RNS No 5565d

BARCLAYS PLC

5 August 1999

PART 4

ADDITIONAL INFORMATION (CONTINUED)

CHANGES IN REPORTING OF GROUP STRUCTURE IN 1999

Since 1st January 1999, a number of changes have been made to the Group's

reporting structure. Major changes, for which comparative figures have been

restated, as appropriate, are:

Retail Financial Services has re-organised the management of its business

around customer segments to deliver services and products. For reporting

purposes it is organised into Retail Customers, Wealth Management and

Barclaycard. Retail Customers and Wealth Management have absorbed the

relevant customer segments from the previous business groupings of UK Retail

Banking, International Premier, Private, Savings and Investment and Africa

and Caribbean, with Barclaycard remaining unaffected.

Retail Customers comprises UK Retail Banking (excluding UK Premier), the

African business, UK retail mutual funds and Barclays Life. Wealth

Management comprises the former International Premier, Private, Savings and

Investment business (excluding UK retail mutual funds and Barclays Life), UK

Premier and the Caribbean business.

The Structured Export Finance business and a number of large corporate

assets have been transferred from Barclays Capital to Corporate Banking.

Certain internal charges have been re-allocated between Retail Financial

Services and Corporate Banking. In addition, Retail Financial Services has

revised its presentation of income and costs within its profit and loss

account. There is no effect on total Group revenue or costs as a result of

these changes.

RECENT DEVELOPMENTS

On 27th July 1999, Barclays announced the appointment of Matthew Barrett as

Group Chief Executive and as a director of Barclays PLC and Barclays Bank

PLC with effect from 1st October 1999, when Sir Peter Middleton will step

down as Group Chief Executive, continuing in his role as Group Chairman.

On 2nd July 1999, the Group announced the appointment of David Allvey as

Finance Director of Barclays PLC and Barclays Bank PLC. He will join the

boards of both companies as a director on 1st September 1999 and succeed

Oliver Stocken as Finance Director on 20th September 1999. Oliver Stocken

will retire as a director of Barclays PLC and Barclays Bank PLC on 30th

September 1999.

ACQUISITIONS AND DISPOSALS

In June 1999 the Group increased its holding in Banque du Caire Barclays

International (subsequently renamed Cairo Barclays SAE) from 49% to 60%.

This entity is now accounted for as a subsidiary.

Details of significant disposals in the period are set out under exceptional

items on page 17.

ACCOUNTING POLICIES

A change in policy has arisen from the adoption in 1999 of Financial

Reporting Standard 12 "Provisions, Liabilities and Assets" (FRS 12). The

Group has a number of vacant leasehold properties where unavoidable costs

exceed anticipated income for which a provision is now required under

FRS 12. Previously costs and income in relation to these properties were

only recognised as they arose.

The change in policy has resulted in a prior year adjustment and the profit

and loss accounts and balance sheets for previous years have been restated.

This has resulted in a net charge to shareholders' funds of #81m as at 1st

January 1999 comprising the cumulative impact of prior year reductions in

net interest income, net provisions for property costs and associated tax

credits. Comparative figures have been restated with the effect that

shareholders' funds have been reduced by #63m at 1st January 1998. Profit

before tax for the six months to 31st December 1998 and 30th June 1998 has

been reduced by #22m and #1m respectively.

There have been no other significant changes to the accounting policies as

described in the 1998 Annual report.

CHANGES IN ACCOUNTING PRESENTATION

The classification of certain items of income and costs have been reviewed

and #25m has been offset between costs and income to more appropriately

reflect the nature of the transactions involved. In view of the amounts

involved no restatements have been made.

There have been no other changes in accounting presentation from that

reflected in the 1998 Annual report.

REVIEW OF FINANCIAL INFORMATION BY AUDITORS

The unaudited financial information for Barclays PLC comprising pages 7 and

9, 39 to 49 and 52 to 56 have been reviewed by PricewaterhouseCoopers and

their report relating to it is included on page 58.

GROUP SHARE SCHEMES

The trustees of the Group's share schemes may make purchases of Barclays PLC

ordinary shares in the market following the announcement of the Group's

results in August 1999 for the purposes of those schemes' current and future

requirements. The total number of ordinary shares purchased would not be

material in relation to the issued share capital of Barclays PLC.

FILINGS WITH THE SEC

This report is being furnished as a Form 6-K with the Securities and

Exchange Commission in the United States of America.

