RNS No 3158e

BARCLAYS PLC

6th August 1998

PART 2

BARCLAYS PLC

FINANCIAL REVIEW

Results by nature of income and expense

In the analysis below to assist in the analysis of the ongoing

business performance, income and cost totals excluding former

BZW businesses are also shown. For most of 1997, BZW

comprised Barclays Capital and the former BZW businesses,

operating as an integrated business with significant levels of

shared costs and infrastructure. Accordingly, the amounts

separately attributed to Barclays Capital and the former BZW

businesses in 1997 include estimates and allocations. Under

these circumstances it is not meaningful to provide a more

detailed analysis of income and costs than that set out below.

Half-year ended

Net interest income 30.6.98 31.12.97 30.6.97

#m #m #m

Interest receivable 5,014 4,797 4,407

Interest payable (2,874) (2,717) (2,374)

Profit on redemption/repurchase 3 (2) 4

of loan capital

2,143 2,078 2,037

Write-down of leases (40) - (77)

2,103 2,078 1,960

Excluding former BZW businesses and

write-down of leases 2,144 2,076 2,031

Net interest income rose by #113m, or 6%, excluding the

contribution from the former BZW businesses and the write-down

of leases following a further reduction in the rate of

Corporation Tax. Adjusting for these, the loss of interest

resulting from share repurchases and other business disposals,

underlying net interest income increased by 7%.

Retail Financial Services net interest income increased by 10%

to #1,381m, benefiting primarily from strong growth in the

United Kingdom in consumer and credit card lendings, current

accounts and home finance (where the cost of incentives fell

by #19m to #11m). Average balances in UK consumer lending

increased by 15% year on year while average savings balances

grew by 8% over the same period, benefiting from a policy of

more actively establishing a range of savings suited to

customers' needs. Overall, lending and deposit margins in UK

Retail Banking were broadly maintained, in part because of

volume growth in higher margin products.

Corporate Banking net interest income rose by 8% to #601m. A

further improvement in the credit quality of the lending book

and a change in its mix resulted in a small reduction in the

lending margin, while the deposit margin was maintained as a

result of a further increase in current account balances,

offset by strong growth in lower margin treasury products.

Overall banking business net margins fell from 3.47% to 3.38%

compared to the first half of 1997. The Group spread reduced

to 2.66% (1997: 2.75%) mainly reflecting increased holdings of

debt securities and other treasury assets and changes in the

funding mix. The contribution from the benefit of free funds

was at 0.72% (1997: 0.72%).

The net contribution from the central management of Group

capital reduced by #71m to a deficit of #59m (1997: surplus of

#12m), mainly as a result of increased interest allocations to

businesses reflecting higher short term interest rates and

increased levels of regulatory capital employed. A fall in

the managed rate earned on free funds and the cumulative

impact of share repurchases also affected interest earned in

the period. A continued narrowing of the gap between the

managed rate and market rates of interest eliminated the

contribution to the net margin from the central management of

Group interest rate exposure (1997 benefit of 0.18%).

Yields, spreads and margins - banking business

Domestic business is transacted by Retail Financial Services,

Corporate Banking, Barclays Capital and Group Treasury and is

conducted primarily in sterling. International business is

transacted by Barclays Capital, mainly with customers

domiciled outside the United Kingdom, and by overseas branches

and subsidiaries. International business is conducted

primarily in foreign currencies and includes foreign currency

loan capital.

The yields, spreads and margins shown below have been computed

on this basis, which generally reflects the domicile of the

borrower. They exclude profits and losses on the

redemption/repurchase of loan capital and the one-off write-

down of leases.

Half-year ended

30.6.98 31.12.97 30.6.97

#m #m #m

Gross yield (i)

Group 7.93 7.77 7.51

Domestic 8.96 8.61 8.11

International 6.09 6.20 6.29

Interest spread (ii)

Group 2.66 2.60 2.75

Domestic 3.36 3.37 3.43

International 1.33 1.13 1.38

Interest margin (iii)

Group 3.38 3.37 3.47

Domestic 4.44 4.55 4.41

International 1.51 1.17 1.52

Average UK base rate 7.29 7.01 6.09

Notes

(i) Gross yield is the interest rate earned on average

interest earning assets.

