TIDMBEMO

The following amendment has been made to the `Half Year Report' announcement

released on Friday 9 June 2023 at 07:00 am.

The third column of the Key Performance Indicators table within the Financial

Highlights for the period to 31 March 2023 has been corrected to Dividend per

Ordinary Share from Discount per Ordinary Share. All other details remain

unchanged. The full amended text is shown below.

Barings Emerging EMEA Opportunities PLC

Half Year Report

for the six-months ended 31 March 2023

The Directors present the Half-Yearly Financial Report of the Company for the

period to 31 March 2023.

Company Summary

Barings Emerging EMEA Opportunities PLC (the "Company") was incorporated on 11

October 2002 as a public limited company and is an investment company in

accordance with the provisions of Section 833 of the Companies Act 2006 (the

"Act"). It is a member of the Association of Investment

Companies (the "AIC"). The ticker is BEMO.

As an investment trust, the Company has appointed an Alternative Investment Fund

Manager, Baring Fund Managers Limited (the "AIFM"), to manage its investments.

The AIFM is authorised and regulated by the Financial Conduct Authority (the

"FCA"). The AIFM has delegated responsibility of the investment management for

the portfolio to Baring Asset Management Limited (the "Investment Manager" or

"Manager"). Further information on the Investment Manager, their investment

philosophy and management of the Investment Portfolio can be found below.

Management Fee

The AIFM receives an investment management fee of 0.75% of the Net Asset Value

("NAV") of the Company. This is paid monthly in arrears based on the level of

net assets at the end of the month.

Investment Objective and Policy

The Company's investment objective is to achieve capital growth, principally

through investment in emerging and frontier equity securities listed or traded

on Eastern European, Middle Eastern and African ("EMEA") securities markets.

The Company intends predominantly to invest in emerging and frontier equity

listed or traded on EMEA securities markets or in securities in which the

majority of underlying assets, revenues and/or profits are, or are expected to

be, derived from activities in EMEA.

Further details of the investment objective and policy can be found below.

Benchmark

The Company's comparator benchmark is the MSCI Emerging Markets EMEA Index (net

dividends reinvested) (the "Benchmark").

This Benchmark is considered to be most representative of the Company's

investment mandate, which covers Emerging Europe, the Middle East and Africa.

The Investment Manager is not limited or constrained by the constituents of the

comparator benchmark and may invest in any companies it considers appropriate in

accordance with the investment mandate.

Financial Highlights for the six-month period to 31 March 2023

KEY PERFORMANCE INDICATORS

NAV total Share price total return1# Dividend per Ordinary Share1#

return Total

Return1#

-2.1% -5.0% 6p

(31 March 2022: (31 March 2022: -22.6%) (31 March 2022: 6p)

-22.4%)

FINANCIAL HIGHLIGHTS FOR THE SIX MONTH PERIOD TO 31 MARCH 2023

[][][][][][]

31 March 2023 31 March 2022 30 September 2022

NAV per Ordinary 607.8p 705.6p 632.1p

Share[1]

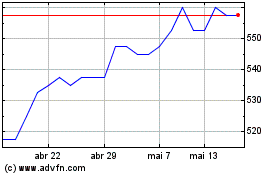

Share price 509.0p 605.0p 548.0p

Share price total -5.0% -22.6% -29.1%

return[1,*,#]

Discount to NAV 16.3% 14.3% 13.3%

per Ordinary

Share[1]

Benchmark [1,*] -5.5% -13.7% -20.1%

Dividend 3.3% 2.8% 3.1%

yield[1,2,3]

Ongoing charges[1] 1.6% 1.5% 1.6%

RETURN PER ORDINARY SHARE

31 31 30

March March September

2023 2022 2022

Revenue Capital Total Revenue Capital Total Revenue

Capital Total

Return 6.71p (20.78)p (14.07)p 8.02p (212.24)p (204.22)p 16.77p

(289.37)p (272.60)p

per

Ordinary

Share

Revenue return (earnings) per Ordinary Share is based on the revenue return of

£805,000 (31 March 2022: £964,000; and the full year to 30 September 2022:

£2,014,000). Capital return per Ordinary Share for the half year is based on net

capital loss of £2,492,000 (31 March 2022: net capital loss of £25,513,000; and

full year to 30 September 2022: net capital loss of £34,746,000). These

calculations are based on the weighted average of 11,921,821 (31 March 2022:

12,020,661; and 30 September 2022: 12,007,165) Ordinary Shares in issue during

the period/year.

As at 31 March 2023, there were 11,807,563 Ordinary Shares of 10 pence each in

issue (31 March 2022: 12,013,503; and 30 September 2022: 11,930,201) which

excludes 3,318,207 Ordinary Shares held in treasury (31 March 2022: 3,318,207;

and 30 September 2022: 3,318,207 shares held in treasury). The shares held in

treasury are treated as not being in issue when calculating the weighted average

of Ordinary Shares in issue during the period/year. During the period 122,638

Ordinary shares were purchased of which 3,727 shares were cancelled with the

balance of 118,911 pending cancellation. Since the period end and up to 31 May

2023, the Company has bought back 10,661 shares for cancellation.

1Alternative Performance Measures ("APMs") definitions can be found in the

Glossary on pages 88 to 91 of the Annual Report.

2 ?The yield as of 31 March 2023 is comprised of the 2022 final dividend of 11

pence per share and the interim dividend for the six months to 31 March 2023 of

6 pence per share, based on the share price as at 31 March 2023.

3 The yield as of 31 March 2022 is comprised of the 2021 final dividend of 11

pence per share and the interim dividend for the six months to 31 March 2022 of

6 pence per share, based on the share price as at 31 March 2022.

*?Movement to 31 March relates to the preceding six months and movement to 30

September relates to the preceding twelve months.

#?Key Performance Indicator.

Chairman's Statement

Frances Daley

Chairman

Performance

EMEA equity markets registered a small decline over the period, following an

extremely volatile performance in the previous financial year. The relatively

modest decline in the index of minus 5.5%, masked a diverse set of returns. Some

markets in Europe rallied in excess of 30%, whilst Middle Eastern markets were

approximately 20% weaker.

Against this backdrop, the Company's Net Asset Value ("NAV") registered a small

decline of minus 2.1%, with the portfolio outperforming the benchmark.

Russian assets in the portfolio continue to be valued at zero, whilst extensive

sanctions and restrictions on the sale of securities remain in place. Dividends

from Russian securities are being received into a Company account, but cannot

currently be repatriated. The Board will continue to value these assets at zero

until circumstances permit otherwise. Consequently, there is no exposure to

Russia in the Company's NAV and Management Fees are not being charged on these

assets.

It is encouraging that performance has continued to improve post the write-down

of Russian assets, with the portfolio ahead of the benchmark over six months and

one year. Regrettably, performance over three and five years continues to be

impacted by the negative relative performance in the prior financial year, with

the Company lagging the benchmark across both periods. However, the portfolio

remains ahead of the benchmark over 7 and 10 years.

Investment Portfolio

The strong performance across markets in Emerging Europe reflected the

continent's improving economic prospects against the backdrop of falling energy

prices, and a surge in many markets that had been undervalued relative to other

developed peers. The Company's holdings in Central and Eastern Europe gained

between 30-50%, with holdings in financials some of our best performers, as

these companies have benefitted from rising interest rates and high demand for

loans.

Similarly, Turkish equities held in the portfolio returned in excess of 30%.

Holdings in the country performed strongest in the first half of the period,

supported by continued low interest rates and by local savers seeking a return

in the inflationary environment.

