TIDMBIDS

RNS Number : 0840O

Bidstack Group PLC

29 September 2023

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this Announcement, this information is considered to

be in the public domain.

29 September 2023

Bidstack Group Plc

("Bidstack" or "the Company")

Interim Results for six months ended 30 June 2023

Bidstack Group plc (AIM: BIDS.L), the native in-game advertising

group, announces its unaudited results for the six months ended 30

June 2023.

The Interim Report for the period ended 30 June 2023 will be

published on the Company's website - www.bidstack.com today.

Financial Update

-- Revenue of GBP1.967m (H1 2022: GBP2.046m), demonstrating a

strong recovery following re-engagement with agencies and

programmatic platforms after the termination of the Azerion

commercial partnership in December 2022. The underlying prior year

comparison (H1 2022: GBP0.4m) highlights the growth in campaign

sizes and quality of global brands;

-- Gross margin contracted to 25.9% (H1 2022: 39.9%), due to

product mix which is expected to improve in H2 2023;

-- Period end cash balance GBP2.084m (30 June 2022: GBP3.672m)

Post Period End Highlights

-- Bidstack Sports, the dedicated sports technology division

announced a partnership with StatusPRO's NFL PRO ERA and the

Washington Commanders professional football team to control their

virtual stadium for brand activations and fan engagement

messaging;

-- Commencement of Venatus partnership on 4 September 2023,

outsourcing Bidstack's in-game advertising network. Venatus has

sole ownership of direct sales of Bidstack's in-game inventory

across US, UK, Germany, Canada, Australia and South Korea

leveraging its extensive global sales presence;

-- A signed heads of terms, announced this morning in relation

to a proposed multi-year licensing agreement with Virtual Sport

Technology ("VST"), a sports marketing agency, subject to contract,

for a licence fee of GBP1.5m (two equal instalments of GBP0.75m

paid quarterly in advance), with Bidstack retaining a 70% share of

future revenues during the initial term of 3 years. Bidstack acts

purely as the technology provider, empowering sports teams to reach

fans within their virtual stadiums;

-- Following a comprehensive business review on the back of

commercial partnerships announced a restructuring programme has

been implemented to reduce monthly cash burn and prioritise

resources. The rationalisation in headcount, rephasing of hires,

working capital management and reduction in operating expenses

should deliver c.GBP3m p.a. of annualised savings;

-- Donald Stewart (Non-Executive Director) and Glen Calvert

(Non-Executive Director) stepped down from the Board at the end of

the Annual General Meeting on 21 July 2023;

-- Thomas Bullen (CFO) will step down from his role with

immediate effect. The Company will commence a search for a

successor.

Current trading and outlook

As we reach the end of Q3, the Board now anticipates that

revenue for FY23E will fall significantly short of previous market

expectations, however due to improving gross margin and cost

savings, EBITDA should be broadly in line. However, the Board

believes that the outsourcing of our sales efforts should allow the

Company to focus on its technology platform.

The business is transitioning to its next phase of growth

however the following factors have impacted market expectations for

the year:

-- The transition from in-house direct sales to Venatus in Q3

2023, the onboarding process is progressing well to ensure a

healthy Q4 2023 and strong start to FY24.

-- The proposed licensing agreement with VST, subject to

contract, includes a licence fee of GBP1.5m (two equal instalments

of GBP0.75m paid quarterly in advance).

-- Over the past several months, the Board and the Management

team have diligently examined numerous possible financing options

with the primary aim of securing the necessary capital to address

the Company's immediate and mid-term funding requirements. After an

extensive search for the best route to access capital by the Group,

the Independent Directors believe that the proposed transaction

announced with VST today, albeit a related party transaction and

subject to contract, represents the best value for shareholders at

this present time. However, the Board will continue to keep all

future funding options under review.

-- The technical development of the open marketplace has

unfortunately taken longer than anticipated. While we do not expect

open marketplace to be the primary source of company revenue going

forward due to the increased focus on technology licensing, we are

continuing to pursue this initiative to generate additional passive

income from our existing mobile publishers.

-- Operating cost reductions should lower FY23E operating costs

by c.GBP2m and generate annualised savings of c.GBP3m p.a.

At the same time the Company will continue to pursue its claim

against Azerion.

