RNS No 6561b

BARCLAYS PLC

16th February 1999

BARCLAYS PLC - SUMMARY PART 2

BARCLAYS PLC - SUMMARY

- Retail Financial Services showed a strong increase in operating profits

of 18% to #1,519 million (1997: #1,287 million*). Total income improved by

8% reflecting, in particular, strong growth in the United Kingdom for

mortgages, consumer lending, retail savings, the insurance business and at

Barclaycard.

- Corporate Banking performed well with operating profits increasing 6%

to #972 million* (1997: #921 million*). Good growth in net interest income

and fees and commissions benefited from improved lending volumes, a rise in

deposit volumes and increased customer related foreign exchange income. The

business benefited from low levels of new and increased specific provisions

and continued releases and recoveries.

- Barclays Capital which sustained an operating loss of #265 million

(1997: operating profit #252 million), was severely impacted by the turmoil

in the global markets during the second half of the year. Dealing losses on

non-customer related proprietary trading (including Russia) were #205

million. There was also a provisions charge against exposure to Russian

counterparties of #130 million (with a further #23 million in Corporate

Banking). Within these poor results a number of core businesses achieved

record profits.

- Barclays Global Investors' profits were #52 million (1997: #51

million). Adjusting for disposals, underlying operating profit increased by

15%. Total assets under management grew to #370 billion at 31st December

1998 (31st December 1997: #308 billion).

- The contribution from Transition businesses (excluding former BZW

businesses) fell to #48 million (1997: #93 million) as the portfolio was

managed down. No significant releases and recoveries are likely in the

future.

- There was an increase of #128 million to #184 million in the deficit

from Other operations, over half of which resulted from increased interest

allocations to businesses, reflecting higher short-term interest rates and

increased levels of regulatory capital employed.

- Costs for the Group's ongoing business increased by 5% in part

reflecting increased spending in respect of euro preparations and Year 2000

compliance.

- Total provisions for bad and doubtful debts excluding exposure to

Russia rose to #339 million from #227 million, primarily because of lower

levels of releases and recoveries. Risk Tendency, the Group's estimated

levels of annualised future credit losses averaged across the cycle,

increased from #670 million to around #700 million reflecting volume growth

particularly in consumer and corporate lending. This was partly offset by

improved quality in the overall portfolio.

- Shareholders' funds were #7.9 billion at 31st December 1998 (31st

December 1997: #7.6 billion) and the tier 1 ratio 7.4% (1997: 7.3%). The

Group estimates it needs shareholders' funds of #6.6 billion to #7.0 billion

to support its current business and to allow for future growth.

- The Group returned #500 million of capital to shareholders through

share buy-backs during the year. Current expectations are to buy back

capital of around #500 million in 1999.

RESULTS FOR YEAR TO 31ST DECEMBER 1998

1998 1997

#m #m

Operating profit before provisions* 2,562 2,715

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments**

Operating profit for the ongoing 1,994 2,484

business*

Former BZW businesses (33) (219)

Exceptional items (net) 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

Profit before tax 1,918 1,716

Tax charge (538) (542)

Profit attributable to shareholders 1,335 1,130

Earnings per share 88.4p 74.4p

Earnings per share for the ongoing 90.9p 109.1p

business*

Dividend per share 43.0p 37.0p

* Figures exclude the results of the former BZW businesses and are stated

prior to the impact of the Finance (No. 2) Act 1997 and the Finance Act

1998.

**The 1998 provision relates to the settlement of the Atlantic litigation.

(Further details are set out on page 38).

- Profit before tax increased by 12% to #1,918 million (1997: #1,716

million). Operating profit for the ongoing business was #1,994 million

(1997: #2,484 million).

- Post-tax return on average shareholders' funds improved to 17% (1997:

15%) and earnings per share rose 19% to 88.4p (1997: 74.4p).

- The dividend increased by 16% with a second interim dividend of 27.5p

(1997: 23.5p) making 43p per share for the year (1997: 37p).

