RNS No 6730e

BARCLAYS PLC

16th February 1999

PART FOUR

BARCLAYS PLC

ADDITIONAL INFORMATION

CHANGES IN GROUP STRUCTURE IN 1998

On 1st April 1998 the Group reorganised into four main business groupings

consisting of Retail Financial Services, Corporate Banking, Barclays Capital

and Barclays Global Investors. Comparative figures have been restated to

reflect the new structure.

RECENT DEVELOPMENTS

On 7th January 1999, Barclays announced that it had agreed to make a

contribution of #116m to the Administrators of British & Commonwealth

Holdings PLC (B&C) as part of the overall settlement of #150m of the

Atlantic litigation. It is expected that some #40m of this contribution

will be offset by insurance cover. The contribution and insurance offset

have been incorporated in these results.

This settlement brings to an end Barclays exposure in the litigation which

arose in connection with B&C's acquisition of Atlantic in 1988.

On 11th February 1999, Barclays announced the appointment of Michael O'Neill

as Group Chief Executive and a Board Director with effect from 26th March

1999.

ACCOUNTING POLICIES

During the year the Group implemented FRS 9 'Associates and Joint Ventures',

FRS 10 'Goodwill and Intangible Assets' and FRS 11 'Impairment of Fixed

Assets and Goodwill'. Implementation of these standards did not have a

significant effect on the Group's results.

There have been no other significant changes to the accounting policies as

described in the 1997 Annual report.

ACQUISITIONS AND DISPOSALS

There were no significant acquisitions in the period. Details of

significant disposals in the period are set out under exceptional items on

page 18.

CHANGES IN ACCOUNTING PRESENTATION

Income from the long-term insurance business now includes amounts previously

reported within Other income. Following a reassessment, certain BGI managed

funds previously reported within life-fund assets attributable to

policyholders are now more appropriately classified as funds under

management. Accordingly these funds, and their related liabilities, have

been excluded from the consolidated balance sheet.

Comparative numbers have been restated for the impact of these changes.

Total operating income and operating profit are not affected.

GROUP SHARE SCHEMES

The trustees of the Group's share schemes may make purchases of Barclays PLC

ordinary shares in the market following the announcement of the Group's

results in February 1999 for the purposes of those schemes' current and

future requirements. The total number of ordinary shares purchased would

not be material in relation to the issued share capital of Barclays PLC.

NOTES

1. Loans and advances to banks 1998 1997

#m #m

Banking business

Loans and advances to banks 20,357 21,751

Less - provisions (41) (22)

20,316 21,729

Trading business 16,296 15,155

Total loans and advances to 36,612 36,884

banks

Of the total loans and advances to banks placings with banks were

#32.8bn at 31st December 1998 (1997: #31.0bn). The majority of placings

have a residual maturity of less than one year.

2. Loans and advances to customers 1998 1997

#m #m

Banking business

Loans subject to non-recourse 278 327

finance arrangements

Less: non returnable finance (269) (319)

9 8

Loans and advances to customers 77,663 69,894

Finance lease receivables 5,776 6,122

83,448 76,024

Less - provisions (1,902) (1,828)

- interest in suspense (77) (85)

81,469 74,111

Trading business 14,641 25,712

Total loans and advances to 96,110 99,823

customers

3. Provisions for bad and doubtful

debts

1998 1997

Credit risk provisions #m #m

Provisions at beginning of year 1,761 2,050

Exchange and other adjustments 5 (53)

Amounts written off

United Kingdom (506) (441)

Other European Union (43) (93)

United States (7) (23)

Rest of the World (9) (14)

(565) (571)

Recoveries (analysed below) 176 126

Sub-total 1,377 1,552

Provisions charged against

profit:

New and increased specific

provisions

United Kingdom 751 536

Other European Union 31 49

United States 11 12

Rest of the World 23 28

816 625

Less: Releases of specific

provisions

United Kingdom (81) (143)

Other European Union (31) (34)

United States (8) (33)

Rest of the World (15) (15)

(135) (225)

Less: Recoveries

United Kingdom (156) (111)

Other European Union (4) (6)

United States (13) (4)

Rest of the World (3) (5)

(176) (126)

Net specific provisions charge 505 274

General provisions release (20) (65)

