Admission to AIM

08 Novembro 2007 - 5:02AM

UK Regulatory

RNS Number:2480H

Chaarat Gold Holdings Ltd

08 November 2007

Chaarat Gold Holdings Ltd

8 November 2007

Chaarat Gold Holdings Ltd - Admission to AIM

("Chaarat Gold" or the "Company", AIM:CGH), a junior exploration and mining

company established for the purpose of exploring and developing the licence

which is currently held by its Kyrgyz wholly-owned subsidiary Chaarat Zaav CJSC

in the western part of the Kyrgyz Republic, today announces its first day of

dealings of its Ordinary Shares on AIM.

Canaccord Adams Limited is acting as both Nominated Adviser and Broker to the

Company.

The Company has raised #8.8m via a Placing at 60p per share, giving the Company

a market capitalisation of #43.1m. The funds raised will be used for future

exploration work, which will be focused on increasing the resource delineated by

the Company, as well as on a pre-feasibility study, which is scheduled to be

undertaken in 2008.

Overview of the Company

Chaarat Gold Holdings Ltd was incorporated in the BVI on 20 July 2007 and became

the holding company of the Group. The Chaarat Group was founded for the purposes

of exploring and developing the Licence currently held by Chaarat K in the

western part of the Kyrgyz Republic.

The Licence grants Chaarat K the exclusive rights to conduct geological

prospecting and exploration for gold and other metals, in the Licence Area, as

well as the exclusive right to apply for a mining licence for the same metals.

The Licence Area is 604.6 km2 in extent and hosts many highly prospective gold

occurrences over a strike length of some 28 kilometres. To date, extensive

prospecting has only been conducted on a small number of higher priority

targets.

The Company has focused its exploration on an area that the Directors considered

to be the most prospective and readily accessible part of the Licence Area,

based on historical information. Advanced stage prospecting, including the

ongoing resource drilling programme, on seven priority targets, has delineated

wide zones of gold mineralisation. By the end of the 2006 exploration season, an

Indicated and Inferred Resource of 1.9 million ounces at a gold grade of 4.1g/t

had been delineated on these targets. Subsidiary amounts of silver and antimony

occur within the mineralised zones. Additional targets are being explored but

had not been drilled during the 2006 season.

The Licence has been granted to 31 December 2008 and the terms of the Licence

allow for the Company to extend the period of licence up to 10 years for

successive periods of, generally, two years until 2012.

Growth Strategy

The Directors' intention for the Group is to continue the intensive

exploration programme to test the priority targets which were identified in its

recent work programmes and to increase the mineral resource base within the

Licence Area. At the same time, the Group intends to undertake a series of

studies which are expected to lead to the completion of a feasibility study

conducted to bankable standards, on the most advanced part of the Mineral

Resource, which, it is intended, will allow for the design, finance,

construction and commissioning of a mine within the next five years. It is

further intended to establish a Mineral Resource on the priority targets which

will support a mining operation with a production rate of 200,000 oz of gold a

year in a proposed 10-year first phase of mining.

The Licence Area hosts many highly prospective gold occurrences and gold soil

sample anomalies which may prove to represent economically viable gold deposits.

The Directors believe the Mineral Resources in the Licence Area may be extended,

through further exploration, and thereby allow for an expansion of the

anticipated first phase mining operation.

Furthermore it is the intention to expand the exploration programme to other

parts of the Licence Area.

The Company also intends to work actively to identify other gold occurrences

with potential, in the vicinity of the Licence Area, where it will seek to

acquire the rights to prospect in order to expand the gold resource base of the

Company.

