RNS Number : 5756U

Chaarat Gold Holdings Ltd

16 May 2008

Company : Chaarat

Gold Holdings Ltd

TIDM : CGH

Headline : Chaarat

Gold Holdings Ltd -

Final Results 2007

16 May 2008

Chaarat Gold Holdings Ltd

Ticker- AIM:CGH

PRELIMINARY ANNOUNCEMENT OF AUDITED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 December 2007

Chairman's Report

A Year of Progress

Our Company has achieved a new milestone in its development with

the admission of its shares to trading on the Alternative

Investment Market in London. For the first time, this provides

investors with the ability to trade in our shares on the stock

exchange.

New capital raised by the IPO amounted to $16.4 million net,

which was less than had been sought but sufficient,

nevertheless, to fund the Company at planned levels of

expenditure into 2009. The onset of the credit crisis at the

time of the IPO undermined sentiment towards exploration

investment. The Company and its strategy were, however, well

received by the investment community.

The fall in our share price since the issue will, I regret, have

been a disappointment to shareholders and in the view of the

Board does not adequately value the prospects of your Company.

To address this further, efforts are being made to raise the

awareness of both the scale of the project and the progress that

we are making towa

Chief Executive's Operation Report

General

The past year has been one of transition, from being a small

private exploration company, we are now a public listed company.

Furthermore, we have increased the scale of our operations and

now operate on a year round basis, with our well established

field base allowing us to avoid the winter close-down, which we

had practised until recently. In addition, the Company commenced

the preparation of a scoping study, which is scheduled for

completion during the 2nd quarter of 2008.

With these developments, the skills base of the Company is being

expanded by recruitment and training. The communication

infrastructure and IT systems have been upgraded. Indeed, during

the recent winter, we were able to continue with field

operations in the development of the adit and the attendant

underground drilling operations, which are ongoing.

Your Company is now well prepared to meet its objectives, namely

the delineation of sufficient resources to support the

development of a

Consolidated income statement

For the years ended 31 December

2007 2006

USD USD

Exploration expenses (5,298,560) (2,695,571)

Administrative expenses (1,623,792) (513,656)

Other operating income/(expense) (2,852) 21,268

Operating loss (6,925,204) (3,187,959)

Financial expense - (82,264)

Financial income 384,858 131,781

Loss for the year, attributable to equity (6,540,346) (3,138,442)

shareholders of the Company

Loss per share (basic and diluted) - USD cents (11.21)c (6.04)c

All amounts relate to continuing activities.

Consolidated balance sheet

At 31 December

2007 2006

USD USD

Assets

Non-current assets

Intangible assets 4,797 -

Property, plant and equipment 1,215,273 126,217

Other receivables 37,740 16,308

1,257,810 142,525

Current assets

Inventories 475,846 -

Trade and other receivables 742,433 110,178

Cash and cash equivalents 13,128,822 846,573

14,347,101 956,751

Total assets 15,604,911 1,099,276

Liabilities and equity

Equity attributable to shareholders

Share capital 718,834 3,431

Share premium 15,665,928 6,454,707

Other reserves 11,048,357 -

Foreign currency reserve (408,059) 11,801

Retained losses (11,995,860) (5,455,514)

15,029,200 1,014,425

Current liabilities

Trade payables 401,253 42,171

Accrued liabilities 174,458 42,680

575,711 84,851

Total liabilities and equity 15,604,911 1,099,276

Consolidated statement of changes in equity

For the years ended 31 December

Share capital USD Share premium USD Retained losses USD Other reserves USD Translation

reserve

USD Total USD

Balance at 31 December 2005 3,156 3,431,063 (2,317,072) -

- 1,117,147

Currency translation - - - -

11,801 11,801

Net income recognised directly - - - -

11,801 11,801

in equity

Loss for the year ended

31 December 2006 - - (3,138,442) -

- (3,138,442)

Total recognised income and

expense for the year - - (3,138,442) -

11,801 (3,126,641)

Issuance of shares 275 3,303,850 - -

- 3,304,125

Share issue costs - (280,206) - -

- (280,206)

Balance at 31 December 2006 3,431 6,454,707 (5,455,514) -

11,801 1,014,425

Currency translation - - - -

(419,860) (419,860)

Net loss recognised directly - - - -

(419,860) (419,860)

in equity

Loss for the year ended

31 December 2007 - - (6,540,346) -

- (6,540,346)

Total recognised income and

expense for the year - - (6,540,346) -

(419,860) (6,960,206)

attributable to equity

shareholders of the Company

Issuance of shares and options 308 4,750,232 - 248,509

- 4,999,049

for cash, pre reverse

acquisition

Transfer to reserves - reverse (3,739) (11,204,939) - 11,208,678

- -

acquisition *

Share for share exchange - 572,136 - - (572,136)

- -

reverse acquisition *

Share options expense - - - 163,306

- 163,306

Issuance of shares for cash 146,698 18,119,004 - -

- 18,265,702

Share issue costs - (2,453,076) - -

- (2,453,076)

