RNS No 5333p

BARCLAYS PLC

5 August 1999

PART 5

AVERAGE BALANCE SHEET AND NET INTEREST INCOME

30.6.99 30.6.99 30.6.99 30.6.98 30.6.98 30.6.98

Average Interest Average Average Interest Average

Balance Rate Balance Rate

Assets #m #m % #m #m %

Treasury bills and

other eligible bills:

in offices in the UK 2,881 73 5.1 2,504 86 6.9

in offices outside the UK 967 45 9.3 1,106 58 10.5

Loans and advances to

banks:

in offices in the UK 7,636 196 5.1 11,470 320 5.6

in offices outside the UK 9,054 198 4.4 10,375 281 5.4

Loans and advances

to customers:

in offices in the UK 66,545 2,698 8.1 61,119 2,850 9.3

in offices outside the 15,065 435 5.8 10,822 418 7.7

UK

Lease receivables:

in offices in the UK 5,058 176 7.0 5,599 224 8.0

in offices outside the UK 555 32 11.5 203 12 11.8

Debt securities:

in offices in the UK 13,251 406 6.1 14,516 472 6.5

in offices outside the UK 9,229 238 5.2 8,829 293 6.6

Average assets of 130,241 4,497 6.9 126,543 5,014 7.9

banking business

Average assets of 65,017 1,785 5.5 78,954 1,795 4.5

trading business

Total average interest 195,258 6,282 6.4 205,497 6,809 6.6

earning assets

Provisions (1,931) (1,847)

Non-interest earning 37,228 39,889

assets

Total average assets 230,555 6,282 5.4 243,539 6,809 5.6

and interest income

Percentage of total

average assets in 32.8 27.8

offices outside the UK

Average interest

earning assets and net

interest income:

Banking business 130,241 2,281 3.5 126,543 2,140 3.4

Trading business 65,017 30 0.1 78,954 4 0.0

Write-down of leases - - - - (40) -

Discount rate - (3) - - (2) -

adjustment on provisions

Profit on redemption/

repurchase of loan - - - - 3 -

capital

Total average interest

earning assets and 195,258 2,308 2.4 205,497 2,105 2.0

net interest income

Total average interest

earning assets related to:

Interest income 6,282 6.4 6,809 6.6

Interest expense (3,971) (4.1) (4,665) (4.5)

Write-down of leases - - (40) -

Discount rate (3) - (2) -

adjustment on provisions

Profit on redemption/

repurchase of loan - - 3 -

capital

2,308 2.4 2,105 2.0

Notes

(i) Loans and advances to customers and banks include all doubtful lendings,

including non-accrual lendings. Interest receivable on such lendings has

been included to the extent to which either cash payments have been received

or interest has been accrued in accordance with the income recognition

policy of the Group.

(ii) Average balances are based upon daily averages for most UK banking

operations and monthly averages elsewhere.

(iii) The average balance sheet does not include the retail life fund assets

attributable to policyholders nor the related liabilities.

AVERAGE BALANCE SHEET AND NET INTEREST INCOME

30.6.99 30.6.99 30.6.99 30.6.98 30.6.98 30.6.98

Average Interest Average Average Interest Average

Balance Rate Balance Rate

Liabilities and #m #m % #m #m %

shareholders' funds

Deposits by banks:

in offices in the UK 12,603 255 4.0 17,118 321 3.8

in offices outside 11,750 216 3.7 12,015 261 4.3

the UK

Customer accounts

- demand accounts:

in offices in the UK 12,222 82 1.3 11,194 101 1.8

in offices outside 1,904 17 1.8 1,745 18 2.1

the UK

Customer accounts

- savings accounts:

in offices in the UK 23,977 387 3.2 21,889 534 4.9

in offices outside 1,278 25 3.9 1,123 33 5.9

the UK

Customer accounts -

other time deposits

- retail:

in offices in the UK 23,553 605 5.1 21,977 761 6.9

in offices outside 4,800 108 4.5 5,256 139 5.3

the UK

Customer accounts -

other time deposits

- wholesale:

in offices in the UK 18,911 412 4.4 17,377 473 5.4

in offices outside 6,744 160 4.7 6,401 144 4.5

the UK

Debt securities in

issue:

in offices in the UK 13,440 383 5.7 13,664 434 6.4

in offices outside 5,866 143 4.9 6,309 171 5.4

the UK

Dated and undated

loan capital and other 3,969 127 6.4 3,223 118 7.3

subordinated liabilities

principally in offices

in the UK

Internal funding of (28,710) (704) 4.9 (30,110) (634) 4.2

trading business

Average liabilities

of banking business 112,307 2,216 3.9 109,181 2,874 5.3

Average liabilities 69,517 1,755 5.0 80,692 1,791 4.4

of trading business

Total average

interest 181,824 3,971 4.4 189,873 4,665 4.9

bearing liabilities

Interest free

customer deposits:

in offices in the UK 8,464 7,901

in offices outside 1,514 1,309

the UK

Other non-interest 30,160 36,373

bearing liabilities

Minority interests

and shareholders' 8,593 8,083

funds

Total average

liabilities, 230,555 3,971 3.4 243,539 4,665 3.8

shareholders' funds

and interest expense

Percentage of total

average non-capital 32.1 31.0

liabilities in offices

outside the UK

CONSOLIDATED STATEMENT OF CHANGES IN

SHAREHOLDERS' FUNDS (UNAUDITED)

Half-year ended

30.6.99 31.12.98 30.6.98

#m #m #m

Share capital

At beginning of period 1,511 1,509 1,530

Shares issued 1 8 2

Repurchase of shares (9) (6) (23)

At end of period 1,503 1,511 1,509

Share premium account

At beginning of period 1,381 1,288 1,281

Premium arising on shares issued 20 93 7

At end of period 1,401 1,381 1,288

Revaluation reserve

At beginning of period 36 34 35

Exchange rate translation (2) 2 (1)

differences

Revaluation of interest in 5 - -

associated undertaking

At end of period 39 36 34

Capital redemption reserve

At beginning of period 179 173 150

Repurchase of ordinary shares 9 6 23

At end of period 188 179 173

Other capital reserve

At beginning and end of period 320 320 320

Profit retained

At beginning of period 4,415 4,498 4,241

Profit retained 433 17 654

Exchange rate translation (38) 66 (35)

differences

Repurchase of ordinary shares (159) (93) (379)

Transfer to capital redemption (9) (6) (23)

reserve

Goodwill written back on 138 - 10

disposals

Shares issued to the QUEST in

relation to share option schemes (13) (67) -

for staff

Other movements - - 30

At end of period 4,767 4,415 4,498

Total reserves 6,715 6,331 6,313

Total shareholders' funds 8,218 7,842 7,822

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES (UNAUDITED)

Half-year ended

30.6.99 31.12.98 30.6.98

#m #m #m

Profit attributable to the 696 431 886

members of Barclays PLC

Exchange rate translation (40) 68 (36)

differences

Other items 5 - 30

Total recognised gains relating 661 499 880

to the period

Prior period adjustment (as (81)

explained on page 38)

Total gains and losses recognised

since 31st December 1998 580

Historical cost profits and losses

There is no material difference between profit before tax and profit

retained, as reported, and historical cost profits.

CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

Half-year ended Full year

Note 30.6.99 30.6.99 30.6.98 30.6.98 31.12.98 31.12.98

#m #m #m #m #m #m

Net cash

inflow/(outflow) from 1 3,403 (2,481) (1,337)

operating activities

Dividends received

from associated 5 1 3

undertakings

Returns on investments

and servicing of

finance:

Interest paid on loan

capital and other (139) (100) (220)

subordinated

liabilities

Preference dividends

paid by subsidiary (13) (13) (25)

undertaking

Dividends paid to

minority shareholders (6) (6) (7)

Net cash outflow from

returns on investment (158) (119) (252)

and servicing of

finance

Tax paid (220) (228) (547)

Capital expenditure

and financial

investment:

Capital expenditure (101) (106) (305)

Sale of property and 34 64 107

equipment

Purchase of investment (7,031) (7,097) (10,866)

securities

Redemption of 2,728 2,476 3,874

investment securities

Sale of investment 1,351 7,435 9,523

securities

Net cash

(outflow)/inflow from (3,019) 2,772 2,333

capital expenditure

and financial

investment

Acquisitions and

disposals:

Acquisition of 2 38 (48) (70)

subsidiary

undertakings

Acquisition of - (43) (43)

associated

undertakings

Sale of associated - 7 7

undertakings

Sale of other group 3 168 675 690

undertakings

Net cash inflow from

acquisitions and 206 591 584

disposals

Equity dividend paid (414) (359) (591)