Key strengths

The Directors believe there are a number of reasons why the Company represents

an attractive investment proposition:

* the Licence Area is within the highly prospective Tien Shan gold belt,

which hosts numerous large gold deposits and mining operations, which have a

similar geological setting to that encountered within the Licence Area;

* the Kyrgyz Republic has a well established mining industry and

infrastructure and the Directors believe that the government is supportive of

the mining industry;

* exploration results, particularly those received by the Company during

the 2005 and 2006 exploration seasons, have extended the zones of mineralisation

in the known gold occurrences, and have discovered new gold occurrences. These

results also have increased the probability that the Licence Area may host

significant gold mineralisation, which has the potential to be developed into

economically viable gold deposits and mining operations;

* exploration results to date have confirmed significant additional gold

occurrences and soil geochemical anomalies within the Licence Area;

* within the Company's Board of Directors and Senior Management

there is appropriate expertise and experience to develop the Company's

operations; and

* the Company's future prospects offer further attractive growth

potential in the expansion of Mineral Resources on its current priority targets,

as well as in advancing prospecting on the gold occurrences within the Licence

Area that have not yet been intensively prospected. In addition, further growth

may be realised if the Company is able to acquire any other gold occurrences

with potential within the area surrounding the Licence Area.

For further Information:

Dekel Golan - Chaarat Gold Holdings Ltd Tel: +44 (0)20 7499 2612

Dekel@chaarat.com

Canaccord Adams Limited Tel: +44 (0) 20 7050 6500

Mike Jones

Robin Birchall

Alex Glover/Tim Weller Fin Public Relations Tel: 020 7608 2280 or

Mob: +44 7887 610 335

alex.glover@fininternational.com

NOTES TO EDITORS

Placing Statistics

Placing Price: 60p

Number of Ordinary Shares being issued pursuant to the Placing: 14,669,833

Number of Ordinary Shares in issue following Admission: 71,883,433

Number of Options in issue following Admission: 8,160,00

Number of Existing Shares: 57,213,600

Existing Shares as a percentage of Enlarged Share Capital: 79.6 per cent.

Placing Shares as a percentage of Enlarged Share Capital: 20.4 per cent.

Estimated gross proceeds of the Placing receivable by the Company: #8,801,900

Estimated net proceeds of the Placing receivable by the Company (exclusive of

applicable VAT): #7,673,533

Market capitalisation of the Company at the Placing Price on Admission (assuming

that no Options are exercised): #43,130,059

Key Management

Mr Dekel Golan (Chief Executive Officer) (Age 51)

Mr Golan is a graduate of Tel Aviv University. Mr Golan, formerly president of

Apex Asia LDC, a subsidiary of Apex Silver Mines Limited, has extensive

experience in promoting and developing businesses both in emerging economies as

well as the developed world. Mr Golan was the founder and Executive Chairman of

African Plantations Corporation Limited. In addition, Mr Golan has advised a

number of international and Israeli companies on business development and

competitive intelligence.

Prior to those activities Mr Golan was Vice President of Business Development of

Supersol, the largest retail operator in Israel and established and managed the

unit for competitive intelligence for Dead Sea Bromine Group, the world's

largest bromine producer. Mr Golan is an Israeli national.

Mr Terence Arthur Cross (Finance Director) (Age 59)

Mr Cross is an MBA graduate of the University of the Witwatersrand, Johannesburg

and is a member of the South African Institute of Professional Accountants. His

working experience has been gained primarily in mining and related industries.

Since immigrating to the UK in 1996, Mr Cross worked for eighteen months as an

independent consultant then for four years as a Projects and Financial Control

Manager for Barclays Bank. During the most recent six years he has worked as

Group Financial Controller for a number of AIM listed mining exploration

companies. Prior to moving to the UK he was, for six years, General Manager of a

specialist equipment and consumables supplier to the mining industry in South

Africa. Mr Cross was a director of Johannesburg Stock Exchange listed companies,

Consolidated

Modderfontein Mines Ltd and South Roodepoort Main Reef Areas Ltd, from 1988 to

1992 and was Group Financial Controller and subsequently a director of the

mining management company, Golden Dumps (Pty) Ltd, through the period from 1986

until 1989.

Mr Cross was previously employed in financial management positions for eleven

years with Celanese Corporation of New York and for seven years with the Barlow

Rand Group, of South Africa. Mr Cross holds dual British and South African

nationality.