(ii) Interest spread is the difference between the interest

rate earned on average interest earning assets and the

interest rate paid on average interest bearing

liabilities.

(iii) Interest margin is net interest income as a percentage of

average interest earning assets.

Average interest earning assets and liabilities - banking

business

Half-year ended

30.6.98 31.12.97 30.6.97

Average interest earning assets #m #m #m

Group 126,543 123,494 117,320

Domestic 80,929 80,390 79,003

International 45,614 43,104 38,317

Average interest bearing liabilities

Group 109,181 105,125 99,690

Domestic 65,314 62,402 62,485

International 43,867 42,723 37,205

Half-year ended

Net fees and commissions 30.6.98 31.12.97 30.6.97

#m #m #m

Fees and commissions receivable 1,445 1,630 1,567

Less: fees and commissions (95) (110) (108)

payable

1,350 1,520 1,459

Excluding former BZW businesses 1,340 1,358 1,294

Excluding the contribution from the former BZW businesses and

the impact of other disposals, fees and commissions grew by

some 6%, primarily in Retail Financial Services.

Within Retail Financial Services, commissions in UK Retail

Banking were at similar levels to 1997. Barclaycard fees and

commissions rose by 7% reflecting volume growth in both the

card issuing and merchant acquiring businesses. An increase

in International Premier, Private, Savings and Investment

commissions reflected the continued focus in European Retail

Banking on growing high net worth business and increased

business levels and favourable market conditions in Barclays

Private Banking.

Fees and commissions in Corporate Banking rose by 5% to #293m

through strong growth in risk related commissions, customer

related foreign exchange income and increased money

transmission income, including greater contributions from

electronic banking products.

Retail Financial Services and Corporate Banking fees and

commissions include #38m (1997: #33m) in respect of foreign

exchange income on customer transactions with Barclays

Capital.

Barclays Capital commissions increased from #53m to #75m,

benefiting primarily from improved performances in the loans

businesses, particularly structured finance, and a change in

the income composition of structured capital markets.

Adjusting for business disposals, commissions in Barclays

Global Investors increased by 21%, assisted by favourable

market conditions and net new business growth in assets under

management.

Half-year ended

Dealing profits 30.6.98 31.12.97 30.6.97

#m #m #m

Interest rate related 114 60 127

Foreign exchange and commodities 43 63 69

Equities and other 40 17 38

197 140 234

Excluding former BZW businesses 198 137 205

Almost all dealing profits arise in Barclays Capital, where

they increased by 3% and 36% over the first and second halves

of 1997. There was strong growth in interest rate derivatives

and the government bond businesses continued to develop with a

significantly improved contribution from the US operation.

These performances were somewhat offset by weaker earnings in

sterling, resulting from an unfavourable interest rate

environment and trading losses in emerging markets. The

credit business performed well throughout the period with the

bond business recovering from the turbulence witnessed in the

Asian markets in the second half of 1997.

The contribution from foreign exchange and commodities fell by

38% to #43m, primarily because of lower revenues as a result

of weakening prices in global commodities. Revenues from the

equities derivatives business, refocused under the management

of Barclays Capital, improved over the first and second halves

of 1997.

There was a small decline in dealing profits earned by the

continental European and African businesses within Retail

Financial Services compared to the first half of 1997.

