RNS No 6555b

BARCLAYS PLC

16th February 1999

PART TWO

BARCLAYS PLC

SUMMARY OF RESULTS

PROFIT BEFORE TAX 1998 1997

#m #m

Retail Financial Services* 1,519 1,287

Corporate Banking* 972 921

Barclays Capital (265) 252

Barclays Global Investors 52 51

Businesses in Transition** 48 93

Other operations (184) (56)

Head office functions (60) (52)

Goodwill amortisation (12) (12)

Provision for litigation (76) -

settlement***

1,994 2,484

Former BZW businesses (33) (219)

Exceptional items 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

1,918 1,716

TOTAL ASSETS #m #m

Retail Financial Services 46,150 41,698

Corporate Banking 42,853 36,505

Barclays Capital 117,194 134,680

Barclays Global Investors 183 161

Businesses in Transition

- former BZW businesses - 8,477

- other 554 771

Other operations and Head office 5,475 4,178

functions

Retail life-fund assets 7,085 5,959

attributable to policyholders

219,494 232,429

WEIGHTED RISK ASSETS

Retail Financial Services 31,493 28,514

Corporate Banking 41,679 35,286

Barclays Capital 31,172 34,942

Barclays Global Investors 207 141

Businesses in Transition

- former BZW businesses - 4,078

- other 594 801

Other operations**** 4,636 4,565

109,781 108,327

* Figures are stated prior to the impact of the Finance (No.2) Act 1997

and the Finance Act 1998.

** Businesses in Transition profit before tax excludes the results of

former BZW businesses which are shown separately.

*** The 1998 provision relates to the settlement of the Atlantic

litigation.

**** Including supervisory adjustments.

BARCLAYS PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

1998 1997

#m #m

Interest receivable 9,952 9,204

Interest payable (5,600) (5,091)

Write-down of leases (40) (77)

Profit on redemption/repurchase of 3 2

loan capital

Net interest income 4,315 4,038

Net fees and commissions 2,779 2,979

receivable

Dealing profits (33) 374

Other operating income 324 228

Life-fund charge - (28)

Total non-interest income 3,070 3,553

Operating income 7,385 7,591

Administration expenses - staff (2,811) (3,035)

costs

Administration expenses - other (1,810) (1,896)

Depreciation and amortisation (275) (269)

Operating expenses (4,896) (5,200)

Operating profit before provisions 2,489 2,391

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments

Operating profit 1,921 2,160

Exceptional items 1 (425)

Write-down of fixed asset (4) (19)

investments

Profit on ordinary activities 1,918 1,716

before tax

Tax on profit on ordinary (538) (542)

activities

Profit on ordinary activities 1,380 1,174

after tax

Minority interests (equity and non- (45) (44)

equity)

Profit for the financial year

attributable to the members of 1,335 1,130

Barclays PLC

Dividends (646) (563)

Profit retained for the financial 689 567

year

Earnings per ordinary share 88.4p 74.4p

Earnings per ordinary share for 90.9p 109.1p

the ongoing business

Dividend per ordinary share:

First interim 15.5p 13.5p

Second interim (payable 30th April 27.5p 23.5p

1999)

BARCLAYS PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE ONGOING BUSINESS

1998 1997

#m #m

Interest receivable 9,952 9,196

Interest payable (5,598) (5,091)

Profit on redemption/repurchase of 3 2

loan capital

Net interest income 4,357 4,107

Net fees and commissions 2,771 2,652

receivable

Dealing profits (27) 342

Other operating income 319 222

Total non-interest income 3,063 3,216

Operating income 7,420 7,323

Administration expenses - staff (2,789) (2,633)

costs

Administration expenses - other (1,793) (1,719)

Depreciation and amortisation (276) (256)

Operating expenses (4,858) (4,608)

Operating profit before provisions 2,562 2,715

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments

Operating profit for the ongoing 1,994 2,484

business

Former BZW businesses (33) (219)

Exceptional items 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

Profit on ordinary activities 1,918 1,716

before tax

The consolidated profit and loss account shown on page 7 is affected by the

inclusion of the results of the former BZW businesses, the majority of which

were sold in the first half of 1998. The table above presents the

consolidated profit and loss account for the ongoing business excluding the

impact of the former BZW businesses' results and the 1997 and 1998 Finance

Acts.