Mr Alexander Novak (Executive Director) (Age 51)

Mr Novak is a graduate of the Kazakh Polytechnic Institute (M.Sc). Mr. Novak has

assisted several companies investing in Kyrgyzstan in various aspects of

finance, administration and representation vis a vis the local authorities since

2000 Mr Novak has more than 25 years experience in various aspects of business

management in Central Asia including negotiations with governmental

institutions, contractors, preparation of development plans, monitoring of

operations and public relations. Mr

Novak was instrumental in drafting and signing investment agreements between the

government of the Kyrgyz Republic and two extraction companies, Textonic and

Kumushtak, a subsidiary of Apex Silver Mines Limited. From 1992 to 1995, Mr

Novak was a founding partner and a director of Maya Elev Diamond Limited, a

diamond processing plant in Russia. From 1978 through to 1990, Mr Novak held

several positions at numerous construction companies in Kazakhstan, including

Director of KazStroiMontajAvtomatika. Mr. Novak is also the sole director of

Chaarat K. Mr Novak is an Israeli national.

Mr Christopher David Palmer-Tomkinson (Non-Executive Chairman) (Age 65)

Mr Palmer-Tomkinson graduated from Oxford University with a degree in

jurisprudence and joined Cazenove in 1963. He served as a partner from 1972

until 2001 and as managing director international corporate finance until May

2002. He was responsible at various times for Cazenove's African and

Australian business which enabled him to focus on the resource sector. Mr

Palmer-Tomkinson is a director of Highland Gold Mining Limited. Mr

Palmer-Tomkinson is a British national.

Mr Stuart Robert Comline (Non-Executive Director) (Age 58)

Mr Comline is a graduate of the University of Natal South Africa (B.Sc

Hons.Geology) and University of Western Ontario (M.Sc Geology). Mr Comline was

Chairman, and formerly President and Chief Operating Officer, of AfriOre

Limited, a TSX and AIM listed company until January 2007, when the company was

purchased by Lonmin Plc. Mr Comline has 35 years of experience in the

international exploration and mining industry mostly in Africa and Canada. He

spent 20 years with JCI Limited, in a number of senior management positions

including General Manager of Exploration. In the mid-nineties he was an

independent consultant and worked with merchant banks and major and junior

exploration companies within the mining and exploration field until joining

AfriOre Limited in 1997. Mr Comline has experience in various commodities

including gold, platinum, base metals, diamonds and coal. Mr

Comline is currently an independent advisor to several mineral exploration

companies and serves Talon Metals Corporation, a TSX listed mining and mineral

exploration company, as a non-executive director. Mr Comline is a British

national.

Mr Oliver Raymond Greene (Non-Executive Director) (Age 64)

Oliver Greene is a graduate in Politics, Philosophy and Economics from Oxford

University. A career banker, he has over thirty five years experience as a

practitioner in international corporate finance, credit and corporate recovery

in the US and Europe.

Mr Greene joined Citibank in 1965 holding various assignments in New York and

London with experience in Petroleum and Chemicals financing, leasing and

structured finance, and exposure to Scandinavian and Eastern European markets.

In 1980 Mr Greene moved to Bankers Trust Company to head their UK World

Corporate Department in London. He joined Chase Manhattan Bank in 1988 as

Managing Director, Head of UK Corporate Finance followed in 1990 by the

management of impaired assets in the UK. In 1996 Mr Greene moved to UBS as a

Managing Director in Corporate Finance before accepting an invitation to join

the European Bank for Reconstruction & Development in 1998 as Director of

Corporate Recovery.

On Mr Greene's retirement from the EBRD in 2003 he became a consultant to the

bank, an appointment that continues. Mr Greene served as a member of the

Supervisory Board and Chairman of the Remuneration Committee of Banca Comerciala

Romana S.A. in Bucharest from 2004 to 2006. Since 2004 Mr Greene has been a

member of the Supervisory Board and Chairman of the Audit Committee of Bank

Pekao S.A Warsaw (a publicly listed Unicredito Group subsidiary) and, since

2006, a member of the Supervisory Board of Korado AS in the Czech Republic. Mr

Greene is a US/UK dual national.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBIBDBBGGGGRR

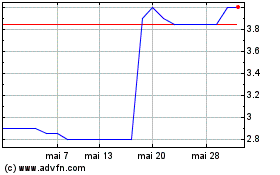

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024