After being some of the strongest performers globally in the first half of 2022,

markets in the Middle East declined in absolute terms during the period due to a

combination of lower energy prices and a weaker US dollar. After hitting a 20

-year high at the end of Q3 2022, the US Dollar began to depreciate largely on

expectations of peaking interest rates, which in turn amplified negative returns

for markets with pegged currencies, such as Saudi Arabia and the UAE. Whilst the

value of the Company's holdings in these markets declined over the period, stock

selection across these markets was strong and helped improve the Company's

relative performance versus the benchmark.

Holdings in South Africa had a negative impact on relative performance. Consumer

-focused holdings were amongst the worst performers, as some businesses had to

reduce their trading hours due to disruptions to the country's electricity

supply. In contrast, the best performers were gold miners as investors sought

out the safe haven asset amidst higher volatility.

Discount Management

The Board continued to pursue an active discount management strategy during the

period, with the aim of containing discount volatility and providing liquidity

to the market.

During the 6-month period, 122,638 Ordinary Shares were bought back for

cancellation at an average price of £5.22 per Ordinary Share, for a total cost

of £640,000. The share buybacks added approximately 1.2 pence to NAV per

Ordinary Share, accounting for just under 0.2% of the total return to

Shareholders.

The discount at 31 March 2023 was 16.3% and the average discount during the

period was 17.9%. This compares with a discount of 14.3% at 31 March 2022. The

average discount over the period has widened, primarily due to increased levels

of market volatility across our investment universe and equity markets globally.

This has had a similar impact on the discounts of many investment trusts

and is not unique to our Company.

Interim Dividend

Income generated by the portfolio has also been impacted in the short-term by

the strong appreciation of Sterling over the reporting period relative to most

currencies in our investment universe, which has weakened dividends received

when expressed in GBP terms. The dividends received from your investments and

therefore the dividends paid out to shareholders have been negatively impacted

by the removal of high payout Russian companies from our investment universe due

to the war in Ukraine. Income generated by the portfolio has also been impacted

in the short-term by the strong appreciation of Sterling over the reporting

period relative to most currencies in our investment universe, which has

weakened dividends received when expressed in GBP terms. The Investment Manager

continues to believe the income potential of the portfolio will grow over the

medium term and that this growth will be sustainable.

In the first half of the financial year, the income account generated a return

of 6.7 pence per Ordinary Share, compared with 8.0 pence for the same period

last year. The Directors are proposing an interim dividend of 6.0 pence per

share, which is the same as last year. The rebalancing of the amount of dividend

paid by way of an Interim Dividend and a Final Dividend which occurred last

year, allows for increased certainty at a time when income projections remain

subject to considerable uncertainty.

Based on dividends over the prior 12 months and the share price as of the end of

the first half of the financial year, the Company's shares yielded 3.3%. The

Board believes that, given the circumstances, this remains an attractive yield.

The Board remains mindful of the significance of the continued payment of

dividends to Shareholders. The Company retains the flexibility to pay out up to

1% per annum of NAV from capital as income to Shareholders. The Investment

Manager continues to believe the income potential of the portfolio will grow

over the medium term and that this growth will be sustainable.

Gearing

There were no borrowings during the period. At 31 March 2023, there was net cash

of £1.4 million (31 March 2022: £1.4 million). The Company does not currently

use a loan facility but keeps its borrowing arrangements and gearing policy

under review. The Company may look to make use of borrowing arrangements when

markets are less volatile with the objective of increasing portfolio returns.

Outlook

Equity markets are likely to remain volatile over the coming months as the path

for inflation and interest rates remains uncertain, and the global economic

outlook continues to present challenges for corporate earnings growth in 2023.

Whilst these trends will undoubtedly impact our investment region, there are

reasons to be optimistic.

We have already seen the positive effect Europe's improving economic picture has

had on the returns across a number of countries in the portfolio. Companies in

the financial services sector in Eastern Europe continue to represent a

significant portion of the portfolio and the Investment Manager is positive on

the prospects for the sector.

Middle Eastern economies continue to benefit from low inflation, healthy

consumer demand and high capital investment. Whilst these markets were weaker

over the reporting period, the Investment Manager continues to find many

exciting opportunities for medium term growth across a number of sectors.

The economic backdrop in South Africa is more challenged, given the ongoing

issues with the country's electricity supply as well as heightened political

risk. However, opportunities do exist for well managed business to navigate what

is undoubtedly a difficult macroeconomic backdrop.

Finally, the political calendar across EMEA for 2023 is fairly congested, with

the recent elections in Greece and Türkiye to be followed towards the end of the

year by elections in Poland. In Greece, the second term won by Prime Minister

Mitsotakis' New Democracy party should help enable the continuation of

structural reform, whilst the victory for President Erdogan in Türkiye will

continue to present challenges as the country attempts to unlock its economic

potential. These are events that may provide compelling bottom-up investment

opportunities but also bring with them a degree of risk.

Promotional activity and keeping shareholders informed

The Board and Investment Manager have in place an ongoing communications

programme that seeks to maintain the Company's profile and its investment remit,

particularly amongst retail investors. Over the review period we have continued

to distribute our monthly BEMO News which is emailed to engaged supporters,

including many hundreds of the Company's shareholders. These emails provide

relevant news and views plus performance updates, which are particularly useful

when there is market uncertainty. If you have not already done so, I encourage

you to sign up for these targeted communications by visiting the Company's web

page at www.bemoplc.com and clicking on `Register for email updates'. Alongside

this, we are continuing to refresh the Company's website with new themed

content, including a recent video update from co-portfolio manager Adnan El

-Araby.

Frances Daley

Chairman

8 June 2023

Business Model and Strategy

Barings Emerging EMEA Opportunities PLC

· Focusing on the markets of Emerging Europe, the Middle East and Africa, the

Company seeks out attractively valued, quality companies across this diverse

and fast-changing region.

· Large investment region underrepresented in global portfolios, with a

portfolio that aims to deliver both attractive levels of income and capital

growth over the long term.

· Managed by one of the region's most experienced investment teams with a

consistent track record of delivering relative outperformance.

· A differentiated and innovative investment process driven by fundamental

bottom-up analysis - with a strong focus on environmental, social and

governance factors.

The Company has no employees and the Board is comprised of Non-Executive

Directors. The day-to-day operations and functions of the Company have been

delegated to third-party service providers, which are subject to the ongoing

oversight of the Board. In line with the stated investment philosophy, the

Manager takes a bottom-up approach, founded on research carried out using the

Manager's own internal resources. This research enables the Manager to identify

what it believes to be the most attractive stocks in EMEA markets. Further

information can be found on pages 20 to 22 of the Annual Report and Accounts for

the year ended 30 September 2022.

Investment Objective

The Company's investment objective is to achieve capital growth, principally

through investment in emerging and frontier equity securities listed or traded

on Eastern European, Middle Eastern and African (EMEA) securities markets. The

Company may also invest in securities in which the majority of underlying

assets, revenues and/or profits are, or are expected to be, derived from

activities in EMEA but are listed or traded elsewhere (EMEA Universe).

Purpose, Values and Strategy

To achieve this investment objective, the Board uses its breadth of skills,

experience and knowledge to oversee and work with the Investment Manager, to

ensure that it has the appropriate capability, resources and controls in place

to actively manage the Company's assets to meet its investment objective. The

Board also select and engage reputable and competent organisations to provide

other services on behalf of the Company.

The Company's values focus on transparency, clarity and constructive challenge.

The Directors recognise the importance of sustaining a culture that contributes

to achieving the purpose of the Company that is consistent with its values and

strategy.

Benchmark

The Company's comparator Benchmark is the MSCI Emerging Markets EMEA Index (net

dividends reinvested).