BARCLAYS PLC

CONSOLIDATED BALANCE SHEET

1998 1997

Assets: #m #m

Cash and balances at central banks 942 750

Items in course of collection from 2,475 2,564

other banks

Treasury bills and other eligible 4,748 5,511

bills

Loans and advances to banks

- banking 20,316 21,729

- trading 16,296 15,155

36,612 36,884

Loans and advances to customers

- banking 81,469 74,111

- trading 14,641 25,712

96,110 99,823

Debt and equity securities 50,068 55,956

Interests in associated 150 57

undertakings and joint ventures

Intangible fixed assets - goodwill 196 191

Tangible fixed assets 1,939 2,016

Other assets 19,169 22,718

212,409 226,470

Retail life-fund assets 7,085 5,959

attributable to policyholders

Total assets 219,494 232,429

Liabilities:

Deposits by banks

- banking 25,951 30,511

- trading 8,469 13,968

34,420 44,479

Customer accounts

- banking 96,099 89,647

- trading 12,706 18,791

108,805 108,438

Debt securities in issue 17,824 20,366

Items in course of collection due 1,279 1,676

to other banks

Other liabilities 38,110 40,638

Undated loan capital - convertible 301 304

to preference shares

Undated loan capital - non- 1,441 1,353

convertible

Dated loan capital - non- 1,992 1,211

convertible

Other subordinated liabilities - - 59

non-convertible

204,172 218,524

Minority interests and

shareholders' funds:

Minority interests: equity 51 61

Minority interests: non-equity 263 265

Called up share capital 1,511 1,530

Reserves 6,412 6,090

Shareholders' funds: equity 7,923 7,620

8,237 7,946

212,409 226,470

Retail life-fund liabilities 7,085 5,959

attributable to policyholders

Total liabilities and 219,494 232,429

shareholders' funds

BARCLAYS PLC

FINANCIAL REVIEW

Results by nature of income and expense

In the tables below, income and cost totals excluding former BZW businesses

are shown to assist in the analysis of the ongoing business performance.

For most of 1997, BZW comprised the businesses that reported as Barclays

Capital and the former BZW businesses, operating as an integrated business

with significant levels of shared costs and infrastructure. Accordingly,

the amounts separately attributed to Barclays Capital and the former BZW

businesses in 1997 include estimates and allocations. Under these

circumstances, it is not meaningful to provide any more detailed analysis of

income and costs.

Net interest income 1998 1997

#m #m

Interest receivable 9,952 9,204

Interest payable (5,600) (5,091)

Profit on redemption/repurchase of 3 2

loan capital

4,355 4,115

Write-down of leases (40) (77)

4,315 4,038

Excluding former BZW businesses

and write-down of leases 4,357 4,107

Net interest income rose by #250m or 6%, excluding the contribution from

former BZW businesses and the write-down of leases following a further

reduction in the rate of Corporation Tax. Adjusting for these, the loss of

interest resulting from share buy-backs and other business disposals,

underlying net interest income increased by 7%.

Retail Financial Services net interest income grew by 9% to #2,821m,

benefiting from an improved contribution in home finance and strong volume

growth in UK consumer loans and extended credit card balances. Average

balances in consumer lending increased by 15% with outstanding balances

exceeding #5.5bn by the year end. Barclaycard increased average interest

earning lendings by 18% and maintained its overall interest margin. There

was also an increased contribution from current account and savings

products. Average savings balances increased by 10% in the year. However

strong growth in lower margin products, as part of a policy to grow and

retain balances, and competitive pressure resulted in a slight fall in the

overall savings margin.

Corporate Banking net interest income increased by 7% reflecting strong

volume growth in both assets and liabilities. Lendings to large corporates

and financial institutions in the United Kingdom and overseas grew

significantly benefiting from the rising cost of raising funds in corporate

bond markets. There was also good growth in middle market lending, with the

majority of the increase resulting from increased customer utilisation of

agreed lending lines and new and extended facilities to existing customers.

A change in the portfolio mix, as a result of strong growth in large

corporate lending, has resulted in a reduction in the overall corporate

lending margin.