FINANCIAL HIGHLIGHTS

1998 1997

RESULTS #m #m

Net interest income* 4,357 4,107

Non-interest income* 3,063 3,216

Operating income* 7,420 7,323

Operating expenses* (4,858) (4,608)

Operating profit before provisions* 2,562 2,715

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments

Operating profit* 1,994 2,484

Former BZW businesses (33) (219)

Exceptional items 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

Profit before tax 1,918 1,716

Profit attributable to shareholders 1,335 1,130

Profit retained 689 567

*Figures exclude the results of the former BZW businesses and are stated

prior to the impact of the Finance (No. 2) Act 1997 and the Finance Act

1998.

BALANCE SHEET

Shareholders' funds 7,923 7,620

Loan capital 3,734 2,868

Total capital resources 11,971 10,873

Total assets 219,494 232,429

Weighted risk assets 109,781 108,327

PER ORDINARY SHARE p p

Earnings 88.4 74.4

Earnings for the ongoing business 90.9 109.1

Dividend 43.0 37.0

Net asset value 525 498

PERFORMANCE RATIO % %

Post-tax return on average 17.0 15.0

shareholders' funds

Post-tax return on average 17.4 21.8

shareholders' funds for the ongoing

business

RISK ASSET RATIO

Tier 1 7.4 7.3

Total 10.7 10.0

GROUP YIELDS, SPREADS & MARGINS % %

Gross yield 7.81 7.64

Interest spread 2.69 2.67

Interest margin 3.42 3.42

EXCHANGE RATES US$/# US$/#

Period end 1.66 1.65

Average 1.66 1.64

BUSINESS AREA PERFORMANCE: HIGHLIGHTS

Retail Financial Services

Retail Financial Services brings together all of the Group's retail

interests around the world. Its purpose is to serve customers by

understanding their needs as individuals and by offering services and

products that anticipate and satisfy their requirements.

1998 1997

#m #m

Net interest income 2,821 2,592

Net fees and commissions 1,777 1,730

Income from long-term assurance 109 61

business

Other operating income 76 62

Total income 4,783 4,445

Total costs (2,874) (2,786)

Provisions for bad and doubtful (391) (387)

debts

1,518 1,272

Problem country debt management 1 15

Operating profit before impact of 1,519 1,287

Finance Act

Life-fund charge - (28)

Operating profit 1,519 1,259

Retail Financial Services performed strongly with an increased operating

profit of #1,519m. This represents growth of 18% before the one-off life

fund charge, or an increase of 21% after this adjustment.

Net interest income grew by #229m, or 9%, to #2,821m primarily as a result

of an improved contribution in home finance and strong volume growth in UK

consumer lending and extended credit balances at Barclaycard. Overall

lending and deposit margins in UK Retail Banking were maintained. Some

competitive pressure in UK consumer lending and Barclaycard margins was

offset by an improvement in the mortgage margin, partly as a result of the

lower cost of incentives.

Fees and commissions grew by 3% to #1,777m, benefiting from volume growth in

the debit and credit card businesses, particularly in the second half of the

year, and good performances in the continental European operations and

Barclays Private Banking.

Customers' funds, which include assets under management and deposits, grew

by 14% to #112bn (31st December 1997: #98bn), of which #10bn was

attributable to net new business and #4bn to market movements. At 31st

December 1998, loans to customers stood at #37bn, up 9% over 1997.

Total costs rose by 3% to #2,874m reflecting the continued investment in

both branch-based and emerging delivery channels (including telephone,

internet and PC banking). By the year end around 850,000 customers were

using our telephone banking service and over 200,000 had subscribed to the

PC and internet banking offering. Technology spend also increased as a

result of Year 2000 compliance and in preparation for the introduction of

the euro. Other initiatives designed to improve customer service, enhance

sales performance and streamline risk assessment were progressed during the

year. Marketing expenditure grew as a result of increased national

television advertising and cinema campaigns in support of new business

development.

Staff costs increased by 4% partly as a result of rationalisation costs of

#15m at Barclaycard. Within UK Retail Banking, staff numbers have remained

broadly unchanged. The cost impact of growth in business volumes and the

expansion of delivery channels was offset by efficiency savings including

further centralisation initiatives.

