RNS No 5560w

BARCLAYS PLC

5 August 1999

PART 1

Interim Results Announcement 1999

1999 INTERIM RESULTS

Page

Summary 1

Financial highlights 3

Half-year review 4

Summary of results 6

Consolidated profit and loss account (unaudited) 7

Consolidated profit and loss account for the

ongoing business (unaudited) 8

Consolidated balance sheet (unaudited) 9

Financial review 10

Additional information (unaudited) 36

Notes (unaudited) 39

Consolidated statement of changes in

shareholders' funds (unaudited) 52

Statement of total recognised gains

and losses (unaudited) 53

Consolidated cash flow statement (unaudited) 54

US GAAP data (unaudited) 57

Independent review report by the auditors 58

Other information 59

The information in this announcement does not comprise statutory accounts

within the meaning of Section 240 of the Companies Act 1985. Statutory

accounts for the year ended 31st December 1998, which also included the

Group's annual report on Form 20-F to the Securities and Exchange Commission

in the United States of America, have been delivered to the Registrar of

Companies in accordance with Section 242 of the Act and contained an

auditors' report which was unqualified and did not make any statements under

Section 237 of the Act.

BARCLAYS PLC, 54 LOMBARD STREET, LONDON EC3P 3AH, TELEPHONE 020 7699 5000

5th August 1999

BARCLAYS PLC - SUMMARY

RESULTS FOR SIX MONTHS TO 30TH JUNE 1999

Half-year ended

30.6.99 31.12.98 30.6.98

#m #m #m

Operating profit before provisions* 1,754 1,059 1,480

Provisions for bad and doubtful (320) (363) (129)

debts

Provisions for contingent - (76) -

liabilities and commitments

Operating profit * 1,434 620 1,351

Restructuring charge (345) - -

Former BZW businesses - (14) (19)

Exceptional items (net) (119) 5 (4)

Write-down of leases - - (40)

Write-down of fixed asset - (4) -

investments

Profit before tax 970 607 1,288

Tax charge (252) (153) (380)

Profit attributable to shareholders 696 431 886

Earnings per share 46.2p 28.9p 58.3p

Earnings per share (and excluding 70.7p 29.6p 60.0p

exceptional items) *

Dividend per share 17.5p 27.5p 15.5p

*Figures exclude the 1999 restructuring charge, the results of the former

BZW businesses and are stated prior to the impact of the Finance Act 1998.

Amounts reported below and in the first half review and summary of results

on pages 4, 5 and 6 for operating profit, earnings per share and post tax

return on average shareholders funds are on a similar basis unless

indicated otherwise.

- Operating profit rose by 6% to #1,434 million (1998: #1,351 million).

Earnings per share increased to 70.7p (1998: 60.0p).

- Operating income improved by 8% to #4,149 million (1998: #3,834

million) and there was tighter control of operating costs, up 2% to #2,395

million (1998: #2,354 million).

- Operating profit before provisions improved by 19% to #1,754 million

(1998: #1,480 million).

- The post-tax return on average shareholders' funds improved to 25.5%

(1998: 23.5%)

- The interim dividend increased by 13% to 17.5p (1998: 15.5p). The

Group returned #168 million of capital to shareholders through its share

buy-back programme as part of the expected share buy-back of around #500

million in 1999.

- Retail Financial Services increased operating profit by 14% to #820

million (1998: #721 million). Net interest income improved by 6% reflecting

strong growth in UK consumer lending and extended credit balances at

Barclaycard together with continued growth in mortgage lending and UK

savings balances. Fees and commissions grew by 4% predominantly in Wealth

Management. Total costs fell slightly.

- Corporate Banking produced a good underlying performance. Net fees and

commissions rose by 9% as a result of good growth in lending related fees

and foreign exchange related income. Provisions for bad and doubtful debts

increased to #65 million (1998: net credit #44 million), mainly as a result

of lower credit risk releases and recoveries. Operating profit was

#458 million (1998: #544 million excluding write-down of leases).