Overall banking business margins were maintained at 3.42%. An increased

contribution from the spread, particularly in the second half of the year

reflecting changes in both the portfolio and funding mix, was offset by a

fall in the benefit of free funds to 0.73% (1997: 0.75%).

The net deficit arising from the central management of Group capital rose to

#98m (1997: deficit #24m), mainly as a result of increased interest

allocations to businesses reflecting higher short-term interest rates and

increased levels of regulatory capital employed by individual businesses. A

narrowing of the gap between the managed medium-term market rate and short-

term market rates of interest during the first half of the year eliminated

the contribution to the net margin from the central management of Group

interest rate exposure for the year (1997: 0.11%).

Yields, spreads and margins - banking business

Domestic business is conducted primarily in sterling and is transacted by

Retail Financial Services, Corporate Banking, Barclays Capital and Group

Treasury. International business is conducted primarily in foreign

currencies. In addition to the business carried out by overseas branches

and subsidiaries, international business is transacted in the United Kingdom

by Barclays Capital, mainly with customers domiciled outside the United

Kingdom.

The yields, spreads and margins shown below have been computed on this

basis, which generally reflects the domicile of the borrower. They exclude

profits and losses on the redemption and repurchase of loan capital and one-

off write-down of leases.

1998 1997

% %

Gross yield (i)

Group 7.81 7.64

Domestic 8.90 8.36

International 5.84 6.24

Interest spread (ii)

Group 2.69 2.67

Domestic 3.40 3.41

International 1.30 1.24

Interest margin (iii)

Group 3.42 3.42

Domestic 4.44 4.48

International 1.55 1.34

Average UK base rate 7.23 6.57

Notes

(i) Gross yield is the interest rate earned on average interest earning

assets.

(ii) Interest spread is the difference between the interest rate earned on

average interest earning assets and the interest rate paid on average

interest bearing liabilities.

(iii) Interest margin is net interest income as a percentage of average

interest earning assets.

Average interest earning assets and liabilities - banking business

1998 1997

Average interest earning assets #m #m

Group 127,396 120,407

Domestic 82,095 79,697

International 45,301 40,710

Average interest bearing

liabilities

Group 109,225 102,408

Domestic 66,492 62,444

International 42,733 39,964

Net fees and commissions 1998 1997

#m #m

Fees and commissions receivable 3,008 3,197

Less: fees and commissions payable (229) (218)

2,779 2,979

Excluding former BZW businesses 2,771 2,652

Excluding the contribution from the former BZW businesses and the impact of

other disposals, net fees and commissions rose by some 7% overall, with

strong performances by Corporate Banking and Barclays Global Investors.

In Corporate Banking commissions rose by 6% with strong growth in customer

related foreign exchange income and lending and arrangement fees,

particularly for large corporates. Money transmission income was maintained

and benefited from continued good growth in electronic banking products.

Excluding the impact of disposals, Barclays Global Investors increased its

income by 20% over 1997 benefiting from favourable market conditions in the

first half of the year and continued new business growth in assets under

management in all its major markets.

Retail Financial Services' fees and commissions grew by 3% reflecting

increased contributions in European Retail Banking and Barclays Private

Banking as a result of new business levels and favourable market conditions,

and volume growth in the debit and credit card businesses in the second half

of the year. This more than offset the lower contribution from Barclays

Insurance, following the move to in-house underwriting of all payment

protection insurance. Premiums on insurance business written in-house are

now reported in Other operating income.

Retail Financial Services and Corporate Banking fees and commissions include

#81m (1997: #71m) in respect of foreign exchange income on customer

transactions with Barclays Capital.

Increased lending activity, particularly in structured finance, contributed

to a #11m improvement in fees and commissions at Barclays Capital.

Dealing profits 1998 1997

#m #m

Interest rate related (132) 199

Foreign exchange and commodities 100 132

Equities and other (1) 43

(33) 374

Excluding former BZW businesses (27) 342

Almost all the Group's dealing profits arise in Barclays Capital. The fall

in interest rate related dealing profits reflects proprietary trading losses

incurred as a result of the Russian government default on its domestic debt

obligations, together with the consequent widening of spreads in all

segments of the corporate bond market and a reduction in general business

volumes. This was partially offset by strong dealing profits within

interest rate derivatives and the government bond business.