Provisions rose by 1% to #391m, as a result of volume growth in UK consumer

lending and extended credit within Barclaycard offset by the absence in 1998

of an additional general provision in Barclaycard, which in 1997 was #43m.

When adjusting for this additional general provision in Barclaycard, the

increase in provision is 14%. Provisions in Africa, the Caribbean and

continental Europe remained at low levels.

Retail Financial Services is organised for reporting purposes into four

major business groupings. The operating profit for these groupings is shown

below:

Analysis of Retail Financial Services operating profit

1998 1997

#m #m

UK Retail Banking 757 672

Barclaycard 338 253

International Premier, Private, 317 221

Savings and Investment

Africa and Caribbean* 107 113

Operating profit 1,519 1,259

*includes contribution of problem country debt of #1m (1997: #15m).

UK Retail Banking

This business provides a wide range of services and products to personal and

small business customers through its UK branch network, ATMs, Barclaycall

(the telephone banking service) and internet and PC Banking.

Profit in UK Retail Banking increased by 13% to #757m. Total income rose by

7%, with particularly strong performances from consumer lending and home

finance. Current accounts, retail savings and the insurance businesses also

achieved good income growth.

Consumer lending maintained strong volume growth with average balances

increasing by 15%. At the year end outstanding balances exceeded #5.5bn.

Consumer lending margins reduced slightly, primarily reflecting competitive

pressure. Growth in the centrally managed Barclayloan product was

particularly buoyant, supported by strong advertising and better

understanding of risk.

Home finance benefited from a 4% growth in average balances and achieved a

further reduction in the cost of incentives to #17m (1997: #48m), which are

expensed as incurred. Gross new lending of #3.5bn in the year was another

record level for the business. This reflects the success of ongoing

initiatives which focus on simplifying the mortgage sanctioning process and

creating new value-added features such as the launch of pre-approved mortgage

limits. Home finance continued to generate sales of complementary products,

such as life assurance, pensions and household insurance in other parts of

Retail Financial Services. The proportion of fixed rate mortgages rose

further and accounted for in excess of 65% of new business.

The current account business performed well with recruitment up by 9%. This

was helped by a successful student campaign and the launch of instant

banking, which allows customers to drawdown against uncleared funds and make

immediate transfers between accounts. Fee income benefited from the

continued success of the fee based current account, Barclays Additions, where

the total numbers of accounts rose to around 645,000 by the end of the year

(1997: 490,000).

Average retail savings balances grew by 10%, benefiting from a competitive

product range and a focus on providing the most appropriate portfolio of

products for the customer in order both to retain and grow balances. Net

interest income on savings products increased by 5% despite some

deterioration in margins as a result of a change in the portfolio mix and

strong competitive pressure.

Barclays Insurance increased overall profitability by 8% largely as a result

of high volumes in associated retail lending products.

Small business income was at similar levels to 1997. Current accounts and

deposits grew by 10%, while lending volumes reduced slightly because of lower

demand. Money transmission income remained at similar levels to 1997.

Provisions have grown from the low levels experienced in 1997, largely

reflecting the gradual deterioration in economic conditions and lower levels

of releases and recoveries. However, the strong liquidity levels of our

customers dampened the overall effect.

Barclaycard

Barclaycard is the largest credit card business in Europe. It offers a full

range of credit card services to individual customers, together with card

payment facilities to retailers and other businesses.

Barclaycard profits increased by 34% to #338m or by 14% excluding the

additional #43m general provision in 1997. Net interest income and

commissions were higher, primarily driven by an 18% increase in average

extended credit balances in the card issuing business. This reflected the

good response by nearly 50% of customers to new product packages. These

included the introduction of new pricing strategies incorporating lower

minimum payments, volume based discounts and payment holidays and the

availability of new added value services in association with Cellnet and

Eastern Electricity and Natural Gas. In continental Europe, Barclaycard

continued to develop its German business and launched a new business in

France.

The overall interest margin was maintained reflecting strong growth in

interest earning balances relative to non-interest earning balances. The

interest spread reduced slightly as a result of the impact of the volume

based pricing policy. The weakening in spreads is expected to continue in

1999.