Investment Policy

The Company intends to invest for the most part in emerging and frontier equity

listed or traded on EMEA securities markets or in securities in which the

majority of underlying assets, revenues and/or profits are, or are expected to

be, derived from activities in EMEA but are listed or traded elsewhere. To

achieve the Company's investment objective, the Company selects investments

through a process of bottom-up fundamental analysis, seeking long term

appreciation through investment in mispriced companies.

Where possible, investments will generally be made directly into public listed

or traded equity securities including equity-related instruments such as

preference shares, convertible securities, options, warrants and other rights to

subscribe or acquire equity securities, or rights relating to equity securities.

It is intended that the Company will generally be invested in equity securities;

however, the Company may invest in bonds or other fixed-income securities,

including high risk debt securities. These securities may be below investment

grade. The number of investments in the portfolio will normally range between 20

and 65.

The Company may invest in unquoted securities, but the amount of such investment

is not expected to be material. The maximum exposure to unquoted securities

should be restricted to 5% of the Company's gross assets, at the time of

investment, in normal circumstances. The Company may also invest in other

investment funds in order to gain exposure to EMEA countries or gain access to a

particular market, or where such a fund represents an attractive investment in

its own right. The Company will not invest more than 10% of its gross assets in

other UK listed closed-ended investment funds, save that, where such UK listed

closed ended investment funds have themselves published investment policies to

invest no more than 15% of their total assets in other listed closed-ended

investment funds, the Company will invest not more than 15% of its gross assets

in such UK listed closed ended investment funds.

Whilst there are no specific limits placed on exposure to any one sector or

country, the Company seeks to achieve a spread of risk through continual

monitoring of the sector and country weightings of the portfolio. The Company's

maximum limit for any single investment at the time of purchase is the higher of

15% of gross assets or the weight of the purchased security in the comparator

benchmark plus 5%, with an upper maximum limit of 20% of gross assets (excluding

for cash management purposes).

Relative guidelines will be based on the Morgan Stanley Capital International

"MSCI" Emerging Markets EMEA Index (net), which will be the index used as the

comparator benchmark.

The Company may use borrowed funds to take advantage of investment

opportunities. However, it is intended that the Company would only be geared

when the Directors, advised by the Investment Manager, have a high level of

confidence that gearing would add significant value to the portfolio. The

Investment Manager has discretion to operate with an overall exposure of the

portfolio to the market of between 90% and 110%, to include the effect of any

derivative positions.

The Company may use derivative instruments for the purpose of efficient

portfolio management (which includes hedging) and for any investment purposes

that are consistent with the investment objective and policies of the Company.

Discount Control Mechanism

The Board is aware of Shareholders' continued desire for a strong discount

control mechanism, though also mindful of the need to provide the Company the

opportunity to achieve its goal of outperforming its Benchmark.

With effect from 1 October 2020, the Board approved a tender offer trigger

mechanism to provide Shareholders with a tender offer for up to 25% of the

Company's issued Ordinary Share capital if: (i) the average daily discount of

the Company's market share capital to its net asset value (`cum-income') exceeds

12%, as calculated with reference to the trading of the Company's shares over

the period between 1 October 2020 and 30 September 2025; or

(ii) the performance of the Company's net asset value per share on a total

return basis does not exceed the return on the MSCI Emerging Markets EMEA Index

(net) by an average of 50 basis points per annum over the Calculation Period.

Please refer to the shareholder circular dated 19 October 2020 for further

details.

In addition, and in order to reduce the discount, the Board authorises the

Company's shares to be bought on the market, from time to time, where the share

price is quoted at a discount to NAV.

Report of the Investment Manager

Our strategy seeks to diversify your portfolio by harnessing the long-term

growth and income potential of Emerging EMEA. The portfolio is managed by our

team of experienced investment professionals, with a repeatable process that

also integrates Environmental, Social and Governance ("ESG") criteria.

Our strategy

Access First-hand Process ESG Integration

Expertise

Experienced Extensive Fully integrated dynamic

investment team The primary ESG assessment combined

helps to investment research and

foster strong team conducts proprietary with active engagement

relationships with hundreds of fundamental to positively influence

the company analysis,

meetings per evaluating ESG practices.

companies in which year, companies

building long

we invest. term over a 5-year

relationships research

and insight. horizon with

macro

considerations

incorporated

through our

Cost of Equity

approach.

A detailed description of the investment process, particularly the ESG approach

can be found on pages 20 to 22 of the Annual Report and Accounts for the year

ended 30 September 2022.

Market Summary

EMEA equity markets were weaker over the period, with the MSCI EM EMEA index

declining -5.5% in GBP terms. Against a challenging market backdrop, the

Company's NAV declined by -2.1% but outperformed the benchmark, which fell by

-5.5%.

Headline performance masked a diverse set of results for countries in our

region, with markets in the Middle East suffering some profit taking after

outperforming for much of 2022 whilst, in contrast, Central and Eastern Europe

rallied significantly on improving economic prospects. The broader global themes

of high inflation and rising interest rates also had an impact on performance at

times during the period.

The EMEA region generated positive returns at the start of the period, helped by

a resilient economic backdrop and improved company earnings expectations, as

risks of a severe recession receded in light of falling energy prices that are

now back at levels last seen prior to Russia's invasion of Ukraine. Positive

sentiment also reflected hopes that inflation across developed countries might

be cooling and, in response, major central banks would slow the pace of interest

rate hikes.

This early rally was, however, brought to an abrupt halt, as strong economic

data in the US, and higher than anticipated inflation led investors to reassess

the path for interest rates. While inflation has begun to recede as food and

energy costs have fallen, core inflation, which strips away these more volatile

facets, has not fallen as fast as anticipated. This led investors to change

their perceptions, moving from the expectation of falling interest rates, to an

environment where rates would likely stay higher for longer.

Later in the period the market began predicting a peak in interest rates due to

the slowing pace of central bank hikes and because of stresses in the banking

sector following the collapse of US regional banks SVB and Signature, and then

shortly thereafter the effective rescue takeover of Credit Suisse by UBS. These

events contributed to the depreciation of the Dollar, which had begun to weaken

in Q4 2022, and amplified negative returns in Middle Eastern markets due to

their pegged currencies.

Regionally, markets in Central and Eastern Europe were some of the best

performers across EMEA, reflecting the reduced risk of a recession across the

continent following the significant retrenchment in energy prices. Greece,

Poland, Hungary and Czechia all returned approximately 30% over the period.

Performance was also amplified by local currency strength, with the Czech

Koruna, Hungarian Forint and Polish Zloty all appreciating versus the Pound over

the period.

EMEA Market Performance (in GBP, based on MSCI indices)

Currency Returns (local currency returns vs. GBP)

Country Returns

+------------+------+

|Greece |35.0% |

+------------+------+

|Turkiye |33.2% |

+------------+------+

|Poland |32.1% |

+------------+------+

|Czechia |27.9% |

+------------+------+

|Hungary |26.6% |

+------------+------+

|Egypt |11.8% |

+------------+------+

|South Africa|6.2% |

+------------+------+

|Kuwait |-8.1% |

+------------+------+

|Saudi Arabia|-16.4%|

+------------+------+

|U.A.E. |-17.8%|

+------------+------+

|Qatar |-24.0%|

+------------+------+

Source: Barings, Factset, MSCI, March 2023

Currency Returns

+------------+------+

|Greece |0.2% |

+------------+------+

|Turkiye |-12.7%|

+------------+------+

|Poland |3.9% |

+------------+------+

|Czechia |4.9% |

+------------+------+

|Hungary |11.5% |

+------------+------+

|Egypt |-42.5%|

+------------+------+

|South Africa|-8.0% |

+------------+------+

|Kuwait |-8.5% |

+------------+------+

|Saudi Arabia|-9.4% |

+------------+------+

|U.A.E. |-9.5% |

+------------+------+

|Qatar |-9.4% |

+------------+------+

Source: Barings, Factset, MSCI, March 2023.

