 75

Other operations (56) 65

Head office functions (52) (54)

Goodwill amortisation (12) (13)

2,484 2,247

Former BZW businesses (219) (11)

Exceptional items (425) 70

Write-down of leases (77) -

Life-fund charge (28) -

Write-down of fixed asset (19) -

investments

1,716 2,306

TOTAL ASSETS

UK Banking Services

- Personal Banking 28,940 27,838

- Business Banking 32,329 32,128

- Cross-border Services 3,600 2,787

Barclays Capital 134,814 90,651

Former BZW businesses 8,477 7,521

Asset Management Group 253 166

International and Private Banking 13,242 12,313

Businesses in Transition 637 1,868

Other operations and Head office 4,178 5,049

functions

Life fund assets attributable to 8,187 5,681

policyholders

234,657 186,002

WEIGHTED RISK ASSETS

UK Banking Services

- Personal Banking 19,723 18,291

- Business Banking 33,208 32,269

- Cross-border Services 2,925 2,109

Barclays Capital 35,084 28,898

Former BZW businesses 4,078 3,107

Asset Management Group 304 208

International and Private Banking 7,781 7,498

Businesses in Transition 659 1,427

Other operations* 4,565 4,584

108,327 98,391

* including supervisory

adjustments

BARCLAYS PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

1997 1996

#m #m

Interest receivable 9,204 8,730

Interest payable (5,091) (4,821)

Write-down of leases (77) -

Profit on redemption/repurchase of 2 32

loan capital

Net interest income 4,038 3,941

Net fees and commissions 2,979 2,945

receivable

Dealing profits 374 414

Other operating income 228 248

Life-fund charge (28) -

Total non-interest income 3,553 3,607

Operating income 7,591 7,548

Administration expenses - staff (3,035) (2,980)

costs

Administration expenses - other (1,896) (1,807)

Depreciation and amortisation (269) (301)

Operating expenses (5,200) (5,088)

Operating profit before provisions 2,391 2,460

Provisions for bad and doubtful (227) (215)

debts

Provisions for contingent (4) (9)

liabilities and commitments

Operating profit 2,160 2,236

Exceptional items (425) 70

Write-down of fixed asset (19) -

investments

Profit on ordinary activities 1,716 2,306

before tax

Tax on profit on ordinary (542) (620)

activities

Profit on ordinary activities 1,174 1,686

after tax

Minority interests (equity and non- (44) (47)

equity)

Profit for the financial year

attributable to the members of 1,130 1,639

Barclays PLC

Dividends (563) (479)

Profit retained for the financial 567 1,160

year

Earnings per ordinary share 74.4p 104.2p

Earnings per ordinary share for 109.1p 100.2p

the ongoing business

Dividend per ordinary share:

Interim 13.5p 11.5p

Final (payable 5th May 1998) 23.5p 20.0p

BARCLAYS PLC

CONSOLIDATED BALANCE SHEET

1997 1996

Assets: #m #m

Cash and balances at central banks 750 729

Items in course of collection from 2,564 3,021

other banks

Treasury bills and other eligible 6,106 4,472

bills

Loans and advances to banks

- banking 21,729 16,125

- trading 15,155 12,898

36,884 29,023

Loans and advances to customers

- banking 74,111 72,977

- trading 25,712 16,441

99,823 89,418

Debt securities and equity shares 55,361 34,180

Interests in associated 57 86

undertakings

Intangible fixed assets - goodwill 191 222

Tangible fixed assets 2,016 2,092

Other assets 22,718 17,078

226,470 180,321

Life fund assets attributable to 8,187 5,681

policyholders

Total assets 234,657 186,002

Liabilities:

Deposits by banks

- banking 30,511 21,636

- trading 13,968 12,520

44,479 34,156

Customer accounts

- banking 89,647 83,421

- trading 18,791 13,143

108,438 96,564

Debt securities in issue 20,366 11,834

Items in course of collection due 1,676 1,596

to other banks

Other liabilities 40,638 25,497

Undated loan capital: convertible 304 292

to preference shares

Undated loan capital: 1,353 1,343

non-convertible

Dated loan capital: 1,211 1,396

non-convertible

Other subordinated liabilities: 59 56

non-convertible

218,524 172,734

Minority interests and

shareholders' funds:

Minority interests: equity 61 65

Minority interests: non-equity 265 255

Called up share capital 1,530 1,542

Reserves 6,090 5,725

Shareholders' funds: equity 7,620 7,267

7,946 7,587

226,470 180,321

Life fund liabilities to 8,187 5,681

policyholders

Total liabilities and 234,657 186,002

shareholders' funds

BARCLAYS PLC

FINANCIAL REVIEW

Results by nature of income and expense

Movements in the exchange rates used to translate the results of certain of

the Group's overseas businesses impact on the comparison of reported results

between 1997 and 1996. The main areas affected are International and

Private Banking, Asset Management Group, Barclays Capital and the former BZW

businesses. Adjusting for the impact of exchange rate translation

differences and the Finance Act, income and costs rose by approximately 5%

and 6% respectively in 1997. There is no significant impact on operating

profit.

Net interest income 1997 1996

#m #m

Interest receivable 9,204 8,730

Interest payable (5,091) (4,821)

Profit on redemption/repurchase 2 32

of loan capital

4,115 3,941

Write-down of leases (77) -

4,038 3,941

Net interest income rose by #204m or 5%, before one-off profits on

redemption/repurchase of loan capital and the write-down of leases following

the Finance Act. Adjusting for these, the loss of interest resulting from

share repurchases, the impact of exchange rate movements and business

disposals, underlying net interest income increased by 9%.

Personal Banking net interest income rose by 10%, reflecting growth in

consumer lending and mortgages as well as current accounts and other deposit

products. Margins were maintained in the personal sector, in part because

of changes in product mix. There was also strong growth in Business Banking

interest income mainly because of higher levels of deposits, which more than

compensated for a slight decline in overall lending margins.

Adjusted for exchange rate movements, net interest income in International

and Private Banking was some 6% higher than in 1996.

Overall banking business net margins rose slightly from 3.33% to 3.42%.

There was an improvement in the domestic margin, which rose by 0.15% to

4.48%, largely in the second half of the year. A narrowing in the gap

between the managed interest rate earned on Group capital and market rates

of interest led to a reduced contribution to the net margin from the central

management of Group interest rate exposure of approximately 0.11% (1996:

0.19%). This was compensated for by increases in the domestic benefit of

free funds and also a widening of the domestic spread. There was a

reduction in the international margin, particularly in the second half year,

reflecting changes in the currency mix and volumes.

Interest forgone on non-performing lendings at #147m was #20m lower than in

1996.

BARCLAYS PLC

Yields, spreads and margins - banking business

Domestic business is transacted by UK Banking Services, Barclays Capital and

the Group Treasury operation and is conducted primarily in sterling.

International business is transacted by Barclays Capital, mainly with

customers domiciled outside the United Kingdom, and by overseas branches and

subsidiaries. International business is conducted primarily in foreign

currencies and includes foreign currency loan capital.

The yields, spreads and margins shown below have been computed on this

basis, which generally reflects the domicile of the borrower. They exclude

profits and losses on the redemption/repurchase of loan capital and the one-

off write-down of leases.

1997 1996

% %

Gross yield (i)

Group 7.64 7.43

Domestic 8.36 7.97

International 6.24 6.50

Interest spread (ii)

Group 2.67 2.64

Domestic 3.41 3.29

International 1.24 1.57

Interest margin (iii)

Group 3.42 3.33

Domestic 4.48 4.33

International 1.34 1.61

Average UK base rate 6.57 5.96

Notes

(i) Gross yield is the interest rate earned on average interest earning

assets.

(ii) Interest spread is the difference between the interest rate earned on

average interest earning assets and the interest rate paid on average

interest bearing liabilities.

(iii) Interest margin is net interest income as a percentage of average

interest earning assets.