Total costs in Barclaycard increased by 4% predominantly as a result of

restructuring costs of #15m associated with the change programme announced

in September. This will result in the loss of 1,100 jobs during the course

of the next three years and a step reduction in operating costs.

Adjusting for the additional general provision charge of #43m in 1997,

provisions for bad and doubtful debts increased by 13%, which reflected

volume growth in extended credit balances and slight deterioration in the

economic environment. The credit quality of outstanding balances has been

maintained through a combination of robust initial assessment and ongoing

credit management.

International Premier, Private, Savings and Investment

The businesses in Spain, France, Germany, Greece and Portugal serve the

medium and high net worth personal markets. Barclays Private Banking offers

an integrated asset management service from offices around the world to

private clients. Barclays Offshore Services, with offices in the Channel

Islands, Isle of Man and London, provides specialist banking services for

personal customers and companies which are non-UK based but require banking

services in a sterling territory. This business also includes Barclays Life,

Barclays Stockbrokers, Barclays Funds and b2, which provide pensions, life

assurance, retail stockbroking services, and fund management and mutual

funds.

Operating profit in these businesses rose in aggregate by 43% to #317m. When

adjusted for the #28m life-fund charge in the first half of 1997, profits

rose by 27%. There was a #25m provision in 1997 for the possible cost of

redress to personal pension customers for non-priority cases. Strong income

growth in Barclays Offshore Services and Barclays Private Banking was partly

offset by the continued investment in front office customer servicing

capability in these businesses and the costs incurred in the launch of the

new brand, b2.

Sales of Barclays Life investment, life and pensions products grew by 25%

over 1997 with demand for investment products being particularly strong, up

44%. Cumulative provisions totalling #120m for the cost of redress to

personal pension customers were made up to 31st December 1997, of which

approximately 50% has been paid. The requirements for non-priority cases

have been considered and it is not felt necessary to make any further

provisions at this time.

European Retail Banking saw significant growth in assets under management, up

22% reflecting the favourable market conditions in the first half of the year

and the introduction of enhanced customer behaviour analysis. Fees and

commissions increased by 15% as a result of the continued focus on expanding

the high net worth business. Despite increased investment expenditure on the

conversion of the European retail network for the introduction of the euro,

costs were held below 1997 levels.

Barclays Offshore Services increased profits by 13% mainly as a result of

improved sales performance and continued steady growth in deposits throughout

the year. The business continues to invest in improved services to customers

through the development of initiatives such as telephone banking. Assets

under management increased by 13% during the year to #12bn.

Barclays Private Banking performed well with strong growth in business

volumes in respect of both new and existing clients. Customers' funds were

in excess of #20bn at 31st December 1998, an increase of 18% compared to last

year.

Barclays Stockbrokers operating profit grew 25% as a result of high volumes

in retail stockbroking and despite reduced demutualisation activity and

uncertainty in the equity markets. This growth was assisted by an increased

client base following the acquisition of Fidelity Brokerage Service customers

in the first half of 1998 and a strong increase in new investment management

clients.

Africa and Caribbean

The African and Caribbean banking operations serve both the personal and

business markets. In the Caribbean, the business comprises domestic island

operations and a growing offshore business. In Africa, the major businesses

are in Kenya and Zimbabwe.

Excluding the contribution from problem country debt management, Africa and

Caribbean profits increased by 8%, or #8m, to #106m.

The African businesses continued to make good progress with a 3% improvement

in profits as a result of strong income growth and tight cost controls and

despite turbulent conditions in some local markets. Profit for the

Caribbean operations increased by 26%. Both the domestic and offshore

operations benefited from an expanding deposit base and growing lending

portfolio.

Corporate Banking

Corporate Banking provides relationship banking to the Group's medium sized

and large business customers. The business has an extensive network of

specialist business centres in the United Kingdom as well as offices in

continental Europe, the United States and the Middle East serving both

corporate and institutional customers. In addition, an office in Miami

provides trade finance and correspondent banking services to the Group's

Latin America customers. As well as a full range of conventional banking

services, Corporate Banking provides foreign exchange and hedging products,

factoring and invoice discounting, asset backed financing and contract hire.

Corporate Banking began opening euro current and savings accounts for its

customers in July 1998 and is now able to provide a wide range of euro

products such as cash management, factoring, leasing and treasury management.