NOTES (UNAUDITED)

Half-year ended

1. Loans and advances to banks 30.6.99 31.12.98 30.6.98

#m #m #m

Banking business

Loans and advances to banks 14,239 20,357 19,749

Less - provisions (25) (41) (24)

14,214 20,316 19,725

Trading business 25,805 16,296 18,109

Total loans and advances to 40,019 36,612 37,834

banks

Of the total loans and advances to banks, placings with banks were

#35.2bn at 30th June 1999 (31st December 1998: #32.8bn, 30th June: 1998

#31.7bn). The majority of placings have a residual maturity of less

than one year.

Half-year ended

2. Loans and advances to 30.6.99 31.12.98 30.6.98

customers

#m #m #m

Banking business

Loans subject to non-recourse

finance arrangements 255 278 304

Less: non returnable finance (245) (269) (294)

10 9 10

Loans and advances to 85,306 77,663 72,519

customers

Finance lease receivables 5,700 5,776 5,875

91,016 83,448 78,404

Less - provisions (1,982) (1,902) (1,833)

- interest in suspense (82) (77) (88)

88,952 81,469 76,483

Trading business 17,094 14,641 31,670

Total loans and advances to 106,046 96,110 108,153

customers

3. Provisions for bad and doubtful debts

Half-year ended

30.6.99 31.12.98 30.6.98

Credit risk provisions #m #m #m

Provisions at beginning of 1,862 1,781 1,761

period

Exchange and other adjustments (23) 12 (7)

Amounts written off

United Kingdom (240) (318) (188)

Other European Union (21) (30) (13)

United States - (5) (2)

Rest of the World (13) (6) (3)

(274) (359) (206)

Recoveries (analysed below) 40 81 95

Sub-total 1,605 1,515 1,643

Provisions charged against profit:

New and increased specific

provisions

United Kingdom 372 489 262

Other European Union 13 20 11

United States 12 7 4

Rest of the World 27 10 13

424 526 290

Less: Releases of specific

provisions

United Kingdom (49) (43) (38)

Other European Union (10) (20) (11)

United States (6) (3) (5)

Rest of the World (5) (9) (6)

(70) (75) (60)

Less: Recoveries

United Kingdom (35) (77) (79)

Other European Union (2) (2) (2)

United States (2) (1) (12)

Rest of the World (1) (1) (2)

(40) (81) (95)

Net specific provisions charge 314 370 135

General provision - 8 (23) 3

charge/(release)

Net credit risk charge to 322 347 138

profit

Provisions at end of period 1,927 1,862 1,781

Country risk provisions

Provisions at beginning of period 81 76 89

Exchange and other adjustments - - 1

Amounts written off (net of 1 (11) (5)

recoveries)

Net specific provision releases (2) (4) (9)

General provision charge - 20 -

Provisions at end of period 80 81 76

Total provisions at end of period 2,007 1,943 1,857

The United Kingdom charge against profit in the second half of 1998

included #153m in respect of exposure to Russian counterparties.

Total provisions for bad and doubtful debts at end of period comprise:

Half-year ended

30.6.99 31.12.98 30.6.98

Specific - credit risk #m #m #m

United Kingdom 1,007 928 801

Other European Union 153 213 225

United States 30 23 24

Rest of the World 75 35 45

1,265 1,199 1,095

Specific - country risk 15 16 31

Total specific provisions 1,280 1,215 1,126

General provisions

- credit risk 662 663 686

- country risk 65 65 45

2,007 1,943 1,857

The geographic analysis of provisions shown above is based on location

of office.

Half-year ended

4. Other assets 30.6.99 31.12.98 30.6.98

#m #m #m

Own shares 48 43 43

Balances arising from off-

balance sheet financial 12,110 13,725 14,908

instruments

Shareholders' interest in long-

term assurance fund 539 530 488

London Metal Exchange warrants

and other metals trading 385 457 535

positions

Sundry debtors 1,680 1,862 2,345

Prepayments and accrued income 2,130 2,552 2,763

16,892 19,169 21,082

'Own shares' represent Barclays PLC shares held in employee benefit trusts

that have not yet vested unconditionally with the eligible employees.

