Barclays PLC - Pre-Close Briefing

16 Junho 1999 - 4:31AM

UK Regulatory

RNS No 9091w

BARCLAYS PLC

16 June 1999

PRE-CLOSE BRIEFINGS WITH ANALYSTS

Barclays PLC ("Barclays") will be meeting analysts ahead of its close period

for the half-year ended 30th June 1999 and is issuing this statement in line

with the practice first adopted in December 1998.

All the Group's businesses made a good start to the year. Key trends

affecting the performance so far this year are as follows:

Net interest income: Within Retail Financial Services there is further

strong growth in UK consumer lending, including extended credit balances at

Barclaycard. In Corporate Banking there is steady loan growth in UK

corporates and leasing and asset finance.

Average UK retail and corporate deposits have seen growth since the

beginning of 1999 broadly in line with the market growth rates.

In the first quarter of 1999, the overall Group interest margin was similar

to the 1998 full year interest margin.

Net fees and commissions income has shown good growth within Wealth

Management throughout the United Kingdom, the rest of Europe and the

Caribbean reflecting the continuing strength of the global financial

markets. At Barclaycard, net fees and commissions in credit and debit card

transactions for the first four months of 1999 were at similar levels to the

same period of last year.

Corporate Banking is benefiting from growth in lending-based and foreign

exchange commissions since the beginning of 1999.

Barclays Global Investors' assets under management were #417 billion at 30th

April 1999 compared with #370 billion at 31st December 1998.

Barclays Capital's dealing profits have been good, with strong contributions

in the Rates business from government bonds, interest rate derivatives and

foreign exchange. In the Credit business there have been good performances

in primary and secondary corporate bond trading.

Costs of the ongoing business in this full year are expected to be at the

1998 level (#4,877 million), excluding the restructuring charge of up to

#400 million (in respect of the recently announced programme to reduce the

workforce primarily in UK Retail and Corporate Banking by 6,000 jobs by the

end of the year).

This year's costs for the first half of 1999 are expected to be around half

of the anticipated costs for the year.

Provisions for bad and doubtful debts: Within Retail Financial Services the

net provisions charge for the first six months of 1999 will be higher than

the second half of 1998, primarily as a result of increased lending volumes.

The net provisions charge in Corporate Banking is expected to be at a

similar level to the second six months of 1998 with a continuing reduction

in releases and recoveries offset by a lower level of new and increased

provisions.

Weighted risk assets grew by 4% overall in the first four months of 1999,

adjusting for a reduction of #1.2bn in weighted risk assets relating to

Merck Finck & Co which was sold during the period.

The sale of Merck Finck & Co for approximately DM500m (approximately #170m)

was at a #20m premium to net asset value. In addition there will be a

charge of some #140m in respect of goodwill to the profit and loss account

in the first half of 1999.

As at the close of business on 15th June 1999 for the year to date, Barclays

has purchased for cancellation 7.2 million of its ordinary shares at a cost

of #134 million.

APPENDIX:

As a result of a change in reporting of the Group structure in 1999 and a

change in accounting policy, this appendix provides restated comparative

figures for the major changes.

Reporting of Group structure in 1999 - major changes from 1998

Retail Financial Services has re-organised the management of its business

around customer segments to deliver services and products through three

principal business groupings - Retail Customers, Wealth Management and

Barclaycard. Retail Customers and Wealth Management have absorbed the

relevant customer segment from the previous business groupings of UK Retail

Banking, International Premier, Private, Savings and Investment and Africa

and Caribbean, with Barclaycard remaining unaffected.

Retail Customers comprises UK Retail Banking (excluding UK Premier), the

African business, UK retail mutual funds and Barclays Life. Wealth

Management comprises the former International Premier, Private, Savings and

Investment business (excluding UK retail mutual funds and Barclays Life), UK

Premier and the Caribbean business.

Certain internal charges have been re-allocated between Retail Financial

Services and Corporate Banking. In addition, Retail Financial Services has

revised its presentation of income and costs within its profit and loss

account. There is no effect on total Group revenue or costs as a result of

these changes.

Change in accounting policy

A change in policy has arisen from the adoption in 1999 of Financial

Reporting Standard 12 "Provisions, Liabilities and Assets" (FRS12).

The Group has a number of vacant leasehold properties where unavoidable

costs exceed anticipated income for which a provision is now required under

FRS12. Previously costs and income in relation to these properties were only

recognised as they arose.

The change in policy has resulted in a prior year adjustment and the profit

and loss accounts and balance sheets for previous years have been restated.

This has resulted in a net charge to shareholders' funds of #81m as at 1st

January 1999 comprising the cumulative impact of prior year reductions in

net interest income, net provisions for property costs and associated tax

credits. Comparative figures have been restated with the effect that

shareholders' funds have been reduced by #63m at 1st January 1998. Profit

before tax for 1998 and 1997 has been reduced by #23m and increased by #3m

respectively.