The emphasis within Corporate Banking is on harnessing this wide product

range to develop bespoke financial solutions for customers, based on their

individual needs. Corporate Banking also works closely with Barclays

Capital to provide customers with integrated access to investment banking

products.

1998 1997

#m #m

Net interest income 1,212 1,132

Net fees and commissions 599 564

Other operating income 24 14

Total income 1,835 1,710

Total costs (866) (832)

Provisions for bad and doubtful (17) 30

debts

952 908

Problem country debt management 20 13

Operating profit before impact of 972 921

Finance Acts

Write-down of leases (40) (77)

Operating profit 932 844

Corporate Banking profits rose by 6%, or #51m, to #972m, before the impact

of a write-down of lease receivables of #40m (1997: #77m).

Net interest income increased by 7% reflecting strong volume growth in both

assets and liabilities.

Total assets increased by 17% to #43bn in 1998. Average UK lendings rose by

7% year on year. There was strong growth in acquisition related finance

together with a high demand for large corporate lending partly as a result

of adverse conditions in the debt capital markets. Given the increased

liquidity within the bond markets towards the end of the year and an

anticipated reduction in acquisition finance and capital project activity,

growth in the large corporate market is not expected to continue at the same

level in 1999. There was good growth in middle market lending throughout

the year. The restructuring of the front line sales teams and streamlining

of the risk management process has been a main factor in this growth, with

increased customer utilisation of agreed lending lines and take up of new or

extended facilities by existing customers.

Total assets in the international business increased by 16% to #7bn during

the year, particularly in respect of short term facilities to banks and

other financial institutions, reflecting the widening of credit spreads in

the corporate bond market. The Latin America operation, which focuses on

providing finance to top tier banks and financial institutions, performed

well reflecting the switch to traditional bank lending from debt capital

raisings.

Stronger overall growth in high quality, low margin business has resulted in

a reduction in the overall lending margin. Risk adjusted lending margins,

which take account of expected credit losses, have been maintained within

each of the businesses.

Average UK deposit volumes rose by 15%, benefiting from increased corporate

liquidity in the first half of the year. Deposit volumes were particularly

buoyant in treasury deposits, although the changing portfolio mix resulted

in a slight reduction in the overall deposit margin.

Net interest income included a #20m realisation from two debts previously

written off, which was in addition to a #31m specific provision recovery in

respect of these customers. In 1997, there was a benefit from a #13m

adjustment to lease charges.

Net fees and commissions improved by 6% to #599m. Higher risk related

commissions reflected increased lending activity. customer related foreign

exchange income improved strongly benefiting from a new pricing policy.

This competitive product package also resulted in greater transaction

volumes. Overall money transmission income was maintained although it

remains under competitive pressure. It benefited from continued good growth

in electronic based banking products. International payment volumes also

experienced strong growth. This is expected to continue as a result of

opportunities following the introduction of the euro.

Costs grew by 4%, or #34m, to #866m mainly as a result of the preparation

for the introduction of the euro and Year 2000 expenditure and continued

investment in key electronic delivery initiatives. Staff numbers increased

slightly, which together with the pay award, accounted for an increase in

staff costs.

Provisions for bad and doubtful debts of #17m (1997: net credit #30m)

benefited from low levels of new and increased specific provisions and high

levels of releases and recoveries during the first half of the year. new

and increased provisions included a charge of #23m in respect of Russian

counterparty exposure. In 1998 credit risk releases and recoveries remained

at high levels of #155m (1997: #177m including a #44m release in respect of

Imry) although they slowed in the second half of the year and are expected

to continue to reduce in 1999.

Barclays Capital

Barclays Capital conducts the Group's international investment banking

business. The business focuses on areas where it has a competitive

advantage and which are integral to the Group's broader business strategy.

Barclays Capital serves as the Group's principal point of access to the

wholesale markets and also deals in these markets with governments,

supranational organisations, corporates, banks, insurance companies and

other institutional investors.