Half-year ended

Other operating income 30.6.98 31.12.97 30.6.97

#m #m #m

Income from associated undertakings 12 5 11

Dividend income from equity shares 8 11 9

Profits on disposal of investment 29 17 29

securities

Income from the long-term 47 17 44

assurance business

Property rentals 21 21 18

Other income 39 21 25

156 92 136

Life-fund charge - - (28)

156 92 108

Excluding former BZW businesses 154 94 100

Income from associated undertakings benefited from the

inclusion from 1st January 1998 of profits on an equity

accounted basis from the Group's Brazilian associate, Banco

Barclays e Galicia. This was offset by a reduced contribution

from Asian associated undertakings, compared to the first half

of 1997.

Profits on disposal of investment securities arose largely

from realisations by Private Equity in the ordinary course of

business.

Income from the long-term assurance business declined in the

second half of 1997 due to a further provision of #25m for the

cost of redress to personal pension customers (non priority

cases).

The higher level of other income in 1998 reflects premium

income on insurance underwriting activities which began in the

second half of 1997. Profits on disposals of properties at

#13m were #2m and #11m higher than in the first and second

halves of 1997 respectively.

BARCLAYS PLC

Half-year ended

Administrative expenses - staff 30.6.98 31.12.97 30.6.97

costs

#m #m #m

Salaries and accrued incentive 1,139 1,291 1,190

payments

Social security costs 84 97 103

Pension costs 21 30 35

Post-retirement health care 11 13 10

Other staff costs 131 142 124

1,386 1,573 1,462

Staff reduction and relocation 33 33 33

costs included above

Staff costs excluding former BZW 1,367 1,315 1,318

businesses

Number of staff at period end:

Retail Financial Services* 59,500 60,000 61,400

Corporate Banking 10,300 10,200 10,100

Barclays Capital** 4,600 7,400 7,200

Barclays Global Investors 1,500 1,500 1,500

Businesses in Transition 500 700 900

Other operations 3,100 3,000 2,900

Head office functions 400 400 400

Group total world wide 79,900 83,200 84,400

of which United Kingdom 59,500 61,100 60,800

* Retail Financial Services figures include staff who

represent a shared resource with Corporate Banking, but

exclude 1,000 Barclays Life advisers and field sales

managers (31st December 1997: 1,000, 30th June 1997: 900)

and 1,200 administrative staff (31st December 1997: 1,200,

30th June 1997: 1,200) whose costs are borne within the

long-term assurance fund.

** Figures include staff relating to former BZW businesses at

30.6.97 and 31.12.97.

Staff costs

Excluding costs incurred by the former BZW businesses, staff

costs rose by 4% in comparison with the first half of 1997.

This increase in costs reflects the 1997 annual pay award to

UK staff, as well as the impact of additional temporary staff.

Higher staff costs within Retail Financial Services in the

United Kingdom, Corporate Banking and Central Services

additionally reflected an increase in resources dedicated to

new products and customer service as well as Year 2000 and

Euro preparations. Staff costs within Barclays Capital were

slightly lower than in the first half of 1997.

The decrease in pension contributions reflected the reduction

in the contribution rate to the Group's main UK scheme from

2.5% of pensionable salary in 1997 to nil with effect from 1st

January 1998.

Staff numbers fell by 3,300 during the period, largely because

of the sale of former BZW businesses. In Retail Financial

Services, reductions of staff numbers in Africa and the

Caribbean and at Barclaycard were offset in part by the

creation of new customer service roles and product delivery

roles in the United Kingdom, particularly within Savings and

Investment. New initiatives also resulted in a modest

increase in Corporate Banking staff.

BARCLAYS PLC

Half-year ended

Administrative expenses - other 30.6.98 31.12.97 30.6.97

#m #m #m

Property and equipment expenses:

Hire of equipment 14 19 16

Property rentals 83 119 98

Other property and equipment 295 338 281

expenses

392 476 395

Stationery, postage and telephones 112 127 118

Advertising and market promotion 107 119 96

Travel, accommodation and 59 70 63

entertainment

Subscriptions and publications 21 18 19

Securities clearing and other 26 37 37

operational expenses

Sundry losses, provisions and 29 51 27

write-offs

Statutory and regulatory audit 2 3 3

and accountancy fees

Consultancy fees 58 63 40

Professional fees 40 59 40

Other expenses 15 16 19

861 1,039 857

Excluding former BZW businesses 851 940 779

Excluding costs of the former BZW businesses, administrative

expenses rose by 9% over the first half of 1997, reflecting

increased expenditure across the Group on customer orientated

and other initiatives (including work on Euro preparations and

Year 2000 compliance) as well as higher levels of allocated

fixed costs in Barclays Capital following sales of former BZW

businesses in this period.