Half-year ended

5. Other liabilities 30.6.99 31.12.98 30.6.98

#m #m #m

Obligations under finance 145 141 146

leases payable

Balances arising from

off-balance sheet financial 13,267 15,849 15,744

instruments

Short positions in securities 19,786 13,682 15,013

Current tax 537 479 670

Sundry creditors 2,379 3,199 3,116

Accruals and deferred income 2,894 3,074 2,672

Provisions for liabilities and 1,492 1,353 1,398

charges

Dividend 263 414 232

40,763 38,191 38,991

6. Potential credit risk lendings

The following table presents an analysis of potential credit risk

lendings in accordance with the US Securities and Exchange Commission

guidelines. Additional categories of disclosure are included, however,

to record lendings where interest continues to be accrued and where

either interest is being suspended or specific provisions have been

raised. Normal US banking practice would be to place such lendings on

non-accrual status.

The amounts, the geographical presentation of which is based on the

location of the office recording the transaction, are stated before

deduction of the value of security held, specific provisions carried or

interest suspended.

Non-performing lendings 30.6.99 31.12.98 30.6.98

#m #m #m

Non-accrual lendings:

United Kingdom 1,004 985 824

Foreign 268 282 283

Accruing lendings where

interest is being suspended:

United Kingdom 308 266 245

Foreign 131 118 125

Other accruing lendings

against which provisions have

been made:

United Kingdom 444 457 370

Foreign 124 134 123

Sub-totals:

United Kingdom 1,756 1,708 1,439

Foreign 523 534 531

Accruing lendings 90 days

overdue, against which no

provisions have been made:

United Kingdom 276 309 382

Foreign 19 19 13

Reduced rate lendings:

United Kingdom 6 7 9

Foreign - - -

Total non-performing lendings

United Kingdom 2,038 2,024 1,830

Foreign 542 553 544

2,580 2,577 2,374

UK non-performing lendings were broadly unchanged. Increases in credit card

and other consumer non-performing lendings were offset by write-offs.

Potential problem lendings: In addition to the above, the following

table shows lendings which are current as to payment of principal and

interest, but where serious doubt exists as to the ability of the

borrower to comply with repayment terms in the near future.

30.6.99 31.12.98 30.6.98

#bn #bn #bn

United Kingdom 0.6 0.6 0.7

Foreign 0.1 0.1 0.1

0.7 0.7 0.8

30.6.99 31.12.98 30.6.98

Credit risk provision coverage % % %

of:

- credit risk non-performing 77.9 75.2 78.7

lendings

- total potential credit risk 60.7 59.4 59.4

lendings

Half-year ended

30.6.99 31.12.98 30.6.98

Interest forgone on non- #m #m #m

performing lendings:

Interest income that would

have been recognised under 84 74 108

original contractual terms

Interest income included in (27) (32) (31)

profit

Interest forgone 57 42 77

7. Exposure to countries subject to International Monetary Fund liquidity

support programmes

Amounts outstanding, net of provisions, and commitments to

counterparties in countries which are subject to International Monetary

Fund liquidity support programmes were as follows:

30.6.99 31.12.98 30.6.98

Asia #bn #bn #bn

Indonesia 0.1 0.1 0.2

South Korea 0.4 0.5 0.5

Thailand 0.1 0.1 0.2

0.6 0.7 0.9

Latin America

Brazil 0.9 0.9 0.8

Eastern Europe

Russia - - 0.5

1.5 1.6 2.2

Of the total of #1.5bn, #1.0bn (31st December 1998: #1.0bn, 30th June

1998: #1.1bn) was related to banks, #0.3bn (31st December 1998: #0.4bn,

30th June 1998: #0.8bn) to governments and #0.2bn (31st December 1998:

#0.2bn, 30th June 1998: #0.3bn) to other corporate bodies, including

project finance companies, and was mainly in respect of loans, off-

balance sheet financial instruments and debt securities. Off-balance

sheet financial instruments and debt securities are marked to market.

The Group has a Brazilian associate, Banco Barclays e Galicia SA, which

is equity accounted. At 30th June 1999 the 50% holding was included in

the balance sheet at a value of #48m (31st December 1998: #47m, 30th

June 1998: #43m), which is included in the figures above.

Of the above exposures #22m (31st December 1998: #35m, 30th June 1998:

#12m) were non-performing (interest not being accrued) as at 30th June

1999. In the second half of 1998 the Group raised a general provision

of #20m in respect of country transfer risk arising from its business

world wide, including exposure in these countries. The balance of such

provisions at 30th June 1999 is #65m, this being in addition to #662m of

general provision held against credit risk.