The activities of Barclays Capital are grouped in two principal areas: Rates

which include sales, trading and research relating to government bonds,

money markets, foreign exchange, commodities, and their related derivative

instruments and Credit which includes origination, sales, trading and

research relating to loans, securitised assets, bonds and their related

derivative instruments and private equity investment and equity derivatives.

Barclays Capital is an important component of the overall Group, providing a

variety of complementary services and products including foreign exchange

and interest rate hedging instruments to all of the Group\'s businesses and

their customers. It also provides a counterbalance to disintermediation of

the traditional corporate lending businesses.

1998 1997

#m #m

Net fees and commissions 159 148

Dealing profits (29) 349

Net interest income 428 337

Other operating income 44 50

Total income 602 884

Total costs (708) (633)

Provisions for bad and doubtful (159) 1

debts

Operating profit (265) 252

Barclays Capital reported an operating loss of #265m compared to an

operating profit of #252m last year. The loss for the year was a result of

the Russian economic crisis and the associated difficulties within other

emerging markets, which led to an increase in credit risk premia across all

markets and the tightening of liquidity, which in turn led to a search by

investors for higher quality assets. The losses were primarily incurred

between August and October and as market conditions stabilised in November

the overall operating performance returned to profitability. Within these

poor overall results, a number of core businesses, such as structured

capital markets and private equity, achieved record profitability.

Dealing losses were #29m during 1998 (1997: dealing profits of #349m). The

fall in dealing income reflected proprietary trading losses incurred as a

result of the Russian government default on its domestic debt obligations,

together with the consequent widening of spreads in all segments of the

corporate bond market, dislocation in the equity markets and a reduction in

general business volumes. This was partially offset by strong dealing

profits within interest rate derivatives and the government bond business.

Overall dealing losses within non-customer related proprietary trading

businesses (including Russia) for the full year totalled #205m, the bulk of

which were incurred in August. In addition the provisions for bad and

doubtful debts by Russian counterparties on currency forward contracts and

repurchase agreements was #130m out of a total charge of #159m for the year.

The country transfer risk provision charge was #10m.

In response to the deterioration in market conditions experienced during

late summer and early autumn management took a number of steps to improve

business performance. The non-customer related proprietary trading

businesses were closed in October and secondary market corporate bond

inventory was substantially reduced during the last three months of the

year. This overall reduction in risk appetite has resulted in a fall in

weighted risk assets and total assets in the second half of the year of 18%

to #31bn and 23% to #117bn respectively.

Significant progress has been made in the core businesses. Primary market

activity has extended the franchise both in terms of product and currency.

As well as maintaining the number one position in sterling bond issuance,

the business has become a leading player in deutschmarks and euro currency

issues. The business is well positioned to take advantage of the

opportunities the introduction of the euro should offer.

Net interest income increased by 27% to #428m as a result of improved

performances in money markets, structured capital markets and corporate

lending activities. The corporate, project finance and other traditional

lending portfolios accounted for 32% or #10bn of weighted risk assets at the

year end.

Overall fees and commissions increased by 7% to #159m as result of increased

lending activity. This offset a beneficial change in the income composition

of the structured capital markets business in the second half of 1997.

Other operating income was at a similar level to 1997, reflecting a strong

performance from the private equity business as a result of a number of

realisations from investments.

Costs rose by 12%. The increase mainly reflected the transfer and

restructuring of the former BZW equity derivatives business from the

beginning of 1998 to complement the interest rate derivative business.

There was also further investment in upgrading technology, including euro

preparations and Year 2000 compliance, and the absorption of certain fixed

costs previously allocated to the former BZW businesses. This was partly

offset by the absence of one-off costs of #20m incurred in 1997 in respect

of the relocation to Canary Wharf and by a significantly lower level of

performance related pay in 1998.

Barclays Global Investors

Barclays Global Investors (BGI) offers advanced active and indexed asset

management services for institutional clients. The objective of advanced

active management is to outperform market benchmarks by the application of

disciplined investment processes. The objective of indexed management is to

replicate the performance of market benchmarks. In addition, BGI is a major

lender of securities. These activities are carried out from thirteen

offices located in seven countries.