In Retail Financial Services, Corporate Banking and Barclays

Global Investors, other property and equipment expenses and

consultancy costs included increased expenditure on software

development and other information technology costs related to

new products and delivery channels and customer service

enhancements.

There were higher levels of postage and telephone costs and

advertising and market promotion expenditure in the period,

reflecting increased activity across the Group, and within

Retail Financial Services in the United Kingdom in particular.

BARCLAYS PLC

Half-year ended

Depreciation and amortisation 30.6.98 31.12.97 30.6.97

#m #m #m

Property depreciation 45 56 50

Equipment depreciation 87 88 82

Goodwill amortisation 6 6 6

Loss on sale of equipment 1 3 -

Write-back of surplus properties (2) (12) (10)

137 141 128

Excluding former BZW businesses 137 133 123

The depreciation charge was higher than in the first six

months of 1997 following the move to Canary Wharf by Barclays

Capital in the second half of last year. The second half of

1997 also saw certain one-off charges in respect of equipment

and adaptation costs in the United Kingdom. In the first half

of 1997 property depreciation included a #7m charge in respect

of the local head office in Paris, which was subsequently

sold.

The write-back of surplus properties represents the recovery

of amounts previously written off against certain City of

London properties which have now been sold. Other gains on

property disposals totalling #13m (1997: #11m) have been

included in Other operating income.

BARCLAYS PLC

Provisions for bad and doubtful debts

Half-year ended

30.6.98 31.12.97 30.6.97

The charge for the period in #m #m #m

respect of bad and doubtful

debts comprises:

Specific provisions - credit risk

(net of releases and recoveries

of #155m:

(31st December 1997: #164m,

30th June 1997: #187m))

United Kingdom 145 139 143

Other European Union (2) (2) 11

United States (13) - (25)

Rest of the World 5 7 1

135 144 130

General provision - credit risk - 3 (35) (30)

charge/(credit)

138 109 100

Specific provision releases - (9) (2) (25)

country risk

General provision charge - - 30 15

country risk

Net charge 129 137 90

Total provisions for bad and doubtful debts at end of

period comprise:

Specific - credit risk

United Kingdom 801 765 762

Other European Union 225 245 282

United States 24 27 33

Rest of the World 45 41 43

1,095 1,078 1,120

Specific - country risk 31 44 48

Total specific provisions 1,126 1,122 1,168

General provisions - credit risk 686 683 721

- country risk 45 45 15

1,857 1,850 1,904

The #39m increase in the overall charge was mainly

attributable to a #3m credit risk general provision charge

compared with a release of #30m in the first half of 1997.

This reflected a lower level of releases in the Transition

businesses in the first half of 1998 and a release of general

provision in the first half of 1997 following the disposal of

part of the UK commercial mortgage portfolio.

In 1997 the Group raised a total general provision of #45m to

cover country transfer risks in major overseas markets in

which the Group operates.

Gross new and increased provisions fell by 9%, or #27m, to

#290m largely as a result of a #23m fall in Other European

Union as a result of favourable economic conditions.

Releases in the United Kingdom and the United States have

declined as the Transition portfolio is managed down.

Releases also included #25m in the first half of 1997

following the sale of part of the assets of Imry. Recoveries

in the United Kingdom increased mainly as a result of an

individual realisation of #25m within Corporate Banking.

Releases and recoveries are expected to slow further in the

second half of 1998 reflecting the current stage of the

economic cycle.