Dr. David Reeves, Chairman, said:

"The Board is pleased with the proposed acceleration of the

business towards a technology licensing business. The announcement

of the partnership with Venatus and proposed agreement with VST in

quick succession should enable the business to move rapidly to

further adapt its cost base. Looking ahead, Bidstack should now be

well positioned to generate recurring revenue and capture upside

potential. I would like to thank the Board and management team for

the hard work over the past six months."

James Draper, Chief Executive, said:

"The first six months of trading highlights the underlying

growth in in-game advertising and was a crucial period in

identifying opportunities to scale revenue which is evident in the

shift in focus to enterprise customers. This has led to some tough

decisions regarding the personnel within the Group as we reviewed

how we take our products to market.

The partnership with Venatus on our network gives Bidstack a

well-respected partner in gaming as we generate revenue through

brand activations for our contracted game publishers.

The proposed partnership with VST should empower our talented

team to focus on the technology and supporting our customers.

The clear actions and positive financial impact over the medium

to longer term of outsourcing media and technical sales

concentrates Bidstack's efforts on compounding revenue with similar

commercial prospects across other network and publisher

partners."

For further information please contact:

Bidstack Group Plc

James Draper, CEO via SPARK

SPARK Advisory Partners Limited

(Nomad)

Mark Brady/Neil Baldwin/James

Keeshan +44 (0) 203 368 3550

Stifel Nicholas Europe Limited

(Broker)

Fred Walsh/Tom Marsh +44 (0) 20 7710 7600

Chairman's Statement

H1 2023 Trading and Post Period Updates

During the first six months of the year, Bidstack demonstrated

underlying revenue growth and significant progress around

enterprise customers. This has enabled rapid implementation of cost

restructuring action and favourable product mix effect on gross

margins taking effect from H2 2023 onwards.

Revenue has been predominantly driven by an internal direct

sales strategy following the termination of the Azerion commercial

partnership in December 2022. The underlying revenue performance H1

2023: GBP1.967m (H12022 GBP0.4m ex-Azerion) represents c.400%

increase from growing campaign sizes and rebookings with blue chip

brands across all categories such as Kroger, Nerdwallet, JP Morgan

Chase, Apple Arcade, McDonalds, Magnum, Samsung and Skoda. This

demonstrates a strong recovery as Bidstack adapted by re-engaging

with agencies and programmatic platforms to maintain market share.

However, the strategy to outsource sales and identify a partner was

a high priority for the management team.

The roll out of the open marketplace, a key revenue initiative

faced technical delays and has unfortunately taken longer than

anticipated which has hampered revenue expectations for the year.

While we do not expect the open marketplace to be the primary

source of company revenue going forward due to increased focus on

technology licensing, we are continuing to pursue this initiative

to generate additional passive income for the existing mobile

publishers.

After the period end, Bidstack is accelerating its transition

into an accretive technology licensing model. This includes the

outsourcing of its ad-network sales to gaming specialist agency

Venatus and the proposed partnership with sports marketing agency

Virtual Sport Technology to sell Bidstack's platform to sports

leagues, teams and publishers.

Outsourcing Bidstack's in-game advertising network to

Venatus

The partnership with Venatus, a gaming specialist agency,

commenced on the 4th September 2023 with the combined objective to

aggressively accelerate market share gains and industry growth.

Venatus was founded in 2010 by Rob Gay (CEO) and Matt Cannon (COO)

and is based in London with offices in New York, Los Angeles,

Sydney and Seoul. In 2021, Livingbridge private equity invested

behind the global expansion of Venatus which is most recently

reflected in key hires in the US.

Venatus has sole ownership of direct sales of Bidstack's in-game

inventory across US, UK, Germany, Canada, Australia and South Korea

leveraging its extensive global sales presence. The access to

Bidstack's intrinsic in-game network adds another dimension to the

Venatus offer which centres on campaigns in-game, next to the game

and around the game.

Bidstack and Venatus have historically worked together and both

are pleased to leverage their relationship and synergies. This

partnership plays to Venatus' strength as a proven sales house

within the gaming segment of the advertising industry and

solidifies Bidstack's role as a technology provider.

Proposed multi-year licensing agreement with Virtual Sport

Technology Limited

Sports leagues and teams have long been identified as enterprise

customers of Bidstack's platform. Until now, Bidstack and its

competitors have been unable to monetise sports games within a

fully licensed stadium due restrictions from official sponsors. By

placing the control of the brand activations into the hands of the

leagues and teams, these licensed stadiums become monetisable for

Bidstack's partners. Bidstack acts purely as the technology

provider, empowering sports teams to reach fans within their

virtual stadiums with a level of targeting and flexibility that has

never been possible in the world of sport before.