Eastern European markets were some of the strongest performers in absolute

terms, whilst weakness in middle Eastern markets was compounded by currency

depreciation.

South Africa also outperformed over the period, although to a lesser extent than

markets in Europe, amid a domestic economy with contrasting drivers. At one end

of the spectrum, the country's gold miners were some of the best performers as

investors sought out safe haven assets, whilst retailers were impacted by

ongoing supply disruption to local electricity supply.

In contrast, markets in the Middle East suffered from some profit taking and

retreated from their earlier highs in 2022. Falling energy prices, a weaker US

dollar and concerns of oversupply following a period of robust capital market

activity also contributed to the negative performance.

Our region underperformed relative to developed and broader emerging markets

over the period. Whilst we benefitted from the significant rally across Emerging

European markets, this was offset by weakness in the Middle East, with Gulf

markets beginning to underperform in Q4 2022 at the time when broader emerging

markets began to outperform, reflecting the reopening of China's economy.

Income

The Company's key objective is to deliver capital growth from a carefully

selected portfolio of emerging EMEA companies. However, we are also focused on

generating an attractive level of income for investors from the companies in the

portfolio.

The portfolio continues to be impacted by our inability to receive dividends

from Russian holdings, which are being accrued in a Company account but which

cannot be repatriated due to sanctions. Unfortunately, this has resulted in a

lower level of dividend generation compared to recent history. Despite this, we

are of the opinion that the underlying revenue generation potential relative to

present valuations within the region remains one of the strongest globally.

Rising pay-out ratios, efficiency gains, and an encouraging economic

environment, most notably in the Middle East and Eastern Europe, will all

contribute positively to revenue growth for the portfolio over the medium term.

Importantly, we believe that this revenue growth will be sustainable.

Macro Themes

In line with our bottom-up approach, our primary focus is to identify attractive

investment opportunities at the company level for our Shareholders.

Nevertheless, we remain vigilant and mindful of broader macro effects within the

region. This in turn helps to support the contribution to performance from our

company selection, accessing long term growth opportunities, while reducing the

effects of declines in performance from major macro dislocations.

Energy Security: One Year On

Russia's invasion of Ukraine led to significant increases in energy prices and

served to push energy security up the agenda, most notably in Europe, which

relied on Russia heavily for its energy mix. Sanctions that followed shortly

after from both the EU and US included a ban on Russian coal imports, alongside

a ban on crude oil and refined petroleum products, with limited exceptions. In

response to these sanctions, Russian natural gas exports to the EU declined

significantly.

Whilst energy prices have fallen from their peaks, the issue remains a priority

for many governments as they seek alternative ways to meet their energy needs.

Prior to the invasion, Russia accounted for approximately 35% of the European

Union's gas imports and 29% of their oil. Since then, dependence on Russian

energy has been significantly reduced, with data released for the fourth quarter

of 2022 showing that Russia accounts for approximately 19% of the bloc's natural

gas imports and 10% of oil imports.

The US, the UK and Norway have all benefited from the EU shifting away from

Russian energy, with natural gas imports from these countries increasing

significantly since the onset of the war. There have also been opportunities for

countries in our investment universe: the share of EU oil imports coming from

Saudi Arabia increased from 5% in 2021 to 9% as of Q3 2022, whilst Qatar now

accounts for 9% of natural gas imports, up from 5% in 2021.

We believe this shift will continue to benefit the economies of Middle Eastern

markets. Demand for the region's exports should not only improve the spending

power of its consumers, creating investment opportunities across multiple

sectors, but will also allow for continued investment into infrastructure and

the diversification of their economies away from oil, helping support long term

financial stability.

Supplying the Green Revolution

The need to transition towards a world less dependent on fossil fuels remains

one of the most critical issues of our time. This will require substantial

investments in solar and wind generation capacity and will require mining and

processing significantly higher amounts of raw materials - namely copper,

aluminum, nickel, platinum group metals, and rare earths, often referred to as

`green metals' - than we have in the last 30 years.

A lack of investment in supply has led to growing imbalances of these raw

materials. For example, in the last couple of years we have seen a huge increase

in the price of copper, from approximately $6000 per tonne in 2019 to $9000 per

tonne at the start of 2023. This economically sensitive commodity has increased

in price despite most economists predicting slowing global growth or even a

recession. We believe the increase in the price of copper is caused by concerns

regarding a lack of supply of a metal that is critical to the energy transition

with global inventories of copper now reportedly at their lowest levels since

2008. Tightness in supply is not expected to be alleviated in the near-term as

the time to find, permit, develop and commission a new mine can take up to 15

years, setting the scene for higher pricing for the foreseeable future. These

supply constraints are not just confined to copper, as the mining of other

commodities such as lithium and nickel also require similar lead times against a

backdrop of higher demand.

The Company continues to invest in a variety of companies that have a role to

play in meeting this demand for raw materials. For example, Anglo American

(nickel, copper), Anglo American Platinum and Impala Platinum (platinum group

metals) and KGHM (copper).

The Political Calendar: Türkiye and Greece

It is difficult to overstate the importance of the recent elections in the

Eastern Mediterranean neighbouring countries of Türkiye and Greece as the

electorate set the tone for what are very promising markets, with a host of

attractively valued, quality companies.

In Greece, victory for Prime Minister Mitsotakis' New Democracy party is a vote

for the continuation of the country's structural reform program. The program has

so far contributed to an impressive economic recovery, record economic growth

rates in the European context and a tangible pick up in foreign direct

investment. However, this has been offset somewhat by high inflation that has

dented the government's popularity.

In Türkiye, the victory for President Erdogan will come with significant

challenges given his historic approach to monetary policy. Cleaning the slate

after the elections won't come without challenges and it will need much more

than gestures for markets to start believing in the country's economic

potential. However, any indication that the Erdogan administration may be

turning towards more orthodox monetary policies would likely be greeted

favourably by the market.

Portfolio Country Weight

+------------+-----+

|Saudi Arabia|31.1%|

+------------+-----+

|South Africa|25.9%|

+------------+-----+

|U.A.E. |10.0%|

+------------+-----+

|Poland |8.0% |

+------------+-----+

|Qatar |5.7% |

+------------+-----+

|Kuwait |4.8% |

+------------+-----+

|Hungary |4.4% |

+------------+-----+

|Turkiye |4.1% |

+------------+-----+

|Greece |3.9% |

+------------+-----+

|Czechia |1.9% |

+------------+-----+

Source: Barings. March 2023.

Portfolio Sector Weight

+----------------------+-----+

|Financials |48.3%|

+----------------------+-----+

|Materials |14.7%|

+----------------------+-----+

|Consumer Discretionary|10.6%|

+----------------------+-----+

|Communication Services|9.5% |

+----------------------+-----+

|Industrials |4.8% |

+----------------------+-----+

|Real Estate |4.2% |

+----------------------+-----+

|Energy |3.2% |

+----------------------+-----+

|Consumer Staples |3.1% |

+----------------------+-----+

|Information Technology|1.5% |

+----------------------+-----+

|Health Care |0.1% |

+----------------------+-----+

Source: Barings. March 2023.

Company Selection

Our team regularly engages with management teams and analyses industry

competitors to gain an insight into a company's business model and sustainable

competitive advantages. Based on this analysis, we seek to take advantage of

these perceived inefficiencies through our in-depth fundamental research, which

includes an integrated Environmental, Social and Governance (ESG) assessment,

and active engagement, to identify and unlock mispriced growth opportunities for

our Shareholders.

Stock selection significantly improved the portfolio's relative return over the

period, whilst sector asset allocation had a small negative impact.