Foreign exchange performed well, albeit profits were lower than the high

levels achieved in 1997. There were also substantially lower revenues in the

commodities business as prices weakened throughout the year.

Equity and other dealing profits primarily arises in the equity derivatives

business. Equity related dealing profits fell in the second half of the

year mainly as a result of the dislocation in the equity markets. In 1997,

equities and other dealing profits predominantly related to the former BZW

businesses.

Other operating income 1998 1997

#m #m

Income from associated 22 16

undertakings and joint ventures

Dividend income from equity shares 14 20

Profits on disposal of investment 49 46

securities

Income from the long-term 109 61

assurance business

Property rentals 44 39

Other income 86 46

324 228

Life-fund charge - (28)

324 200

Excluding former BZW businesses 319 194

Income from associated undertakings and joint ventures benefited from the

inclusion from 1st January 1998 of profits on an equity accounted basis from

the Group's Brazilian associate, Banco Barclays e Galicia.

Profits on disposal of investment securities arose largely from realisations

by the private equity business within Barclays Capital in the ordinary

course of business.

In 1997, income from the long term insurance business was reduced by a

further #25m provision for the cost of redress for personal pension

customers (non priority cases).

The higher level of other income in 1998 reflected #31m of premium income on

insurance underwriting activities, the first stage of which commenced in the

second half of 1997, and an increase of #7m, to #20m, in respect of profits

on disposal of properties.

Administrative expenses - staff 1998 1997

costs

#m #m

Salaries and accrued incentive 2,211 2,380

payments

Social security costs 173 200

Pension costs 37 65

Post-retirement health care 17 23

UK profit sharing 88 101

Other staff costs 285 266

2,811 3,035

Staff reduction and relocation 86 66

costs included above

Staff costs excluding former BZW 2,789 2,633

businesses

Number of staff at period end:

Retail Financial Services* 58,100 59,500

Corporate Banking 10,800 10,700

Barclays Capital** 4,400 7,400

Barclays Global Investors 1,500 1,300

Businesses in Transition 100 700

Other operations 3,300 3,200

Head office functions 400 400

Group total world wide 78,600 83,200

of which United Kingdom 58,900 61,100

* Retail Financial Services figures include staff who represent a shared

resource with Corporate Banking, but exclude 1,000 Barclays Life advisors

and field sales managers (31st December 1997: 1,000) and 1,300

administrative staff (31st December 1997: 1,200) whose costs are borne

within the long-term assurance fund.

**1997 figures include staff relating to former BZW businesses.

Staff costs

Excluding costs incurred by the former BZW businesses, staff costs rose by

6% in 1998 mainly reflecting the impact of the 1998 annual pay award to UK

staff and increased resource (including temporary staff) in key areas of the

business.

In Retail Financial Services, staff costs increased by 4%. This was partly

the result of rationalisation costs of #15m at Barclaycard, where in

September a reduction of 1,100 staff over the next three years was

announced. Within UK Retail Banking, the cost impact of growth in business

volumes and expansion of delivery channels was offset by efficiency savings

and the continued centralisation of the network. There was also increased

investment in front office customer servicing capability in Barclays

Offshore and Barclays Private Banking.

Higher staff costs in Barclays Global Investors, Corporate Banking and Other

operations reflected the investment in resources to support new products and

customer service enhancements, as well as Year 2000 and euro preparations.

Reductions in Barclays Capital staff costs resulted from lower levels of

performance related pay. This was offset by the transfer of staff from the

former BZW equity derivatives business at the beginning of 1998.

The fall in pension costs reflected the reduction in the contribution rate

to the Group's main UK scheme from 2.5% of pensionable salary in 1997 to nil

with effect from 1st January 1998.

Staff numbers fell by 4,600, primarily because of the sale of former BZW

businesses. In Retail Financial Services, there were reductions in Africa

and the Caribbean and to a lesser extent in Barclaycard. These were partly

offset by the creation of new customer service and product delivery roles in

UK Retail Banking and International Premier, Private, Savings and

Investment.