Net cash (197) 177 193

(outflow)/inflow

before financing

Financing:

Issue of loan capital

and other

subordinated 363 903 962

liabilities (net of

expenses)

Redemption/repurchase

of loan capital - (117) (240)

and other subordinated

liabilities

Repurchase of ordinary (168) (402) (501)

shares

Issue of ordinary

shares (net of 8 9 43

contribution to the

QUEST)

Net cash inflow from 203 393 264

financing

Increase in cash 4 6 570 457

NOTES TO CONSOLIDATED CASHFLOW STATEMENT (UNAUDITED)

1. Reconciliation of operating profit to net operating cashflows

Half-year ended Full year

30.6.99 30.6.98 31.12.98

#m #m #m

Operating profit 1,089 1,292 1,898

Provisions for bad and 320 129 492

doubtful debts

Depreciation and amortisation 135 136 270

Net decrease in accrued

expenditure (312) (938) (719)

and prepayments

Provisions for contingent

liabilities and commitments - - 76

Other provisions for 336 (51) 56

liabilities and charges

Interest on dated and undated

loan capital and other 127 118 244

subordinated liabilities

Associated undertakings - (5) (12) (22)

profit included

Increase in shareholders'

interest in the long-term (10) (40) (95)

assurance fund

Profit on - (3) (3)

redemption/repurchase of loan

capital

Net decrease/(increase) in net

interest and commission 561 (432) (23)

receivable

Net profit on disposal of

investments and fixed assets (30) (58) (106)

Other non-cash movements (13) 45 53

2,198 186 2,121

Net change in items in transit

and items in course of (209) (519) (311)

collection

Net increase/(decrease) in 2,339 (37) (4,230)

other credit balances

Net (increase)/decrease in

loans and advances to banks (14,420) (10,467) 8,652

and customers

Net increase/(decrease) in

deposits and debt securities 18,368 17,705 (14,958)

in issue

Net decrease in other assets 1,945 2,637 3,215

Net (decrease)/increase in

other debt securities and (3,528) (10,320) 3,642

equity shares

Net (increase)/decrease in

treasury (3,513) (1,547) 777

and other eligible bills

Other non-cash movements 223 (119) (245)

Net cash inflow/(outflow) from

operating activities 3,403 (2,481) (1,337)

NOTES TO CONSOLIDATED CASHFLOW STATEMENT (UNAUDITED)

2. Cash flow in respect of the purchase of subsidiary undertakings during

the period

Half-year ended Full year

30.6.99 30.6.98 31.12.98

#m #m #m

Cash consideration 41 52 74

Cash at bank and in hand (79) (4) (4)

acquired

Net cash (inflow)/outflow in

respect of the purchase of (38) 48 70

subsidiary undertakings

3. Sale of subsidiary and associated undertakings

Half-year ended Full year

30.6.99 30.6.98 31.12.98

#m #m #m

Goodwill written off 138 11 12

Advances and other accounts 1,520 1,419 1,561

Deposits and other borrowings (1,365) (717) (829)

Net assets disposed of 293 713 744

Net loss on disposal (119) (53) (51)

174 660 693

Less: Deferred consideration (6) (2) (3)

Add: Deferred consideration

received in respect of prior - 17 -

year disposals

Settled by net cash received 168 675 690

4. Analysis of cash balances

30.6.99 1.1.99 Change 30.6.98 1.1.98 Change

#m #m #m #m #m #m

Cash and

balances at 780 942 (162) 709 750 (41)

central bank

Loans and

advances to

other banks

repayable on 1,310 1,174 136 1,489 908 581

demand

2,090 2,116 (26) 2,198 1,658 540

Half-year ended Full year

30.6.99 30.6.98 31.12.98

#m #m #m

Balance at beginning of 2,116 1,658 1,658

period/year

Net increase in cash before the

effect of exchange rate 6 570 457

movements

Effect of exchange rate movements (32) (30) 1

(26) 540 458

Balance at end of period/year 2,090 2,198 2,116

US GAAP DATA (UNAUDITED)

The following unaudited financial information has been adjusted from data

prepared under UK GAAP to reflect significant differences from US GAAP.