Stock selection in the Financials sector had the largest positive impact on

relative performance. The portfolio's holdings in Emerging Europe were some of

the best performers, as high interest rates and robust credit demand across the

region have fed through to strong company earnings, whilst Polish financials

also benefitted from ongoing efforts to resolve the legacy burden of loan loss

provisions on mortgages denominated in Swiss francs. Polish insurance business

PZU, National Bank of Greece and Komercni in Czechia were amongst the

portfolio's best performers on a relative basis.

Strong performance of European financials was partially offset by Middle Eastern

banks, with the holding Saudi National Bank (SNB) detracting after the company

came under pressure following uncertainty regarding its M&A strategy and news

that the government will be reducing mortgage subsidies. The holding in Qatar

National Bank (QNB) also underperformed, caused in part by a more muted growth

outlook domestically. We reduced the holdings in both SNB and QNB over the

period.

Despite volatility in the global banking sector towards the end of the reporting

period we continue to believe that financials in our investment region, and

BEMO's holdings specifically, are in a strong financial position. The banks are

well capitalised, have firm regulatory oversight and hedge their interest rate

exposure. The sector is also highly concentrated, meaning retail and corporate

deposits are less vulnerable to withdrawals.

Engagement Case Study:

Tawuniya (insurance company)

We regularly engage with companies with the aim of improving corporate

behaviour or enhancing disclosure levels.

Overview:

· Over the period we engaged with Saudi insurance company Tawuniya to discuss

its ESG policies and identify areas for improvement.

Objective:

· Following release of Tawuniya's first ESG report we wanted to engage with

them to give guidance on areas for improvement and to monitor targets that the

company has set.

Outcome:

· We initially engaged with the company to encourage them to publish a formal

ESG policy, which was acknowledged and actioned shortly thereafter.

· We welcomed the publication of the ESG report but recognised the potential

for improvement in areas such as workers' rights, whistleblowing, and data

security.

· We have since re-engaged with the company and suggested enhancements to

these areas for the next report. We continue to monitor Tawuniya's progress

against these enhancements and other targets the company has set itself.

Positioning in the Materials sector also improved relative performance over the

period, driven largely by holdings in South Africa. Gold miner AngloGold Ashanti

was one of the portfolio's top performers on a relative basis, helped by rising

gold prices and news of a joint venture with Gold Fields to create Africa's

largest gold mine. In contrast Anglo American Platinum underperformed,

reflecting a weaker production outlook and some short term earnings weakness.

In the Industrials sector Turkish conglomerate Koc Holding was one of the best

performers. The operational performance of Koc's subsidiaries has been strong,

particularly the company's export orientated businesses, such as refiner Tupras,

that have benefitted from a weaker Lira in recent months.

The Consumer Staples sector had a negative impact on relative returns in

aggregate. South African retailers were amongst the weakest performers, as they

suffered from significant wage inflation and disruption to trading hours because

of electricity cuts. Pick N Pay and Mr Price Group were two of the largest

detractors on a relative basis and both were sold over the period. In contrast,

amongst Consumer Discretionary holdings the position in ecommerce and technology

investor Prosus outperformed. The company holds a significant stake in Tencent,

which is expected to benefit from the rebound of consumption in China as a

result of COVID-19 restrictions being lifted, and a more favourable regulatory

backdrop.

The portfolio's underweight exposure to the Health Care sector also had a

negative impact on relative performance following the strong performance of a

small number of benchmark holdings. There continues to be a very limited

opportunity set in this space across EMEA and we believe there are better

opportunities elsewhere.

Outlook

In the short term equity markets are likely to remain volatile as investors

monitor developments in Ukraine, as well as the outlook for inflation and global

economic growth. However, there is evidence that monetary tightening may have

moderated inflation which is supportive. While the region will not be immune to

these global trends, we believe there are a number of compelling opportunities

across EMEA.

The Middle East continues to invest large sums of capital to further diversify

their economies. This, combined with robust consumer demand, lower inflation and

higher labour participation rate should continue to support earnings growth

across multiple sectors. The representation of the Middle East in major indices

has risen recently, whilst a burgeoning IPO market is broadening the investment

opportunity. Interestingly, Middle Eastern markets remain underrepresented

within investor portfolios, which - in combination with the region's economic

and structural tailwinds mentioned above - should help increase demand across

the region's equity markets.

South Africa presents another interesting investment opportunity, primarily

because of its access to a broad range of metals, many of which have a role to

play in the energy transition. High commodity prices have helped improve the

country's fiscal position, whilst increased demand from China reopening its

economy will also be supportive. Political risk has increased recently and we

remain vigilant to the potential for social unrest, whilst the country struggles

to resolve the problem of electricity supply outages.

Markets across Central and Eastern Europe look set to have a softer economic

landing than originally feared, helped by the significant fall in energy prices.

Opportunities will exist as the region pivots away from Russian gas,

particularly via the support of large EU infrastructure projects, such as the

European Green Deal and NextGen EU funds. The region is also well placed to take

advantage of nearshoring trends via the provision of lower cost skilled labour,

strong regulatory protection, and crucially, a lower delivery time for the end

consumer.

While Emerging European, Middle East and African markets have experienced

challenges, the recent market volatility has also resulted in a potential

opportunity, particularly for long term investments in high quality businesses

with the potential for earnings growth that have seen their share prices weighed

down by broader market moves. Markets continue to digest near term challenges to

economic growth, alongside shifts from disruptive technological innovation and

geopolitical tensions, all of which may cause mispricings from which the

portfolio can benefit. This, however, creates an environment in which divergence

in company performance is likely to increase as companies adjust and winners

emerge stronger This environment offers improving opportunities for active

management to secure outperformance. We intend to take advantage of this

opportunity by adopting, where possible, an increasingly active approach

designed to enhance potential returns for our shareholders.