- Barclays Capital increased operating profit by 14% to #178 million

(1998: #156 million). Total income increased by 24% with both the Rates and

Credit businesses performing well in a fair trading environment.

- Barclays Global Investors operating profit was #28 million (1998: #29

million). Total assets under management and advice grew to #434 billion

(31st December 1998: #370 billion). Increased revenues in the securities

lending business helped maintain the overall margin.

- Although costs in the first half of the year increased slightly

compared to the same period last year, costs for the full year, excluding

the restructuring charge of #345 million, are not expected to exceed the

1998 level of #4,877 million.

- The restructuring charge for 1999 primarily relating to Retail

Financial Services and Corporate Banking is estimated at #345 million and

has been charged in full in the first half of the year. The overall

provision for the 6,000 UK job losses announced in May is now expected to be

approximately #300 million. This is based on the estimated number of staff

opting to take their redundancy entitlement by way of enhanced pension borne

by the pension fund surplus. In addition to the 6,000 job losses, Retail

Financial Services has finalised plans relating to certain of its

international operations resulting in an additional charge of #45 million

and a further 1,000 job losses.

- Total provisions for bad and doubtful debts rose by #191 million to

#320 million, as a result of a #134 million rise in new and increased

specific credit risk provisions and a reduction in releases and recoveries.

The higher level of new and increased provisions mainly reflected strong

volume growth within Retail Financial Services.

- Shareholders' funds were #8.2 billion at 30th June 1999 (31st December

1998: #7.8 billion) and the tier 1 ratio 7.4% (31st December 1998: 7.3%).

The Group estimates it needs shareholders' funds of #6.6 billion to #7.0

billion to support its current business and to allow for future growth.

- The exceptional loss of #119 million is primarily in respect of the

loss on the sale of Merck Finck & Co, which includes #138 million of

goodwill previously written-off to reserves.

FINANCIAL HIGHLIGHTS

Half-year ended

30.6.99 31.12.98 30.6.98

RESULTS #m #m #m

Net interest income* 2,278 2,211 2,142

Non-interest income* 1,871 1,371 1,692

Operating income* 4,149 3,582 3,834

Operating expenses* (2,395) (2,523) (2,354)

Operating profit before 1,754 1,059 1,480

provisions*

Provisions for bad and doubtful (320) (363) (129)

debts

Provision for contingent - (76) -

liabilities and commitments

Operating profit* 1,434 620 1,351

Restructuring charge (345) - -

Former BZW businesses - (14) (19)

Exceptional items (119) 5 (4)

Write-down of leases - - (40)

Write-down of fixed asset - (4) -

investments

Profit before tax 970 607 1,288

Profit attributable to 696 431 886

shareholders

Profit retained 433 17 654

BALANCE SHEET

Shareholders' funds 8,218 7,842 7,822

Loan capital 4,117 3,734 3,597

Total capital resources 12,684 11,890 11,798

Total assets 241,265 219,494 248,956

Weighted risk assets 113,994 109,800 111,521

PER ORDINARY SHARE P P P

Earnings 46.2 28.9 58.3

Earnings (and excluding 70.7 29.6 60.0

exceptional items) *

Dividend 17.5 27.5 15.5

Net asset value 547 519 519

PERFORMANCE RATIO % % %

Post-tax return on average 16.8 11.0 22.8

shareholders' funds

Post-tax return on average

shareholders' funds (and 25.5 11.2 23.5

excluding exceptional items) *

RISK ASSET RATIO

Tier 1 7.4 7.3 7.2

Total 10.9 10.6 10.4

GROUP YIELDS, SPREADS & MARGINS % % %

Gross yield 6.90 7.70 7.93

Interest spread 2.96 2.71 2.66

Interest margin 3.50 3.45 3.38

EXCHANGE RATES US$/# US$/# US$/#

Period end 1.58 1.66 1.67

* Figures exclude the 1999 restructuring charge, the residual losses of the

former BZW businesses and are stated prior to the impact of the Finance

Act 1998.