8. Cross-border outstandings

At 30th June 1999, countries where Barclays cross-border outstandings

exceeded 1% of assets were the United States, Germany and France. In

this context, assets comprise total assets as presented in the

consolidated balance sheet and include acceptances. On this basis total

assets amounted to #242,583m at 30th June 1999 (31st December 1998:

#220,564m).

Cross-border outstandings As % Total

exceeding 1% of assets of assets #m

At 30th June 1999

United States 2.2 5,401

Germany 2.0 4,746

France 1.3 3,184

At 31st December 1998

United States 3.3 7,211

Germany 1.4 3,142

France 1.4 3,094

Netherlands 1.3 2,772

Japan 1.1 2,420

As at 30th June 1999, the countries with aggregate cross-border

outstandings between 0.75% and 1% of total Group assets were Japan at

#1,908m and the Netherlands at #1,892m. At 31st December 1998, Barclays

had no countries in this category.

9. European Economic and Monetary Union

The Group's implementation of the euro in the first week of January 1999

was very successful. Barclays believes it is competitively placed to

meet the needs of its customers for the euro.

Some planning for the possibility of UK entry has taken place and

Barclays is participating in follow-up work identified by the Government

in its National Changeover Plan. The Group's current policy is not to

incur significant expenditure until there is more certainty about a

decision to enter. It is too early to give any meaningful estimate of

the cost of preparing for UK entry.

10. Year 2000 Readiness Disclosure

Barclays has confidence in its readiness for the Year 2000.

The Barclays Group Year 2000 Programme, initiated in 1996, is

responsible for Year 2000 projects across the Group world wide. A

Programme Board of executives representing all Group businesses is

chaired by the Director, Planning, Operations and Technology, who

reports directly to the Chairman and Chief Executive.

During the first half of 1999 Barclays has continued working to ensure

that its mission critical systems (those which could have an immediate

and observable impact on the Group's customers and therefore its ability

to continue to operate effectively) can deal satisfactorily with the

Year 2000. All mission critical IT systems, including embedded systems,

have now been tested and are Year 2000 ready.

Together with other banks and external network providers Barclays has

taken part in successful testing of the key industry infrastructure in

the United Kingdom including the cheque clearing and electronic payment

systems, credit cards and ATMs. Barclays will continue to participate

in industry-wide testing throughout the remainder of 1999. Where

appropriate, similar joint testing is undertaken in other countries in

which it operates.

As a result of working closely with key suppliers the Group has been

able to satisfy itself as to their current, or planned, state of

readiness and the support arrangements required for the cutover to the

new year. The Year 2000 readiness of approximately 1,500 of Barclays

most critical counterparties is being assessed centrally and procedures

are in place to ensure that credit exposure to those, and other banks

with whom the Group has a relationship, is managed with Year 2000

readiness in mind.

The Group collates and analyses information on specific aspects of the

preparedness of countries in which it operates using data from a variety

of sources. Barclays continues to evaluate significant potential Year

2000 impacts on its funding capability and incorporates such risks into

the capital and liquidity plans.

Awareness campaigns have been undertaken for corporate, small business

and personal customers in the United Kingdom and some overseas areas.

Information gathered from these campaigns, the results of surveys and

other internal initiatives have allowed the Group to continue to

evaluate the preparedness of the corporate and small business customer

base and this information has been used to inform the Group's risk

management activities.

In the United Kingdom Barclays has co-operated with other major

financial institutions in order to support public confidence concerning

the Year 2000 by working closely with the British Bankers Association in

the production of an information leaflet "Your Money and the Millennium"

and with Action 2000 on "Facts Not Fiction". In June Barclays issued

its own leaflet, "The Millennium Bug - It's business as usual with

Barclays into 2000" and launched in the United Kingdom a telephone

helpline to address specific Year 2000 questions from staff and

customers. A Year 2000 Website (www.y2000.barclays.com) gives further

information on the Programme.

Despite all these actions Barclays is not taking its progress for

granted. All systems changes are now subject to "Clean Management"

processes in order to prevent the Year 2000 problem being reintroduced.

In order to further mitigate the risk associated with the introduction

of new systems a "Change Freeze" regime has been implemented across the

Barclays Group the first element of which commenced in July.

It is a prudent planning scenario that there could be some disruption

caused directly or indirectly by the Year 2000 issue. Contingency plans

across the Group are therefore being reviewed and updated, and are being

augmented with continuity plans to mitigate the possible effects of the

Year 2000. At the end of July Barclays had completed an initial cutover

plan which defines how the Group will operate across the change from

1999 into 2000. This includes the establishment and testing of a

network of command centres, internal and external communications and

participation in industry testing during the non-business days. This

work will continue to be refined during the remainder of 1999

incorporating market requirements.