The non-binding heads of terms terms for the proposed the

multi-year licensing agreement with VST, which remains subject to

contract, are as follows:

-- Bidstack would provide VST worldwide third party exclusivity

to provide access to Bidstack's proprietary video game content

management platform to rights-holders including sports leagues,

teams and publishers for an initial term of three years with a

further three year extension mutually available;

-- VST would pay Bidstack a licence fee of GBP1.5m (two equal

instalments of GBP0.75m paid quarterly in advance);

-- Bidstack would provide certain support services to VST in

consideration of a quarterly service fee of GBP45,000; and

-- Bidstack would capture upside of the growth potential through

retaining a revenue share of 70 per cent.

As part of these arrangements, certain Bidstack employees would

transfer their employment to VST with the consequent cost saving to

Bidstack.

Cost savings

Following a comprehensive business review, a restructuring

programme has been implemented to reduce the monthly cash burn and

prioritise resources. The Directors believe that the

rationalisation in headcount, rephasing of hires, working capital

management and reduction in operating expenses delivers c.GBP3m

p.a. of annualised savings. This is primarily driven by the

positive impact of outsourcing of commercialisation to external

parties whilst operating on a leaner cost base.

Board Changes and Review

As announced on the 18 July 2023, the Company has been

undertaking a review of the respective roles and responsibilities

of the Board.

Following the Company's Annual General Meeting on 21(st) July

2023, Donald Stewart (Non-Executive Director) and Glen Calvert

(Non-Executive Director) both stepped down from the Board to focus

on other business commitments.

Thomas Bullen (CFO) will step down from his role with immediate

effect. The Company will commence a search for a successor.

The Board will continue to evaluate its needs going forward and

seek to review the structure, size, composition, skills and

experience. A committee of the Board shall make recommendations in

regard to any adjustments considered necessary and the Company will

make further announcements as appropriate.

Future Prospects

As we reach the end of Q3, the Board now anticipates that

revenue for FY23E will fall significantly short of previous market

expectations, however due to improving gross margin and cost

savings, EBITDA should be broadly in line. However, the Board

believes that the outsourcing of our sales efforts should allow the

Company to focus on its technology platform.

The business is transitioning to its next phase of growth

however the following factors has impacted market expectations for

the year:

-- The transition from in-house direct sales to Venatus in Q3

2023, the onboarding process is progressing well to ensure a

healthy Q4 2023 and strong start to FY24.

-- Signing of the non-binding heads of terms for the proposed

multi-year licensing agreement with VST, for an initial GBP1.5m,

with Bidstack retaining a 70% share of future revenues during the

initial term of 3 years.

-- The technical development of the open marketplace has

unfortunately taken longer than anticipated. While we do not expect

open marketplace to be the primary source of company revenue going

forward due to the increased focus on technology licensing, we are

continuing to pursue this initiative to generate additional passive

income from our existing mobile publishers;

-- Operating costs to reduce FY23E operating costs by c.GBP2m

and generate annualised savings of c.GBP3m p.a.

The recent developments enable Bidstack to scale revenue on a

leaner cost base as it evolves into a technology provider

empowering its enterprise customers. Bidstack has improving

visibility and commercial partnerships in place driven by:

-- Potential recurring revenue from VST's proposed licensing

agreement that is expected to compound through retaining a revenue

share;

-- Outsourcing of ad-network sales to Venatus' 40 gaming

specialists in the following exclusive markets US, UK, Canada,

Germany, South Korea and Australia;

-- Outsourcing of ad-network to remaining markets to known and trusted gaming specialists;

-- Optimisation of open marketplace in Q4 2023 and beyond

following delayed rollout to generate passive revenue;

-- Benefit from rapid restructuring action that contracts the

cost base as it migrates from a media model to a

software-as-a-service model which significantly improves the

working capital profile.

It is expected that the proposed commercial terms of the

licensing agreement with VST and outsourcing of ad-network sales to

Venatus will provide cash flow and limit dilution to existing

shareholders. However, the Board will also continue to keep all

funding options under review.