Average interest earning assets and liabilities - banking business

1997 1996

Average interest earning assets #m #m

Group 120,407 117,518

Domestic 79,697 74,254

International 40,710 43,264

Average interest bearing

liabilities

Group 102,408 100,728

Domestic 62,444 57,751

International 39,964 42,977

BARCLAYS PLC

Net fees and commissions 1997 1996

#m #m

Fees and commissions receivable 3,197 3,168

Less: fees and commissions payable (218) (223)

2,979 2,945

Fees and commissions includes #327m (1996: #341m) earned by former BZW

businesses.

Excluding the impact of exchange rate movements and the contribution from

former BZW businesses, fees and commissions grew by some 5%. Growth in

retail banking and asset management commissions in both the UK and overseas

compensated for lower levels of commission elsewhere. UK Banking Services

fees and commissions includes #71m (1996: #64m) in respect of foreign

exchange income on customer transactions with Barclays Capital.

Within Personal Banking, growth related to volume increases in current

accounts, credit card and consumer lending products. In Asset Management

Group, the European Retail Banking Group and Barclays Private Banking,

commission levels benefited from increased levels of assets under management

as a result of higher volumes of institutional and retail funds and market

performance in the year. In Business Banking there was a 3% reduction in

fees and commissions largely because of lower money transmission income and

lower income from loan default and account control fees. This was partially

offset by an increase in new business activity and growth in foreign

exchange related income.

Commissions in Barclays Capital were at similar levels to 1996 as was

mergers and acquisitions advisory income in the former BZW businesses.

Equities commissions were affected by the uncertainty surrounding the sale

announcement of certain BZW businesses in the last quarter of the year and

by lower volumes following the introduction of the London Order Driven

Market system.

Dealing profits 1997 1996

#m #m

Interest rate related 187 202

Foreign exchange and commodities 132 71

Equities and other 55 141

374 414

Excluding the contribution from former BZW businesses of #32m (1996: #126m),

dealing profits increased by 19% or #54m.

In Barclays Capital, dealing profits increased by 26%, primarily as a result

of a strong performance in foreign exchange, together with improved results

from derivatives and sterling fixed income. The emerging markets business

generated strong revenues and there was also a significant improvement in

the commodities business. The credit businesses were adversely affected in

the final quarter of the year by the widening of credit spreads as a result

of the impact of turbulence in the Asian markets.

Equities and other dealing profits were significantly lower than in 1996

largely because of a number of factors creating poor trading conditions

during the year. These were uncertainties in the UK market leading up to

the May 1997 general election and in anticipation of and following the

Budget proposals, resulting in some #30m of mark-to-market losses in equity

derivatives, the absence of certain products following the changes in the

tax treatment of trading dividends and an #8m reduction due to a change in

accounting treatment of dividend income. Additionally, in the second half

of the year, revenues were adversely affected by uncertainties surrounding

the sale announcement of certain BZW businesses.

BARCLAYS PLC

Other operating income 1997 1996

#m #m

Income from associated 16 23

undertakings

Dividend income from equity shares 20 20

Profits on disposal of investment 46 29

securities

Increase in shareholders' interest 47 61

in the long-term assurance fund

Property rentals 39 36

Other income 60 79

228 248

Life-fund charge (28) -

200 248

Income from associated undertakings declined as a result of reduced

contributions from Korea Merchant Banking Corporation and Malaysian

International Merchant Bank. The Group has also written down its investment

in these businesses (see Write-down of fixed asset investments on page 17).

The increased profit on the disposal of investment securities arose largely

from realisations by Private Equity in the ordinary course of business.

The contribution from the shareholders' interest in the long-term assurance

fund declined due to a further #25m provision for the cost of redress for

personal pension customers (non-priority cases). There was also a one-off

charge of #28m in 1997 arising from changes in economic assumptions relating

to the long-term assurance fund as a result of the Finance Act.

The higher level of Other income in 1996 was attributable to Camden Motors,

the motor trading business, which was sold in that year.