Baring Asset Management Limited

Investment Manager

8 June 2023

Investment Portfolio

as at 31 March 2023

Holding Primary country Market value % of

of listing or investment £'000 Net assets

1 Al Rajhi Bank Saudi Arabia 4,869 6.78%

2 Naspers Limited South Africa 4,489 6.25%

3 Saudi National Bank Saudi Arabia 3,493 4.87%

4 Saudi Basic Saudi Arabia 3,370 4.70%

Industries

5 Qatar National Bank Qatar 2,987 4.16%

6 Firstrand South Africa 2,969 4.14%

7 MTN Group South Africa 2,600 3.62%

8 Saudi Telecom Saudi Arabia 2,477 3.45%

9 PZU Poland 2,214 3.08%

10 Abu Dhabi Commercial United Arab Emirates 2,073 2.89%

Bank

11 Aldar Properties United Arab Emirates 2,051 2.86%

12 Koç Holding Türkiye 1,975 2.75%

13 National Bank of Kuwait 1,831 2.55%

Kuwait

14 Anglogold Ashanti South Africa 1,787 2.49%

15 Mol Hungarian Oil and Hungary 1,617 2.25%

Gas

16 Etihad Etisalat Saudi Arabia 1,590 2.22%

17 National Bank of Greece 1,584 2.21%

Greece

18 OTP Bank Hungary 1,458 2.03%

19 Allegro Poland 1,441 2.01%

20 First Abu Dhabi Bank United Arab Emirates 1,374 1.91%

21 Komercni Bank Czechia 1,345 1.87%

22 Saudi Arabian Mining Saudi Arabia 1,307 1.82%

23 Anglo American South Africa 1,290 1.80%

24 Human Soft Kuwait 1,180 1.64%

25 BUPA Arabia Saudi Arabia 1,126 1.57%

26 Nedbank Group South Africa 1,058 1.47%

27 Industries Qatar Qatar 1,025 1.43%

28 Shoprite Holdings South Africa 1,021 1.42%

29 Arabian Internet and Saudi Arabia 1,015 1.41%

Communication

Services

30 Riyad Bank Saudi Arabia 949 1.32%

31 Anglo American South Africa 934 1.30%

Platinum

32 Alpha Services and Greece 909 1.27%

Holdings

33 The Cooperative Saudi Arabia 877 1.22%

Insurance

34 Emaar Properties United Arab Emirates 872 1.22%

35 PKO Bank Polski Poland 855 1.19%

36 Impala Platinum South Africa 831 1.16%

37 BIM Birlesik Türkiye 815 1.14%

Magazalar

38 Capitec South Africa 798 1.11%

39 KGHM Polska Poland 739 1.03%

40 Saudi Tadawul Group Saudi Arabia 623 0.87%

41 Adnoc Dilling Company United Arab Emirates 616 0.86%

42 Inpost Poland 372 0.52%

43 Bid Corporation South Africa 360 0.50%

44 Kuwait Finance House Kuwait 357 0.50%

45 Jumbo Greece 228 0.32%

46 D Market Electronic Türkiye 91 0.13%

Services

47 Dr Sulaiman Al Habib Saudi Arabia 83 0.12%

Medical Group

48 Gazprom Russia - 0.00%

49 GMK Norilskiy Nikel Russia - 0.00%

50 Magnit Russia - 0.00%

51 Moscow Exchange Russia - 0.00%

52 NK Lukoil Russia - 0.00%

53 Novatek Russia - 0.00%

54 Sberbank Rossi Russia - 0.00%

56 Tcs Group Holding Russia - 0.00%

56 United Company Rusal Russia - 0.00%

57 X5 Retail Group Russia - 0.00%

58 Yandex Russia - 0.00%

Total investments 69,925 97.43%

Net current assets 1,842 2.57%

Net assets 71,767 100.00%

Income Statement

for the six months to 31 March 2023 (unaudited)

Six

Year

months Six months

ended 30

to 31 to 31 March

September

March 2022

2022

2023

Notes Revenue Capital Total £'000 Revenue Capital Total

Revenue Capital Total

£'000 £'000 £'000 £'000 £'000

£'000 £'000

£'000

(Losses)/gai - (2,167) (2,167) - (25,265)

(25,265) - (34,402) (34,402)

ns

on

investments

held at

fair

value

through

profit or

loss

Foreign - (104) (104) - 52 52

- 190 190

exchange

gains/losses

Income 1,270 - 1,270 1,829 - 1,829

3,440 - 3,440

Investment (55) (221) (276) (74) (300) (374)

(133) (533) (666)

management

fee

Other (342) - (342) (409) - (409)

(790) (1) (791)

expenses

Return on 873 (2,492) (1,619) 1,346 (25,513)

(24,167) 2,517 (34,746) (32,229)

ordinary

activities

before

taxation

Taxation (68) - (68) (382) - (382)

(503) - (503)

Return for 805 (2,492) (1,687) 964 (25,513)

(24,549) 2,014 (34,746) (32,732)

the

period

Return per 3 6.71p (20.78p) (14.07p) 8.02p (212.24p)

(204.22p) 16.77p (289.37p) (272.60p)

ordinary

share

The total column of this statement is the income statement of the Company.

The supplementary revenue and capital columns are both prepared under the

guidance published by the AIC.

All revenue and capital items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the period.

There is no other comprehensive income and therefore the return for the year is

also the total comprehensive income for the year.

The notes below form part of these financial statements.

Statement of Financial Position

as at 31 March 2023 (unaudited)

Notes At 31 March At 31 March At

2023 2022 30 September

£'000 £'000 2022

£'000

Fixed assets

Investments at fair 6 69,925 83,233 75,059

value through profit or

loss

Current assets

Debtors 976 647 467

Cash and cash 1,417 1,350 233

equivalents

2,393 1,997 700

Current liabilities

Creditors: amounts (551) (462) (351

falling due within one

year

Net current assets 1,842 1,535 349

Net assets 71,767 84,768 349

Capital and reserves

Called-up share capital 4 1,513 1,533 1,525

Capital redemption 3,275 3,255 3,263

reserve

Share premium 1,411 1,411 1,411

Capital reserve 63,886 76,707 67,018

Revenue reserve 1,682 1,862 2,191

Total equity 71,767 84,768 75,408

Net asset value per 5 607.81p 705.60p 632.08p

share

Number of shares in 11,807,563 12,013,503 11,930,201

issue excluding Treasury

The notes below form part of these financial statements.

Statement of Changes in Equity

for the six months to 31 March 2023 (unaudited)

Called Capital Share Capital Revenue Total

-up reserve

redemption premium reserve £'000

share £'000 £'000

reserve account

capital £'000

£'000

£'000

For the six

months ended

31

March 2023

Opening 1,525 3,263 1,411 67,018 2,191 75,408

balance as at

1

October 2022

Return for the - - - (2,492) 805 (1,687)

six months to

31 March 2023

Contributions

by and

distributions

to

Shareholders:

Repurchase of (12) 12 - (640) - (640)

Ordinary

Shares

Dividends paid - - - - (1,314) (1,314)

Total (12) 12 - (640) (1,314) (1,954)

contributions

by and

distributions

to

Shareholders:

Balance as at 1,513 3,275 1,411 63,886 1,682 71,767

31 March 2023

Called Capital Share Capital Revenue Total

-up reserve

redemption premium reserve £'000

share £'000 £'000

reserve account

capital £'000

£'000

£'000

For the six

months ended

31

March 2022

Opening 1,536 3,252 1,411 102,479 2,220 110,898

balance as at

1

October 2021

Return for the - - - (25,513) 964 (24,549)

six months to

31 March 2022

Contributions

by and

distributions

to

Shareholders:

Repurchase of (3) 3 - (259) (1,322) (259)

Ordinary

Shares

Dividends paid - - - - (1,322) (1,322)

Total (3) 3 (259) (1,581)

contributions

by and

distributions

to

Shareholders:

Balance as at 1,533 3,255 1,411 76,707 1,862 84,768

31 March 2022

Called Capital Share Capital Revenue Total

-up reserve

redemption premium reserve £'000

share £'000 £'000

reserve account

capital £'000

£'000

£'000

For the year

ended 30

September 2022

Opening 1,536 3,252 1,411 102,479 2,220 110,898

balance as at

1

October 2021

Return for the - - - 2,014 (32,732)

year

Contributions - (715) - (715)

by and

distributions

to

Shareholders:

Repurchase of (11) 11 - - (715)

Ordinary

Shares

Dividends paid - - - - (2,043) (2,043)

Total (11) 11 - (715) (2,043) (2,758)

contributions

by and

distributions

to

Shareholders:

Balance at 30 1,525 3,263 1,411 67,018 2,191 75,408

September 2022

The distributable reserves of the Company at 31 March 2023 were £63,886,000 (31

March 2022: £88,384,000; 30 September 2022: £61,870,000).

All investments are held at fair value through profit or loss. When the Company

revalues the investments still held during the period, any gains or losses

arising are credited/charged to the capital reserve.

The notes below form part of these financial statements.

Notes to the Financial Statements

for the half year ended 31 March 2023 (unaudited)

1. Accounting Policies

Barings Emerging EMEA Opportunities PLC (the "Company") is a company

incorporated and registered in England and Wales. The principal activity of the

Company is that of an investment trust company within the meaning of Sections

1158/159 of the Corporation Tax Act 2020 and its investment approach is detailed

in the Strategic Report set out in the Annual Report and Financial Statements of

the Company for the year ended 30 September 2022.

Basis of Preparation

The Company's Financial Statements for the six months to 31 March 2023 have been

prepared on the basis of the accounting policies set out in the Annual Report

and Financial Statements of the Company for the year ended 30 September 2022 and

in accordance with FRS 104: "Interim Financial Reporting".