HALF YEAR REVIEW

Barclays made good progress in the first half of 1999. Operating profit was

#1,434 million, an increase of 6% over the first half of 1998. Earnings per

share increased to 70.7 pence from 60.0 pence and average return on equity

improved to 25.5% (1998: 23.5%). Group operating income increased by 8% to

#4,149 million. The interim dividend is being increased by 13% to 17.5p.

We continue to return capital to shareholders through share buy-backs and

during the first half of 1999 completed around a third of our target of #500

million for the year.

All four businesses performed well in meeting their objectives to grow

revenue, to contain costs and to innovate. This was achieved at a time of

considerable change to bring about customer focus throughout Barclays which

is essential to our future.

Retail Financial Services now has three customer-focused business groupings:

Retail Customers, Wealth Management and Barclaycard. Its operating profit

rose by 14% to #820 million. This reflected good performances from UK

consumer lending, mortgages and savings and strong growth within Wealth

Management, where profit improved by 43% to #221 million. Barclaycard

profits rose as a result of growth in extended credit balances and through

cost savings from the change programme announced in September 1998.

Barclays.net was launched in March and is the first free internet service to

be provided by a UK bank and has led to increased demand for on-line

banking. On-line and telephone banking customers now total 1.3 million.

Underlying income growth remains strong within Corporate Banking, with good

levels of acquisition finance activity from our large corporate customers

and greater product sales to our middle market customers to whom we offer an

integrated approach. Operating profit declined from #544 million to #458

million. The decrease in profit resulted from a higher net provisions

charge of #65 million following a net credit of #44 million in 1998. This

largely reflected the expected reduction in the high levels of releases and

recoveries experienced a year ago. The quality of the lending portfolio has

also improved. A full range of euro products, including current and deposit

accounts, euro denominated overdrafts and loan products and specialised

leasing and sales financing, has been launched and supports our position as

one of the world's top cross-border payment banks.

Barclays Capital's profits improved by 14% to #178 million and reflect a

significant turnaround following the loss suffered in the second half of

1998. Both the Rates and Credit businesses performed well in favourable

trading conditions. The results were achieved while running a significantly

lower risk profile and using less regulatory capital. The focus has been on

strengthening the underlying business and delivering higher quality

earnings. Barclays Capital is making progress in building its European

franchise, following the introduction of the euro, and is among the leaders

in the developing debt markets in Europe.

Closer working between Barclays Capital and Corporate Banking is resulting

in greater opportunities to offer more effective and flexible finance

solutions for our large corporate and institutional customers.

Barclays Global Investors (BGI) profits were flat at #28 million

(1998: #29 million), reflecting an increase in its investment programme in

new products, channels and infrastructure to support its goal of leadership

in global fund management. It has taken on significant new business in all

the regions in which it operates and continues as the top-ranked manager of

tax-exempt assets in the world. Total assets under management grew by 17%

to #434 billion in the first half of the year.

In May, we announced the reshaping of our operations through the

centralisation of core processes and the application of new technologies to

enable us to improve service to our customers. As a result we will cut the

number of jobs in the United Kingdom by 6,000 this year, principally in

Retail Financial Services and Corporate Banking. At the same time we are

creating 1,800 new positions, largely in call centres within Retail

Financial Services, some of which will be filled by staff whose jobs have

gone. We have also worked closely with the unions to ensure the best

outcome for all affected staff. In addition we have now finalised plans

relating to certain of Retail Financial Services' international operations

resulting in a reduction of a further 1,000 jobs. As a result the total

restructuring charge is #345 million for 1999. The programme is expected to

yield annual gross savings in excess of #200m.

We are managing costs with determination and are committed to maintaining

costs for this year at 1998 levels, excluding the exceptional charge for

restructuring.

We are confident that Barclays is now prepared for the Year 2000. All our

mission critical systems, being those which could directly impact our

customers and our ability to continue to operate effectively, are now Year

2000 ready.

Matthew Barrett as Group Chief Executive and David Allvey as Group Finance

Director will join us over the next two months. They bring valuable

experience to the central leadership of the Group which already has strong

leaders at business level.

Work to add value to the Barclays brand - arguably the most valuable brand

in the UK - is progressing well; all our businesses are working to ensure we

strengthen this important asset. We are also in the process of introducing

an updated visual identity across the Group.