Half-year ended

30.6.99 30.6.99 30.6.98 30.6.98

UK US UK US

GAAP GAAP GAAP GAAP

#m #m #m #m

Profit attributable to

the members of Barclays 696 612 886 936

PLC - Net income

Shareholders' funds 8,218 7,722 7,822 7,484

Total assets 241,265 246,173 248,956 258,984

PER ORDINARY SHARE pence Pence pence pence

Earnings 46.2 40.7 58.3 61.6

Diluted Earnings - US - 40.0 - 60.3

GAAP

Dividend 17.5 27.5 15.5 23.5

Net asset value 547 514 519 496

PERFORMANCE RATIOS % % % %

Net income as a

percentage of

average total assets 0.6 0.5 0.7 0.7

average shareholders' 16.8 15.3 22.8 25.2

funds

Dividends as a 37.8 67.7 26.2 38.4

percentage of net income

Average shareholders'

funds as a percentage of 3.6 3.3 3.2 2.9

average total assets

INDEPENDENT REVIEW REPORT BY THE AUDITORS

Independent review report to the Board of Directors of Barclays PLC

Introduction

We have been instructed by the company to review the financial information

set out on pages 7 and 9, 39 to 49 and 52 to 56 and we have read the other

information contained in the interim report for any apparent misstatements

or material inconsistencies with the financial information.

Directors' responsibilities

The interim report, including the financial information contained therein,

is the responsibility of, and has been approved by the directors. The

Listing Rules of the London Stock Exchange require that the accounting

policies and presentation applied to the interim figures should be

consistent with those applied in preparing the preceding annual accounts

except where any changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin

1999/4 issued by the Auditing Practices Board. A review consists

principally of making enquiries of group management and applying analytical

procedures to the financial information and underlying financial data, and

based thereon, assessing whether the accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review

excludes audit procedures such as tests of controls and verification of

assets, liabilities and transactions. It is substantially less in scope

than an audit performed in accordance with Auditing Standards and therefore

provides a lower level of assurance than an audit. Accordingly we do not

express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications

that should be made to the financial information as presented for the six

months ended 30th June 1999.

PricewaterhouseCoopers

Chartered Accountants 4th August 1999

London, England

OTHER INFORMATION

Registered office

54 Lombard Street, London, EC3P 3AH, England, United Kingdom.

Tel: 020 7699 5000

Registrar and transfer office

The Registrars to Barclays PLC, PO Box 82, Caxton House, Redcliffe Way,

Bristol, BS99 7NH

Tel: 0117 930 6600

Listing

The principal trading market for Barclays PLC ordinary shares is the London

Stock Exchange. Ordinary shares are also listed on the New York Stock

Exchange and the Tokyo Stock Exchange. Trading on the New York Stock

Exchange is in the form of ADSs under the ticker symbol 'BCS'. Each ADS

represents four #1 ordinary shares and is evidenced by an ADR. The ADR

depositary is Morgan Guaranty Trust Company of New York. Details of trading

activity are published in the stock tables of certain daily newspapers in

the United States.

The non-cumulative dollar-denominated preference shares of Barclays Bank PLC

are traded on the New York Stock Exchange in the form of ADSs. Each series

of preference shares is also listed on the London Stock Exchange.

Filings with the SEC

Statutory accounts for the year ended 31st December 1998, which also include

the joint annual report on Form 20-F of Barclays PLC and Barclays Bank PLC

to the Securities and Exchange Commission in the United States of America,

can be obtained from the Vice President, Corporate Communications, Barclays

Bank PLC, 75 Wall Street, New York, NY 10265 or from the Head of Investor

Relations at Barclays registered office address shown above.

The 1999 interim report including extracts from this announcement will be

posted to shareholders on 16th August 1999 when copies will be available to

the public at Barclays registered office from the Group Secretary.

For further information, please contact:

Oliver Stocken

Finance Director

020 7699 2944 - Direct Line

020 7699 5000 - Switchboard

Ian Roundell

Head of Investor Relations

020 7699 2961 - Direct Line

Leigh Bruce

Director, Corporate Communications

020 7699 2658 - Direct Line

Maria Darby

Director, Group Media Relations

020 7699 2970 - Direct Line

More information on Barclays, including the 1999 interim results, can be

found on our website at the following address:

http://www.investor.barclays.com

END

IRCBIGBICSGCCCS

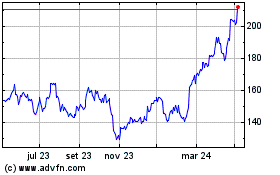

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024