TIDMBIRG

RNS Number : 3847R

Bank of Ireland Group PLC

26 October 2023

B ank of Ireland Gro up p lc (the "Gro u p")

Interim M a nagem e nt St a teme nt - Q3 20 23 up date

26 Oc t o ber 20 23

C o mment: My les O'Grad y, Bank of Ireland Gr o up CEO:

" We had a stro ng business and financial perfo r mance in the

peri od. This performance sup p o rts o ur purp ose to deli ver m o

re for o ur custo mers, c olleagu es, shareh olders and s ociet

y.

" We are pr o gressing well on o ur 2 0 23 - 2 0 25 strategic

pri orities. In Q3 2 0 23, we c o ntin ue to successfully deliver,

with further Irish lending growt h, particularly in mo rtgages, o

ng oing progress in develo ping o ur wealth franchise and with o ur

a m biti o us ESG agenda. While asset quality re mains ro bu st, we

are mindful of the challeng es facing o ur custo mers fr om the

higher interest rate en viro n ment a nd co ntinue to sup p o rt

them thro ugh a balanced approach to pricin g. Our co m mercial

actio ns and strate gic ex ecution are delivering c o ntinued stro

ng organic capital generation and give us c o nfidence in the o utl

o ok f or the Gr o up for the re mainder of 2 023 and beyo nd

."

Ke y hig h l i g hts

-- 2 0 2 3 n et interest in c o me g uidance increased (H2 2 0

23 n ow ex p ected to be c. 5% higher than H1

2 0 2 3 level), reflecting higher rates and o ng oing business m

omentum

-- Irish net lending (ex-acquisitio ns) up EUR 1.3 billio n; sup

p orted by stro ng perf o r mance in m ortgage lending; o verall l

oan b o ok growth of EUR8 .7 billi on since Dece m ber 2 0 22

-- 2 0 2 3 busin ess in c o me guidance unchanged, with perf

ormance in the 9 m o nths to end-Septe m b er in line with ex

pectati o ns

-- Operating expenses perfo r ming in-line with guidance; sup p

orted by c o ntinued c ost discipline

-- Stro ng capital p ositio n; n et organic capital generati on

of 2 70 basis p oin ts in t he 9 m o nths to

Septe m ber; fully l oaded CET1 ratio of 1 5 . 2%

-- Asset quali ty re mains r o b ust; n o n-perfo r ming ex p osures (NPE) ratio of 3 . 6%

-- Stro ng liquidity positi o n; deposit growth of EUR 1 .3

billi on in the 9 m o nths to Septe m ber 2 0 2 3; L oan to Dep

osit Ratio 8 0%

-- Sustainability-related finance at c.EUR 10 .5 billion end-Se

ptem ber; up c. 3 0% during 2 0 23, with g reen mo rtgages acc o

unting for 5 1% of n ew ROI mo rtgage le nding

I n c o me

N et interest in c o me guidance increased with H2 2 0 23 n ow

expected to be c. 5% h i gher than H1 2 0 23 le v el of EUR 1,8 02

milli o n. This stro nger o utlo ok pri marily reflects higher inte

rest rates and the Gr o up 's co m mercial acti o ns, with i

nterest rates in H2 2 0 23 now expected to be higher co m pared to

earlier in the year. Perf ormance in the 9 mo nths to end-Septe m

ber reflects the rate envir onm e n t, acquisiti o ns, lending

growth in Ireland, and busi ness m o mentu m, supp orted by o n g

oing str o ng c o mmercial pricing disciplin e.

Business in c o me (including share of associates and JVs)

guidance re mains u nchanged, with H2 2 0 23 ex pected to be

broadly in-line with H1 2 0 23 le vel of EUR 361 milli o n. Gr owth

in the 9 mo nths to end- Septe m ber c om pared to the same period

in 2 0 22 of 1 1% has primarily been sup p orted by increased fee

inco me as a result of high er customer activit y, and the benefit

from the acquisiti on of D a v y.

Other income/ex penses and valuation items at end-Se ptem ber 2

0 23 we re EUR 19 m illion (versus EUR 49 million at end-June 2 0 2

3), reflecti ng market mo vements in Q 3.