Administrative expenses - other 1998 1997

#m #m

Property and equipment expenses:

Hire of equipment 28 35

Property rentals 176 217

Other property and equipment 638 619

expenses

842 871

Stationery, postage and telephones 230 245

Advertising and market promotion 225 215

Travel, accommodation and 113 133

entertainment

Subscriptions and publications 43 37

Securities clearing and other 49 74

operational expenses

Sundry losses, provisions and 53 78

write-offs

Statutory and regulatory audit and 6 6

accountancy fees

Consultancy fees 126 103

Professional fees 91 99

Other expenses 32 35

1,810 1,896

Excluding former BZW businesses 1,793 1,719

Administrative expenses rose by 4%, excluding costs of former BZW

businesses. This reflected continued investment across the Group on

upgrading technology and customer orientated and other initiatives

(including euro preparation and Year 2000 compliance).

In Retail Financial Services and Corporate Banking other administrative

expenses included expenditure on existing and emerging delivery channels

(including telephone, internet and PC banking), new product development and

other customer based service initiatives. Marketing expenditure grew as a

result of increased television and cinema advertising in support of new

business development.

Barclays Capital's other administrative expenses included increased

expenditure on upgrading technology as well as higher levels of allocated

fixed costs previously attributed to the former BZW businesses. In 1997

property and equipment costs increased as a result of the one-off impact of

the relocation to Canary Wharf.

The increase in consultancy fees reflected higher levels of expenditure on

technology initiatives, Year 2000 compliance and preparations for the

introduction of the euro, together with costs relating to the restructuring

of Group Property Services and other central functions.

Depreciation and amortisation 1998 1997

#m #m

Property depreciation 88 106

Equipment depreciation 172 170

Goodwill amortisation 12 12

Loss on sale of equipment 5 3

Write-back of surplus properties (2) (22)

275 269

Excluding former BZW businesses 276 256

The reduction in the property depreciation charge primarily resulted from

one-off adaptation charges in 1997, and a #7m charge in respect of the local

head office in Paris in the same year.

The write-back of surplus properties represents the recovery of amounts

previously written off against certain City of London properties which have

now been sold. Other gains on property disposals totalling #20m (1997: #13m)

have been included in Other operating income.

Provisions for bad and doubtful debts

1998 1997

The charge for the year in respect #m #m

of bad and doubtful debts

comprises:

Specific provisions - credit risk

New and increased 816 625

Releases (135) (225)

Recoveries (176) (126)

505 274

General provision releases - (20) (65)

credit risk

485 209

Specific provision releases - (13) (27)

country risk

General provision charge - country 20 45

risk

Net charge 492 227

Total provisions for bad and

doubtful debts at end of year

comprise:

Specific - credit risk 1,199 1,078

Specific - country risk 16 44

Total specific provisions 1,215 1,122

General provisions

- credit risk 663 683

- country risk 65 45

1,943 1,850

The #265m increase in the net charge was mainly as a result of a #153m

provision in the second half of 1998 in respect of exposure to Russian

counterparties (primarily in respect of currency forward contracts and

repurchase agreements). Net releases and recoveries of specific and general

credit risk provisions reduced by #85m to #331m.

Excluding the impact of Russia, gross new and increased specific credit risk

provisions rose by #38m compared to last year. There were increased charges

in UK consumer lending and Barclaycard, largely because of higher volumes

Releases and recoveries continued to decline in the transition businesses in

the United States and France as the portfolios were managed down to low

levels. Releases and recoveries in Corporate Banking slowed in the second

half of the year and are expected to reduce further in 1999.

The country risk general provision was raised by a further #20m to #65m in

the second half of the year to cover increased transfer risks arising from

continuing uncertainty in emerging markets.

The net provisions charge for the year as a percentage of average loans and

advances was 0.49%, compared with 0.23% in 1997.

Provisions for contingent liabilities and commitments

1998 1997

#m #m

(76) (4)

The charge for the year represents a contribution of some #116m to the

Administrators of British & Commonwealth Holdings PLC (B&C) in relation to the

overall settlement of proceedings which arose in connection with B&C's

acquisition of Atlantic Computers Plc in 1988, adjusted for expected insurance

cover of #40m.

Exceptional items 1998 1997

#m #m

Loss on sale or restructuring of

BZW:

Profit/(loss) on sale of business 8 (57)

assets

Staff reductions, property and

equipment, and other costs* - (283)

Goodwill written off (11) (129)

(3) (469)

Profit on disposal of other Group 4 44

undertakings

1 (425)

* Expenditure of #245m has been incurred to date in respect of the

restructuring of BZW, for which a provision of #283m was raised in 1997.