Balance at 31 December 2007 718,834 15,665,928 (11,995,860) 11,048,357

(408,059) 15,029,200

* The transfers to reserves during 2007 represent the issued share capital and share premium of subsidiary Chaarat Gold Limited prior to

its reverse

acquisition of Chaarat Gold Holdings Ltd

Consolidated cash flow statement

For the periods ended 31 December

2007 2006

USD USD

Operating activities

Result for the period before and after tax (6,540,346) (3,138,442)

Adjustments:

Amortisation expense intangible assets 430 -

Depreciation expense property, plant and 200,415 21,486

equipment

Loss on disposal of property, plant and 3,541 19,782

Equipment

Loan discounting - 82,264

Interest income (263,558) (131,781)

Share based payments 163,306 -

Foreign exchange 87,875 (7,145)

(Increase)/decrease in inventories (475,846) -

(Increase)/decrease in accounts receivable (633,208) (29,344)

Increase/(decrease) in accounts payable 490,859 45,454

Net cash flow used in operations (6,966,532) (3,137,726)

Investing activities

Purchase of computer software (5,227) -

Purchase of property plant and equipment (1,297,372) (123,689)

Proceeds from sale of equipment 13,750 26,707

Loans issued - (160,000)

Loans repaid 40,000 40,000

Interest received 203,079 105,825

Net cash used in investing activities (1,045,770) (111,157)

Financing activities

Proceeds from issue of share capital 23,264,751 3,304,125

Issue costs (2,453,076) (280,206)

Net cash from financing activities 20,811,675 3,023,919

Net change in cash and cash equivalents 12,799,373 (224,964)

Cash and cash equivalents at beginning of 846,573 1,059,977

the year

Effect of changes in foreign exchange rates (517,124) 11,560

Cash and cash equivalents at end of the year 13,128,822 846,573

Notes:

1 Preparation of accounts

The financial information set out in this preliminary announcement does not constitute the Group's complete financial statements under

the

definition of ISA 1, for the years ended 31 December 2007 or 2006.

The consolidated balance sheet at 31 December 2007, the consolidated income statement, consolidated statement of changes in equity,

consolidated

cash flow statement and associated notes for the year then ended have been extracted from the Group's 2007 annual financial statements

upon which

the auditors' opinion is unqualified.

2 Loss per share

The loss per share is calculated by reference to the loss for the year of USD6,540,346 (2006:USD3,138,442) and the weighted average

number of

shares in issue during the year of 58,366,390 (2006: 51,938,220). There is no dilutive effect of share options or warrants.

3 Dividend

No dividend is proposed in respect of the period.

4 Selected accounting policies

Basis of preparation of financial statements

The financial information has been prepared on the historical cost basis and in accordance with International Financial Reporting

Standards (IFRSs

and IFRIC interpretations) as adopted by the European Union. The acquisition of the Company has been treated as a reverse acquisition

by its

operating subsidiary, without the presence of goodwill.

In common with many exploration companies, the Company raises finance for its exploration and appraisal activities in discrete

tranches to finance

its activities for limited periods. Further funding is raised as and when required.

The Directors are confident that the Group has sufficient funding to enable it to continue to meet its debts as they fall due.

The Directors are of the opinion that the Company will require to raise additional financial resources to enable the group to

undertake an optimal

programme of exploration and appraisal activity beyond the next twelve months. Accordingly, the Directors intend to raise further

funds during the

course of the next twelve months.

Basis of consolidation

Where the Company has the power, either directly or indirectly, to govern the financial and operating policies of another entity or

business so as

to obtain benefits from its activities, that entity or business is classified as a subsidiary. The consolidated financial statements

present the

results of the Company and its subsidiaries as if they formed a single entity. Intercompany transactions and balances between group

companies are

therefore eliminated in full.

On 7 September 2007, the Company became the legal parent company of

5 Publication of Annual Report

Copies of the Annual Report and Accounts for the year ended 31 December 2007 will be posted to shareholders during May 2008 and will

be available,

free of charge, from Central Asia services Limited, 5 Conduit Street, London, W1S.2XD, for a period of 14 days from the date of their

posting and

will be made available on the Company's website - www.chaarat.com.

The Company's Annual General Meeting will be held at the offices of Chaarat Zaav CJSC, Chokmorova Street 127, Bishkek 720040, Kyrgyz

Republic, on

3 July 2008 at 4:00pm local time.

Enquiries:

Chaarat Gold Holdings Ltd Tel: +44 (0) 20 7499 2612

Dekel Golan - Dekel@chaarat.com

Terry Cross - terry@caserve.co.uk

Canaccord Adams Limited Tel: +44 (0) 20 7050 6500

Mike Jones

Robin Birchall

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BSGDUIXBGGIU

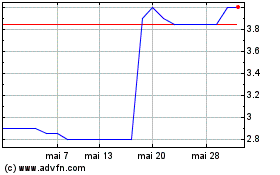

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024