The total cost of the Year 2000 Programme is estimated not to exceed

#250m (including #20m of capitalised costs) for the four year period

ending December 2000. The total amount spent on the Year 2000 Programme

to the end of June was about #180m (including #15m of capitalised costs)

of which #35m was incurred in the half year to June 1999. Year 2000

costs include correction, testing, third party assurance and contingency

planning.

Cautionary statement

Certain of the statements contained in the foregoing Year 2000 Readiness

Disclosure are forward looking statements within the meaning of the

United States Private Securities Litigation Reform Act 1995. Barclays

expectations about the anticipated business, operational and financial

risks to it from Year 2000 problems are subject to a number of

uncertainties. The foregoing Readiness Disclosure of Year 2000,

therefore, should be read in conjunction with the cautionary statements

contained in Barclays Annual Report on Form 20-F for 1998.

11. Legal proceedings

Barclays is party to various legal proceedings, the ultimate resolution

of which is not expected to have a material adverse effect on the

financial position of the Group.

12. Geographical analysis

Half-year ended

30.6.99 31.12.98 30.6.98

Profit before tax #m #m #m

United Kingdom 622 437 1,046

Other European Union 177 130 111

United States 103 2 65

Rest of the World 68 38 66

970 607 1,288

30.6.99 31.12.98 30.6.98

Total assets #m #m #m

United Kingdom 170,607 154,446 183,371

Other European Union 18,288 18,490 20,231

United States 35,407 24,886 23,720

Rest of the World 16,963 21,672 21,634

241,265 219,494 248,956

13. Contingent liabilities and commitments

Half-year ended

30.6.99 31.12.98 30.6.98

Contingent liabilities #m #m #m

Acceptances and endorsements 1,331 1,384 1,531

Guarantees and assets

pledged as collateral security 11,011 8,784 6,861

Other contingent liabilities 5,359 5,069 5,181

17,701 15,237 13,573

Commitments

Standby facilities, credit

lines and other commitments 73,376 68,191 63,545

14. Off-balance sheet financial instruments, including derivatives

The tables set out below analyse the contract or underlying principal

amounts of derivative financial instruments held for trading purposes

and for the purposes of managing the Group's structural exposures.

Foreign exchange derivatives 30.6.99 31.12.98 30.6.98

#m #m #m

Contract or underlying

principal amount

Forward foreign exchange 233,836 263,958 323,816

Currency swaps 81,025 79,447 65,537

Other exchange rate related 65,460 101,310 183,648

contracts

380,321 444,715 573,001

Interest rate derivatives

Contract or underlying

principal amount

Interest rate swaps 900,052 787,486 690,780

Forward rate agreements 69,513 99,960 164,726

OTC options bought and sold 232,236 222,589 189,712

Other interest rate related 124,381 104,003 222,366

contracts

1,326,182 1,214,038 1,267,584

Equity, stock index and

commodity derivatives

Contract or underlying 55,961 51,347 57,865

principal amount

Other exchange rate related contracts are primarily OTC options. Other

interest rate related contracts are primarily exchange traded options

and futures.

Derivatives entered into as trading transactions, together with any

associated hedging thereof, are measured at fair value and the resultant

profits and losses are included in dealing profits. The tables below

summarise the positive and negative fair values of such derivatives,

including an adjustment for netting where the Group has the ability to

insist on net settlement which is assured beyond doubt, based on a legal

right that would survive the insolvency of the counterparty.

Positive fair values 30.6.99 31.12.98 30.6.98

#m #m #m

Foreign exchange derivatives 6,090 9,913 9,222

Interest rate derivatives 16,573 20,083 13,062

Equity, stock index and 2,289 2,240 2,939

commodity derivatives

Effect of netting (12,842) (18,511) (10,315)

12,110 13,725 14,908

Negative fair values

Foreign exchange derivatives 6,836 12,062 9,012

Interest rate derivatives 16,517 19,603 13,446

Equity, stock index and 2,756 2,695 3,601

commodity derivatives

Effect of netting (12,842) (18,511) (10,315)

13,267 15,849 15,744

Deferred profits and losses on hedging activities

Derivative instruments used to manage risk on transactions which are

superseded, cease to be effective or are terminated early are measured

at fair value. Any profits or losses arising are deferred and amortised

into interest income or expense over the remaining life of the asset,

liability, position or cashflow previously being hedged.