Retail Financial Services (restated)

1998 31.12.98 30.6.98 1997

#m #m #m #m

Net interest income 2,831 1,445 1,386 2,603

Net fees and 1,698 868 830 1,655

commissions

Income from long-term 109 62 47 61

assurance business

Other operating income 62 42 20 52

Total income 4,700 2,417 2,283 4,371

Total costs (2,809) (1,438) (1,371) (2,724)

Provisions for bad and (390) (199) (191) (374)

doubtful debts

Operating profit 1,501 780 721 1,273

before impact of the

1997 Finance Act

Life-fund charge - - - (28)

Operating profit 1,501 780 721 1,245

The operating profit for Retail Financial Services is represented by the

following groupings:

1998 31.12.98 30.6.98 1997

#m #m #m #m

Retail Customers 839 441 398 738

Barclaycard 338 170 168 253

Wealth Management 324 169 155 254

Operating profit 1,501 780 721 1,245

Retail Customers

This business provides a wide range of services and products to personal and

small business customers throughout the United Kingdom and in parts of

Africa. These services are provided through a network of branches and ATMs,

and through direct channels such as the telephone and the internet.

Barclaycard

Barclaycard is the largest credit card business in Europe, with operations

in the United Kingdom, Germany, France and Spain. It offers a full range of

credit card services to individual customers, together with card payment

facilities to retailers and other businesses.

Wealth Management

This business serves affluent and high net worth clients globally, with

relationship based services and bespoke products, particularly in the areas

of banking, asset management and long-term financial planning.

Corporate Banking (restated)

1998 31.12.98 30.6.98 1997

#m #m #m #m

Net interest income 1,214 613 601 1,136

Net fees and 613 313 300 579

commissions

Other operating income 24 11 13 14

Total income 1,851 937 914 1,729

Total costs (862) (448) (414) (828)

Provisions for bad and 2 (42) 44 39

doubtful debts

Operating profit 991 447 544 940

before impact of the

Finance Acts

Write down of leases (40) - (40) (77)

Operating profit 951 447 504 863

Profit before tax by business grouping (restated)

1998 31.12.98 30.6.98 1997

#m #m #m #m

Retail Financial 1,501 780 721 1,273

Services

Corporate Banking 991 447 544 940

Barclays Capital (270) (426) 156 247

Barclays Global 52 23 29 51

Investors

Businesses in 48 24 24 93

Transition*

Other operations (203) (111) (92) (53)

Head Office functions (60) (35) (25) (52)

Goodwill amortisation (12) (6) (6) (12)

Provision for (76) (76) - -

litigation settlement

1,971 620 1,351 2,487

Former BZW businesses (33) (14) (19) (219)

Exceptional items 1 5 (4) (425)

Write down of leases (40) - (40) (77)

Life fund charge - - - (28)

Write down of fixed (4) (4) - (19)

asset investments

1,895 607 1,288 1,719

* excludes the results of former BZW businesses which are shown separately.

Selected financial highlights (restated)

1998 31.12.98 30.6.98 1997

#m #m #m #m

RESULTS

Net interest income* 4,353 2,211 2,142 4,103

Non-interest income* 3,063 1,371 1,692 3,216

Operating income* 7,416 3,582 3,834 7,319

Operating expenses* (4,877) (2,523) (2,354) (4,601)

Operating profit* 1,971 620 1,351 2,487

Profit before tax 1,895 607 1,288 1,719

Profit attributable to 1,317 431 886 1,133

shareholders

Profit retained 671 17 654 570

*Figures exclude the results of the former BZW businesses and are stated

prior to the impact of the Finance (No.2) Act 1997 and the Finance Act

1998.

PER ORDINARY SHARE P P P P

Earnings 87.2 28.9 58.3 74.6

Earnings for the 89.6 29.6 60.0 109.3

ongoing business

Net asset value 519 519 519 494

31.12.98 30.6.98 31.12.97

#m #m #m

BALANCE SHEET

Shareholders funds 7,842 7,822 7,557

RISK ASSET RATIO % % %

Tier 1 7.3 7.2 7.2

Total 10.6 10.4 9.9

This information is intended to be indicative of the comparative data to be

included in future results announcements.

For further information please contact:

Investor Relations Media Relations

Ian Roundell Leigh Bruce

0171 699 2961 0171 699 2658

Emma Savage Maria Darby

0171 699 2960 0171 699 2970

This document contains certain forward-looking statements with respect to the

financial condition and results of operations of Barclays, which by their

nature involve risk and uncertainty because they relate to events and depend

on circumstances that may occur in the future. There are a number of factors

that could cause actual results and developments to differ materially from

those expressed or implied by these forward-looking statements. These factors

include, but are not limited to, changes in economic conditions in countries

in which Barclays conducts its business and internationally elsewhere, as well

as future exchange and interest rates, interest margins, the level of deposits

taken and the level of lending by Barclays. A more detailed list of these

factors is contained on page 1 of Barclays Annual Report for 1998.

END

MSCFFMFBLLABMIL

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

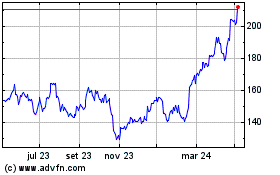

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024