1998 1997

#m #m

Net fees and commissions 277 258

Net interest income 9 7

Other operating income 2 2

Total income 288 267

Total costs (236) (216)

Operating profit 52 51

Underlying operating profit increased by 15% after adjusting for the sales

of MasterWorks and a part of the Hong Kong fund management business. These

businesses were sold in August 1997 and June 1998 respectively. The

operating results of these businesses were a combined profit of #5m in 1997

and a loss of #1m in 1998.

Adjusting for these business disposals, fees and commissions increased 20%

to #275m (1997: #230m), benefiting from favourable market conditions in the

early part of the year and new business growth in assets under management

throughout the year. BGI's funds performed well despite the market turmoil

in the second half of the year, in line with most index funds and as a

result fees and commissions were only partially affected. The overall fee

income margin was maintained as a result of increased asset levels, which

generated increased internal crossing opportunities and securities lending

levels.

Total assets under management grew to #370bn from #308bn at 31st December

1997; #21bn of the increase is attributable to net new business and #41bn is

attributable to market movements. Assets under management consist of #286bn

of indexed funds and #84bn under advanced active management.

BGI's business units continued their strong performance from 1997. North

America, Japan and Europe won a record amount of new business mandates

during the year. The volume of new requests for proposals for investment

management services continues to be robust.

Underlying operating expenses increased 9% in line with total costs. This

increase was as a result of a rise in costs to support the increase in

future growth, product development and growth in assets under management.

BGI has continued the integration and infrastructure investment that

reflects the global development of the business.

The acquisition of the LongView Group, Inc. was successfully completed in

the second half of the year. LongView specialises in the creation of

software to support institutional portfolio management and trading. In

addition, the capital markets group within BGI recently entered the

securities lending market in Japan, becoming the first non-custodial agent

to lend securities in Japan. These activities further strengthen BGI's

position as one of the top global investment management firms in the market

place.

SUMMARY OF RESULTS

PROFIT BEFORE TAX 1998 1997

#m #m

Retail Financial Services* 1,519 1,287

Corporate Banking* 972 921

Barclays Capital (265) 252

Barclays Global Investors 52 51

Businesses in Transition** 48 93

Other operations (184) (56)

Head office functions (60) (52)

Goodwill amortisation (12) (12)

Provision for litigation (76) -

settlement***

1,994 2,484

Former BZW businesses (33) (219)

Exceptional items 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

1,918 1,716

TOTAL ASSETS #m #m

Retail Financial Services 46,150 41,698

Corporate Banking 42,853 36,505

Barclays Capital 117,194 134,680

Barclays Global Investors 183 161

Businesses in Transition

- former BZW businesses - 8,477

- other 554 771

Other operations and Head office 5,475 4,178

functions

Retail life-fund assets 7,085 5,959

attributable to policyholders

219,494 232,429

WEIGHTED RISK ASSETS

Retail Financial Services 31,493 28,514

Corporate Banking 41,679 35,286

Barclays Capital 31,172 34,942

Barclays Global Investors 207 141

Businesses in Transition

- former BZW businesses - 4,078

- other 594 801

Other operations**** 4,636 4,565

109,781 108,327

* Figures are stated prior to the impact of the Finance (No.2) Act

1997 and the Finance Act 1998.

** Businesses in Transition profit before tax excludes the results of

former BZW businesses which are shown separately.

*** The 1998 provision relates to the settlement of the Atlantic

litigation.

**** Including supervisory adjustments.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

1998 1997

#m #m

Interest receivable 9,952 9,204

Interest payable (5,600) (5,091)

Write-down of leases (40) (77)

Profit on redemption/repurchase of 3 2

loan capital

Net interest income 4,315 4,038

Net fees and commissions 2,779 2,979

receivable

Dealing profits (33) 374

Other operating income 324 228

Life-fund charge - (28)

Total non-interest income 3,070 3,553

Operating income 7,385 7,591

Administration expenses - staff (2,811) (3,035)

costs

Administration expenses - other (1,810) (1,896)

Depreciation and amortisation (275) (269)

Operating expenses (4,896) (5,200)

Operating profit before provisions 2,489 2,391

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments

Operating profit 1,921 2,160

Exceptional items 1 (425)