Dr. David Reeves

Chairman

Unaudited Condensed Consolidated Statement of Total

Comprehensive Income

for the interim period ended 30 June 2023

Unaudited Audited

Unaudited 6 months year

6 months ended ended

ended 30 Jun 31 Dec

Note 30 Jun 2023 2022 2022

GBP GBP GBP

-------------- ----------- -------------

Revenue 1,967,779 2,045,986 5,267,155

(1,457,29

Cost of sales 8 ) (1,229,225) (1,484,512)

-------------- ----------- -------------

Gross profit 510, 481 816,761 3,782,643

Administrative expenses ( 5,972,383) (3,769,066) (11,352,785)

Share based payment charge 6 115,413 (738,435) (1,192,931)

( 5 , 346,489

Operating loss ) (3,690,740) (8,763,073)

Finance income 501 96 749

Finance costs (3,853) (1,442) (2,998)

-------------- ----------- -------------

( 5,349,841 (3, 692,086

Loss before taxation ) ) (8,765,322)

Taxation 325,000 938,1 84 1,079,136

-------------- ----------- -------------

( 5,024,841 (2,7 53,902

Loss for the period ) ) (7,686,186)

Other comprehensive income

Items that may be subsequently

reclassified to profit or loss

(1 0,675

Currency translation differences (145,242) ) 113,358

-------------- ----------- -------------

Total comprehensive loss for

the period attributable to owners (5, 170,083 (2, 764,577

of the parent ) ) (7,572,828)

============== =========== =============

Loss per share - basic and diluted

(pence) 5 (0 .39 ) ( 0.30 ) (0.62)

The above consolidated statement of profit and loss and other

comprehensive loss for the period relates to continuing operations

for the Group.

Unaudited Condensed Consolidated Statement of Financial

Position

as at 30 June 2023

Unaudited Unaudited Audited

30 Jun 30 Jun 31 Dec

Note 2023 2022 2022

ASSETS GBP GBP GBP

------------- ------------ -------------

Non-current assets

------------- ------------ -------------

Intangible assets 7 828,066 233,162 765,454

Right of use asset 2,240 5,600 3,920

Property, plant and equipment 44,313 45,8 41 56,623

------------- ------------ -------------

Total non-current assets 87 4,619 284,603 825,997

------------- ------------ -------------

Current assets

Trade and other receivables 8 10,064,279 4,284,584 9,319,868

Cash and cash equivalents 2,084,355 3,671,976 8,662,039

-------------

Total current assets 1 2,148,634 7,956,560 17,981,907

------------- ------------ -------------

Total assets 13, 023,253 8,241,163 18,807,904

============= ============ =============

EQUITY AND LIABILITIES

Equity

Share capital 9 10,796,670 8,950,048 10,796,670

Share premium 43,216,919 35,375,326 43,216,919

Share-based payment reserve 2,667,483 2,328,400 2,782,896

Merger relief reserve 6,508,673 6,508,673 6,508,673

Reverse acquisition reserve (23,320,632) (23,320,632) (23,320,632)

Warrant reserve - 71,480 -

Foreign exchange reserve (21,295) (86) 123,947

Retained losses (34,515,893) (24,630,248) (29,491,052)

-------------

Total equity 5,331,926 5,282,961 10,617,421

------------- ------------ -------------

Non-current liabilities

Lease liability - 2,416 614

------------- ------------ -------------

Total non-current liabilities - 2,416 614

------------- ------------ -------------

Current liabilities

Trade and other payables 7,688,911 2,952,597 8,186,323

Lease liability 2,416 3,189 3,546

------------- ------------

Total current liabilities 7,691,327 2,955,786 8,189,869

------------- ------------ -------------

Total liabilities 7,691,327 2,958,202 8,190,483

------------- ------------ -------------

Total equity and liabilities 13,023,253 8,241,163 18,807,904

============= ============ =============

The interim financial report was approved by the board of

Directors on 29 September 23 and signed on its behalf by:

David Reeves

Chairman of Bidstack Group Plc

Unaudited Condensed Consolidated Statement of Changes in

Equity

for the six months to 30 June 2023

Share-based Merger Reverse Foreign

Share Share payment relief acquisition exchange Retained Total

capital premium reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP

As at 1

January 2023 10,796,670 43,216,919 2,782,896 6,508,673 (23,320,632) 123,947 (29,491,052) 10,617,421

---------- ---------- ----------- ----------- -------------- --------- ------------ -----------