The net provision charge for the period as a percentage of

average loans and advances was 0.13% compared with 0.10% in

the first half of 1997.

BARCLAYS PLC

Half-year ended

Exceptional items 30.6.98 31.12.97 30.6.97

#m #m #m

Loss on sale or restructuring of BZW:

Profit/(loss) on sale of business 8 (57) -

assets

Staff reductions, property and

equipment, and other costs* - (283) -

Goodwill written off (11) (129) -

(3) (469) -

(Loss)/profit on disposal of (1) 2 42

other Group undertakings

(4) (467) 42

* In the first half of 1998, expenditure of #122m incurred in

respect of the restructuring of BZW was covered fully by the

provision of #283m raised in 1997.

The profit on sale of business assets of #8m and the goodwill

of #11m written off in the first half of 1998 relate to the

sale of the Australasian investment banking business.

Half-year ended

Write-down of fixed asset 30.6.98 31.12.97 30.6.97

investments

#m #m #m

- (19) -

The charge in 1997 was in respect of the write-down of certain

Asian banking associates.

Tax

The charge for the period assumes a UK corporation tax rate of

31% for the calendar year 1998 (1997: 31.5%). The increase

for the period in the effective tax rate to 29.5% (1997:

27.2%) resulted from a reversal of non-provided deferred tax

following the termination of certain leases compared with a

one-off benefit of tax free profits on the disposal of the

Group's residual interest in 3i Group plc in the first half of

1997.

Included in the charge is #1m (31st December 1997: #8m credit,

30th June 1997: #28m charge) in respect of advance corporation

tax on franked investment income and #12m (31st December 1997:

#7m, 30th June 1997: #3m) notional tax on the increase in the

shareholders' interest in the long-term assurance fund.

Earnings per ordinary share

Earnings per ordinary share is based upon the results after

deducting tax, profit attributable to minority interests and

dividends on staff shares.

Half-year ended

30.6.98 31.12.97 30.6.97

Earnings in period #887m #227m #903m

Earnings in period for the #913m #748m #909m

ongoing business

Weighted average of ordinary 1,519m 1,511m 1,526m

shares in issue

Earnings per ordinary share 58.4p 15.2p 59.2p

Earnings per ordinary share for

the ongoing business 60.1p 49.5p 59.6p

Dividends on ordinary shares

The Board has declared an interim dividend for the half year

ending 30th June 1998 of 15.5p per ordinary share, payable on

7th October 1998, in respect of shares registered in the books

of the company at the close of business on 21st August 1998.

For qualifying US and Canadian resident ADR holders, the

interim dividend of 15.5p per ordinary share becomes 77.5p per

ADS (representing four shares) inclusive of tax credit, before

deduction of UK withholding tax. The ADR depositary will mail

the dividend on 7th October 1998 to ADR holders on record as

at 21st August 1998.

For qualifying Japanese shareholders, the interim dividend of

15.5p per share becomes 19.375p per ordinary share inclusive

of tax credit, before deduction of UK withholding tax. The

dividend will be distributed in mid October to shareholders on

record as at 21st August 1998.

Shareholders may have their dividends reinvested in the

company's shares by participating in the dividend reinvestment

plan. The scope of the plan has recently been extended to

overseas shareholders although residents of the United States

and Canada and of some other territories are unable to

participate because of local legal and regulatory

requirements. Any shareholder who is unable to participate

for these reasons should contact The Plan Administrator to

Barclays, PO Box 82, Caxton House, Redcliffe Way, Bristol,

BS99 7FA with the exception of residents in the United States

and Canada. Information giving relevant dates for

participation in the plan will be available in the interim

report which will be mailed to all shareholders on 17th August

1998.

MORE TO FOLLOW

IR BRGBIRUGCCIU

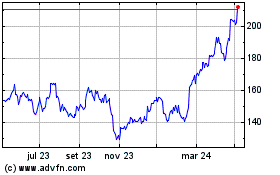

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024