The investments of the Company are listed and are carried at fair value. The

Company has therefore elected to remove the Cash Flow Statement from the Half

-Yearly Report, as permitted by FRS 102 section 7.

The accounting policies are set out in the Company's Annual Report and Financial

Statements for the year ended 30 September 2022 and remain unchanged.

Going Concern

The financial statements have been prepared on a going concern basis and on the

basis that approval as an investment trust company will continue to be met.

The Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that the Company has adequate resources to

continue in operational existence for a period of at least twelve months from

the date when these financial statements were approved.

In making the assessment, the Directors have considered the likely impacts of

the international and economic uncertainties on the Company, operations and the

investment portfolio. These include, but are not limited to, the impact of COVID

-19, the war in Ukraine, international uncertainties, political and economic

instability in the UK, supply shortages and inflationary pressures.

The Directors noted that the Company's current cash balance exceeds any short

term liabilities, the Company holds a portfolio of listed investments. The

Directors are of the view that the Company is able to meet the obligations of

the Company as they fall due. The surplus cash enables the Company to meet any

funding requirements and finance future additional investments. The Company is a

closed-end fund, where assets are not required to be liquidated to meet day to

day redemptions.

The Directors, the Manager and other service providers have put in place

contingency plans to minimise disruption. Furthermore, the Directors are not

aware of any material uncertainties that may cast significant doubt on the

Company's ability to continue as a going concern, having taken into account the

liquidity of the Company's investment portfolio and the Company's financial

position in respect of its cash flows, borrowing facilities and investment

commitments (of which there are

none of significance). Therefore, the financial statements have been prepared on

the going concern basis.

Segmental Reporting

The Directors are of the opinion that the Company is re-engaged in a single

segment of business, being the investment business.

Comparative Information

The financial information contained in this Half Year Report does not constitute

statutory accounts as defined in the Companies Act 2006. The financial

information for the half-year period ended 31 March 2023 has not been audited or

reviewed by the Company's Auditor. The comparative figures for the financial

year ended 30 September 2022 are not the Company's statutory accounts for that

financial year. Those accounts have been reported on by the Company's Auditor

and delivered to the Registrar of Companies. The report of the Auditor was (i)

unqualified, (ii) did not include a reference to any matters to which the

Auditor drew attention by way of emphasis without qualifying their report, and

(iii) did not contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

2. Dividend

During the period, the Company paid a final dividend of 11 pence per Ordinary

Share for the year ended 30 September 2022 on 6 February 2023 to Ordinary

shareholders on the register at 16 December 2022 (ex-dividend 15 December 2022).

An interim dividend of 6 pence per Ordinary Share for the period ended 31 March

2023 has been declared and will be paid on 28 July 2023 to Ordinary shareholders

on the register at the close of business on 23 June 2023 (ex-dividend 22 June

2023).

3. Return per Ordinary Share

The total return per Ordinary Share is based on the return on ordinary

activities after taxation of £(1,687,000) (six months ended 31 March 2022:

£(24,549,000); and year ended 30 September 2022: £(32,732,000)) and on a

weighted average of 11,991,821 Ordinary Shares in issue (excluding Ordinary

Shares held in treasury) during the six months ended 31 March 2023 (six months

ended 31 March 2022: weighted average of 12,020,661 Ordinary Shares in issue;

and year ended 30 September 2022: weighted average of 12,007,165 Ordinary Shares

in issue).

4. Called - up share capital

Number of shares Nominal value

£'000

Allotted, issued and fully

paid

Ordinary Shares of 10p each

Opening balance 15,248,408 1,525

Ordinary Shares bought back (122,638) (12)

for cancellation

Total Ordinary Shares in 15,125,770 1,513

issue

Number of shares

Treasury shares 3,318,207

Total Ordinary Share 11,807,53

capital excluding treasury

shares

During the six months ended 31 March 2023 122,638 Ordinary Shares of 10p were

bought back for cancellation for an aggregate consideration of £640,000. The

shares bought back for cancellation consists of shares cancelled and pending

cancellation which are excluded when calculating the NAV on the day of

acquisition.

The Company at 31 March 2023 holds 3,318,207 Ordinary Shares in treasury and are

treated as not being in issue when calculating the NAV per share. Shares held in

Treasury are non-voting and not eligible for receipt of dividends.

The allotted, called up and fully paid shares at 31 March 2023 consisted of

15,125,770 Ordinary Shares of 10p each in issue, and 3,318,207 Ordinary Shares

held in treasury. Therefore the total number of Ordinary Shares with voting

rights and ranking for dividends consisted of 11,807,563 at 31 March 2023.

Since the period end and up to 31 May 2023, the Company has bought back 10,661

shares for cancellation.

5. Net Asset Value per Ordinary Share

The NAV per Ordinary Share is based on net assets of £71,767,000 (31 March 2022:

£103,053,000; 30 September 2022: £110,898,000) and Ordinary Shares, being the

number of Ordinary Shares in issue excluding shares held in treasury at the

relevant period ends (31 March 2023: 11,807,563, 31 March 2022: 12,243,905 and

year ended 30 September 2022: 12,044,780).

6. Fair Value of Investments

The fair value hierarchy analysis for financial instruments held at fair value

at the period end is as follows:

Financial assets at fair value Level Level 2 Level 3 Total

through profit or loss at 31 March 1

2023 £'000 £'000 £'000

£'000

Equity investments 71,767

Financial assets at fair value Level Level 2 Level 3 Total

through profit or loss at 31 March 1 £'000

2022 £'000 £'000 £'000

Equity investments 83,233 - - 83,233

Financial assets at fair value Level Level 2 £'000 Level 3 Total

through profit or loss at 30 1 £'000

September 2022 £'000 £'000

Equity investments 75,059 - - 75,059

The currency exposure is exposure of the currency values of the investee

companies.

Saudi South United Poland Qatar Kuwait Hungary

Türkiye Greece Czechia United UK Total

Arabia Africa ArabEmirates

States

2023 SAR ZAR AED £'000 PLN QAR KWD HUF TRY

EUR CZK USD GBP£'000 £'000

£'000 £'000 £'000 £'000 £'000 £'000 £'000

£'000 £'000 £'000

Cash - - - - - - - -

- - 1,410 7 1,417

Debtor 170 153 199 - - - - -

- - - 277 976

Creditor - - (88) - - - - -

- - - (463) (551)

Investments 21,779 18,137 6,986 5,621 4,012 3,368 3,075 2,881

2,721 1,345 - - 69,925

Total 21,949 18,290 7,097 5,621 4,012 3,368 3,075 2,881

2,721 1,522 1,410 (179) 71,767

7. Related Party Disclosures and Transactions with the AIFM

Investment management fees charged in the period were £276,000 (six months to 31

March 2022: £374,000; year ended 30 September 2021: £666,000). At the end of the

half year, there was an investment management fee of £45,000 outstanding (31

March 2021: £102,000;30 September 2022: £46,000).

Fees paid to the Directors for the six months amounted to £77,000 (six months to

31 March 2022: £77,000; year ended 30 September 2022: £154,500).

Fees paid to the Company's Directors are disclosed in the Director's

Remuneration Report within the Company's Annual Report and Accounts for 2022. At

the year end, there were no outstanding fees payable to the Directors (year

ended 30 September 2022: £nil).

Post balance sheet event subsequent to 31 March 2023, a further 10,661 Ordinary

shares have been bought back for cancellation with a nominal value of £1,066.10

at a total cost of £53,688.

Interim Management Report

Going Concern

The financial statements have been prepared on a going concern basis and on the

basis that approval as an investment trust company will continue to be met. The

Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that the Company has adequate resources to

continue in operational existence for a period of at least 12 months from the

date when these financial statements were approved.