C o st and l e vi es

Cost guidance re mains un c hanged with o perating expenses

expected to be c. EUR1 . 85 billi on in 2 0 2 3, as the

Gro up c o ntinues to maintain tight c o ntrol o ver its cost

base n otw ithstand i ng o ng oing inflatio nary p ressures. Rep

orted c osts were 1 0% higher in the 9 mo n t hs to end-Sep tem ber

2 0 23 co m pared to the same peri od in 2 0 22, pri marily

reflecting acquisiti on im pacts, an all owance f or t he lifting

of variable p ay restricti o ns and additi o nal i n vest ment to

drive future efficiencies.

Following rece nt publication of the Irish G o vern ment Finance

Bill 2 0 2 3, the Gro up provisi o nally est i mates that its 2 0

24 Irish bank levy will be c. EUR 90 milli on, c o m pared to EUR

25 milli on in 2 0 23.

B a l an c e S heet

The Gr o up's l oan bo ok increased by EUR 8 .7 billion since

Dece m ber 2 022 to EUR 8 0.7 billio n. This increase includes the

EUR8 billi on of loans acquired fr om KBC in February, EUR0 .6

billi on net i m pact fr om FX/ i m pairment/ other and net organic

growth of EUR0 .1 b illio n. The net organic g r owth co m prises

EUR 1 .3 billi on increase in net lending in Ireland and a redu

ction in Retail UK of EUR0 .5 billio n, in line with strategy, and

reduced intern atio nal co r p orate and pro perty lending of EUR

0.7 billion reflecting a co ntinued cauti o us approach.

The Gro up's liquid assets were EUR 4 2 .2 billi on and

wholesale funding was EUR 11 billi on at end-Septe m ber

2 0 23 .

Custo mer dep osits were EUR 1 00.5 billi on at end-Septe m ber

2 0 23, EUR1 .3 billi on higher co m pared to Dece m ber

2 0 22 , reflecting the KBC deposit p ortf olio acquisiti on of

EUR1 .8 billion and growth in Retail Ireland of EUR0 .4

b illio n, partly offset by a re duction in Retail UK and C orp

orate & C om mercial v olu mes.

The Gr o up's Loan to Dep osit Ratio was 8 0% at end-Septem ber

2 0 23 ( Decem ber 2 0 2 2: 7 3%). The Liquidity Co verage Ratio

was 1 8 6% at end-Sep tem ber 2 0 23 ( D ecem ber 2 0 2 2: 2 2 1

%), whil st the N et Stab le Fu nding Ratio was 15 3% at end-Septem

ber ( D ece m ber 2 0 2 2: 1 6 3 %). As ex pected, the cha nges in

all three rati os in 2 0 23 pri mari ly reflect t he im p act of t

he KBC p o rtfo lios' acquisitio n.

Asset Qua li ty

Impairment guidance r e m ains unchanged, with the Gro up's

asset quali ty in Q3 2 0 23 perf o r ming in-line with ex pect atio

ns. Macr o eco no mic sce nari os i m pacting credit i m pairment

will, as usual, be refreshed to reflect updated market f o recasts

and captured as part of the Gr o up's full-year cre dit im pair

ment pro cess. The Gr o up's NPE ratio is u nchanged from Dece m

ber 2 0 22 at 3.6%. The Gro up re m ains focused on reducing the le

vel of N PEs.

C ap i tal Posi t i on

The Gr o up's fully l oaded CET1 ratio at end-Sep tem b er 2 0

23 was 15 . 2% (1 4 . 8% at end-June 2 0 23). The m o v e ment in

the quarter reflects net organic capital generation of 90 basis p o

i nts, partial ly offset by a

3 3 % dividend accrual and t he mix of in vestment in custo mer

lending. The Gr o up's regulato ry CET1 and

total capital ratios were 1 5 . 4% and 20 . 1% respectively at

end-Septe m ber 2 0 2 3.

ESG

In addition to a c. 3 0% increase in sustainable lending in 2 0

23, as part of Financial Wellbeing, the Gr o up co ntinues to focus

on sup p orting cust o mers to i m p r o ve their financial

resilience. As a fo unding signat o ry of the UN PRB c om mit ment

to Financial Health and Inclusio n, in Q3 2 0 23, the Gro up has c

o mm itted to increase the nu m ber of c usto mers who have the

resilience to withstand the financial im pact of an unex pected day

-to-d ay ex pense or a maj or life e vent. Bank of Ireland is o ne

of only 20 banks glo bally to have set targets in relati on to this

c o mm itment and is a co-lead of the UN PRB w orking gro up on

Financial Health and Inclusio n.