Net credit risk charge to 485 209

profit

Provisions at end of year 1,862 1,761

Country risk provisions

Provisions at beginning of year 89 80

Exchange and other adjustments 1 1

Amounts written off (net of (16) (10)

recoveries)

Net specific provision releases (13) (27)

General provision charge 20 45

Provisions at end of year 81 89

Total provisions at end of year 1,943 1,850

3. Provisions for bad and doubtful debts (continued)

Total provisions for bad and doubtful debts at end of year comprise:

1998 1997

Specific - credit risk #m #m

United Kingdom 928 765

Other European Union 213 245

United States 23 27

Rest of the World 35 41

1,199 1,078

Specific - country risk 16 44

Total specific provisions 1,215 1,122

General provisions - credit 663 683

risk

- country risk 65 45

1,943 1,850

The geographic analysis of provisions shown above is based on location

of office. The United Kingdom charge includes #153m raised in respect

of exposure to Russian counterparties.

4. Other assets 1998 1997

#m #m

Own shares 43 43

Balances arising from off- 13,725 17,124

balance sheet financial

instruments

Shareholders' interest in long- 530 460

term assurance fund

London Metal Exchange warrants 457 665

and other metals trading

positions

Sundry debtors 1,862 2,121

Prepayments and accrued income 2,552 2,305

19,169 22,718

'Own shares' represent Barclays PLC shares held in employee benefit

trusts that have not yet vested unconditionally with the eligible

employees.

5. Other liabilities 1998 1997

#m #m

Obligations under finance 141 157

leases payable

Balances arising from off- 15,849 18,703

balance sheet financial

instruments

Short positions in securities 13,682 13,170

Current tax 479 509

Sundry creditors 3,199 2,729

Accruals and deferred income 3,074 3,557

Provisions for liabilities and 1,272 1,454

charges

Dividend 414 359

38,110 40,638

6. Exposure to countries subject to International Monetary Fund liquidity

support programmes

Amounts outstanding, net of provisions, and commitments to

counterparties in countries which are subject to International Monetary

Fund liquidity support programmes were as follows:

1998 1997

Asia #bn #bn

Indonesia 0.1 0.3

South Korea 0.5 0.6

Thailand 0.1 0.3

0.7 1.2

Latin America

Brazil 0.9 0.8

Eastern Europe

Russia 0.0 0.1

1.6 2.1

Of the total of #1.6bn, #1.0bn (1997: #1.5bn) was related to banks,

#0.4bn (1997: #0.4bn) to governments and #0.2bn (1997: #0.2bn) to other

corporate bodies including project finance companies, and was mainly in

respect of loans, off-balance sheet financial instruments and debt

securities. Off-balance sheet financial instruments and debt securities

are marked to market.

The Group has a Brazilian associate, Banco Barclays e Galicia SA, which

is equity accounted. At 31st December 1998 the 50% holding was included

in the balance sheet at a value of #47m (included in the figures above).

Of the above exposures #35m (1997: #10m) were non-performing (interest

not being accrued) as at 31st December 1998. During the year the Group

raised a general provision of #20m in respect of country transfer risk

arising from its business world wide, including exposure in these

countries, bringing the total of such provisions to #65m at 31st

December 1998. This is in addition to #663m of general provision held

against credit risk.

7. Potential credit risk lendings

The following table presents an analysis of potential credit risk

lendings in accordance with the US Securities and Exchange Commission

guidelines. Additional categories of disclosure are included, however,

to record lendings where interest continues to be accrued and where

either interest is being suspended or specific provisions have been

raised. Normal US banking practice would be to place such lendings on

non-accrual status.

The amounts, the geographical presentation of which is based on the

location of the office recording the transaction, are stated before

deduction of the value of security held, specific provisions carried or

interest suspended.

Non-performing lendings 1998 1997

#m #m

Non-accrual lendings:

United Kingdom 985 911

Foreign 282 309

Accruing lendings where

interest is being suspended:

United Kingdom 266 234

Foreign 118 153

Other accruing lendings against

which provisions have been

made:

United Kingdom 457 408

Foreign 134 117

Sub-totals:

United Kingdom 1,708 1,553

Foreign 534 579

Accruing lendings 90 days

overdue, against which no

provisions have been made:

United Kingdom 309 388

Foreign 19 14

Reduced rate lendings:

United Kingdom 7 37

Foreign - -

Total non-performing lendings

United Kingdom 2,024 1,978

Foreign 553 593

2,577 2,571

UK non-performing lendings increased by #46m including exposures to

Russian counterparties. A further reduction in business in transition

balances was primarily responsible for the fall in overseas balances.