The table below summarises the deferred profits and losses at 30th June

1999, all of which are in respect of interest rate derivatives:

Under One to Over five Total

one year five years years

#m #m #m #m

Deferred profits

being amortised 5 5 1 11

Deferred losses

being amortised 2 2 - 4

15. Market risk

Market risk is the risk of loss arising from adverse movements in the

level or volatility of market prices, which can occur in the interest

rate, foreign exchange, equity and commodity markets. It is incurred as

a result of both trading and asset/liability management activities.

The market risk management policies of the Group are determined by the

Group Risk Management Committee, which also determines overall market

risk appetite. The Group's policy is that exposure to market risk

arising from trading activities is concentrated in Barclays Capital.

The Group's banking businesses are also subject to market risk, which

arises in relation to non-trading positions, such as capital balances,

demand deposits and customer originated transactions and flows.

The Group uses a 'value at risk' measure as the primary mechanism for

controlling market risk. Daily Value at Risk (DVAR) is an estimate,

with a confidence level of 98%, of the potential loss which might arise

if the current positions were to be held unchanged for one business day.

Daily losses exceeding the DVAR figure are likely to occur, on average,

only twice in every one hundred business days. Actual outcomes are

monitored regularly to test the validity of the assumptions made in the

calculation of DVAR.

Barclays Capital Trading activities

In Barclays Capital, the formal process for the management of risk is

through the Barclays Capital Risk Management Committee. Day-to-day

responsibility for market risk lies with the Chief Executive of Barclays

Capital, supported by a dedicated global market risk management unit

that operates independently of the business areas.

In the fourth quarter of 1998, Barclays Capital closed its non-customer

related proprietary trading businesses and its secondary market

corporate bond inventory was substantially reduced. This reduction in

risk contributed to a decrease in DVAR from #22.8m at 30th June 1998 to

#12.2m at 31st December 1998. The lower risk profile was maintained in

the first half of 1999, with a DVAR of #14.5m being recorded on 30th

June 1999. The average, maximum and minimum daily values of DVAR were

estimated as follows:

DVAR Half-year ended

30th June 1999

Average High Low

#m #m #m

Interest rate risk 10.1 13.1 6.2

Foreign exchange risk 3.7 11.7 1.0

Equities risk 1.8 3.7 0.6

Commodities risk 0.8 1.5 0.5

Diversification effect (3.4)

Total DVAR 13.0 20.4 7.7

Half-year ended Half-year ended

31st December 1998 30th June 1998

Average High Low Average High Low

#m #m #m #m #m #m

Interest Rate Risk 16.2 36.6 9.6 13.9 24.2 9.5

Foreign Exchange 5.3 13.2 1.2 6.4 13.9 3.7

Risk

Equities Risk 3.3 7.9 1.3 2.6 3.5 1.7

Commodities Risk 0.8 1.5 0.6 1.6 2.9 0.8

Diversification (3.9) (4.4)

Effect

Total 21.7 43.3 12.2 20.1 31.6 15.9

In February 1999, Barclays Capital implemented historical simulation as

the standard method for calculating DVAR, having previously used mainly

a variance/covariance calculation. Compared with the previous approach,

historical simulation is considered to give better risk aggregation, a

more accurate estimate of options risk and a more realistic assessment

of the statistical distribution of low probability extreme losses. The

new method, currently based on a one-year historical sample, is now used

for the majority of the Barclays Capital businesses, the main exception

being that a historical simulation method is still being developed for

the Commodities business. The new approach has been approved by the

Financial Services Authority for calculating regulatory capital for

general market risk.

All 1999 figures reported in the above table are based on the new

method, while the 1998 figures use the old approach. The Group estimate

that the change to the new methodology increased the reported average

DVAR for the first half of 1999 by around 10% to 15%. This increase is

due to the new methodology placing equal weighting on all data points in

the sample, whereas the old methodology placed greater weighting on more

recent data points. As a result, the new method places more emphasis on

the higher levels of market volatility during the second half of 1998.

MORE TO FOLLOW

IRCBIGBIIGGCCCS

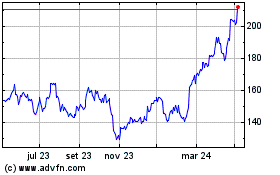

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024