Barclays is winning business through our strengthening brand, the commitment

and creativity of our staff and their determination to maintain our business

values. They will enable us to meet our customers needs as the business

changes aggressively to stay ahead of the competition.

Sir Peter Middleton

Chairman and Group Chief Executive

SUMMARY OF RESULTS

Half-year ended

PROFIT BEFORE TAX 30.6.99 31.12.98 30.6.98

#m #m #m

Retail Financial Services 820 780 721

Corporate Banking* 458 447 544

Barclays Capital 178 (426) 156

Barclays Global Investors 28 23 29

Businesses in Transition** - 24 24

Other operations (12) (111) (92)

Head office functions (32) (35) (25)

Goodwill amortisation (6) (6) (6)

Provision for litigation - (76) -

settlement***

Operating profit 1,434 620 1,351

Restructuring charge (345) - -

Former BZW businesses - (14) (19)

Exceptional items (119) 5 (4)

Write-down of leases - - (40)

Write-down of fixed asset - (4) -

investments

970 607 1,288

30.6.99 31.12.98 30.6.98

TOTAL ASSETS #m #m #m

Retail Financial Services 45,746 46,150 42,671

Corporate Banking 46,662 45,341 42,519

Barclays Capital 135,941 114,706 150,094

Barclays Global Investors 199 183 167

Businesses in Transition - - 88

- former BZW businesses

- other - 554 443

Other operations and Head office 5,204 5,475 6,223

functions

Retail life-fund assets 7,513 7,085 6,751

attributable to policyholders

241,265 219,494 248,956

WEIGHTED RISK ASSETS

Retail Financial Services 31,657 31,499 29,712

Corporate Banking 46,381 43,507 40,162

Barclays Capital 31,652 29,344 36,053

Barclays Global Investors 297 207 150

Businesses in Transition - - 61

- former BZW businesses

- other - 594 470

Other operations**** 4,007 4,649 4,913

113,994 109,800 111,521

* Figures are stated prior to the impact of the Finance Act 1998.

** Businesses in Transition profit before tax excludes the results of

former BZW businesses which are shown separately.

***The provision in the second half of 1998 relates to the settlement of

the Atlantic litigation.

****Including supervisory adjustments.

CONSOLIDATED PROFIT AND LOSS ACCOUNT (UNAUDITED)

Half-year ended

30.6.99 31.12.98 30.6.98

#m #m #m

Interest receivable 4,497 4,938 5,014

Interest payable (2,219) (2,728) (2,876)

Write-down of leases - - (40)

Profit on redemption/repurchase of - - 3

loan capital

Net interest income 2,278 2,210 2,101

Net fees and commissions 1,417 1,429 1,350

receivable

Dealing profits 325 (230) 197

Other operating income 129 168 156

Total non-interest income 1,871 1,367 1,703

Operating income 4,149 3,577 3,804

Administration expenses - staff (1,668) (1,425) (1,386)

costs

Administration expenses - other (935) (969) (860)

Depreciation and amortisation (137) (138) (137)

Operating expenses (2,740) (2,532) (2,383)

Operating profit before provisions 1,409 1,045 1,421

Provisions for bad and doubtful (320) (363) (129)

debts

Provisions for contingent - (76) -

liabilities and commitments

Operating profit 1,089 606 1,292

Exceptional items (119) 5 (4)

Write-down of fixed asset - (4) -

investments

Profit on ordinary activities 970 607 1,288

before tax

Tax on profit on ordinary (252) (153) (380)

activities

Profit on ordinary activities 718 454 908

after tax

Minority interests (equity and non- (22) (23) (22)

equity)

Profit attributable to the members 696 431 886

of Barclays PLC

Dividends (263) (414) (232)

Profit retained 433 17 654

Earnings per ordinary share 46.2p 28.9p 58.3p

Earnings per ordinary share

for the ongoing business 70.7p 29.6p 60.0p

Dividend per ordinary share:

First interim (payable 1st October 17.5p - 15.5p

1999)