7. Potential credit risk lendings (continued)

Potential problem lendings: In addition to the above, the following

table shows lendings which are current as to payment of principal and

interest, but where serious doubt exists as to the ability of the

borrower to comply with repayment terms in the near future.

1998 1997

#bn #bn

United Kingdom 0.6 0.6

Foreign 0.1 0.1

0.7 0.7

1998 1997

Total provision coverage of: % %

- credit risk non-performing 75.2 71.8

lendings

- total potential credit risk 59.4 56.3

lendings

1998 1997

Interest forgone on non- #m #m

performing lendings:

Interest income that would have 182 218

been recognised under original

contractual terms

Interest income included in (63) (71)

profit

Interest forgone 119 147

8. European Economic and Monetary Union

The Group's preparations for EMU and the introduction of the euro on 1st

January 1999, required the effective management across the Group of a

wide range of changes and upgrades to systems, processes and procedures.

This culminated in the successful completion of its conversion weekend

activity on 3rd January 1999.

The original cost estimate for the Group's work on achieving euro

compliance, on the assumption that the United Kingdom did not

participate, was some #150m. Throughout 1998 efforts were concentrated

on providing the most benefit to our customers. As the markets and

payment/settlements infrastructure changes became more clearly defined

and more robust implementation plans were developed, the contingency

planning requirements were reduced. The estimated total cost reduced to

#120m at 30th June 1998, and is now expected to be #90m, of which some

#75m has been spent to date (#55m in 1998).

Further expenditure of #15m includes anticipated costs in respect of the

introduction of euro banknotes and coins in the Group's continental

European operations and further systems development within Corporate

Banking.

Barclays is continuing to monitor developments around the possibility of

the United Kingdom joining EMU. Planning has been undertaken in 1998 to

identify what further work would be required should the United Kingdom

decide to join EMU. In the meanwhile only limited preparations to UK

systems have been made and no significant expenditure will be incurred

until there is more certainty over a decision to enter.

9. Year 2000

The Barclays Group Year 2000 programme was initiated in early 1996 and

is responsible for ensuring that Year 2000 projects are in place across

the whole Group world wide. A Programme Board of executives from across

the Group is chaired by the Director, Planning, Operations and

Technology, who reports directly to the Group Deputy Chairman and Chief

Executive.

The Group has given priority to its mission critical computer systems

(those which would have an immediate and observable impact on the

Group's customers and therefore its ability to continue to operate

effectively). Over 90% of such systems were tested as Year 2000 ready

as at 31st December 1998, and this is forecast to rise to 98% by the end

of March 1999. The aim is to have all mission critical systems

including embedded systems, corrected and implemented by the end of June

1999.

The total cost of the Year 2000 Programme is estimated not to exceed

#250m (including #20m of capitalised costs) for the four year period

ending December 2000. The total amount spent on the Year 2000 Programme

to date is about #145m (including #15m of capitalised costs) of which

#105m was incurred in 1998. Year 2000 costs include correction,

testing, third party assurance and contingency planning.

10.Legal proceedings

Barclays is party to various legal proceedings, the ultimate resolution

of which is not expected to have a material adverse effect on the

financial position of the Group.

See pages 17 and 38 for details of the settlement with the

Administrators of British & Commonwealth Holdings PLC.

11. Geographical analysis

1998 1997

Profit before tax #m #m

United Kingdom 1,470 1,402

Other European Union 241 118

United States 67 96

Rest of the World 140 100

1,918 1,716

1998 1997

Total assets #m #m

United Kingdom 154,446 164,257

Other European Union 18,490 19,872

United States 24,886 25,667

Rest of the World 21,672 22,633

219,494 232,429

12. Contingent liabilities and commitments

1998 1997

Contingent liabilities #m #m

Acceptances and endorsements 1,384 1,602

Guarantees and assets pledged 8,784 6,623

as collateral security

Other contingent liabilities 5,069 5,123

15,237 13,348

Commitments

Standby facilities, credit 68,191 59,121

lines and other commitments

13.Off-balance sheet financial instruments, including derivatives

The tables set out below analyse the contract or underlying principal

amounts of derivative financial instruments held for trading purposes

and for the purposes of managing the Group's structural exposures.