Ends

For further inf o r mati on please c o ntact: Bank of

Ireland

M ark S p ai n, Gr o u p Ch i ef F i n a n cial Off i cer +3 5 3

1 2 5 0 8 9 0 0 e x t 4 3 2 9 1

Eam o nn Hughes, Chief Sustainability & In vestor Relati o

ns Offi cer + 3 53 ( 0)87 2 0 2 6 3 25

D arach O'L eary, Head of Gr oup In vestor Relatio ns + 3 53 (

0)87 9 4 8 0 6 50

D am ien Gar v e y, Head of Gr o up External C o mm unicati o ns

and P ublic Affairs +3 53 (0 ) 86 8 3 1 4 4 35

Forward L o oking State ment

T his document co n tains forwar d- lo ok ing state m ents wi th

respect to c e rtain of the Bank of Ireland Group plc ( the 'Co

mpany' or 'BOIG plc') and its subs idiar i es' (c o lle c tive ly t

he 'Gro up' or 'BOIG p lc G r oup') plans and i ts current g oals

and expe ctat i ons r elat i ng to its f u ture financ ial c ondi t

ion and per f or mance, the markets in whi ch it ope rates and its

future cap ital r equire m ents. These forwar d - lo o king state m

ents o f ten can be ide n ti f ied by the fact that they do not rel

a te only to hist o rical or curre nt fac ts. G enerally, but not

always, words such as 'may,' 'could,' 'should,' 'will ,'

'expect,' 'intend,' 'est i mate,' 'anticipate,' 'assu m e,'

'believe,' 'plan,' 'seek,' 'continue,' 'tar g et,' 'g oal ,'

'would,' or their ne gative vari a tions or si m ilar express i ons

ide n tify forward-l ooking state m ents, but their abs ence does

not m ean that a s tate m ent is n ot forwar d - lo o king.

E xamples of forward- looking state m ents includ e, am ong

others: state m ents re garding the Group's near term and longer

term future capit al require m ents and r a tios, loan to de p osit

ratios, expec t ed i mpair m ent cha r g es, the l evel of the

Group's as s ets, the Group's financi al po s iti on, future inco m

e, busine ss st rate g y, pr ojected c osts, mar g ins, future pay

m e nt of divi d ends, f u ture share b u ybacks, the i mple m

entation of changes in respe ct of cert a in of the G r oup's p

ension sche m es, est i mates of cap ital expenditures, d iscussi

ons with Ir ish, United Kingd o m, European and other r e gulators,

plans and obje c tiv es for future oper a tions, and the i mpa ct

of Russia's i n vasion of Ukr a ine pa r ticular ly on cert a in of

the ab ove issues and g enerally on the g lobal and do m est ic

econo m ies. Such forwar d - looking state m ents are inhere n tly

subject to r isks and unc e rtai n ties, and hence actual resu l ts

may diff er material ly f r om those

express ed or i m p lied by such forward- lo o king state

ments.

Such risks and unce r taint ies include, but are n ot l i m ited

to, those as set o ut in the R isk Manag e m ent Repo rt in the

Group's Annual R eport for the year ended 31 Dece mber 2022. Inv

est ors should al so read 'P ri n cipal Ri s ks and Uncertainti es'

in the Group's Interim Report f or the six m onths ended 30 June

2023 be g inning on pa ge 25.

Not hing in this document should be considered to be a forecast

of future profitab i li t y, dividend for e cast or f i nancial

posi t ion of the Group and none of the i n for mation in this doc

u m ent is or is int end ed to be a pr o fit forecast, di v idend f

o recast, or pr of it est i mate. Any forward- looking state m ent

spe a ks only as at the da te it is made. The Group does n ot

undertake to release publ icly any r e v ision to t h ese forwar d

- looking state m ents to ref l ect e v ents, c i rcumstances or

una n ticipa ted eve n ts o c cur ring after t he date h e

reof.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTEQLBLXBLXFBV

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

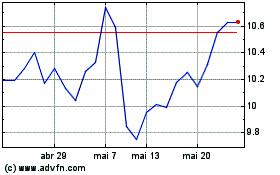

Bank Of Ireland (LSE:BIRG)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Bank Of Ireland (LSE:BIRG)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024