BARCLAYS PLC

Administrative expenses - staff 1997 1996

costs

#m #m

Salaries and accrued incentive 2,380 2,274

payments

Social security costs 200 214

Pension costs 65 80

Post-retirement health care 23 18

UK profit sharing 101 96

Other staff costs 266 298

3,035 2,980

Staff reduction and relocation 66 105

costs included above

Number of staff at period end:

UK Banking Services* 52,600 52,700

Barclays Capital and former BZW 7,400 7,300

businesses

Asset Management Group 3,600 3,400

International and Private Banking 15,800 17,700

Businesses in Transition 700 1,100

Other operations 2,700 2,600

Head office functions 400 400

Group total world wide 83,200 85,200

of which United Kingdom 61,100 60,800

*UK Banking Services figures exclude 1,000 Barclays Life advisers and field

sales managers (1996: 900) and 1,200 administrative staff (1996: 1,100)

whose costs are borne within the long-term assurance fund.

Staff costs

Adjusting for changes in exchange rates, staff costs rose by 5% in 1997,

largely because of increased salaries and accrued incentive payments in

Barclays Capital and former BZW businesses reflecting additional staff

retention costs arising from the sale announcement of certain BZW businesses

and also the full year's impact of staff recruitment in certain areas made

in 1996. Overall, staff costs in the former BZW businesses were some #60m

higher than in 1996.

In UK Banking Services, a further fall in average staff numbers and lower

staff reduction expenses (mainly reported in other costs) enabled the rise

in staff costs to be kept at 3% overall.

Staff reduction and relocation costs reported above do not include costs

reported within the exceptional loss on the sale or restructuring of BZW.

On this basis, these costs were #39m lower than in 1996, with reductions in

UK Banking Services and France in Transition being offset by higher costs in

Africa.

The decrease in pension contributions in 1997 mainly reflects reductions in

overseas schemes. Following an actuarial review of the surplus in the

Group's main UK scheme, contributions to that scheme will be reduced from

2.5% of pensionable salaries in 1997 to nil in 1998.

Staff numbers fell by 2,000 in 1997 mainly because of reductions in Africa,

the Caribbean and in Businesses in Transition. These were offset by new

jobs created in Asset Management Group in response to business growth and

investment. There was a small net fall in UK Banking Services numbers in

the year, where reductions from further centralisation of back office

support functions were partially offset by the creation of new customer

service roles.

BARCLAYS PLC

Administrative expenses - other 1997 1996

#m #m

Property and equipment expenses:

Hire of equipment 35 28

Property rentals 217 199

Other property and equipment 619 612

expenses

871 839

Stationery, postage and telephones 245 221

Advertising and market promotion 215 201

Travel, accommodation and 133 140

entertainment

Subscriptions and publications 37 34

Securities clearing and other 74 67

operational expenses

Sundry losses, provisions and 78 74

write-offs

Statutory and regulatory audit and 6 8

accountancy fees

Consultancy fees 103 80

Professional fees 99 96

Other expenses 35 47

1,896 1,807

The rise in administrative costs reflects increases in property and

equipment costs of #32m and in other costs of #57m, reflecting in part

increased business volumes and higher levels of IT and other project costs.

Property and equipment costs increased as a result of the one-off impact of

the investment bank's move to Canary Wharf in 1997.

Other property and equipment expenses includes a continuing high level of

expenditure on software and systems development in a wide range of customer

service and operational areas. Euro implementation and Year 2000

expenditure also contributed to the increase in costs.

The increase in other administrative costs arose largely within UK Banking

Services in the second half of the year and reflected increases in

advertising, customer communication and investment costs across a number of

areas.

Depreciation and amortisation 1997 1996

#m #m

Property depreciation 106 107

Equipment depreciation 170 175

Goodwill amortisation 12 13

Loss on sale of equipment 3 6

Write-back of surplus properties (22) -

269 301

Property depreciation includes a charge of #7m in respect of the local head

office in Paris which was sold during the year. The write-back of surplus

properties represents the recovery of amounts previously written off against

certain City of London properties which have now been sold. Other gains on

property disposals totalling #13m have been included in other operating

income.

MORE TO FOLLOW

FR ALLLDFSIRLAT

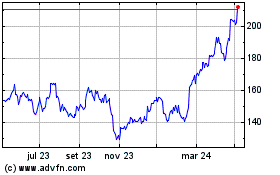

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024