Second interim - 27.5p -

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE ONGOING

BUSINESS (UNAUDITED)

Half-year ended

30.6.99 31.12.98 30.6.98

#m #m #m

Interest receivable 4,497 4,938 5,014

Interest payable (2,219) (2,727) (2,875)

Profit on redemption/repurchase - - 3

of loan capital

Net interest income 2,278 2,211 2,142

Net fees and commissions 1,417 1,431 1,340

receivable

Dealing profits 325 (225) 198

Other operating income 129 165 154

Total non-interest income 1,871 1,371 1,692

Operating income 4,149 3,582 3,834

Administration expenses - staff (1,421) (1,422) (1,367)

costs

Administration expenses - other (837) (962) (850)

Depreciation and amortisation (137) (139) (137)

Operating expenses (2,395) (2,523) (2,354)

Operating profit before 1,754 1,059 1,480

provisions

Provisions for bad and doubtful (320) (363) (129)

debts

Provisions for contingent - (76) -

liabilities and commitments

Operating profit for the ongoing 1,434 620 1,351

business

Restructuring charge (345) - -

Former BZW businesses - (14) (19)

Exceptional items (119) 5 (4)

Write-down of leases - - (40)

Write-down of fixed asset - (4) -

investments

Profit on ordinary activities 970 607 1,288

before tax

The results shown on page 7 include the restructuring charge in the first

half of 1999 and the residual losses relating to the former BZW businesses

and the impact of the 1998 Finance Act in previous periods. The table above

presents the consolidated profit and loss account for the ongoing business

excluding the impact of these items.

CONSOLIDATED BALANCE SHEET (UNAUDITED)

Half-year ended

30.6.99 31.12.98 30.6.98

Assets: #m #m #m

Cash and balances at central 780 942 709

banks

Items in course of collection 2,709 2,475 3,129

from other banks

Treasury bills and other eligible 8,321 4,748 6,890

bills

Loans and advances to banks 14,214 20,316 19,725

- banking

- trading 25,805 16,296 18,109

40,019 36,612 37,834

Loans and advances to customers 88,952 81,469 76,483

- banking

- trading 17,094 14,641 31,670

106,046 96,110 108,153

Debt and equity securities 56,767 50,068 62,173

Interests in associated 131 150 143

undertakings and joint ventures

Intangible fixed assets - 209 196 183

goodwill

Tangible fixed assets 1,878 1,939 1,909

Other assets 16,892 19,169 21,082

233,752 212,409 242,205

Retail life-fund assets 7,513 7,085 6,751

attributable to policyholders

Total assets 241,265 219,494 248,956

Liabilities:

Deposits by banks - banking 24,863 25,951 31,206

- trading 14,213 8,469 19,989

39,076 34,420 51,195

Customer accounts - banking 98,629 96,099 96,527

- trading 18,316 12,706 20,343

116,945 108,805 116,870

Debt securities in issue 22,976 17,824 21,625

Items in course of collection due 1,308 1,279 1,726

to other banks

Other liabilities 40,763 38,191 38,991

Undated loan capital - 317 301 300

convertible to preference shares

Undated loan capital - non- 1,463 1,441 1,410

convertible

Dated loan capital - non- 2,337 1,992 1,887

convertible

Other subordinated liabilities - - - 58

non-convertible

225,185 204,253 234,062

Minority interests and

shareholders' funds:

Minority interests: equity 72 51 59

Minority interests: non-equity 277 263 262

Called up share capital 1,503 1,511 1,509

Reserves 6,715 6,331 6,313

Shareholders' funds: equity 8,218 7,842 7,822

8,567 8,156 8,143

233,752 212,409 242,205

Retail life-fund liabilities 7,513 7,085 6,751

attributable to policyholders

Total liabilities and 241,265 219,494 248,956

shareholders' funds

MORE TO FOLLOW

IR BRGBISUGCCCS

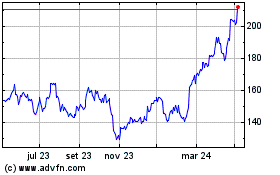

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024