Independent Scoping Study for Chaarat Gold

16 Junho 2008 - 3:01AM

UK Regulatory

RNS Number : 7349W

Chaarat Gold Holdings Ltd

16 June 2008

For immediate release 16th June 2008

Unit Average years 2-5 Average years 2-10

Tonnes mined t 1,814,396 1,814,396

Mill grade g/t 4.27 3.98

Process Recovery % 94.4% 94.7%

Ounces produced annually oz 234,751 219,787

Operating costs mining $/t 25 25

Operating costs processing $/t 18 18

Operating costs G&A $/t 5 5

Total operating costs $/t 48 48

Operating cash cost per ounce $/oz 373 397

Revenue related taxes $/oz 54 54

Refining and shipping $/oz 19 19

Total cash cost per ounce $/oz 445 470

Credit from Silver @ $16 /oz $/oz 30 32

Credit from Antimony @ $2.60/lb $/oz 57 61

*

Net cash cost per ounce $/oz 359 378

* Recovery of Sb is currently an estimate as testwork confirming the actual recovery is ongoing.

Dekel Golan - CEO comments; "We are extremely encouraged by the positive results of the study, which indicates the economic viability of

the Chaarat project with a healthy cash cost of $420 per ounce of gold, a NPV of $158 million and a respectable IRR of 20.3%. We share the

expressed belief of Behre Dolbear that further optimisation of the mining schedule will improve the economics of the mine as well as their

opinion that there is potential for the discovery of similar deposits in the vicinity of the Chaarat deposit and at other as yet untested

regional exploration targets within the licence area.

We are confident that the initial annual production level of 235,000 ounces can be maintained as our ongoing exploration work aims to

prove up additional gold resources in higher grade areas, which will have a beneficial impact on the project's economics.

Our immediate priority is to complete the Pre-Feasibility Study in order to maintain our momentum towards our production target of

2012".

Based on the positive results of the study, the Company plans to proceed to a Pre-Feasibility Study, with a target completion date of

the end of the first half of 2009.

Competent Persons

Richard James Fletcher is qualified to act as a "competent person" as defined in the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves' and accepts responsibility for the information on Exploration Results and Mineral Resources in

the Scoping Study. Behre Dolbear affirms that Mr Fletcher :-

1. has more than 10 years experience in the former Soviet Union region,

2. is a Fellow of the Australasian Institute of Mining and Metallurgy,

3. has more than 40 years experience in the estimation, assessment and evaluation of mineral resources and ore reserves that is

relevant to the styles of mineralisation and the types of deposits under consideration.

Mr Brian Spratley is qualified to act as a "competent person" as defined by the UK's Institute of Materials, Minerals and Mining for

reporting on mine planning, mine design, mine economics and mine organisation for underground and open pit mines. Behre Dolbear affirms

that Mr Spratley:-

4. has more than 10 years experience in the former Soviet Union Region,

5. is a Member of Institute of Materials, Minerals and Mining,

6. has more than 35 years experience in the assessment of operations, development, and implementation of precious and base metals

mining projects.

About the Chaarat Gold Project

The Chaarat project is situated within the Middle Tien Shan Mountains of Kyrgyzstan which form part of the Tien Shan gold belt. The

Company has delineated indicated resources of 15.4 million tonnes at 4.45 g/t gold (2.202 million ounces) and additional inferred resources

of 6.7 million tonnes at a grade of 4.41 g/t gold (933,000 ounces). The Company's ongoing exploration programme employing 6 drill rigs is

aimed at increasing the confidence levels in the project through infill drilling and increasing the known resources to four million ounces

through down-dip and along-strike extension drilling in the ten kilometre strike length of the Chaarat deposit. In addition, the company

intends to explore the remaining gold occurrences in the other twenty eight kilometres of strike length within the Chaarat Licence Area.

About Chaarat Gold Holdings

Chaarat is an exploration company founded for the purpose of developing the Chaarat License Area. Chaarat was admitted to AIM on 8

November 2007. The Company has 71.9 million shares issued (78.4 fully diluted).

Disclaimer

This press release includes forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties

and other important factors beyond Chaarat's control that would cause the actual results, performance or achievements of Chaarat to be

materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such

forward-looking statements are based on numerous assumptions regarding Chaarat's present and future business strategies and the environment

in which Chaarat will operate in the future. Any forward-looking statements speak only as at the date of this document. Chaarat expressly

disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to

reflect any change in Chaarat's expectations with regard thereto or any change in events, conditions or circumstances on which any such

statements are based. As a result of these factors, the events described in the forward-looking statements in this press release may not occur either partially or at all.

Enquiries:

Chaarat Gold Holdings Ltd Tel: +44 (0) 20 7499 2612

Dekel Golan - Dekel@chaarat.com

Terry Cross - terry@caserve.co.uk

Canaccord Adams Limited Tel: +44 (0) 20 7050 6500

Mike Jones - Mike.Jones@canaccordadams.com

Smith's Corporate Advisory Tel: +44 (0) 20 7239 0140

Dominic Palmer-Tomkinson - Tomkinson@smiths-ca.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFKNKNOBKDFAD

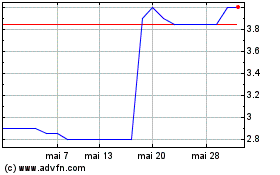

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024