The sales of the former BZW businesses in respect of the equities, equity

capital markets and mergers and acquisitions advisory businesses in the

United Kingdom, Europe and Asia were completed in 1998 at a loss of #57m

(before goodwill written off). This was provided for in 1997. A further

loss of #3m (after goodwill written off) arose in 1998 in respect of the

disposal of the Australasian investment banking business.

The net profit on disposal of other Group undertakings includes goodwill

written off of #1m. It represents gains of #14m (including a final #11m

realisation in respect of the sale of the Custody business in 1997) offset

by losses of #10m.

Write-down of fixed asset 1998 1997

investments

#m #m

(4) (19)

The charge in 1997 was primarily in respect of the write-down of the cost of

investments in certain Asian banking associates.

Tax

The charge for the year assumes UK corporation tax rate of 31% for the

calendar year 1998 (1997: 31.5%) and comprises current tax of #553m (1997:

#555m) and deferred tax credit of #15m (1997: credit #13m). The effective

rate of tax is 28.1% (1997: 31.6%). The reduction in the rate is mainly

attributable to relief not being available in 1997 on the whole of the

disposal costs of the former BZW businesses.

Included in the charge is #4m (1997: #20m) in respect of advance corporation

tax on franked investment income and #25m (1997: #10m) notional tax on the

increase in the shareholders' interest in the long-term assurance fund.

There has been no change in the policy for partial provision for deferred

taxation in respect of leasing.

Earnings per ordinary share

Earnings per ordinary share is based upon the results after deducting tax,

profit attributable to minority interests and dividends on staff shares.

1998 1997

Earnings in period #1,335m #1,130m

Earnings in period for the ongoing #1,371m #1,657m

business

Weighted average of ordinary 1,510m 1,519m

shares in issue

Earnings per ordinary share 88.4p 74.4p

Earnings per ordinary share for 90.9p 109.1p

the ongoing business

Diluted earnings per share is not materially different from the basic

earnings per share figure reported above in either 1998 or 1997.

Dividends on ordinary shares

The Board has decided to pay, on 30th April 1999, a second interim dividend

for 1998 of 27.5p per ordinary share, in respect of shares registered in the

books of the Company at the close of business on 26th February 1999.

The total distribution on the ordinary shares for 1998 is 43.0p

(1997: 37.0p).

For qualifying US and Canadian resident ADR holders, the second interim

dividend of 27.5p per ordinary share becomes 110p per ADS (representing four

shares). The ADR depositary will mail the dividend on 30th April 1999 to

ADR holders on record on 26th February 1999.

For qualifying Japanese shareholders, the second interim dividend of 27.5p

per share will be distributed in May to shareholders on record on 26th

February 1999.

Foreign shareholders previously eligible for repayment of a part of the UK

tax credit under the 'G' and 'H' arrangements will be sent a letter

explaining the consequences to them of the changes caused by the abolition

of ACT in respect of dividend payments after 5th April 1999.

Shareholders may have their dividends reinvested in Barclays PLC shares by

participating in the Dividend Reinvestment Plan. The plan is available to

all shareholders provided that they do not live in or are subject to the

jurisdiction of any country where their participation in the plan would

require Barclays or the plan administrator to take action to comply with local

government or regulatory procedures or any similar formalities. Any

shareholder wishing to obtain details of the plan and a mandate form should

contact The Plan Administrator to Barclays, PO Box 82, Caxton House, Redcliffe

Way, Bristol, BS99 7FA. Those wishing to participate for the first time in

the plan should send their completed mandate form to the plan administrator

before 9th April 1999 for it to be applicable to the payment of the second

interim dividend on 30th April 1999. Existing participants should take no

action unless they wish to alter their current mandate instructions in

which case they should contact the plan administrator.

MORE TO FOLLOW

FRCALLIDFTIELAA

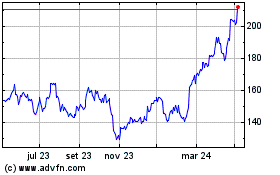

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024