Foreign exchange derivatives 1998 1997

#m #m

Contract or underlying

principal amount

Forward foreign exchange 263,958 337,276

Currency swaps 79,447 57,838

Other exchange rate related 101,310 177,860

contracts

444,715 572,974

Net replacement cost 4,262 9,402

Interest rate derivatives

Contract or underlying

principal amount

Interest rate swaps 787,486 664,722

Forward rate agreements 99,960 138,619

OTC options bought and sold 222,589 138,392

Other interest rate related 104,003 182,875

contracts

1,214,038 1,124,608

Net replacement cost 7,417 6,116

Equity, stock index and

commodity derivatives

Contract or underlying 51,347 45,420

principal amount

Net replacement cost 2,173 1,722

Other exchange rate related contracts are primarily OTC options. Other

interest rate related contracts are primarily exchange traded options

and futures.

Replacement cost or credit exposure on derivative instruments represents

the cost to replace contracts with a positive fair value if

counterparties failed completely to perform their obligations.

Replacement cost varies over time as the market price of the underlying

instrument varies.

14.Market risk

Market risk is the risk of loss arising from adverse movements in the

level or volatility of market prices, which can occur in the interest

rate, foreign exchange, equity and commodity markets. It is incurred as

a result of both trading and asset/liability management activities.

The market risk management policies of the Group are determined by the

Group Risk Management Committee, which also determines overall market

risk appetite. The Group's policy is that exposure to market risk

arising from trading activities is concentrated in Barclays Capital.

The Group's banking businesses are also subject to market risk, which

arises in relation to non-trading positions, such as capital balances,

demand deposits and customer originated transactions and flows.

Management responsibilities

In Barclays Capital, the formal process for the management of risk is

through the Barclays Capital Risk Management Committee. Day to day

responsibility for market risk lies with the Chief Executive of Barclays

Capital, supported by a dedicated global market risk management unit

that operates independently of the business areas.

Market risk measurement

The Group uses a 'value at risk' measure as the primary mechanism for

controlling market risk. Daily Value at Risk (DVAR) is an estimate,

with a confidence level of 98% of the potential loss which might arise

if the current positions were to be held unchanged for one business day.

Daily losses exceeding the DVAR figure are likely to occur, on average,

only twice in every one hundred business days. Actual outcomes are

monitored regularly to test the validity of the assumptions made in the

calculation of DVAR.

As in 1997, volatilities reached high levels in 1998 as a result of

market turbulence, leading to occasional sharp rises in DVAR. The peak

DVAR of #43.3m occurred in July following a significant increase in the

estimated volatilities relating to Russian government debt. In reaction

to this increased market turbulence, the non-client related proprietary

businesses in Barclays Capital were closed in October and secondary

market corporate bond inventory was substantially reduced during the

last quarter of 1998.

This reduction in risk contributed to a decrease in overall DVAR from

#22.8m at 30th June 1998 to #12.2m at 31st December 1998 (31st December

1997: #17.3m). During 1999 it is intended that Barclays Capital will

continue to operate in its current markets and pursue market

opportunities as appropriate.

The daily average, maximum and minimum values of DVAR were estimated as

below.

DVAR

Twelve months to Twelve months to

31st December 1998 31st December 1997

Average High* Low* Average High* Low*

#m #m #m #m #m #m

Interest rate 15.1 36.6 9.5 10.2 18.4 4.7

risk

Foreign exchange 5.8 13.9 1.2 5.4 21.9 0.7

risk

Equities risk 3.0 7.9 1.3 2.3 3.4 1.5

Commodities risk 1.2 2.9 0.6 1.4 2.9 0.4

Diversification (4.2) (3.6)

effect

Total DVAR 20.9 43.3 12.2 15.7 35.1 7.0

* The high (and low) DVAR figures reported for each category did not

necessarily occur on the same day as the high (and low) DVAR reported

as a whole. A corresponding diversification effect cannot be

calculated and is therefore omitted from the above table.

The above figures for 1997 include market risk taken by the former BZW

businesses that have been sold or closed. The calculation of the market

risk relating to Barclays Capital and the former BZW businesses cannot

be precisely separated, but based on reasonable assumptions, it can be

estimated that the DVAR in Barclays Capital businesses would have

accounted for the substantial majority of the total DVAR for the

combined businesses as detailed above.