Loss for the

period - - - - - - (5,024,841) (5,024,841)

---------- ---------- ----------- ----------- -------------- --------- ------------ -----------

Other

comprehensive

loss:

---------- ---------- ----------- ----------- -------------- --------- ------------ -----------

Foreign

currency

exchange

difference - - - - - (145,242) - (145,242)

---------- ---------- ----------- ----------- -------------- --------- ------------ -----------

Total

comprehensive

loss

for the

period - - - - - (145,242) (5,024,841) (5,170,083)

---------- ---------- ----------- ----------- -------------- --------- ------------ -----------

Transactions

with owners

Share-based

payments - - (115,413) - - - - (115,413)

---------- ---------- ----------- ----------- -------------- --------- ------------

Total

transaction

with

owners - - (115,413) - - - - (115,413)

As at 30 June

2023 10,796,670 43,216,919 2,667,483 6,508,673 (23,320,632) (21,295) (34,515,892) 5,331,925

========== ========== =========== =========== ============== ========= ============ ===========

Unaudited Condensed Consolidated Statement of Changes in

Equity

for the six months to 30 June 2022

Share-based Merger Reverse Foreign

Share Share payment relief acquisition exchange Warrant Retained Total

capital premium reserve reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

As at 1

January 2022 8,950,048 35,375,326 1,589,965 6,508,673 (23,320,632) 10,589 71,480 (21,876,346) 7,309,103

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Loss for the

period - - - - - - - (2,753,902) (2,753,902)

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Other

comprehensive

loss:

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Foreign

currency

exchange

difference - - - - - (10,675) - - (10,675)

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Total

comprehensive

loss

for the

period - - - - - (10,675) - (2,753,902) (2,764,577)

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Transactions

with owners

Share-based

payments - - 738,435 - - - - - 738,435

--------- ---------- ----------- --------- ------------ -------- ------- ------------ -----------

Total

transaction

with

owners - - 738,435 - - - - - 738,435

As at 30 June

2022 8,950,048 35,375,326 2,328,400 6,508,673 (23,320,632) (86) 71,480 (24,630,248) 5,282,961

========= ========== =========== ========= ============ ======== ======= ============ ===========

Audited Consolidated Statement of Changes in Equity

for the year ended 31 December 2022

Share-based Merger Reverse Foreign

Share Share payment relief acquisition exchange Warrant Retained Total

capital premium reserve reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

---------- ---------- ----------- --------- ------------ -------- -------- ------------ -----------

As at 01

January 2022 8,950,048 35,375,326 1,589,965 6,508,673 (23,320,632) 10,589 71,480 (21,876,346) 7,309,103

Loss for the

year - - - - - - - (7,686,186) (7,686,186)

Other

comprehensive

loss:

Foreign

currency

exchange

difference - - - - - 113,358 - - 113,358

Total

comprehensive

loss

for the year - - - - - 113,358 - (7,686,186) (7,572,828)

---------- ---------- ----------- --------- ------------ -------- -------- ------------ -----------

Transactions

with owners

Issue of

shares 1,839,122 8,643,873 - - - - - - 10,482,995

Issue of share

options

exercised 7,500 22,500 - - - - - - 30,000

Costs of

raising

equity - (824,780) - - - - - - (824,780)

Share-based

payments - - 1,192,931 - - - - - 1,192,931

Unexercised

lapsed

warrants - - - - - - (71,480) 71,480 -

Total

transaction

with

owners 1,846,622 7,841,593 1,192,931 - - - (71,480) 71,480 10,881,146

---------- ---------- ----------- --------- ------------ -------- -------- ------------ -----------

As at 31

December 2022 10,796,670 43,216,919 2,782,896 6,508,673 (23,320,632) 123,947 - (29,491,052) 10,617,421

---------- ---------- ----------- --------- ------------ -------- -------- ------------ -----------

Unaudited Condensed Consolidated Statement of Cash Flows

6 months 6 months Year end

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

GBP GBP GBP

----------- ----------- -----------

Cash flows from operating activities

Loss before taxation (5,349,841) (2,753,902) (8,765,322)

Adjustments for:

Amortisation - Intangibles 79,544 15,598 71,528

Amortisation - Right of use asset 1,680 1,680 3,360

Depreciation 17,463 13,140 28,765

Equity settled share-based payments (115,413) 738,435 1,192,931

Interest received (501) (96) (749)