In making the assessment, the Directors have considered the impact of the

conflict in Ukraine on the Company and the investment portfolio. Whilst the

write-down of Russian securities in the portfolio has had a significant impact

on net asset value, the Company continues to operate at a size similar to levels

seen historically. The Directors have also discussed the impact of the conflict

on the Company's ability to pay dividends to Shareholders, both in the near-term

and over the next few years.

The Directors noted that the Company's current cash balance exceeds any short

term liabilities, the Company holds a portfolio of liquid listed investments.

The Directors are of the view that the Company is able to meet the obligations

of the Company as they fall due. The surplus cash enables the Company to meet

any funding requirements and finance future additional investments. The Company

is a closed end fund, where assets are not required to be liquidated to meet day

to day redemptions.

The Directors are not aware of any material uncertainties that may cast

significant doubt on the Company's ability to continue as a going concern,

having taken into account the liquidity of the Company's investment portfolio

and the Company's financial position in respect of its cash flows, borrowing

facilities and investment commitments (of which there are none of significance).

Therefore, the financial statements have been prepared on the going concern

basis.

Principal Risks and Uncertainties

The Company is exposed to a variety of risks and uncertainties. The Board,

through delegation to the Audit Committee, has undertaken an assessment and

review of the principal risks facing the Company, together with a review of any

new risks which may have arisen during the year, including those risks which

would threaten the Company's business model, future performance, solvency or

liquidity. The Directors have considered the impact of the continued uncertainty

on the Company's financial position and based on the information available to

them at the date of this Report, have fair-value adjusted Russian securities to

zero in response to exchange closures and sanction activities as a result of the

conflict in Ukraine. The Directors have concluded that no further adjustments

are required to the accounts as at 31 March 2023.

A review of the half year including reference to the risks and uncertainties

that existed during the period and the outlook for the Company can be found in

the Chairman's Statement and in the Investment Manager's Report.

The principal risks faced by the Company fall into the following broad

categories: Investment and Strategy, Adverse Market Conditions, Size of the

Company, Share Price Volatility and Liquidity/Marketability Risk, Loss of Assets

and Engagement of Third-Party Service providers.

Information on each of these areas is given in the Strategic Report within the

Annual Report and Accounts for the year ended 30 September 2022. In the view of

the Board these principal risks and uncertainties are as applicable to the

remaining six months of the financial year as they were to the six months under

review.

The Board is aware that due to the current situation in Russia and Ukraine,

sanctions imposed by a number of jurisdictions have resulted in the devaluation

of the Russian currency, a downgrade in the country's credit rating, an

immediate freeze of Russian assets, a decline in the value and liquidity of

Russian securities, property or interests, and/or other adverse consequences.

Sanctions could also result in Russia taking counter measures or other actions

in response, which may further impair the value and liquidity of Russian

securities.

These sanctions, and the resulting disruption of the Russian economy, may cause

volatility in other regional and global markets and may negatively impact the

performance of various sectors and industries. The Board continue to monitor the

situation and will provide further updates as needed.

Related Party Transactions

The Investment Manager is regarded as a related party and details of the

management fee payable during the six months ended 31 March 2023 is shown in the

Income Statement above. There have been no other related party transactions

during the six months ended 31 March 2023. The Directors' current level of

remuneration is £28,000 per annum for each Director, with the Chairman of the

Audit Committee receiving an additional fee of £3,500 per annum and the Senior

Independent Director receiving an additional fee of £1,000 per annum. The

Chairman's fee is £38,000 per annum.

Directors' Responsibility Statement

in respect of the Half Year Report for the six months ended 31 March 2023

Responsibility Statement

The important events that have occurred during the period under review, the key

factors influencing the financial statements and the principal risks and

uncertainties for the remaining six months of the financial year are set out in

the Interim Management Report above.

The Directors confirm that to the best of their knowledge:

· the condensed set of financial statements has been prepared in accordance with

UK Accounting Standards; Financial Reporting Standard 102, and gives a true and

fair view of the assets, liabilities and financial position of the Company; and

the interim management report (which includes the Chairman's Statement) as

required by the FCA's Disclosure Guidance and Transparency Rule 4.2.4R; and

· this Half Year Report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months of

the financial year and their impact on the condensed set of financial

statements; and a description of the principal risks and uncertainties for the

remaining six months of the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the Company during that period; and any changes in the related

party transactions that could do so.

This Half Year Report was approved by the Board of Directors on 8 June 2023 and

the above responsibility statement was signed on its behalf by Frances Daley,

Chairman.

Glossary

AIFM

The AIFM, or Alternative Investment Fund Manager, is Baring Fund Manager

Limited, which manages the portfolio on behalf of the Company's Shareholders.

The AIFM has delegated the investment management of the portfolio to Baring

Asset Management Limited (the "Investment Manager").

Alternative performance measures ("APM")

An APM is a numerical measure of the Company's current, historical or future

financial performance, financial position or cash flows, other than a financial

measure defined or specified in the applicable financial framework. In selecting

these APMs, the Directors considered the key objectives and expectations of

typical investors in an investment trust such as the Company.

Benchmark

The Company's comparator Benchmark is the MSCI Emerging Markets EMEA Index. This

index is designed to measure the performance of large and midcap companies

across 11 Emerging Markets (EM) countries in Europe, the Middle East and Africa

(EMEA). This includes, Czechia, Egypt, Greece, Kuwait, Hungary, Poland, Qatar,

Saudi Arabia, South Africa, Türkiye and United Arab Emirates.

The Benchmark is an index against which the performance of the Company may be

compared. This is an indicative performance measure as the overall investment

objectives of the Company differ to the index and the investments of the Company

are not aligned to this index.

Discount/Premium (APM)

If the share price is lower than the NAV per share, the shares are trading at a

discount. The size of the discount is calculated by subtracting the share price

of 509.00p (2021: 605.00p) from the NAV per share of 607.81p (2021: 705.60p) and

is usually expressed as a percentage of the NAV per share, 16.3% (2021: 14.3%).

If the share price is higher than the NAV per share, the situation is called a

premium.

Dividend Pay-out Ratio (APM)

The ratio of the total amount of dividends paid out to Shareholders relative to

the net income of the company. Calculated by dividing the Dividends Paid by Net

Income.

Dividend Reinvested Basis

Applicable to the calculation of return, this calculates the return by taking

any dividends generated over the relevant period and reinvesting the proceeds to

purchase new shares and compound returns.

Dividend Yield (APM)

The annual dividend expressed as a percentage of the current market price.

EMEA

The definition of EMEA is a shorthand designation meaning Europe, the Middle

East and Africa. The acronym is used by institutions and governments, as well as

in marketing and business when referring to this region: it is a shorthand way

of referencing the two continents (Africa and Europe) and the Middle Eastern sub

-continent all at once.

Emerging Markets

An emerging market economy is a developing nation that is becoming more engaged

with global markets as it grows. Countries classified as emerging market

economies are those with some, but not all, of the characteristics of a

developed market.

Environmental, Social and Governance ("ESG")

ESG (environmental, social and governance) is a term used in capital markets and

used by investors to evaluate corporate behaviour and to determine the future

financial performance of companies. The Company will evaluate investments in

investee companies considering:

· Environmental criteria considering how the company performs as a steward of

nature;

· Social criteria examine how the company manages relationships with employees,

suppliers, customers, and communities; and

· Governance deals with the company's leadership, executive pay, audits,

internal controls, and shareholder rights.

Frontier Markets

A frontier market is a country that is more established than the least developed

countries globally but still less established than the emerging markets because

its economy is too small, carries too much inherent risk, or its markets are too

illiquid to be considered an emerging market.

Gearing (APM)