15.US GAAP

There are some significant differences between accounting practices in

the United States (US GAAP) and those in the United Kingdom (UK GAAP).

Key figures on a UK GAAP basis and as estimated on a US GAAP basis are:

1998 1998 1997 1997

#m #m #m #m

UK GAAP US GAAP UK GAAP US GAAP

Net income 1,335 1,370 1,130 1,274

Shareholders' funds 7,923 7,781 7,620 7,409

BARCLAYS PLC

CONSOLIDATED STATEMENT OF CHANGES IN

SHAREHOLDERS' FUNDS

1998 1997

#m #m

At beginning of year 7,620 7,267

Proceeds of shares issued (net of 110 113

expenses)

Exchange rate translation 32 (101)

differences

Repurchase of ordinary shares* (501) (351)

Goodwill written back on disposals 10 126

Shares issued in relation to share (67) -

option schemes for staff**

Other items 30 (1)

Profit retained 689 567

At end of year 7,923 7,620

* Including nominal amount of #29m (1997: #30m).

** The Group has established a Qualifying Employee Share Ownership Trust

(QUEST) for the purposes of the Group's Save As You Earn Share Option

Scheme.

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

1998 1997

#m #m

Profit attributable to the members 1,335 1,130

of Barclays PLC

Exchange rate translation 32 (101)

differences

Other items 30 -

Total recognised gains relating to 1,397 1,029

the period

SUMMARY CONSOLIDATED CASH FLOW STATEMENT

Note 1998 1997

#m #m

Net cash(outflow)/inflow from 1 (1,337) 8,979

operating activities

Dividends received from 3 7

associated undertakings

Net cash outflow from returns (252) (303)

on investment and servicing

of finance

Tax paid (547) (263)

Net cash inflow /(outflow) 2,333 (7,513)

from capital expenditure and

financial investment

Acquisitions and disposals 584 50

Equity dividend paid (591) (445)

Net cash inflow before 193 512

financing

Net cash inflow/(outflow) 264 (468)

from financing

Increase in cash 457 44

NOTE TO CONSOLIDATED CASHFLOW STATEMENT

1998 1997

#m #m

1 Operating profit 1,921 2,160

Provisions for bad and 492 227

doubtful debts

Depreciation and amortisation 270 266

Net (decrease)/increase in (719) 729

accrued expenditure and

prepayments

Provisions for contingent 76 4

liabilities and commitments

Interest on dated and undated 244 265

loan capital and other

subordinated liabilities

Associated undertakings - (22) (16)

profit included

Increase in shareholders' (95) (19)

interest in the UK long-term

assurance fund

Profit on (3) (2)

redemption/repurchase of loan

capital

Net (increase)/decrease in net (23) 70

interest and commission

receivable

Net profit on disposal of (106) (104)

investments and fixed assets

Other non-cash movements 53 13

2,088 3,593

Net change in items in transit (311) 500

and items in course of

collection

Net (decrease)/increase in (4,197) 14,365

other credit balances

Net decrease/(increase) in 8,652 (21,324)

loans and advances to banks

and customers

Net (decrease)/increase in (14,958) 33,695

deposits and debt securities

in issue

Net decrease/(increase) in 3,215 (5,516)

other assets

Net decrease/(increase) in 3,642 (15,122)

other debt securities and

equity shares

Net decrease/(increase) in 777 (1,226)

treasury and other eligible

bills

Other non-cash movements (245) 14

Net cash (outflow)/inflow from (1,337) 8,979

operating activities

OTHER INFORMATION

Financial Summary 1998 1997 1996 1995 1994

#m #m #m #m #m

Profit before tax 1,918 1,716 2,306 2,017 1,831

Profit after tax 1,380 1,174 1,686 1,407 1,251

Total capital resources 11,971 10,873 10,674 11,021 10,152

p p p p p

Earnings per ordinary 88.4 74.4 104.2 83.6 72.4

share

Dividends per ordinary 43.0 37.0 31.5 26.0 21.0

share

Net asset value per 525 498 472 433 377

ordinary share

Dividend cover (times) 2.1 2.0 3.4 3.2 3.4

Risk asset ratios: % % % % %

Tier 1 ratio 7.4 7.3 7.6 7.7 7.0

Total ratio 10.7 10.0 10.4 10.9 10.4

Performance ratios

Return on average % % % % %

shareholders' funds:

Pre-tax 23.7 22.1 31.3 29.8 30.7

Post-tax 17.0 15.0 22.8 20.7 20.7

Return on average total

assets:

Pre-tax 0.8 0.8 1.3 1.2 1.1

Post-tax 0.6 0.5 0.9 0.8 0.7

Return on average

weighted risk assets:

Pre-tax 1.8 1.6 2.3 2.3 1.9

Post-tax 1.3 1.1 1.7 1.5 1.3

Non interest income/total 41.3* 46.5** 47.8 47.4 47.4

income

Non interest 62.7 68.9** 70.9 68.7*** 71.4

income/operating expenses

* Excluding the impact of the Finance Act 1998.

**Excluding the impact of the Finance (No 2) Act 1997.

***Excluding the provision for diminution in property value.

The financial information above is extracted from the published accounts for

the last five years, restated where appropriate to accord with the current

accounting policies of the Group.

OTHER INFORMATION (CONTINUED)

PROFIT BEFORE TAX 31.12.98 30.6.98 31.12.97 30.6.97

(half-year ended - unaudited) #m #m #m #m

Retail Financial Services* 787 732 619 668

Corporate Banking* 437 535 434 487

Barclays Capital (424) 159 107 145

Barclays Global Investors 23 29 23 28

Businesses in Transition** 24 24 46 47

Other operations (88) (96) (64) 8

Head office functions (35) (25) (28) (24)

Goodwill amortisation (6) (6) (6) (6)

Provision for litigation (76) - - -

settlement***

642 1,352 1,131 1,353

Former BZW businesses (14) (19) (200) (19)

Exceptional items 5 (4) (467) 42

Write-down of leases - (40) - (77)

Life-fund charge - - - (28)

Write-down of fixed asset (4) - (19) -

investments

629 1,289 445 1,271

31.12.98 30.6.98 31.12.97 30.6.97

TOTAL ASSETS #m #m #m #m

Retail Financial Services 46,150 42,671 41,698 41,635

Corporate Banking 42,853 39,948 36,505 35,432

Barclays Capital 117,194 152,665 134,680 123,378

Barclays Global Investors 183 167 161 122

Businesses in Transition

- former BZW businesses - 88 8,477 15,030

- other 554 443 771 1,247

Other operations and Head 5,475 6,223 4,178 4,768

office functions

Retail life-fund assets 7,085 6,751 5,959 5,425

attributable to

policyholders

219,494 248,956 232,429 227,037

WEIGHTED RISK ASSETS

Retail Financial Services 31,493 29,705 28,514 28,178

Corporate Banking 41,679 38,357 35,286 33,594

Barclays Capital 31,172 37,858 34,942 32,187

Barclays Global Investors 207 150 141 120

Businesses in Transition

- former BZW businesses - 61 4,078 4,515

- other 594 470 801 1,309

Other operations**** 4,636 4,906 4,565 4,507

109,781 111,507 108,327 104,410

* Figures are stated prior to the impact of the Finance (No.2) Act 1997 and

the Finance Act 1998.

** Businesses in Transition profit before tax excludes the results of

former BZW businesses which are shown separately.

***The 1998 provision relates to the settlement of the litigation brought

by the Administrators of British & Commonwealth Holdings PLC.

****Including supervisory adjustments.

OTHER INFORMATION (CONTINUED)

Consolidated profit and loss account by half-year (unaudited)

31.12.98 30.6.98 31.12.97 30.6.97

#m #m #m #m

Interest receivable 4,938 5,014 4,797 4,407

Interest payable (2,726) (2,874) (2,717) (2,374)

Write-down of leases - (40) - (77)

Profit on - 3 (2) 4

redemption/repurchase of

loan capital

Net interest income 2,212 2,103 2,078 1,960

Net fees and commissions 1,429 1,350 1,520 1,459

receivable

Dealing profits (230) 197 140 234

Other operating income 168 156 92 136

Life-fund charge - - - (28)