Interest paid 3,853 1,442 2,998

Bad debts expense - - 1,456,236

Exchange differences on translation

of foreign operations (145,242) (10,675) 113,358

----------- -----------

(5,508,457) (1,994,378) (5,896,895)

Changes in working capital

Increase in trade and other receivables (419,411) (1,532,550) (8,199,385)

(Decrease)/increase in trade and

other payables (497,411) 127,679 5,361,405

----------- ----------- -----------

Cash used in operations (6,425,279) (3,399,249) (8,734,875)

Taxation credits received - - 1,254,451

----------- ----------- -----------

Net cash used in operations (6,425,279) (3,399,249) (7,480,424)

Cash flow from investing activities

Investment in intangible assets (142,155) - (588,222)

Investment in property, plant and

equipment (5,153) (12,462) (38,869)

----------- ----------- -----------

Net cash flow used in investing

activities (147,308) (12,462) (627,091)

Cash flow from financing activities

Proceeds from issue of share capital - - 10,512,995

Cost of issue - - (824,780)

Principal movement on lease liabilities (1,744) (1,872) (3,318)

Interest received 501 96 749

Interest paid on lease liabilities (3,854) (1,443) (2,998)

----------- -----------

Net cash generated from financing

activities (5,097) (3,219) 9,682,648

(Decrease)/increase in cash and

cash equivalents in the period (6,577,684) (3,414,930) 1,575,133

Cash and cash equivalents at beginning

of period 8,662,039 7,086,906 7,086,906

Cash and cash equivalents at the

end of the period 2,084,355 3,671,976 8,662,039

=========== =========== ===========

for the interim period ended 30 June 2023

Notes to the unaudited interim report for six months ended 30

June 2023

1 General information

The Company is a public limited company which is admitted to

trading on the AIM Market of the London Stock Exchange and is

incorporated and domiciled in the UK. The address of the registered

office is Wework The Hewett 3(rd) Floor, 14 Hewett Street, London,

United Kingdom, EC2A 3NP. The registered number of the company is

04466195.

2 Basic of preparation

The condensed consolidated interim financial statements

consolidates those of the Company and its trading subsidiaries,

Bidstack Limited, Pubguard Ltd, Bidstack SIA, Bidstack Technologies

Ltd, Bidstack Sports Limited and Bidstack Inc. (together the

"Group") for the six months ended 30 June 2023. These condensed

consolidated interim financial statements do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006.

These condensed consolidated interim financial statements have

been prepared in accordance with the AIM rules and the recognition

and measurement requirements of UK-adopted International Accounting

Standards ("UK-IAS") and adopting the accounting policies that will

be applied in the 31 December 2023 annual financial statements.

These condensed consolidated financial statements should be read

in conjunction with the financial statements for the year ended 31

December 2022, which is available on the Group's website at

www.bidstack.com.

3 Accounting policies

Going concern

The interim results have been prepared on a going concern basis

which assumes that the Group will be able to continue trading for

the foreseeable future. Although an operating loss has been

reported for the reporting period and an operating loss is expected

to be incurred in the 12 months subsequent to the date of this

report, the Directors believe, having considered all available

information, including the cash resources currently available to

the Group, that the Group will have sufficient funds to meet its

expected committed and contractual expenditure for the foreseeable

future. Thus, the Directors continue to adopt the going concern

basis of accounting in preparing the interim financial report for

the period ended 30 June 2023.

Summary of significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in the financial statements disclosed as at

and for the year ended 31 December 2022.

4 Critical accounting judgements and estimates

The preparation of the condensed consolidated interim financial

statements requires directors to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may differ from these judgements and estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

audited consolidated financial statements for the year ended 31

December 2022.

5 Loss per share

Basic and diluted loss per share

The calculation of basic and diluted loss per share is based

upon the loss of attributable to equity holders divided by the

weighted average number of shares in issue during the period.

The loss incurred by the Group means that the effect of any

outstanding warrants and options would be considered anti-dilutive

and is ignored for the purposes of the loss per share

calculation.