Write-down of fixed asset (4) (19)

investments

Profit on ordinary activities 1,918 1,716

before tax

Tax on profit on ordinary (538) (542)

activities

Profit on ordinary activities 1,380 1,174

after tax

Minority interests (equity and non- (45) (44)

equity)

Profit for the financial year 1,335 1,130

attributable to the members of

Barclays PLC

Dividends (646) (563)

Profit retained for the financial 689 567

year

Earnings per ordinary share 88.4p 74.4p

Earnings per ordinary share for 90.9p 109.1p

the ongoing business

Dividend per ordinary share:

First interim 15.5p 13.5p

Second interim (payable 30th April 27.5p 23.5p

1999)

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE ONGOING BUSINESS

1998 1997

#m #m

Interest receivable 9,952 9,196

Interest payable (5,598) (5,091)

Profit on redemption/repurchase of 3 2

loan capital

Net interest income 4,357 4,107

Net fees and commissions 2,771 2,652

receivable

Dealing profits (27) 342

Other operating income 319 222

Total non-interest income 3,063 3,216

Operating income 7,420 7,323

Administration expenses - staff (2,789) (2,633)

costs

Administration expenses - other (1,793) (1,719)

Depreciation and amortisation (276) (256)

Operating expenses (4,858) (4,608)

Operating profit before provisions 2,562 2,715

Provisions for bad and doubtful (492) (227)

debts

Provisions for contingent (76) (4)

liabilities and commitments

Operating profit for the ongoing 1,994 2,484

business

Former BZW businesses (33) (219)

Exceptional items 1 (425)

Write-down of leases (40) (77)

Life-fund charge - (28)

Write-down of fixed asset (4) (19)

investments

Profit on ordinary activities 1,918 1,716

before tax

The consolidated profit and loss account shown on page 7 is affected by the

inclusion of the results of the former BZW businesses, the majority of which

were sold in the first half of 1998. The table above presents the

consolidated profit and loss account for the ongoing business excluding the

impact of the former BZW businesses' results and the 1997 and 1998 Finance

Acts.

CONSOLIDATED BALANCE SHEET

1998 1997

Assets: #m #m

Cash and balances at central banks 942 750

Items in course of collection from 2,475 2,564

other banks

Treasury bills and other eligible 4,748 5,511

bills

Loans and advances to banks

- banking 20,316 21,729

- trading 16,296 15,155

36,612 36,884

Loans and advances to customers

- banking 81,469 74,111

- trading 14,641 25,712

96,110 99,823

Debt and equity securities 50,068 55,956

Interests in associated 150 57

undertakings and joint ventures

Intangible fixed assets - goodwill 196 191

Tangible fixed assets 1,939 2,016

Other assets 19,169 22,718

212,409 226,470

Retail life-fund assets 7,085 5,959

attributable to policyholders

Total assets 219,494 232,429

Liabilities:

Deposits by banks

- banking 25,951 30,511

- trading 8,469 13,968

34,420 44,479

Customer accounts

- banking 96,099 89,647

- trading 12,706 18,791

108,805 108,438

Debt securities in issue 17,824 20,366

Items in course of collection due 1,279 1,676

to other banks

Other liabilities 38,110 40,638

Undated loan capital - convertible 301 304

to preference shares

Undated loan capital - non- 1,441 1,353

convertible

Dated loan capital - non- 1,992 1,211

convertible

Other subordinated liabilities - - 59

non-convertible

204,172 218,524

Minority interests and

shareholders' funds:

Minority interests: equity 51 61

Minority interests: non-equity 263 265

Called up share capital 1,511 1,530

Reserves 6,412 6,090

Shareholders' funds: equity 7,923 7,620

8,237 7,946

212,409 226,470

Retail life-fund liabilities 7,085 5,959

attributable to policyholders

Total liabilities and 219,494 232,429

shareholders' funds

More information on Barclays Financial Results can also be found on Barclays

website - http://www.investor.barclays.com

END

FRCTAMRBLLTBBLL

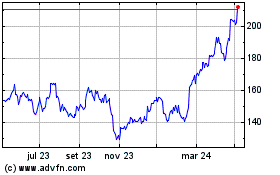

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024