Total non-interest income 1,367 1,703 1,752 1,801

Operating income 3,579 3,806 3,830 3,761

Administration expenses - (1,425) (1,386) (1,573) (1,462)

staff costs

Administration expenses - (949) (861) (1,039) (857)

other

Depreciation and (138) (137) (141) (128)

amortisation

Operating expenses (2,512) (2,384) (2,753) (2,447)

Operating profit before 1,067 1,422 1,077 1,314

provisions

Provisions for bad and (363) (129) (137) (90)

doubtful debts

Provisions for contingent (76) - (9) 5

liabilities etc

Operating profit 628 1,293 931 1,229

Exceptional items 5 (4) (467) 42

Write-down of fixed asset (4) - (19) -

investments

Profit on ordinary 629 1,289 445 1,271

activities before tax

Tax on profit on ordinary (158) (380) (196) (346)

activities

Profit on ordinary 471 909 249 925

activities after tax

Minority interests (equity (23) (22) (22) (22)

and non-equity)

Profit attributable to the 448 887 227 903

members of Barclays PLC

Dividends (414) (232) (359) (204)

Profit retained 34 655 (132) 699

Earnings per ordinary 30.0 p 58.4 p 15.2 p 59.2 p

share

Dividends per ordinary 27.5 p 15.5 p 23.5 p 13.5 p

share

OTHER INFORMATION (CONTINUED)

Results by half year (unaudited)

31.12.98 30.6.98 31.12.97 30.6.97

#m #m #m #m

Net interest income* 2,213 2,144 2,076 2,031

Net fees and commissions 1,431 1,340 1,358 1,294

receivable

Dealing profits (225) 198 137 205

Other operating income 165 154 94 128

Total non-interest 1,371 1,692 1,589 1,627

income*

Operating income* 3,584 3,836 3,665 3,658

Operating expenses* (2,503) (2,355) (2,388) (2,220)

Operating profit before 1,081 1,481 1,277 1,438

provisions*

Provisions for bad and (363) (129) (137) (90)

doubtful debts

Provisions for contingent (76) - (9) 5

liabilities

Operating profit* 642 1,352 1,131 1,353

Former BZW businesses (14) (19) (200) (19)

Exceptional items 5 (4) (467) 42

Write-down of leases - (40) - (77)

Life-fund charge - - - (28)

Write-down of fixed asset (4) - (19) -

investments

Profit before tax 629 1,289 445 1,271

* Figures exclude the results of the former BZW businesses and are stated

prior to the impact of the Finance Act (No. 2) 1997 and the Finance Act

1998.

KEY FACTS (UNAUDITED)

1998 1997

RETAIL FINANCIAL SERVICES

UK Retail Bank

Number of branches (UK only excl. 1,950 1,975

CI & IOM)

Number of current accounts 7.7m 7.4m

Customers registered for 850,000 560,000

Barclaycall

Customers registered for On Line 205,000 28,000

banking

Small business customers 434,000 417,000

Barclaycard

Barclaycards in issue 10m 10m

Number of merchant transactions 1.0bn 0.9bn

processed

International Premier, Private,

Savings and Investment

Premier clients 112,000 87,000

ERBG - number of customers 278,000 268,000

Savings accounts 3.5m 3.2m

Sales through BarclaysLife #149m #119m

salesforce

Barclays Stockbrokers deal volumes 5,800 6,800

per day

Customers' funds #72.7bn #62.0bn

Africa and the Caribbean

Countries with Barclays 25 25

representation

Customer deposits #4.2bn #3.8bn

CORPORATE BANKING

Number of UK Corporate Banking 110,700 108,700

connections

- Core connections 95,000 94,000

- Complex connections 14,000 13,000

- Large connections 1,700 1,700

Customers registered for 20,000 11,000

electronic banking

Number of current accounts 220,000 215,000

For further information; please contact:

Oliver Stocken

Finance Director

0171-699 2944 - Direct Line

0171-699 5000 - Switchboard

Ian Roundell

Head of Investor Relations

0171-699 2961 - Direct Line

Leigh Bruce

Director, Corporate Communications

0171-699-2658 - Direct Line

More information on Barclays, including the 1998 results, can be found on

our website at the following address : http://www.investor.barclays.com

END

FRCALLERFTIELAA

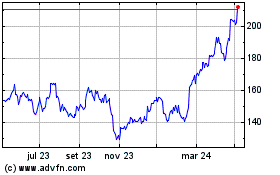

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024