Barclays PLC - Final Results-Summary Part 1

16 Fevereiro 1999 - 5:38AM

UK Regulatory

RNS No 6737p

BARCLAYS PLC

16th February 1999

BARCLAYS PLC - SUMMARY PART 1

For further information please contact:

Leigh Bruce, Director, Corporate Communications, Barclays PLC

Tel: 0171 699 2658

BARCLAYS PLC

RESULTS FOR 1998:

ANNUAL REVIEW

Barclays profit before tax for 1998 was #1,918 million. Earnings per share

stood at 88.4p. Post-tax return on equity was 17%. This was achieved against a

background of a weakening economic climate in the United Kingdom and much of the

rest of the world as well as turbulent conditions in the international credit

markets. Barclays contribution to the settlement of the long standing Atlantic

litigation resulted in a charge of #76 million, which also had a detrimental

effect on the Group's results.

We have continued to reshape our business around the changing demands of our

customers. From April 1998 Barclays was organised into four business groups

- Retail Financial Services, Barclays Global Investors, Corporate Banking

and Barclays Capital. Our overseas operations - substantial businesses in

themselves - were incorporated into this framework. Each business has

international capability and presence. We are now organised so that we

reflect our customers' needs, offering the right service and right product

at the right time.

Retail Financial Services provides a broad range of services and products

through multiple delivery channels serving a substantial customer base.

Profit before tax grew strongly by 18% to #1,519 million. This reflected

good performances from UK mortgages, consumer lending and savings, and from

the insurance and stockbroking business. Barclaycard continues to trade

strongly in the intensely competitive cards market. Elsewhere there were

good contributions from Barclays Offshore Services, European Retail Banking

and Barclays Private Banking. The businesses in Africa and the Caribbean

performed well.

Corporate Banking had another good year and continued to build on its

strength in the UK medium and large corporate sectors where it held strong

market shares. The business is investing further, with particular emphasis

on payments and liquidity management, so that it can provide customers with

a European capability and international reach. The euro conversion

programme was extremely successful and we are now able to provide a wide

range of euro products. Profit before tax increased by 6% to #972 million

partly as a result of strong volume growth in both assets and liabilities.

It also benefited from low provisions reflecting high levels of releases and

recoveries, which are not expected to occur in 1999.

Corporate Banking and Barclays Capital are becoming more closely aligned in

the interests of our large corporate and institutional customers who are

becoming more sophisticated in the services they require and their attitude

to credit. This is a continuing strategic priority.

Barclays Capital recorded an operating loss of #265 million in 1998 compared

to an operating profit of #252 million in 1997. Its results were dominated

by two factors; the Russian government's default on its domestic debt

obligations in August and the ensuing effect on credit markets around the

world. Default by a major country on its domestic currency debt is a rare

event. That said, management took a number of actions. We have closed non-

client related proprietary trading activities, reduced emerging market and

corporate bond positions and managed down our financing exposure to hedge

funds without incurring any losses. Weighted risk assets and total assets

reduced by 18% and 23% respectively in the second half of the year.

Barclays Global Investors (BGI) is deepening its relationships with

institutional clients through the development of a broader, enhanced product

range. BGI continues to invest in building a leading global institutional

fund management business maintaining its position in the market as a world

leader. Operating profit improved slightly to #52 million (1997: #51

million). Adjusting for disposals, underlying profit rose by 15%. Total

assets under management grew by 20% to #370 billion during the year.

Costs grew by 5% for the ongoing business. Part of this increase is

associated with euro and Year 2000 preparations, on which we spent a total

of #160 million on the euro and Year 2000 (1997: #60 million). In 1999 and

thereafter, we expect to spend no more than #120 million.

We recognise the need to reduce costs, which have been the subject of

considerable attention for all of the businesses during the second half of

the year. We expect that in 1999 total underlying and investment costs will

be held at 1998 levels. The business transformation programme announced by

Barclaycard in September is one example of what we are seeking to achieve,

the effect of which should reduce its costs by 15% over the course of the

next three years.

Our capital position remains strong, with a tier 1 ratio of 7.4% and the

risk asset ratio at 10.7%. We continue to remain disciplined in the level

of capital we maintain in the business and estimate that we need

shareholders' funds of #6.6 billion to #7.0 billion for our current

portfolio of businesses, allowing for future growth potential. The total

dividend for the year is being increased by 16% to 43.0p. We continue to

maintain a progressive dividend policy and believe that cover of slightly

over two times remains appropriate over the economic cycle.

In 1998 we returned #500 million of capital to shareholders through share

buy-backs. Our current expectations are to buy-back capital of around #500

million in 1999.

The UK economy has entered a more difficult phase over the last six months.

In recent years we have enhanced our risk management techniques, improving

both the quality and spread of our retail and corporate lending portfolios.

In 1998 our strong growth in chosen lending sectors reflects increased

corporate merger and acquisition financing requirements, a switch to

traditional bank finance from debt capital raisings, increased market share

as a result of the work we have done to enhance our overall customer

relationship and a better confidence in our understanding of the risk. We

believe our businesses are well prepared to meet the more challenging

business climate.

We are delighted with the appointment of Michael O'Neill as Group Chief

Executive who will join us at the end of next month. He has a proven track

record and under his leadership the Group will benefit from his knowledge

and experience in the financial services industry.

We ended last year and began 1999 on a strong note. Neither the Russian

losses nor the management changes in November caused the Group to pause in

its forward momentum. All four divisions are currently performing strongly,

business quality is good and the Group is well capitalised. The April

reorganisation has been successfully implemented and the prospects for cost

reduction and revenue enhancement are good.

Andrew Buxton Sir Peter Middleton

Chairman Deputy Chairman and Chief Executive

MORE TO FOLLOW

FRCTAMRBLLMBBFL

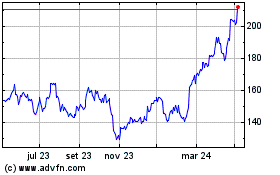

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024