6 months 6 months Year ended

to 30 Jun to 31 Dec

2023 30 Jun 2022 2022

Loss for the period from continuing

activities (GBP's) (5,024,841) (2,764,577) (7,686,186)

Weighted average number of ordinary

shares 1,300,855,984 931,531,573 1,235,295,798

Basic and diluted loss per share

(pence) (0.39) (0.30) (0.62)

============= ============ =============

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

6 Share based payment expense.

6 months 6 months Year ended

to 30 Jun to 31 Dec

2023 30 Jun 2022 2022

GBP GBP GBP

Share based payment charge (115,413) 738,435 1,192,931

========== ============ ==========

The calculation of the share-based payment expense is based on

the grant date fair value to establish the fair value per

instrument. This fair value is multiplied by the number of options

that are expected to vest after considering performance conditions

and the likelihood of these performance conditions being met.

In the six months to June 2023, the revenue targets set as

performance conditions the for the LTIP awards made in December

2021 ("LTIP 2021") and LTIP awards made in December 2022 ("LTIP

2022") are now not expected to meet the minimum threshold for

vesting for the year ended 31 December 2023. The revenue targets

for FY2024 and FY2025 for both LTIP 2021 and LTIP 2022 are

currently expected to be met.

The result of result of this is a remeasurement to the options

expected to vest and reversal of the expense associated with these

options equates to GBP458,032, which has been offset against the

underlying charge for options continuing to vest as normal.

7 Intangible assets

Website Trademarks Software Brand Goodwill R&D Total

costs GBP GBP GBP GBP GBP GBP GBP

Cost

At 1 January

2023 48,618 1,460 88,205 29,402 168,000 588,222 923,907

Additions - - - - - 142,155 142,155

---------- ---------- -------- ------ -------- ------- ---------

At 30 June

2023 48,618 1,460 88,205 29,402 168,000 730,377 1,066,062

---------- ---------- -------- ------ -------- ------- ---------

Amortisation

At 1 January

2023 43,249 688 55,637 18,546 - 40,333 158,453

Charge 3,835 73 8,142 2,714 - 64,779 79,543

---------- ---------- -------- ------ -------- ------- ---------

At 30 June

2023 47,084 761 63,779 21,260 - 105,112 237,996

---------- ---------- -------- ------ -------- ------- ---------

Net book

---------- ---------- -------- ------ -------- ------- ---------

At 30 June

2023 1,533 699 24,426 8,142 168,000 625,265 828,066

---------- ---------- -------- ------ -------- ------- ---------

At 31 Dec 2022 1,533 699 24,426 8,142 168,000 547,889 765,454

---------- ---------- -------- ------ -------- ------- ---------

Research and development costs are internally generated

intangible assets associated with the development of the Group's

products.

8 Trade and other receivables

30 Jun 30 Jun 31 Dec

2023 2022 2022

GBP GBP GBP

---------- --------- ---------

Trade receivables 7,120,874 1,131,621 6,857,633

Contract assets 6,905 32,538 10,500

Prepayments 1,516,119 235,080 1,205,045

Other receivables 1,095,378 1,947,162 307,491

Corporation tax 325,000 938,183 939,199

---------- --------- ---------

Total trade and other receivables 10,064,276 4,284,584 9,319,868

========== ========= =========

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses (ECL) which uses a lifetime expected loss

allowance for all trade receivables. The trade receivables do not

contain a significant financing component as the credit terms

offered by the Group to its customers are 45 days.

The Group measures ECL based on historical data by determining

the historical default rates to be applied to the Group's trade

receivables. The Group adjusted the historical default rates to

incorporate forward looking information looking at any linear or

non-linear relationships that could impact the Group's credit

losses.

The Group apply those default rates against the trade

receivables that have been analysed out into time buckets based on

their risk profile to determine the ECL to be applied. The Group

separately assesses the trade receivables for any bad debt

provisions.

During the period end 30 June 2023, the Group has made a nil bad

debt provision against the trade receivables.

9 Share capital and share premium

Allotted, called up and fully Ordinary

paid 0.5p shares Share capital Share premium

No. GBP GBP

At 1 January 2022 931,531,573 8,950,048 43,216,919

Issue of shares 369,324,411 1,846,622 -

As at 31 December 2022 1,300,855,984 10,796,670 43,216,919

------------- ------------- --------------

As at 30 June 2023 1,300,855,984 10,796,670 43,216,919

============= ============= ==============

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESEFAEDSEFU

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

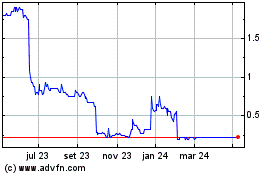

Bidstack (LSE:BIDS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bidstack (LSE:BIDS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025